Simple Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2024-02-21 15:11:32Tags:

Overview

This is a combination trading strategy based on simple moving averages (SMA). It uses a crossover of the 9-day and 21-day SMA lines as buy and sell signals. When the short-term SMA crosses above the long-term SMA from below, a buy signal is generated. When the short-term SMA crosses below the long-term SMA from above, a sell signal is generated.

Strategy Logic

The core logic of this strategy is to use two SMA lines with different parameters - a 9-day SMA representing the short-term trend and a 21-day SMA representing the long-term trend. When the short-term trend line crosses above the long-term trend line from below, it indicates the market is changing from downtrend to uptrend, generating a buy signal. When the short-term line crosses below the long-term line from above, it signals a change from uptrend to downtrend, generating a sell signal.

The key signals this strategy relies on are the “golden cross” and “death cross” of the two SMA lines. A golden cross occurs when the short SMA crosses above the long SMA, signaling a possible change from downtrend to uptrend. A death cross occurs when the short SMA crosses below the long SMA, suggesting a downturn from uptrend may start. By utilizing these two signals, the strategy identifies relationships between short-term and long-term trends to make trading decisions.

Advantages

- Simple to understand and implement

- Few parameters needing extensive testing/optimization

- Reasonable trading frequency avoiding overly aggressive trades

- Fairly accurate at identifying trend reversal points

- Offers measurability and stability to a certain extent

Risks

- Prone to generating false signals and whipsaws

- Buying/selling point selection relies heavily on experience instead of a systematic approach

- Performance highly parameter dependent. 9-day/21-day SMA may not be optimal

- Ineffective at filtering noise trades in choppy/sideways markets

- Sizable losing trades in high volatility environments

Possible Enhancements:

1. Add filters to avoid acting on false signals

2. Incorporate other indicators to gauge signal reliability

3. Test and optimize parameters for different products

4. Implement stop loss/take profit to control risks

Conclusion

Overall this is a fairly traditional and simple dual moving average crossover system. It is easy to understand and implement with relatively simple parameter selection. It can effectively track changes between short-term and long-term trends. However, issues like false signals, empirically chosen parameters, mediocre performance in high volatility environments need to be addressed. Appropriate optimizations, enhancements, and combinations should be considered along with solid risk control practices.

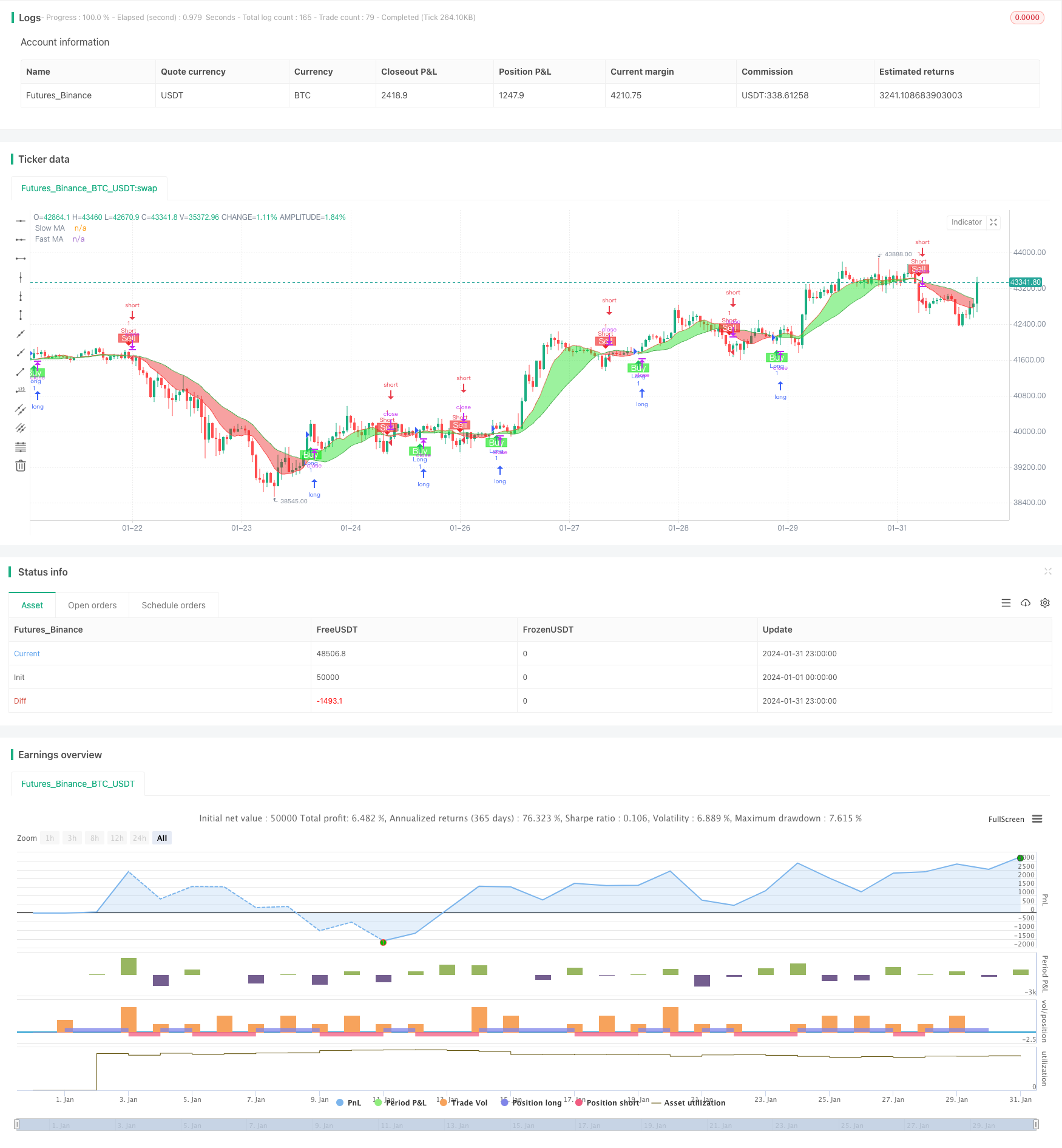

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bitboy Strategy", overlay=true)

// Define MAs

SlowMA = ta.sma(close, 9)

FastMA = ta.sma(close, 21)

// Plot MAs

plot1 = plot(SlowMA, color=color.new(color.red, 0), title="Slow MA")

plot2 = plot(FastMA, color=color.new(color.green, 0), title="Fast MA")

// Plot MA Ribbon

fill(plot1, plot2, color=FastMA > SlowMA ? color.rgb(233, 21, 21, 50) : color.new(#1de223, 45))

// Define buy/sell conditions

longCondition = ta.crossover(SlowMA, FastMA)

shortCondition = ta.crossunder(SlowMA, FastMA)

// Strategy commands for buy/sell

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

// Plot buy/sell signals (for visualization)

plotshape(longCondition, location=location.belowbar, color=color.rgb(18, 230, 25, 37), style=shape.labelup, text="Buy", textcolor=color.white)

plotshape(shortCondition, location=location.abovebar, color=color.rgb(239, 23, 23, 40), style=shape.labeldown, text="Sell", textcolor=color.white)

- Trend Reversal Strategy Based on Moving Averages

- Trend Following Strategy Based on Renko Moving Average

- Three RSI Moving Average Bands Strategy

- Bidirectional Trading Strategy Based on Moon Phases

- Reversal Trading Strategy with EMA Crossover and Bollinger Bands

- Adaptive Moving Stop Line Trading Strategy

- Recursive Moving Trend Average Combined with 123 Reversal Pattern Strategy

- Multi Timeframe Moving Average and EMA Based Trend Strategy

- Multi Timeframe RSI and Stochastics Strategy

- Enhanced Moving Average Crossover Sakkoulas Trading Strategy

- Donchian Adaptive Moving Average Trading System

- Volume Weighted Trend Reversal Strategy

- Trading Strategy Based on Multiple Time Frame EMA Breakthrough and K-line Pattern Combination

- Trend Following Strategy with Stop Loss and Take Profit

- Dynamic Position Sizing Quant Strategy

- Buy Strategy Based on Close Price Breakthrough

- Dual Moving Average Strategy

- Breakout Bollinger Bands Oscillation Trading Strategy

- Trading Psychology Balancing Strategy

- Quantitative Trading Strategy Based on Double Moving Average Crossover