Overview

The BONK Multi-Factor Trading Strategy is a quantitative trading strategy that combines multiple technical indicators. The strategy utilizes EMA, MACD, RSI, and volume indicators to capture market trends and momentum, along with stop loss and take profit mechanisms to control risk. The main idea behind this strategy is to generate trading signals based on the collective confirmation of multiple indicators, thereby improving the accuracy and reliability of trades.

Strategy Principles

The strategy employs four main technical indicators: EMA, MACD, RSI, and volume.

EMA (Exponential Moving Average): The strategy uses two EMA lines, with periods of 9 and 20. When the short-term EMA crosses above the long-term EMA, it generates a buy signal; conversely, when the short-term EMA crosses below the long-term EMA, it generates a sell signal.

MACD (Moving Average Convergence Divergence): MACD consists of two lines, the MACD line and the signal line. When the MACD line crosses above the signal line, it indicates an upward market trend and supports buying; when the MACD line crosses below the signal line, it indicates a downward market trend and supports selling.

RSI (Relative Strength Index): RSI is used to measure overbought and oversold conditions in the market. When RSI is above 70, it suggests that the market is overbought and may face a pullback risk; when RSI is below 30, it suggests that the market is oversold and may present a rebound opportunity.

Volume: The strategy employs a 20-period moving average of volume. When the actual volume is higher than the average line, it indicates higher market activity, and the trend may continue.

Combining these four indicators, the strategy generates a buy signal when EMA, MACD, and volume all support buying, and RSI is not in the overbought range. Conversely, it generates a sell signal when EMA, MACD, and volume all support selling, and RSI is not in the oversold range.

Furthermore, the strategy sets stop loss and take profit levels. For long trades, the stop loss level is set at 95% of the entry price, while the take profit level is set at 105% of the entry price. For short trades, the stop loss level is set at 105% of the entry price, while the take profit level is set at 95% of the entry price. This helps control the risk exposure of individual trades.

Strategy Advantages

Multi-indicator confirmation: The strategy incorporates multiple technical indicators, including trend indicators (EMA), momentum indicators (MACD), overbought/oversold indicators (RSI), and volume indicators. By requiring confirmation from multiple indicators, the reliability of trading signals is enhanced, reducing the occurrence of false signals.

Trend-following capability: Both EMA and MACD indicators possess good trend-following abilities. By capturing the primary market trends, the strategy can align trades with the market direction, increasing the chances of profitability.

Volume confirmation: The strategy introduces the volume indicator as a supplementary judgment. When price signals appear, an increase in volume can validate the authenticity of the trend, enhancing the credibility of trading signals.

Risk control: The strategy sets explicit stop loss and take profit levels, which helps control the risk exposure of individual trades. Additionally, the inclusion of the RSI indicator helps avoid trading in overbought or oversold ranges, reducing risk.

Strategy Risks

Parameter optimization risk: The strategy involves multiple parameters, such as EMA periods, MACD parameters, RSI periods, etc. The selection of these parameters affects the performance of the strategy. If the parameters are over-optimized, it may lead to poor performance of the strategy in future market conditions.

Changing market environments: The strategy is backtested and optimized based on historical data, but future market conditions may differ from historical data. When the market experiences severe volatility, unexpected events, or trend reversals, the effectiveness of the strategy may diminish.

Trading frequency and costs: The strategy may generate a high trading frequency, especially during periods of high market volatility. Frequent trading can increase transaction costs, such as commissions and slippage, which may impact the overall performance of the strategy.

Stop loss and take profit levels: The strategy uses fixed stop loss and take profit percentages (5%). This static approach to risk control may not be suitable for all market conditions. In some cases, fixed stop loss levels may be too tight, leading to premature exits; while fixed take profit levels may limit the profit potential of the strategy.

Strategy Optimization Directions

Dynamic stop loss and take profit: Consider using dynamic stop loss and take profit mechanisms, such as those based on ATR (Average True Range) or Bollinger Bands. This can better adapt to market volatility and improve the effectiveness of risk control.

Incorporating additional indicators: Consider introducing other technical indicators, such as Bollinger Bands, KDJ, etc., to further confirm trading signals. Additionally, incorporating macroeconomic indicators or market sentiment indicators can capture more market information.

Parameter optimization: Regularly optimize the key parameters of the strategy to adapt to the ever-changing market environment. Methods like genetic algorithms or grid search can be used to optimize parameter combinations and improve the robustness of the strategy.

Risk management: Introduce more advanced risk management techniques, such as position sizing and capital allocation. The size of positions can be dynamically adjusted based on factors like market volatility and account balance to control overall risk exposure.

Strategy combination: Combine this strategy with other strategies, such as trend-following strategies or mean-reversion strategies. Through strategy combination, better risk diversification and return smoothing can be achieved.

Conclusion

The BONK Multi-Factor Trading Strategy is a quantitative trading strategy based on EMA, MACD, RSI, and volume indicators. The strategy generates trading signals through the collective confirmation of multiple indicators and sets fixed stop loss and take profit levels to control risk. The strengths of the strategy lie in its trend-following capability, multi-indicator validation, and risk control. However, it also faces risks such as parameter optimization risk, changing market environments, and trading costs. To further improve the strategy, methods like dynamic stop loss and take profit, incorporating additional indicators, parameter optimization, advanced risk management, and strategy combination can be considered. Overall, the BONK Multi-Factor Trading Strategy provides a viable framework for quantitative trading, but it still requires careful evaluation and continuous optimization in practical applications.

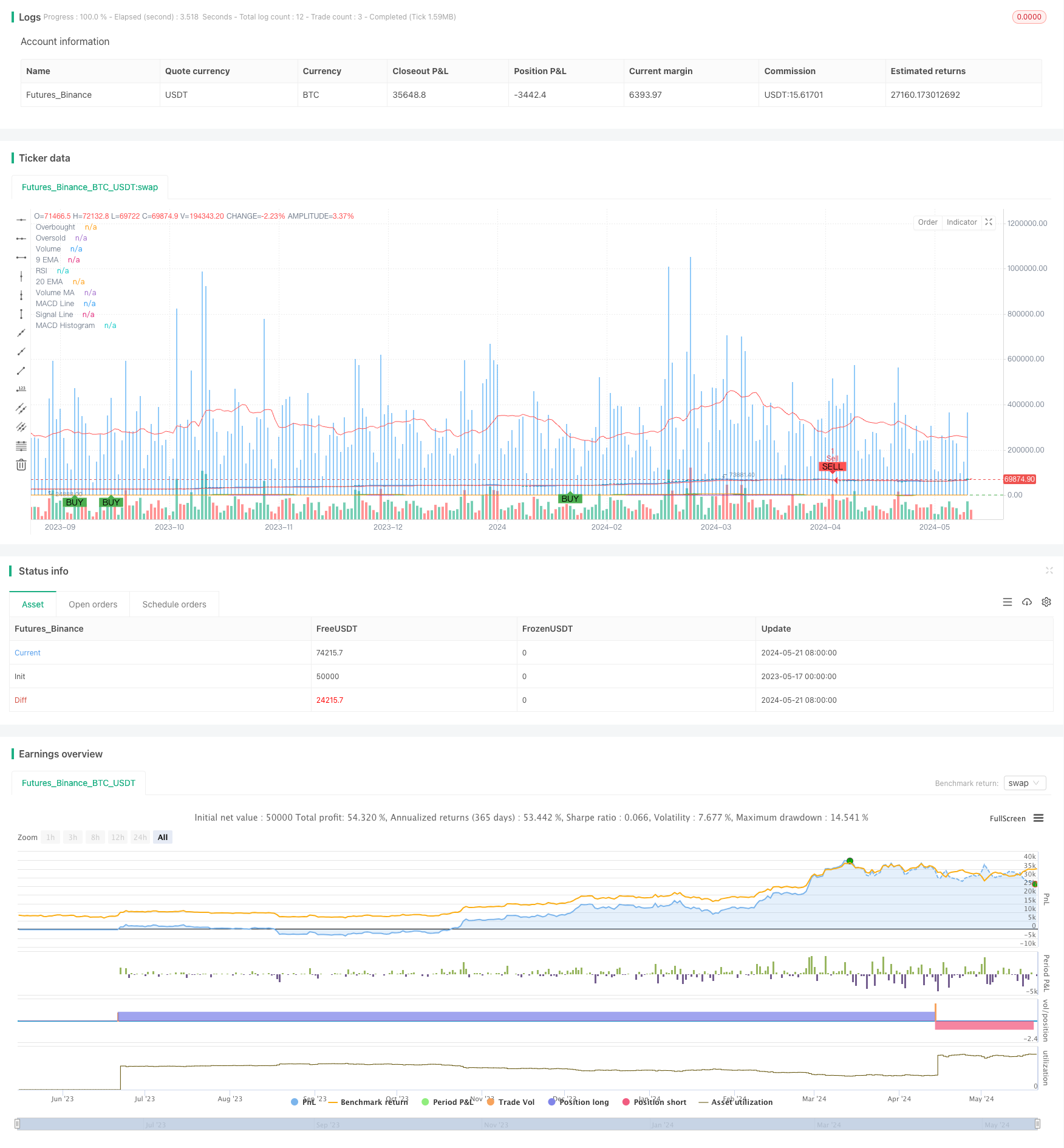

/*backtest

start: 2023-05-17 00:00:00

end: 2024-05-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BONK Trading Bot with Volume, Stop Loss, and Take Profit", overlay=true)

// Input parameters for EMA

emaShortLength = input.int(9, title="Short EMA Length", minval=1)

emaLongLength = input.int(20, title="Long EMA Length", minval=1)

// Input parameters for MACD

macdFastLength = input.int(12, title="MACD Fast Length")

macdSlowLength = input.int(26, title="MACD Slow Length")

macdSignalSmoothing = input.int(9, title="MACD Signal Smoothing")

// Input parameters for RSI

rsiLength = input.int(14, title="RSI Length")

rsiOverbought = input.int(70, title="RSI Overbought Level")

rsiOversold = input.int(30, title="RSI Oversold Level")

// Calculate EMA

emaShort = ta.ema(close, emaShortLength)

emaLong = ta.ema(close, emaLongLength)

// Plot EMA

plot(emaShort, title="9 EMA", color=color.blue)

plot(emaLong, title="20 EMA", color=color.red)

// Calculate MACD

[macdLine, signalLine, _] = ta.macd(close, macdFastLength, macdSlowLength, macdSignalSmoothing)

macdHist = macdLine - signalLine

// Plot MACD

plot(macdLine, title="MACD Line", color=color.green)

plot(signalLine, title="Signal Line", color=color.orange)

plot(macdHist, title="MACD Histogram", color=color.gray, style=plot.style_histogram)

// Calculate RSI

rsi = ta.rsi(close, rsiLength)

// Plot RSI

plot(rsi, title="RSI", color=color.purple)

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

// Volume Indicator

volumeMA = ta.sma(volume, 20)

plot(volume, title="Volume", color=color.blue, style=plot.style_histogram)

plot(volumeMA, title="Volume MA", color=color.red)

// Define trading conditions

buyCondition = ta.crossover(emaShort, emaLong) and (macdLine > signalLine) and (rsi < rsiOverbought) and (volume > volumeMA)

sellCondition = ta.crossunder(emaShort, emaLong) and (macdLine < signalLine) and (rsi > rsiOversold) and (volume > volumeMA)

// Calculate stop loss and take profit levels

longStopLoss = close * 0.95

longTakeProfit = close * 1.05

shortStopLoss = close * 1.05

shortTakeProfit = close * 0.95

// Execute trades with stop loss and take profit

if (buyCondition)

strategy.entry("Buy", strategy.long, stop=longStopLoss, limit=longTakeProfit)

if (sellCondition)

strategy.entry("Sell", strategy.short, stop=shortStopLoss, limit=shortTakeProfit)

// Plot buy/sell signals on the chart

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.labelup, text="BUY")

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.labeldown, text="SELL")