Adaptive Dual Breakthrough Trading Strategy

Author: ChaoZhang, Date: 2024-02-06 15:31:36Tags:

Overview

The adaptive dual breakthrough trading strategy is a quantitative strategy that makes judgments and trading operations based on the relationship between the opening price and closing price of stocks. This strategy will take long or short positions when the set parameter conditions are met. At the same time, it has an adaptive exit mechanism that can decide when to exit the current position based on recent changes in opening and closing prices.

Strategy Principle

The core logic of this strategy is to judge the direction based on the size relationship between opening price and closing price. Specifically, if the closing price is higher than the opening price exceeding the set threshold val1, a long signal is generated; if the opening price is higher than the closing price exceeding the threshold val1, a short signal is generated. Once a position is entered, the strategy will continue to monitor price changes. If the opening and closing prices reverse beyond the set threshold val2, the exit operation will be executed. It can be seen that this strategy includes both opening position logic and exit logic, forming a relatively complete trading framework.

In terms of code implementation, the strategy first defines the long and short position conditions, and places orders when the opening position logic is met. It then continuously detects whether the exit condition has been triggered, and once the exit condition is met, it executes the closing operation. So this strategy monitors market changes in real time and is adaptive and flexible.

Advantages of the Strategy

The adaptive dual breakthrough trading strategy has the following advantages:

- Clear and simple operation, easy to understand and implement

- Dynamically adjust positions to adapt to market changes

- Has stop loss function to control risks

- Can be applied to different varieties by adjusting parameters

- Easy to optimize algorithms with large expansion space

Risks of the Strategy

Although this strategy has certain advantages, it also has the following risks:

- Stop loss strategies may fail during violent market fluctuations

- Unable to catch long-term trends, frequent position switching

- Improper parameter settings can lead to over-trading

- System failures may result in inability to stop losses

These risks need to be closely monitored during live trading to promptly adjust parameters or optimize algorithms.

Optimization Directions

The main aspects for optimizing this strategy include:

- Enhance stop loss optimization to control frequent position switching while ensuring sensitivity.

- Add trend judgment indicators to reduce trading frequency in non-trend environments.

- Combine short-term intraday trading strategies to improve strategy returns.

- Optimize adaptive parameter mechanisms for dynamic threshold adjustment.

- Add machine learning models to judge trend directions.

Through algorithm and model optimization, the overall stability and profitability of the strategy can be improved.

Summary

The adaptive dual breakthrough trading strategy combines trend judgment and adaptive exit mechanisms, which can effectively control risks. Its simple principles and flexible parameters make it easy to understand and expand, making it a recommended and worthwhile quantitative strategy to study deeply.

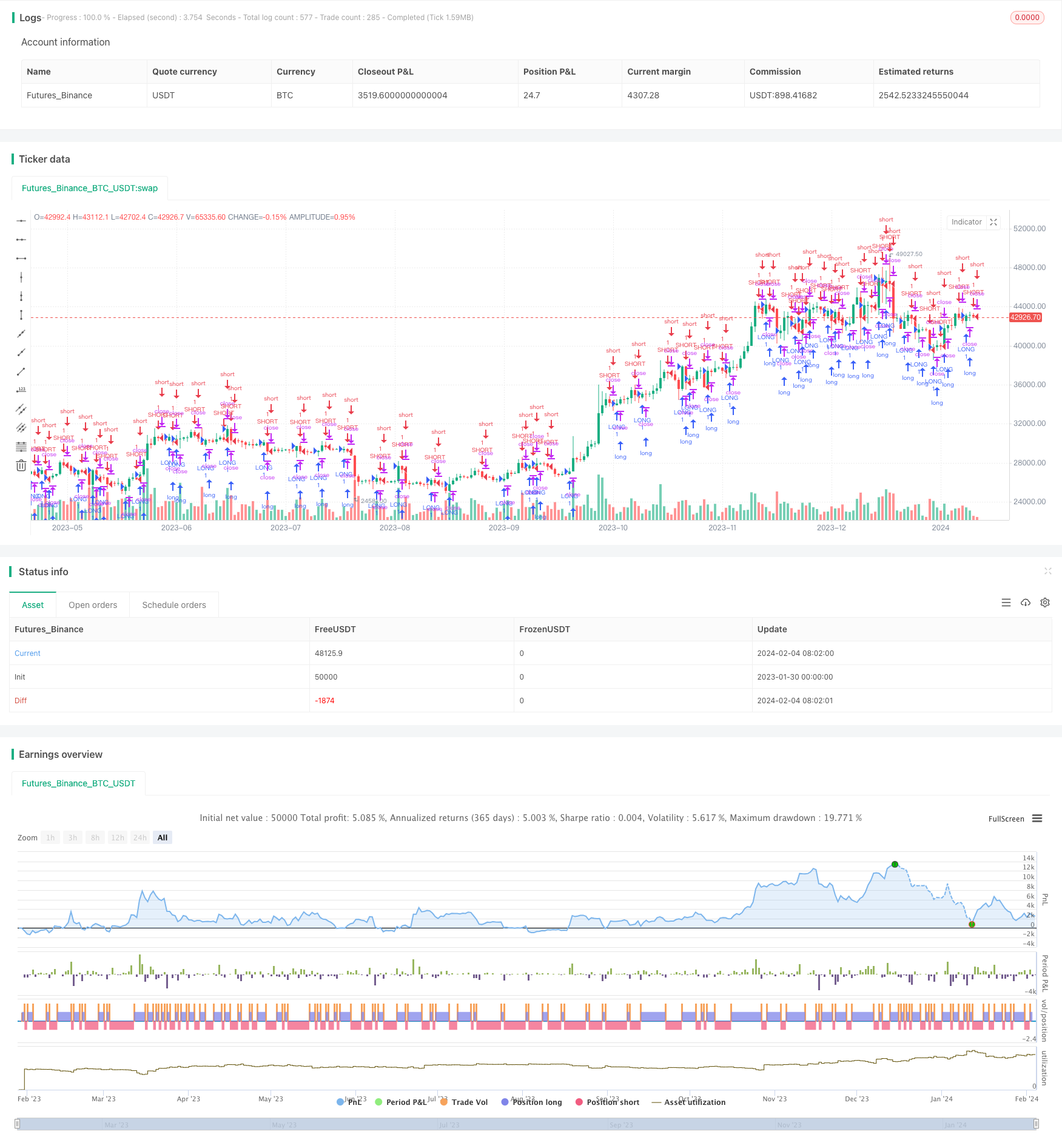

/*backtest

start: 2023-01-30 00:00:00

end: 2024-02-05 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Repaint in version 3", overlay=true, calc_on_every_tick=true, calc_on_order_fills=true) // Repaint?

// strategy("Repaint in version 3", overlay=true, calc_on_every_tick=true) // Correct

val1 = input(123)

val2 = input(234)

from_year=input(2018, minval=2000, maxval=2020)

from_month=input(6, minval=1, maxval=12)

from_day=input(1, minval=1, maxval=31)

to_year=input(2019, minval=2007, maxval=2020)

to_month=input(12, minval=1, maxval=12)

to_day=input(31, minval=1, maxval=31)

long = (close-open) > val1

short = (open-close) > val1

exitLong = (open-close) > val2

exitShort = (close-open) > val2

term = true

strategy.entry("LONG", strategy.long, when=long and term)

strategy.close("LONG", when = exitLong and not short and term)

strategy.entry("SHORT", strategy.short, when=short and term)

strategy.close("SHORT", when = exitShort and not long and term)

- Momentum Average Inverse Relief Pullback Strategy

- Multitimeframe Trend Hunter Strategy

- DCCI Breakout Strategy

- Doubly Confident Price Oscillation Quant Strategy

- Volatility Trend Tracking Strategy

- Dual-driver Quantized Reversal Tracking Strategy

- Overlay Trend Signals Strategy

- Swing Points Breakouts Long-term strategy

- The Quantitative Trading Strategy Based on Dynamic Moving Average Breakthrough Entry

- Three Candle Reversal Trend Strategy

- Quantitative Trading Strategy for Bottom Reversal

- Momentum Trend Optimization Combination Strategy

- Multiple Moving Average Bollinger Bands Strategy

- Crossing Moving Average Breakout Strategy

- SuperTrend Trailing Stop Strategy Based on Heikin Ashi

- Dual Moving Average With Momentum Breakout Strategy

- Bollinger Band Breakout Strategy Based on VWAP

- Fibonacci Retracement Dynamic Stop Loss Strategy

- Dynamic EMA and MACD Crossover Strategy

- Double Momentum Index and Reversal Hybrid Strategy