Overview

The Breakout Bollinger Bands Oscillation Trading Strategy is a trading strategy for when the market is in an oscillating state. This strategy uses the Bollinger Bands indicator to judge the oscillating condition of the market and sends out trading signals when the price touches the upper or lower rails of the Bollinger Bands. Unlike traditional trend following strategies, this strategy is more suitable for range-bound sideways markets.

Strategy Logic

This strategy is mainly implemented based on the Bollinger Bands indicator. Bollinger Bands consist of a middle rail, upper rail and lower rail. When the price approaches the upper or lower rail, it represents over-optimism or over-pessimism in the market, which means a relatively high probability of reversal.

Specifically, this strategy first uses the DMI indicator to determine if the market is in an oscillating state. When the difference between +DMI and -DMI is less than 20, the market is considered to be ranging sideways. Under this condition, go long when the price breaks above the lower rail, and go short when the price breaks below the upper rail. The stop loss point is set near the opposite rail.

Advantages

Compared with trend following strategies, this strategy is more suitable for range-bound market environments and will not lose money chasing trends. Compared with traditional oscillation trading strategies, this strategy can more accurately judge the overbought and oversold situations in the market by using the Bollinger Bands indicator, thus improving the probability of entering the market.

Risks

This strategy mainly relies on Bollinger Bands to determine market oscillation and overbought/oversold conditions. When Bollinger Bands diverge or contract abnormally, it may lead to wrong signals. In addition, the stop loss point is close, so a single stop loss could be relatively large. It is recommended to optimize the stop loss strategy with money management.

Optimization

We can consider combining other indicators to filter entry signals, such as RSI and other oscillators, to improve entry accuracy. In addition, optimizing the stop loss strategy is also very important to avoid a single large stop loss. We can also choose trading varieties that are more suitable for this strategy, such as low market cap coins.

Conclusion

In general, this strategy is suitable for oscillating markets and can be used when trend strategies fail. But there is still room for improving its effectiveness by judging market states with indicators. We can further improve this strategy by methods like multi-indicator combos, money management, etc. to make it more stable and profitable.

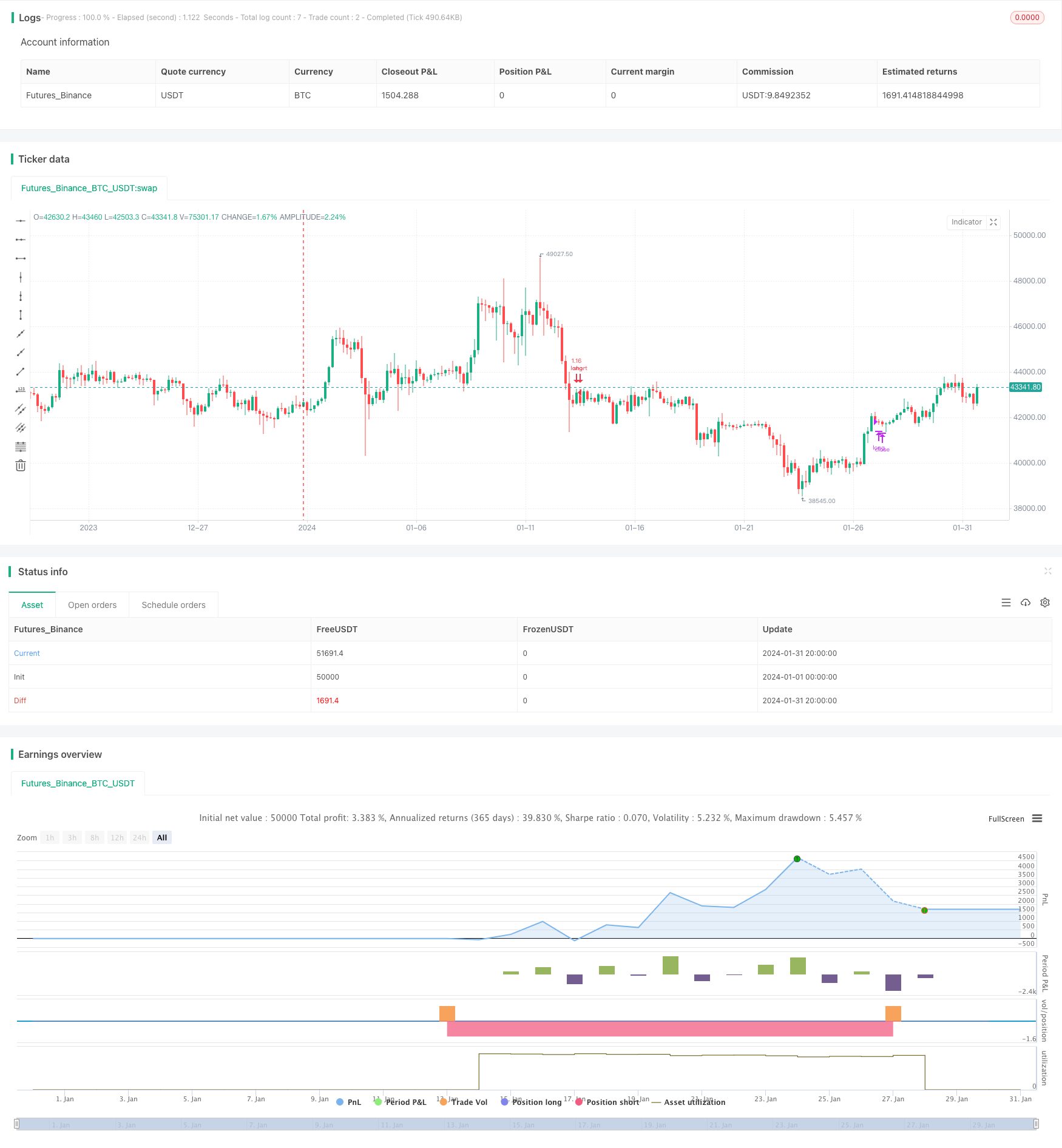

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(shorttitle='Sideways Strategy DMI + Bollinger Bands',title='Sideways Strategy DMI + Bollinger Bands (by Coinrule)', overlay=true, initial_capital = 100, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, commission_type=strategy.commission.percent, commission_value=0.1)

// Works on ETHUSD 3h, 1h, 2h, 4h

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2021, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 12, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 31, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2022, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

[pos_dm, neg_dm, adx] = dmi(14, 14)

lengthBB = input(20, minval=1)

src = input(close, title="Source")

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(src, lengthBB)

dev = mult * stdev(src, lengthBB)

upper = basis + dev

lower = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

sideways = (abs(pos_dm - neg_dm) < 20)

//Stop_loss= ((input (3))/100)

//Take_profit= ((input (2))/100)

//longStopPrice = strategy.position_avg_price * (1 - Stop_loss)

//longTakeProfit = strategy.position_avg_price * (1 + Take_profit)

//closeLong = close < longStopPrice or close > longTakeProfit or StopRSI

//Entry

strategy.entry(id="long", long = true, when = sideways and (crossover(close, lower)) and window())

//Exit

strategy.close("long", when = (crossunder(close, upper)))