Overview

This strategy is a short-term mean reversion trading system that combines a 200-day moving average with a 2-period RSI indicator. The core concept is to identify oversold correction opportunities within long-term uptrends through a triple validation mechanism.

Strategy Principles

The strategy employs a triple validation mechanism: first, price must be above the 200-day moving average to confirm a long-term uptrend; second, RSI must decline for three consecutive days with the initial decline starting above 60; finally, RSI must fall below 10 indicating extreme oversold conditions. When all three conditions are met simultaneously, a long signal is generated. The position is closed when RSI rises above 70, indicating overbought conditions.

Strategy Advantages

- Triple validation mechanism significantly improves signal reliability

- Combination of long and short-term indicators avoids false signals

- Clear logic and simple parameters make it easy to understand and execute

- Moving average filter ensures trades align with the main trend

- Extreme oversold conditions trigger entries, increasing probability of success

Strategy Risks

- Frequent trading may result in high transaction costs

- May miss continuous upward movements in strong trend markets

- RSI indicator may lag in certain market conditions

- Excessive false signals possible during high volatility Risk management through stop-loss settings, position duration control, and trading frequency optimization is recommended.

Optimization Directions

- Consider adding volume indicators for confirmation

- Optimize RSI parameters and test different periods

- Introduce adaptive mechanisms to adjust parameters based on market volatility

- Add trend strength filters to improve trade quality

- Implement stop-loss mechanisms for better risk control

Summary

The strategy creates a robust trading system through clever combination of moving averages and RSI indicators. While the triple validation mechanism effectively improves trading reliability, attention to risk management and parameter optimization remains crucial. The overall design is rational with good practical value and optimization potential.

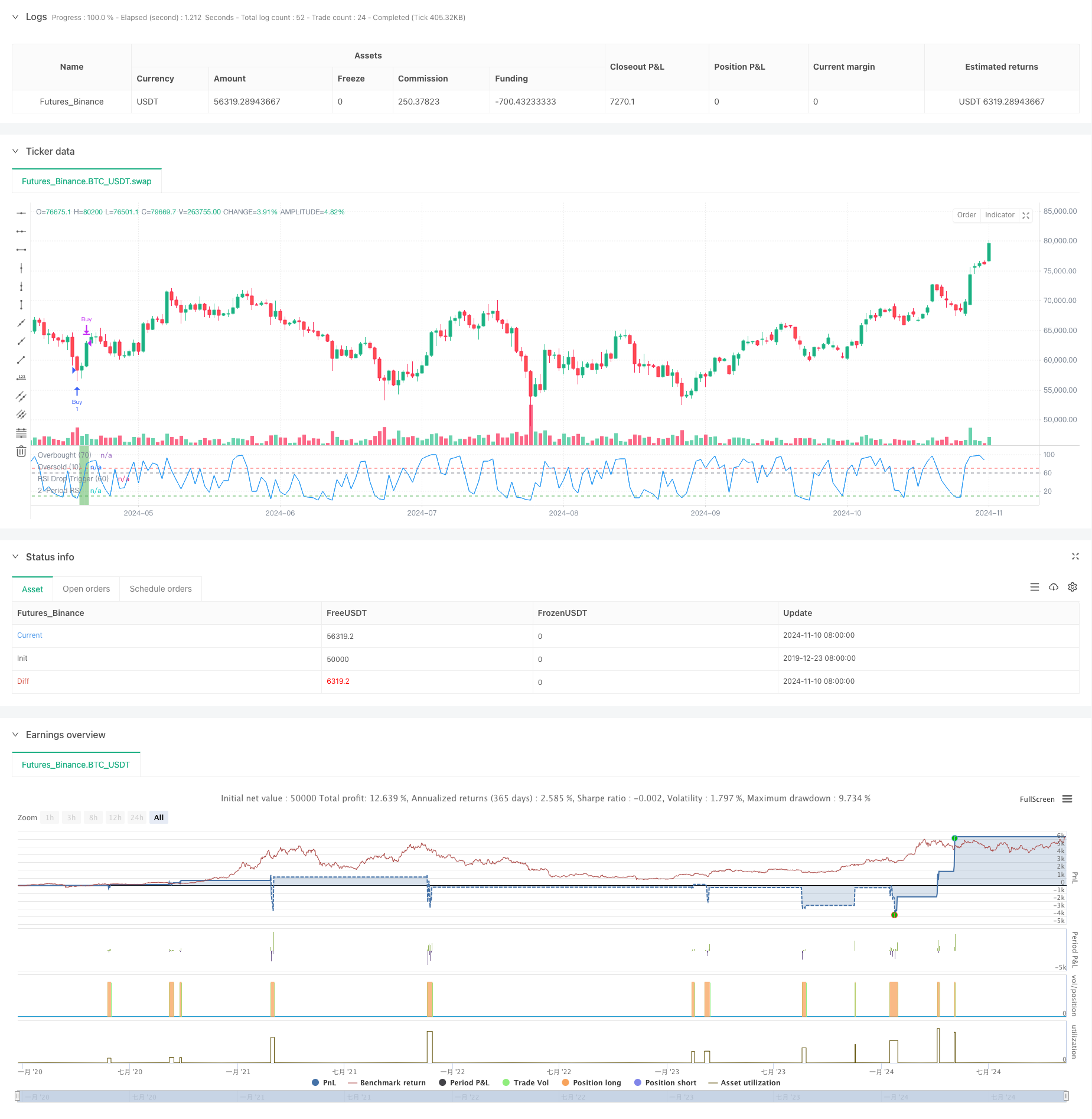

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Larry Connors RSI 3 Strategy", overlay=false)

// Define the moving averages and the RSI

sma200 = ta.sma(close, 200)

rsi2 = ta.rsi(close, 2)

// Conditions for the strategy

condition1 = close > sma200 // Close above the 200-day moving average

// RSI drops three days in a row and the first day’s drop is from above 60

rsi_drop_3_days = rsi2[2] > rsi2[1] and rsi2[1] > rsi2 and rsi2[2] > 60 // The 3-day RSI drop condition

condition2 = rsi_drop_3_days

// The 2-period RSI is below 10 today

condition3 = rsi2 < 10

// Combined buy condition

buyCondition = condition1 and condition2 and condition3

// Sell condition: The 2-period RSI is above 70

sellCondition = rsi2 > 70

// Execute the buy signal when all buy conditions are met

if buyCondition

strategy.entry("Buy", strategy.long)

// Execute the sell signal when the sell condition is met

if sellCondition

strategy.close("Buy")

// Plotting the RSI for visual confirmation

plot(rsi2, title="2-Period RSI", color=color.blue)

hline(70, "Overbought (70)", color=color.red)

hline(10, "Oversold (10)", color=color.green)

hline(60, "RSI Drop Trigger (60)", color=color.gray)

// Set background color when a position is open

bgcolor(strategy.opentrades > 0 ? color.new(color.green, 50) : na)