Overview

The moving average crossover MACD trading strategy is a quantitative trading strategy that tracks the crossover situations of short-term and long-term exponential moving averages (EMA) and makes buy and sell operations when golden cross and dead cross occur. This strategy combines the MACD indicator for trading signal judgment.

Strategy Logic

This strategy mainly relies on 12-day EMA, 26-day EMA and MACD indicator. The specific logic is:

- Calculate the 12-day EMA and 26-day EMA.

- Calculate the MACD (that is, the 12-day EMA minus the 26-day EMA).

- Calculate the 9-day EMA of MACD as the signal line.

- When the MACD goes above the signal line, a buy signal is generated.

- When the MACD falls below the signal line, a sell signal is generated.

- Make the corresponding buy or sell operation at the close of the second candlestick after the signal is generated.

Additionally, this strategy also sets some filtering conditions:

- The trading time is the non-closing time of each trading day.

- The absolute value of the difference between the MACD and signal line needs to be greater than 0.08.

- Only one direction of position is allowed at a time.

Advantage Analysis

This strategy combines moving average crossover and MACD indicator, which can effectively capture the inflection points of market short-term and medium-term trends. The main advantages are:

- The strategy rules are simple and clear, easy to understand and implement.

- The indicator parameters are optimized for relatively stable performance.

- It takes into account tracking medium and short term trends and timely stop loss exit.

- The trading logic is rigorous to avoid invalid trading.

Risk Analysis

This strategy also has some risks:

- Backtesting data overfitting risk. Actual application may require parameter and threshold adjustment.

- High slippage cost risk from frequent trading.

- Loss risk from failure to exit timely when trend reverses.

- Leverage risk amplification inherent in quantitative trading itself.

Corresponding mitigation methods:

- Dynamically optimize parameters and adjust thresholds.

- Appropriately relax trading rules to reduce unnecessary trading.

- Combine more indicators to judge reversal signals.

- Strictly control positions and leverage.

Optimization Directions

The main aspects for optimizing this strategy include:

- Test longer cycle moving average combinations to find optimal parameters.

- Add fundamentals like financial performance, significant events etc. as filters.

- Incorporate more indicators to determine trend reversal timing, like Bollinger Bands, KDJ etc.

- Develop stop loss mechanisms. Actively cut losses when losses reach pre-set stop loss points.

- Add drawdown ratio to control maximum drawdown.

Summary

The moving average crossover MACD trading strategy generates trading signals through simple trend tracking and effectively controls risks with appropriate filtering conditions. It is an effective quantitative trading strategy. The strategy can be improved in ways like parameter optimization, adding stop loss mechanisms, incorporating more auxiliary indicators etc.

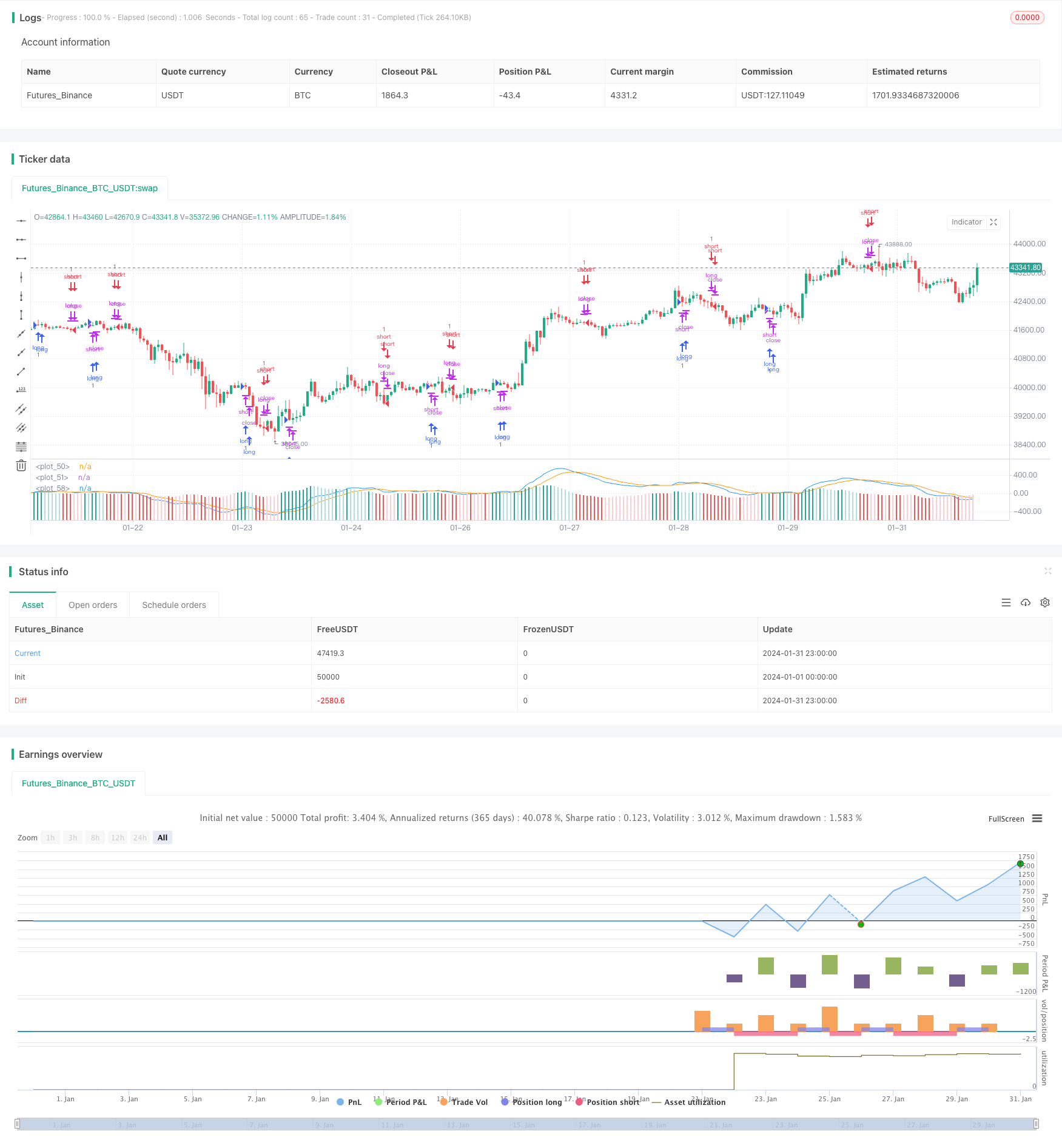

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMMA", max_bars_back = 200)

var up1 = #26A69A

var up2 = #B2DFDB

var down1 = #FF5252

var down2 = #FFCDD2

var confirmationLength = 2

var earliest = timestamp("20 Jan 2024 00:00 +0000")

// Regn u

shortEMA = ta.ema(close, 12)

longEMA = ta.ema(close, 26)

macd = shortEMA - longEMA

signal = ta.ema(macd, 9)

delta = macd - signal

absDelta = math.abs(delta)

previousDelta = delta[1]

signalCrossover = ta.crossover(macd, signal)

signalCrossunder = ta.crossunder(macd, signal)

harskiftetdag = hour(time[confirmationLength]) > hour(time)

enterLongSignal = signalCrossover[confirmationLength] and (macd > signal) and (absDelta >= 0.08)

exitLongSignal = signalCrossunder[confirmationLength] and (macd < signal)

enterShortSignal = signalCrossunder[confirmationLength] and (macd < signal) and (absDelta >= 0.08)

exitShortSignal = signalCrossover[confirmationLength] and (macd > signal)

// Så er det tid til at købe noe

qty = math.floor(strategy.equity / close)

if time >= earliest and not harskiftetdag

if exitLongSignal

strategy.close("long")

else if enterLongSignal

strategy.close("short")

strategy.entry("long", strategy.long, qty = qty)

if exitShortSignal

strategy.close("short")

else if enterShortSignal

strategy.close("long")

strategy.entry("short", strategy.short, qty = qty)

// Så er det tid til at vise noe

plot(macd, color=color.blue)

plot(signal, color=color.orange)

// bgcolor(color = delta > 0.1 ? color.new(color.green, 90) : color.new(color.green, 100))

// bgcolor(color = signalCrossover ? color.purple : signalCrossunder ? color.aqua : color.new(color.green, 100))

histogramColor = delta > 0 ? (previousDelta < delta ? up1 : up2) : (previousDelta > delta ? down1 : down2)

plot(

delta,

style=plot.style_columns,

color=histogramColor

)