All About Momentum Trading Strategy with Stop Loss for Gold

Author: ChaoZhang, Date: 2024-02-20 16:27:18Tags:

Overview

This strategy calculates the deviation of gold price from its 21-day exponential moving average to determine overbought and oversold situations in the market. It adopts a momentum trading approach with stop loss mechanism to control risk when deviation reaches certain thresholds in terms of standard deviation.

Strategy Logic

- Calculate 21-day EMA as the baseline

- Compute deviation of price from EMA

- Standardize deviation into Z-Score

- Go long when Z-Score crosses over 0.5; Go short when Z-Score crosses below -0.5

- Close position when Z-Score falls back to 0.5/-0.5 threshold

- Set stop loss when Z-Score goes over 3 or below -3

Advantage Analysis

The advantages of this strategy are:

- EMA as dynamic support/resistance to capture trends

- Stddev and Z-Score effectively gauge overbought/oversold levels, reducing false signals

- Exponential EMA puts more weight on recent prices, making it more sensitive

- Z-Score standardizes deviation for unified judgment rules

- Stop loss mechanism controls risk and limits losses

Risk Analysis

Some risks to consider:

- EMA can generate wrong signals when price gaps or breaks out

- Stddev/Z-Score thresholds need proper tuning for best performance

- Improper stop loss setting could lead to unnecessary losses

- Black swan events may trigger stop loss and miss trend opportunity

Solutions:

- Optimize EMA parameter to identify major trends

- Backtest to find optimal Stddev/Z-Score thresholds

- Test stop loss rationality with trailing stops

- Reassess market post-event, adjust strategy accordingly

Optimization Directions

Some ways to improve the strategy:

- Use volatility indictors like ATR instead of simple Stddev to gauge risk appetite

- Test different types of moving averages for better baseline

- Optimize EMA parameter to find best period

- Optimize Z-Score thresholds for improved performance

- Add volatility-based stops for more intelligent risk control

Conclusion

Overall this is a solid trend following strategy. It uses EMA to define trend direction and standardized deviation to clearly identify overbought/oversold levels for trade signals. Reasonable stop loss controls risk while letting profits run. Further parameter tuning and adding conditions can make this strategy more robust for practical application.

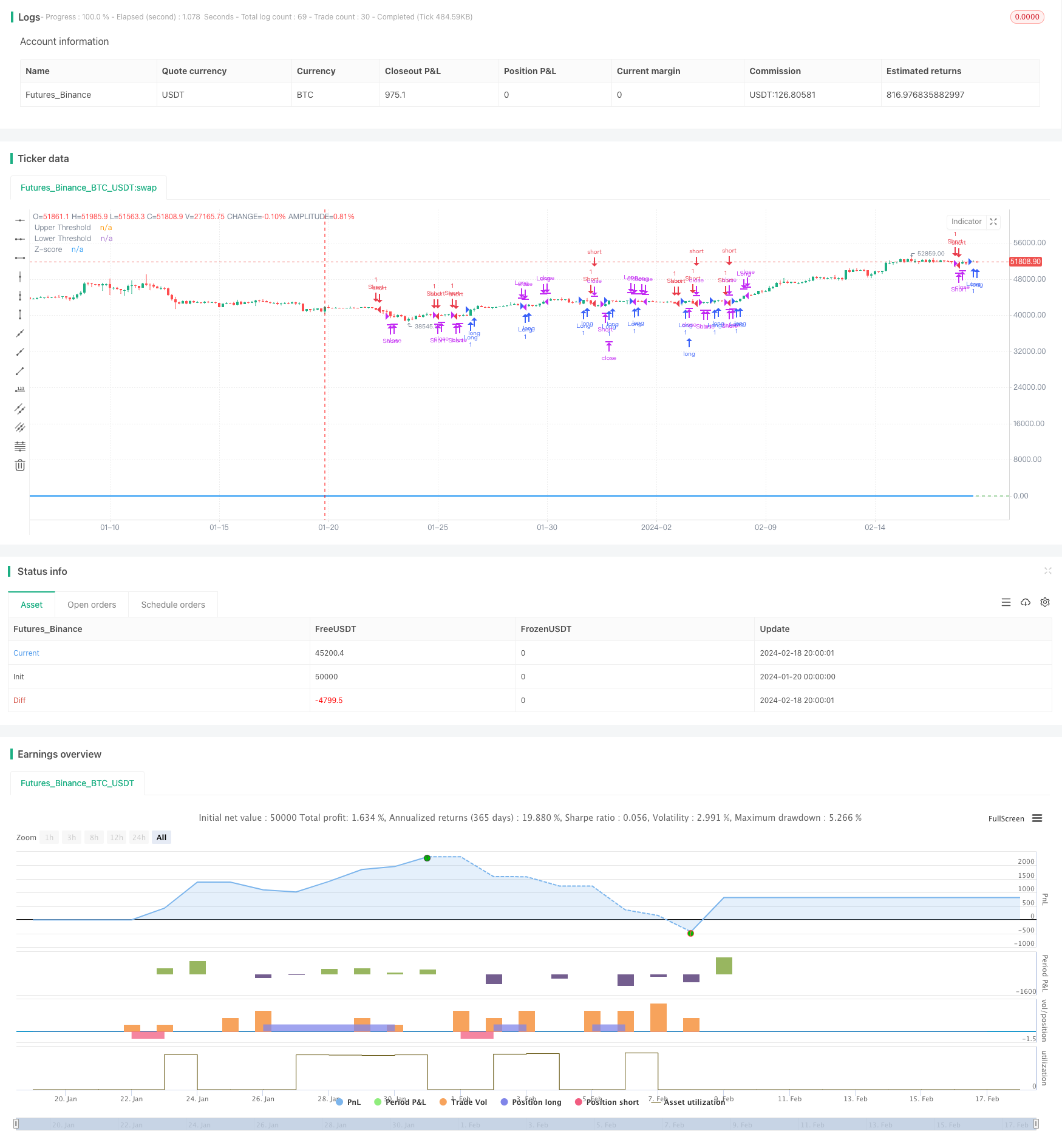

/*backtest

start: 2024-01-20 00:00:00

end: 2024-02-19 00:00:00

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("GC Momentum Strategy with Stoploss and Limits", overlay=true)

// Input for the length of the EMA

ema_length = input.int(21, title="EMA Length", minval=1)

// Exponential function parameters

steepness = 2

// Calculate the EMA

ema = ta.ema(close, ema_length)

// Calculate the deviation of the close price from the EMA

deviation = close - ema

// Calculate the standard deviation of the deviation

std_dev = ta.stdev(deviation, ema_length)

// Calculate the Z-score

z_score = deviation / std_dev

// Long entry condition if Z-score crosses +0.5 and is below 3 standard deviations

long_condition = ta.crossover(z_score, 0.5)

// Short entry condition if Z-score crosses -0.5 and is above -3 standard deviations

short_condition = ta.crossunder(z_score, -0.5)

// Exit long position if Z-score converges below 0.5 from top

exit_long_condition = ta.crossunder(z_score, 0.5)

// Exit short position if Z-score converges above -0.5 from below

exit_short_condition = ta.crossover(z_score, -0.5)

// Stop loss condition if Z-score crosses above 3 or below -3

stop_loss_long = ta.crossover(z_score, 3)

stop_loss_short = ta.crossunder(z_score, -3)

// Enter and exit positions based on conditions

if (long_condition)

strategy.entry("Long", strategy.long)

if (short_condition)

strategy.entry("Short", strategy.short)

if (exit_long_condition)

strategy.close("Long")

if (exit_short_condition)

strategy.close("Short")

if (stop_loss_long)

strategy.close("Long")

if (stop_loss_short)

strategy.close("Short")

// Plot the Z-score on the chart

plot(z_score, title="Z-score", color=color.blue, linewidth=2)

// Optional: Plot zero lines for reference

hline(0.5, "Upper Threshold", color=color.red)

hline(-0.5, "Lower Threshold", color=color.green)

- EMA Breakthrough Trap Strategy

- Golden Cross Dead Cross Trading Strategy

- Supertrend Based Multitimeframe Trend Tracking Strategy

- Manual Buy & Sell Alerts Strategy

- Quantitative Breakthrough Uptrend Reference Strategy

- Adaptive Grid Trading Strategy Based on Quantitative Trading Platform

- Quantitative Trading Strategy Based on Ichimoku Cloud and Moving Average

- Dual Moving Average Reversal Tracking Strategy

- Bollinger Bands Reversal Strategy

- Ichimoku Kinko Hyo Cloud + QQE Quantitative Strategy

- Parabola Oscillator Seeking Highs and Lows Strategy

- Bollinger Bands Breakout Strategy

- Breakthrough Fair Value Gap Strategy

- Adaptive Moving Average Crossover System with Momentum Breakout

- Peak-to-Peak Pattern Based Trading Strategy

- Multiple EMA Buy Strategy

- OBV EMA Crossover Trend Following Strategy

- RSI and MA Crossover Trend Tracking Strategy

- Reversal Momentum Strategy with Double Confirmation

- EMA Crossover for Long Line Quant Strategy