Open-High-Low Stop Loss Tracking Strategy

Author: ChaoZhang, Date: 2024-02-18 14:30:08Tags:

Overview

This strategy is designed based on the open, high and low data of candlestick charts to identify trend reversal points for entries. After entries, stop loss lines will be set based on the ATR indicator and tracked. Targets will also be calculated based on the risk-reward ratio. When price hits either the stop loss or profit target, orders will be sent to close positions.

Strategy Logic

The entry signals of this strategy come from the open, high and low prices. A buy signal is generated when the opening price equals the low of the candlestick, and a sell signal is generated when the opening price equals the high, indicating potential trend reversal opportunities.

After entry, dynamic trailing stop loss is calculated based on the ATR indicator. The long stop loss is set at the lowest low of recent N bars minus 1 ATR; the short stop loss is set at the highest high of recent N bars plus 1 ATR. The stop loss line will update dynamically to trail price moves.

Profit targets are calculated based on the risk-reward ratio setting. The long target is set at the entry price plus (the risk difference between entry price and stop loss multiplied by the risk-reward ratio); the short target is set at the entry price minus (the risk difference between stop loss and entry price multiplied by the risk-reward ratio).

When price hits either the stop loss or profit target, orders will be sent to flatten positions.

Advantage Analysis

The advantages of this strategy include:

Simple and clear entry signals, avoiding multiple whipsaws.

Dynamic ATR trailing stop locks in profits and prevents chasing highs and lows.

Risk-reward ratio control avoids leaving profits on table and over-trading.

Applicable to different products, easy to optimize.

Risk Analysis

There are also some risks of this strategy:

Entry signals may lag to some extent, missing best market entry.

Stop loss too tight or too loose, causing unnecessary stop loss or missing profits.

No trend determination, prone to being trapped in ranging markets.

Unable to handle overnight positions.

The optimization directions are:

Incorporate other indicators for trend bias to avoid whipsaws.

Fine tune ATR parameters or add volatility control for better stop loss.

Add trend filtering to reduce signal noise.

Add overnight position handling for certain products.

Conclusion

In conclusion, this is a simple and straightforward strategy with clear entry logic, reasonable stop loss methodology and good risk control. But there are some limitations like insufficient trend bias, signal lagging etc. These flaws also point out directions for future optimization. By incorporating more indicators filters and risk management modules, this strategy can be further enhanced and made more robust.

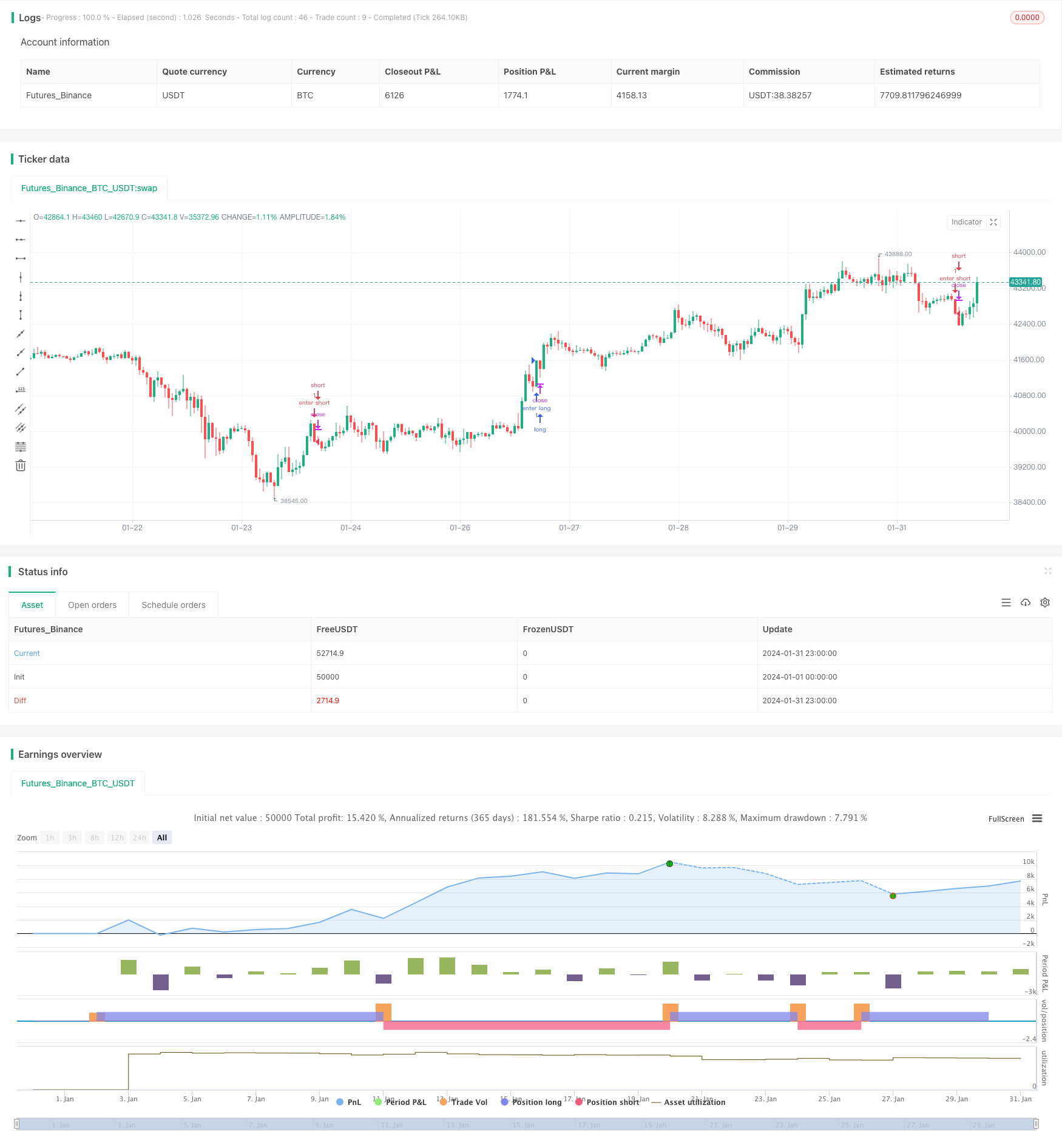

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// Open-High-Low strategy

strategy('Strategy: OLH', shorttitle="OLH", overlay=true )

// Inputs

slAtrLen = input.int(defval=14, title="ATR Period for placing SL", group="StopLoss settings")

showSLLines = input.bool(defval=false, title="Show SL lines in chart", tooltip="Show SL lines also as dotted lines in chart. Note: chart may look untidy.", group="Stolploss settings")

// Trade related

rrRatio = input.float(title='Risk:Reward', step=0.1, defval=2.0, group="Trade settings")

endOfDay = input.int(defval=1500, title="Close all trades, default is 3:00 PM, 1500 hours (integer)", group="Trade settings")

mktAlwaysOn = input.bool(defval=true, title="Markets that never closed (Crypto, Forex, Commodity)", tooltip="Some markers never closes. For those cases, make this checked.", group="Trade settings")

lotSize = input.int(title='Lot Size', step=1, defval=1, group="Trade settings")

// Utils

green(open, close) => close > open ? true : false

red(open, close) => close < open ? true : false

body(open, close) => math.abs(open - close)

lowerwick = green(open, close) ? open - low : close - low

upperwick = green(open, close) ? high - close : high - open

crange = high - low

crangep = high[1] - low[1] // previous candle's candle-range

bullish = close > open ? true : false

bearish = close < open ? true : false

// Trade signals

longCond = barstate.isconfirmed and (open == low)

shortCond = barstate.isconfirmed and (open == high)

// For SL calculation

atr = ta.atr(slAtrLen)

highestHigh = ta.highest(high, 7)

lowestLow = ta.lowest(low, 7)

longStop = showSLLines ? lowestLow - (atr * 1) : na

shortStop = showSLLines ? highestHigh + (atr * 1) : na

plot(longStop, title="Buy SL", color=color.green, style=plot.style_cross)

plot(shortStop, title="Sell SL", color=color.red, style=plot.style_cross)

// Trade execute

h = hour(time('1'), syminfo.timezone)

m = minute(time('1'), syminfo.timezone)

hourVal = h * 100 + m

totalTrades = strategy.opentrades + strategy.closedtrades

if (mktAlwaysOn or (hourVal < endOfDay))

// Entry

var float sl = na

var float target = na

if (longCond)

strategy.entry("enter long", strategy.long, lotSize, limit=na, stop=na, comment="Enter Long")

sl := longStop

target := close + ((close - longStop) * rrRatio)

alert('Buy:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

if (shortCond)

strategy.entry("enter short", strategy.short, lotSize, limit=na, stop=na, comment="Enter Short")

sl := shortStop

target := close - ((shortStop - close) * rrRatio)

alert('Sell:' + syminfo.ticker + ' ,SL:' + str.tostring(math.floor(sl)) + ', Target:' + str.tostring(target), alert.freq_once_per_bar)

// Exit: target or SL

if ((close >= target) or (close <= sl))

strategy.close("enter long", comment=close < sl ? "Long SL hit" : "Long target hit")

if ((close <= target) or (close >= sl))

strategy.close("enter short", comment=close > sl ? "Short SL hit" : "Short target hit")

else if (not mktAlwaysOn)

// Close all open position at the end if Day

strategy.close_all(comment = "Close all entries at end of day.")

- Byron Serpent Cloud Quant Strategy

- Dual Timeframe Volatility Spread Trading Strategy

- scillator Profile Reversal Strategy Based on Multi Timeframe MACD Zero-crossing

- MACD EMA Crossover Trend Tracking Strategy

- Dual Moving Average Trading Strategy

- Dual Moving Average Golden Cross Trend Trading Strategy

- V-Reversal SMA Strategy

- Linear Regression Channel Breakout Trading Strategy

- Dual-EMA Indicator Based Trend Following Strategy

- Real Turtle—Steadfast as a Rock Turtle Strategy

- Comprehensive Futures Automated Trading Strategy for Both Long and Short

- Supertrend Breakout Trading Strategy

- 3 Moving Average Swing Interval Reversal Strategy

- Momentum Average Inverse Relief Pullback Strategy

- Multitimeframe Trend Hunter Strategy

- DCCI Breakout Strategy

- Doubly Confident Price Oscillation Quant Strategy

- Volatility Trend Tracking Strategy

- Dual-driver Quantized Reversal Tracking Strategy

- Overlay Trend Signals Strategy