Overview

This is a trading strategy that combines dual MACD indicators with price action analysis. The strategy identifies market trends through color changes in the MACD histograms on the 15-minute timeframe, looks for strong candle patterns on the 5-minute timeframe, and confirms breakout signals on the 1-minute timeframe. It employs ATR-based dynamic stop-loss and trailing take-profit mechanisms to effectively manage risk while maximizing profit potential.

Strategy Principles

The strategy utilizes two MACD indicators with different parameters (34/144/9 and 100/200/50) to confirm market trends. When both MACD histograms show the same color trend, the system looks for strong candle patterns on the 5-minute chart, characterized by bodies 1.5 times larger than their shadows. Once a strong candle is identified, the system monitors for breakouts on the 1-minute chart. Positions are opened when price breaks above highs in uptrends or below lows in downtrends. Stops are set based on ATR, while a 1.5x ATR multiple is used for dynamic trailing take-profits.

Strategy Advantages

- Multi-timeframe analysis: Combines 15-minute, 5-minute, and 1-minute timeframes for improved signal reliability

- Trend confirmation: Uses dual MACD cross-validation to reduce false signals

- Price action analysis: Identifies key price levels through strong candle patterns

- Dynamic risk management: Adaptive stop-loss and trailing take-profit mechanisms based on ATR

- Signal filtering: Strict entry conditions reduce false trades

- High automation: Fully automated trading reduces human intervention

Strategy Risks

- Trend reversal risk: False breakouts possible in highly volatile markets

- Slippage risk: High-frequency trading on 1-minute timeframe may face slippage

- Overtrading risk: Frequent signals may lead to excessive trading

- Market environment dependence: May underperform in ranging markets Mitigation measures:

- Add trend filters

- Set minimum volatility thresholds

- Implement trade frequency limits

- Introduce market environment recognition

Optimization Directions

- MACD parameter optimization: Adjust MACD parameters based on market characteristics

- Stop-loss optimization: Consider adding volatility-based dynamic stops

- Trading time filters: Add trading window restrictions

- Position management: Implement scaled entry and exit mechanisms

- Market environment filtering: Add trend strength indicators

- Drawdown control: Introduce equity curve-based risk control

Summary

This is a comprehensive strategy system combining technical analysis and risk management. It ensures trade quality through multi-timeframe analysis and strict signal filtering while effectively managing risk through dynamic stops and trailing profits. The strategy shows strong adaptability but requires continuous optimization based on market conditions. For live trading, thorough backtesting and parameter optimization are recommended, along with adjustments based on specific market characteristics.

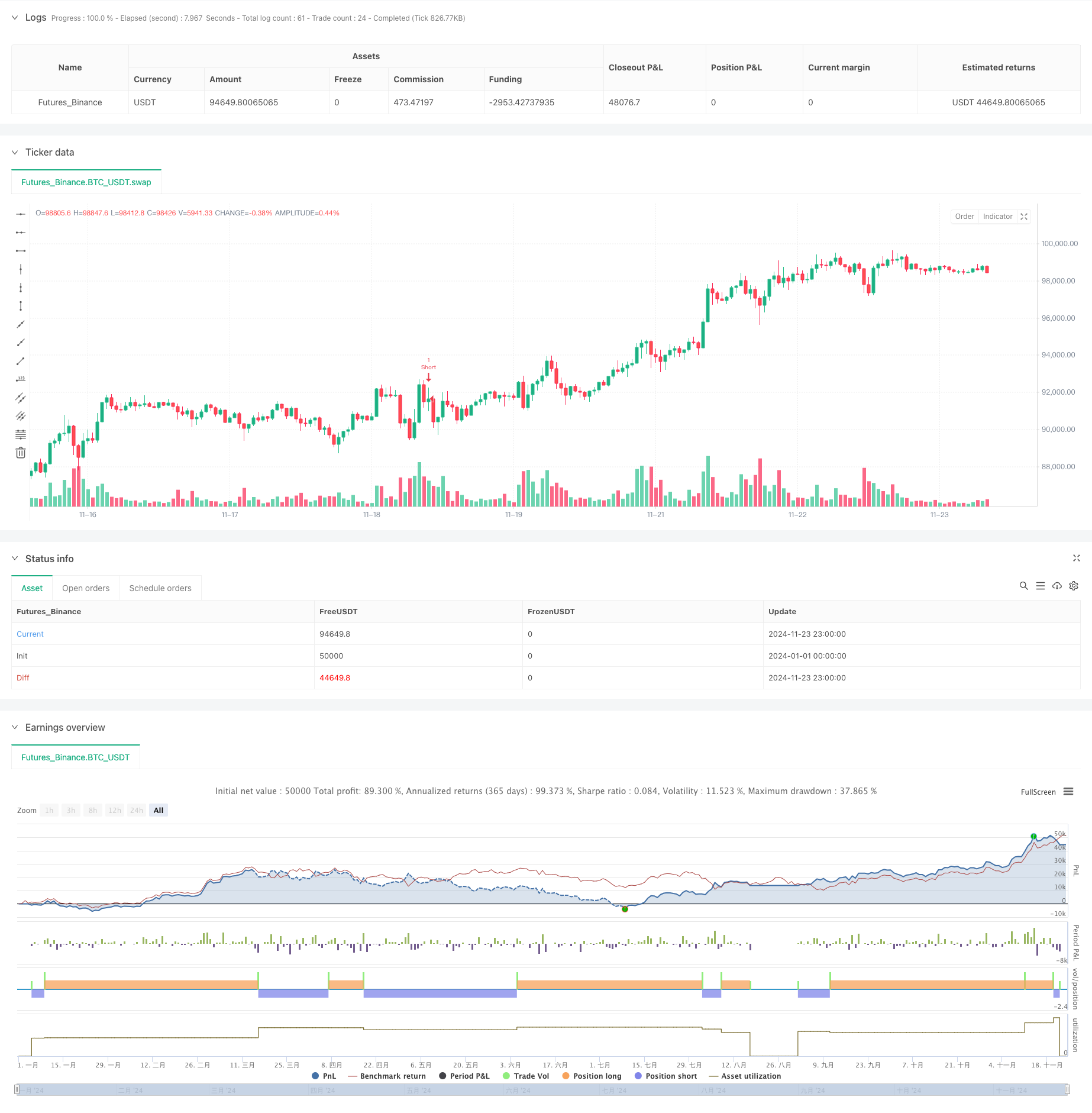

/*backtest

start: 2024-01-01 00:00:00

end: 2024-11-24 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=5

strategy("Price Action + Double MACD Strategy with ATR Trailing", overlay=true)

// Inputs for MACD

fastLength1 = input.int(34, title="First MACD Fast Length")

slowLength1 = input.int(144, title="First MACD Slow Length")

signalLength1 = input.int(9, title="First MACD Signal Length")

fastLength2 = input.int(100, title="Second MACD Fast Length")

slowLength2 = input.int(200, title="Second MACD Slow Length")

signalLength2 = input.int(50, title="Second MACD Signal Length")

// Input for ATR Trailing

atrMultiplier = input.float(1.5, title="ATR Multiplier for Trailing")

// Inputs for Stop Loss

atrStopMultiplier = input.float(1.0, title="ATR Multiplier for Stop Loss")

// MACD Calculations

[macdLine1, signalLine1, macdHist1] = ta.macd(close, fastLength1, slowLength1, signalLength1)

[macdLine2, signalLine2, macdHist2] = ta.macd(close, fastLength2, slowLength2, signalLength2)

// Get 15M MACD histogram colors

macdHist1Color = request.security(syminfo.tickerid, "15", (macdHist1 >= 0 ? (macdHist1[1] < macdHist1 ? #26A69A : #B2DFDB) : (macdHist1[1] < macdHist1 ? #FFCDD2 : #FF5252)))

macdHist2Color = request.security(syminfo.tickerid, "15", (macdHist2 >= 0 ? (macdHist2[1] < macdHist2 ? #26A69A : #B2DFDB) : (macdHist2[1] < macdHist2 ? #FFCDD2 : #FF5252)))

// Check MACD color conditions

isMacdUptrend = macdHist1Color == #26A69A and macdHist2Color == #26A69A

isMacdDowntrend = macdHist1Color == #FF5252 and macdHist2Color == #FF5252

// Function to detect strong 5M candles

isStrongCandle(open, close, high, low) =>

body = math.abs(close - open)

tail = math.abs(high - low) - body

body > tail * 1.5 // Ensure body is larger than the tail

// Variables to track state

var float fiveMinuteHigh = na

var float fiveMinuteLow = na

var bool tradeExecuted = false

var bool breakoutDetected = false

var float entryPrice = na

var float stopLossPrice = na

var float longTakeProfit = na

var float shortTakeProfit = na

// Check for new 15M candle and reset flags

if ta.change(time("15"))

tradeExecuted := false // Reset trade execution flag

breakoutDetected := false // Reset breakout detection

if isStrongCandle(open[1], close[1], high[1], low[1])

fiveMinuteHigh := high[1]

fiveMinuteLow := low[1]

else

fiveMinuteHigh := na

fiveMinuteLow := na

// Get 1-minute close prices

close1m = request.security(syminfo.tickerid, "5", close)

// Ensure valid breakout direction and avoid double breakouts

if not na(fiveMinuteHigh) and not breakoutDetected

for i = 1 to 3

if close1m[i] > fiveMinuteHigh and not tradeExecuted // 1M breakout check with close

breakoutDetected := true

if isMacdUptrend

// Open Long trade

entryPrice := close

stopLossPrice := close - (atrStopMultiplier * ta.atr(14)) // ATR-based stop loss

longTakeProfit := close + (atrMultiplier * ta.atr(14)) // Initialize take profit

strategy.entry("Long", strategy.long)

tradeExecuted := true

break // Exit the loop after detecting a breakout

else if close1m[i] < fiveMinuteLow and not tradeExecuted // 1M breakout check with close

breakoutDetected := true

if isMacdDowntrend

// Open Short trade

entryPrice := close

stopLossPrice := close + (atrStopMultiplier * ta.atr(14)) // ATR-based stop loss

shortTakeProfit := close - (atrMultiplier * ta.atr(14)) // Initialize take profit

strategy.entry("Short", strategy.short)

tradeExecuted := true

break // Exit the loop after detecting a breakout

// Update trailing take-profit dynamically

if tradeExecuted and strategy.position_size > 0 // Long trade

longTakeProfit := math.max(longTakeProfit, close + (atrMultiplier * ta.atr(14)))

strategy.exit("Long TP/SL", "Long", stop=stopLossPrice, limit=longTakeProfit)

else if tradeExecuted and strategy.position_size < 0 // Short trade

shortTakeProfit := math.min(shortTakeProfit, close - (atrMultiplier * ta.atr(14)))

strategy.exit("Short TP/SL", "Short", stop=stopLossPrice, limit=shortTakeProfit)

// Reset trade state when position is closed

if strategy.position_size == 0

tradeExecuted := false

entryPrice := na

longTakeProfit := na

shortTakeProfit := na