MA Crossover Trading Strategy Based on Short-term and Long-term Moving Average Crossovers

Author: ChaoZhang, Date: 2024-02-22 15:36:49Tags:

Overview

This strategy is a simple moving average crossover trading strategy based on short-term and long-term moving average crossovers. It uses 34-period and 89-period moving averages to observe their crossovers during the morning session as buy and sell signals. When the short-term moving average crosses above the long-term moving average from below, a buy signal is generated. When it crosses below from above, a sell signal is generated.

Strategy Logic

The core logic of this strategy is based on crossovers between short-term and long-term moving averages as trading signals. Specifically, the strategy defines 34-period and 89-period short-term and long-term simple moving averages (SMAs). It only observes the crossovers between these two SMAs during the morning session (08:00 - 10:00). When the short-term SMA crosses above the long-term SMA from below, the market is considered to be in an upward trend, hence generating a buy signal. When the short-term SMA crosses below the long-term SMA from above, the market is considered to be in a downward trend, thus generating a sell signal.

Upon receiving a buy or sell signal, the strategy will enter a position and set a condition to exit the position, which is to take profit after holding for a specified number of candles (default is 3 candles) since entry. This allows locking in partial profits and avoids further losses.

It should be noted that the strategy only identifies crossover signals during the morning session. This is because this time frame has higher trading volumes and trend change signals are more reliable. Other time frames have larger price fluctuations and are easier to generate false signals.

Advantage Analysis

The strategy has the following advantages:

Using simple and universal moving average crossover rules, easy to understand, suitable for beginners

Only identifying signals during morning session where quality signals are abundant, which filters out false signals during other time frames

Has stop loss conditions that allow timely stop loss, locking in partial profits, and reducing risk of loss

Many customizable parameters that can be adjusted based on market conditions and personal trading style

Easily extensible to combine with other indicators to design more complex strategies

Risk Analysis

The strategy also has some risks, mainly from the following aspects:

Moving averages themselves have greater lagging attributes, may miss short-term price reversal points

Relies solely on simple indicators, prone to failure in certain market environments (trend shocks, range-bound, etc.)

Improper stop loss positioning may cause unnecessary losses

Improper parameter settings (moving average periods, holding periods, etc.) may also affect strategy performance

Corresponding solutions:

Incorporate other leading indicators to improve sensitivity to short-term changes

Add filtering conditions to avoid being affected by false signals during shocks and range-bound markets

Optimize stop loss logic and dynamically adjust stop loss range based on market volatility

Multi-parameter optimization to find optimal parameter settings

Optimization Directions

The strategy also has great potential for optimization, mainly from the following aspects:

Add other filtering conditions to avoid false signals during shocks and range-bound markets

Incorporate momentum indicators to identify stronger breakout signals

Optimize the moving average period parameters to find the best parameter combination

Automatically optimize the stop loss range based on market volatility

Attempt to automatically optimize the entire strategy based on machine learning techniques

Attempt to combine with other strategies to design more complex multi-strategy systems

Conclusion

In general, this strategy is relatively simple and practical, suitable for beginners to learn from. It embodies the typical pattern of moving average crossover strategies and uses stops to control risks. However, further optimizations can be made to improve performance for more market conditions. Investors can leverage this basic framework to design more advanced quantitative trading strategies.

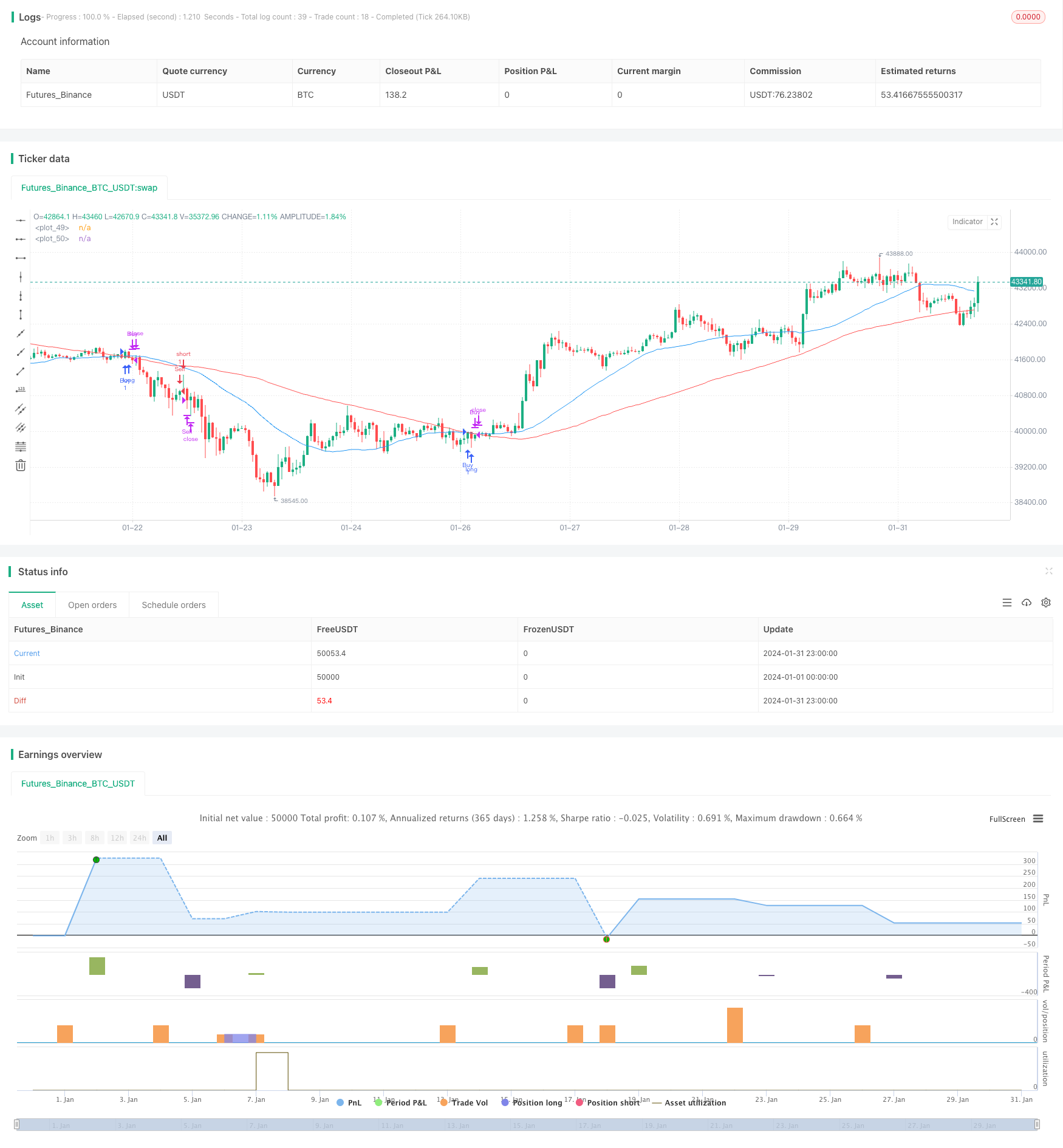

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("34 89 SMA Crossover Strategy", overlay=true)

// Define the length for the SMAs

short_length = input(34, title="Short SMA Length")

long_length = input(89, title="Long SMA Length")

exit_candles = input(3, title="Exit after how many candles?")

exit_at_open = input(true, title="Exit at Open?")

// Define morning session

morning_session = input("0800-1000", "Morning Session")

// Calculate SMAs

short_sma = ta.sma(close, short_length)

long_sma = ta.sma(close, long_length)

// Function to check if current time is within specified session

in_session(session) =>

session_start = na(time(timeframe.period, "0800-1000")) ? na : true

session_start

// Condition for buy signal (short SMA crosses over long SMA) within specified trading hours

buy_signal = ta.crossover(short_sma, long_sma)

// Condition for sell signal (short SMA crosses under long SMA) within specified trading hours

sell_signal = ta.crossunder(short_sma, long_sma)

// Function to exit the trade after specified number of candles

var int trade_entry_bar = na

var int trade_exit_bar = na

if (buy_signal or sell_signal)

trade_entry_bar := bar_index

if (not na(trade_entry_bar))

trade_exit_bar := trade_entry_bar + exit_candles

// Exit condition

exit_condition = (not na(trade_exit_bar) and (exit_at_open ? bar_index + 1 >= trade_exit_bar : bar_index >= trade_exit_bar))

// Execute trades

if (buy_signal)

strategy.entry("Buy", strategy.long)

if (sell_signal)

strategy.entry("Sell", strategy.short)

if (exit_condition)

strategy.close("Buy")

strategy.close("Sell")

// Plot SMAs on the chart

plot(short_sma, color=color.blue, linewidth=1)

plot(long_sma, color=color.red, linewidth=1)

- Dual EMA Crossover Strategy

- Trend Tracking Strategy Based on RSI and ZigZag Indicators

- Moving Average Crossover Breakout Strategy

- Momentum Breakout Backtesting Support Resistance Strategy

- MyQuant Trend Identifier Strategy

- Dual Trendlines Breakout Golden Cross Death Cross Trend Following Strategy

- Nifty 50 Quantitative Trading Strategy Based on Dynamic Position Adjustment with Support and Resistance Levels

- Dynamic Channel Moving Average Trend Tracking Strategy

- Harmonic Dual System Strategy

- Breakthrough Callback Long Strategy

- Dual Moving Average Crossover MACD Quantitative Strategy

- Dual Moving Average Pressure Rebound Strategy

- Four WMA Trend Tracking Strategy

- Trend Following Strategy Based on Nadaraya-Watson Regression and ATR Channel

- Trend Tracking Strategy Based on Moving Average Crossover

- Trend Following Strategy Based on EMA Crossover

- Log Ichimoku Cross Variety Strategy

- Bitcoin Trading Strategy Based on RVI and EMA

- Bi-directional Reversal Quantitative Trading Strategy

- Bollinger Bands Consolidation Strategy