Versión de JavaScript de la estrategia SuperTrend

El autor:La bondad, Creado: 2020-04-29 12:09:15, Actualizado: 2023-11-06 20:03:58

Versión de JavaScript de la estrategia SuperTrend

Hay muchas versiones del indicador de SuperTrend en el televisor. Encontré un algoritmo relativamente fácil de entender y lo trasplanté. Comparado con el indicador de SuperTrend cargado en el gráfico de TV del sistema de prueba de retroceso de la plataforma de comercio FMZ, encontré una ligera diferencia y no entendí la razón de las causas, estoy esperando la orientación de nuestros lectores. Primero mostraré mi comprensión como sigue.

Indicador de SuperTendencia Algoritmo de versión JavaScript

// VIA: https://github.com/freqtrade/freqtrade-strategies/issues/30

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

// The main function for testing indicators is not a trading strategy

function main() {

while (1) {

var r = _C(exchange.GetRecords)

var st = SuperTrend(r, 10, 3)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

Sleep(2000)

}

}

Comparación del código de prueba con el backtest:

Una estrategia sencilla utilizando el indicador SuperTrend

La parte de la lógica de negociación es relativamente simple, es decir, cuando la tendencia corta se convierte en una tendencia larga, se abren posiciones largas. Abre una posición corta cuando la tendencia larga se convierta en una tendencia corta.

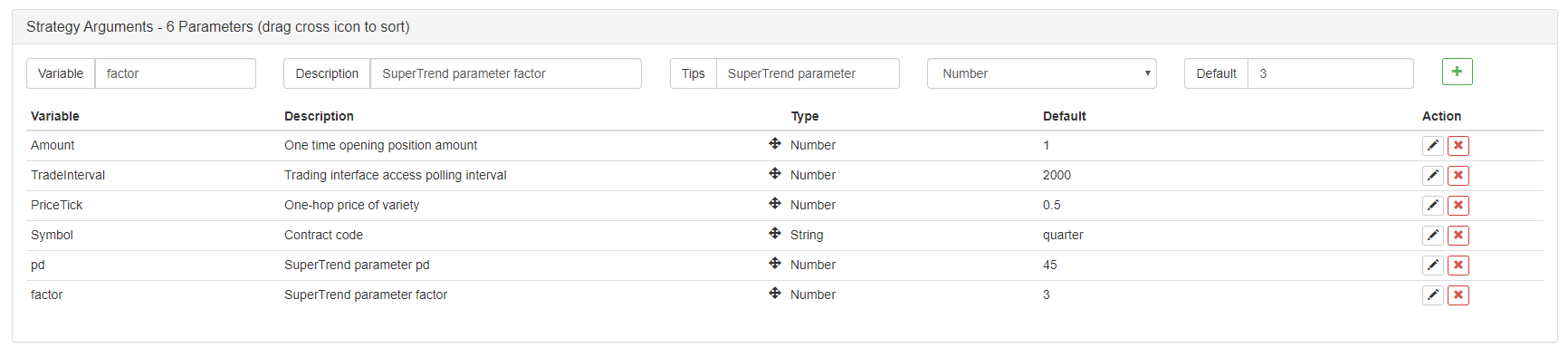

Parámetros de la estrategia:

Estrategia de negociación de SuperTrend

/*backtest

start: 2019-08-01 00:00:00

end: 2020-03-11 00:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_OKCoin","currency":"BTC_USD"}]

*/

// Global variables

var OpenAmount = 0 // The number of open positions after opening

var KeepAmount = 0 // Reserved position

var IDLE = 0

var LONG = 1

var SHORT = 2

var COVERLONG = 3

var COVERSHORT = 4

var COVERLONG_PART = 5

var COVERSHORT_PART = 6

var OPENLONG = 7

var OPENSHORT = 8

var State = IDLE

// Trading logic part

function GetPosition(posType) {

var positions = _C(exchange.GetPosition)

/*

if(positions.length > 1){

throw "positions error:" + JSON.stringify(positions)

}

*/

var count = 0

for(var j = 0; j < positions.length; j++){

if(positions[j].ContractType == Symbol){

count++

}

}

if(count > 1){

throw "positions error:" + JSON.stringify(positions)

}

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == Symbol && positions[i].Type === posType) {

return [positions[i].Price, positions[i].Amount];

}

}

Sleep(TradeInterval);

return [0, 0]

}

function CancelPendingOrders() {

while (true) {

var orders = _C(exchange.GetOrders)

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id);

Sleep(TradeInterval);

}

if (orders.length === 0) {

break;

}

}

}

function Trade(Type, Price, Amount, CurrPos, OnePriceTick){ // Processing transactions

if(Type == OPENLONG || Type == OPENSHORT){ // Handling open positions

exchange.SetDirection(Type == OPENLONG ? "buy" : "sell")

var pfnOpen = Type == OPENLONG ? exchange.Buy : exchange.Sell

var idOpen = pfnOpen(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idOpen) {

exchange.CancelOrder(idOpen)

} else {

CancelPendingOrders()

}

} else if(Type == COVERLONG || Type == COVERSHORT){ // Deal with closing positions

exchange.SetDirection(Type == COVERLONG ? "closebuy" : "closesell")

var pfnCover = Type == COVERLONG ? exchange.Sell : exchange.Buy

var idCover = pfnCover(Price, Amount, CurrPos, OnePriceTick, Type)

Sleep(TradeInterval)

if(idCover){

exchange.CancelOrder(idCover)

} else {

CancelPendingOrders()

}

} else {

throw "Type error:" + Type

}

}

function SuperTrend(r, period, multiplier) {

// atr

var atr = talib.ATR(r, period)

// baseUp , baseDown

var baseUp = []

var baseDown = []

for (var i = 0; i < r.length; i++) {

if (isNaN(atr[i])) {

baseUp.push(NaN)

baseDown.push(NaN)

continue

}

baseUp.push((r[i].High + r[i].Low) / 2 + multiplier * atr[i])

baseDown.push((r[i].High + r[i].Low) / 2 - multiplier * atr[i])

}

// fiUp , fiDown

var fiUp = []

var fiDown = []

var prevFiUp = 0

var prevFiDown = 0

for (var i = 0; i < r.length; i++) {

if (isNaN(baseUp[i])) {

fiUp.push(NaN)

} else {

fiUp.push(baseUp[i] < prevFiUp || r[i - 1].Close > prevFiUp ? baseUp[i] : prevFiUp)

prevFiUp = fiUp[i]

}

if (isNaN(baseDown[i])) {

fiDown.push(NaN)

} else {

fiDown.push(baseDown[i] > prevFiDown || r[i - 1].Close < prevFiDown ? baseDown[i] : prevFiDown)

prevFiDown = fiDown[i]

}

}

var st = []

var prevSt = NaN

for (var i = 0; i < r.length; i++) {

if (i < period) {

st.push(NaN)

continue

}

var nowSt = 0

if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close <= fiUp[i]) {

nowSt = fiUp[i]

} else if (((isNaN(prevSt) && isNaN(fiUp[i - 1])) || prevSt == fiUp[i - 1]) && r[i].Close > fiUp[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close >= fiDown[i]) {

nowSt = fiDown[i]

} else if (((isNaN(prevSt) && isNaN(fiDown[i - 1])) || prevSt == fiDown[i - 1]) && r[i].Close < fiDown[i]) {

nowSt = fiUp[i]

}

st.push(nowSt)

prevSt = st[i]

}

var up = []

var down = []

for (var i = 0; i < r.length; i++) {

if (isNaN(st[i])) {

up.push(st[i])

down.push(st[i])

}

if (r[i].Close < st[i]) {

down.push(st[i])

up.push(NaN)

} else {

down.push(NaN)

up.push(st[i])

}

}

return [up, down]

}

var preTime = 0

function main() {

exchange.SetContractType(Symbol)

while (1) {

var r = _C(exchange.GetRecords)

var currBar = r[r.length - 1]

if (r.length < pd) {

Sleep(5000)

continue

}

var st = SuperTrend(r, pd, factor)

$.PlotRecords(r, "K")

$.PlotLine("L", st[0][st[0].length - 2], r[r.length - 2].Time)

$.PlotLine("S", st[1][st[1].length - 2], r[r.length - 2].Time)

if(!isNaN(st[0][st[0].length - 2]) && isNaN(st[0][st[0].length - 3])){

if (State == SHORT) {

State = COVERSHORT

} else if(State == IDLE) {

State = OPENLONG

}

}

if(!isNaN(st[1][st[1].length - 2]) && isNaN(st[1][st[1].length - 3])){

if (State == LONG) {

State = COVERLONG

} else if (State == IDLE) {

State = OPENSHORT

}

}

// 执行信号

var pos = null

var price = null

if(State == OPENLONG){ // Open long positions

pos = GetPosition(PD_LONG) // Check positions

// Determine whether the status is satisfied, if it is satisfied, modify the status

if(pos[1] >= Amount){ // Open positions exceed or equal to the open positions set by the parameters

Sleep(1000)

$.PlotFlag(currBar.Time, "Open long positions", 'OL') // mark

OpenAmount = pos[1] // Record the number of open positions

State = LONG // Mark as long

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2 // Calculate the price

Trade(OPENLONG, price, Amount - pos[1], pos, PriceTick) // Placing Order function (Type, Price, Amount, CurrPos, PriceTick)

}

if(State == OPENSHORT){ // Open short position

pos = GetPosition(PD_SHORT) // Check positions

if(pos[1] >= Amount){

Sleep(1000)

$.PlotFlag(currBar.Time, "Open short position", 'OS')

OpenAmount = pos[1]

State = SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(OPENSHORT, price, Amount - pos[1], pos, PriceTick)

}

if(State == COVERLONG){ // Handling long positions

pos = GetPosition(PD_LONG) // Get position information

if(pos[1] == 0){ // Determine if the position is 0

$.PlotFlag(currBar.Time, "Close long position", '----CL') // mark

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1], pos, PriceTick)

}

if(State == COVERSHORT){ // Deal with long positions

pos = GetPosition(PD_SHORT)

if(pos[1] == 0){

$.PlotFlag(currBar.Time, "Close short position", '----CS')

State = IDLE

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1], pos, PriceTick)

}

if(State == COVERLONG_PART) { // Partially close long positions

pos = GetPosition(PD_LONG) // Get positions

if(pos[1] <= KeepAmount){ // The position is less than or equal to the holding amount, this time the closing action is completed

$.PlotFlag(currBar.Time, "Close long positions, keep:" + KeepAmount, '----CL') // mark

State = pos[1] == 0 ? IDLE : LONG // update status

continue

}

price = currBar.Close - (currBar.Close % PriceTick) - PriceTick * 2

Trade(COVERLONG, price, pos[1] - KeepAmount, pos, PriceTick)

}

if(State == COVERSHORT_PART){

pos = GetPosition(PD_SHORT)

if(pos[1] <= KeepAmount){

$.PlotFlag(currBar.Time, "Close short positions, keep:" + KeepAmount, '----CS')

State = pos[1] == 0 ? IDLE : SHORT

continue

}

price = currBar.Close - (currBar.Close % PriceTick) + PriceTick * 2

Trade(COVERSHORT, price, pos[1] - KeepAmount, pos, PriceTick)

}

LogStatus(_D())

Sleep(1000)

}

}

Dirección estratégica:https://www.fmz.com/strategy/201837

Desempeño de las pruebas de retroceso

Configuración de parámetros, período de la línea K, referencia: homilía SuperTrend V.1

El período de la línea K se establece en 15 minutos, y el parámetro SuperTrend se establece en 45, 3. Pruebe el contrato trimestral de futuros de OKEX para el año más reciente y establezca un contrato para operar a la vez. Debido al ajuste para operar solo un contrato a la vez, la tasa de utilización de los fondos es muy baja y no necesita preocuparse por el valor Sharpe.

- Práctica cuantitativa de los intercambios DEX (2) -- Guía de usuario de hiperlíquidos

- Prácticas de cuantificación en el mercado DEX ((2) -- Guía de uso de Hyperliquid

- Práctica cuantitativa de los intercambios DEX (1) -- Guía de usuario de dYdX v4

- Introducción al arbitraje de lead-lag en criptomonedas (3)

- Prácticas de cuantificación de las bolsas DEX ((1) -- dYdX v4 Guía de uso

- Introducción al conjunto de Lead-Lag en las monedas digitales (3)

- Introducción al arbitraje de lead-lag en criptomonedas (2)

- Introducción al conjunto de Lead-Lag en las monedas digitales (2)

- Discusión sobre la recepción de señales externas de la plataforma FMZ: una solución completa para recibir señales con servicio HTTP incorporado en la estrategia

- Exploración de la recepción de señales externas de la plataforma FMZ: estrategias para una solución completa de recepción de señales de servicios HTTP integrados

- Introducción al arbitraje de lead-lag en criptomonedas (1)

- El hombre de Oak te enseñará cómo usar la API para la extensión de FMZ con JS.

- Basado en el uso de un nuevo índice de fortaleza relativa en las estrategias intradiarias

- Investigación sobre Binance Futures estrategia de cobertura multi-moneda Parte 4

- Larry Connors Larry Connors RSI2 estrategia de retorno de la media

- Investigación sobre la estrategia de cobertura de divisas múltiples de Binance Futures Parte 3

- Investigación sobre Binance Futures estrategia de cobertura multi-moneda Parte 2

- Investigación sobre la estrategia de cobertura de divisas de futuros de Binance Parte 1

- La mano te enseña cómo actualizar la función de recolección de datos personalizada para la recopilación de datos

- Sistema de negociación de líneas de cocodrilo versión Python

- Compra de señales de alarma de TradingView con la API ampliada de la plataforma de negociación cuantitativa de los inventores (recomendado)

- SuperTrend V.1 - Sistema de líneas de tendencia súper

- Versión de JavaScript de la política de SuperTrend

- [Guerra de los Milenios] Moneda de divisas estrategias de cobertura de múltiples monedas resultados de las últimas revisiones y las revisiones de la línea K a nivel de minutos (part 4)

- La mano a la mano te enseña a hacer un recolector de transacciones

- [Guerra de los Mil] Análisis de riesgos de los futuros de divisas y divisas para el superávit y el superávit de estrategias para el superávit (part 3)

- [Guerra de los Milenios] Optimización importante de la estrategia de los futuros de divisas para el superávit de las bolsas para el superávit de las caídas (part 2)

- [Guerra de los Mil] Investigación de estrategias de cobertura de monedas multicurrency (part 1)

- Monedas de la universidad de 98 y el camino a la cuantificación

- La estrategia de asignación del iceberg en Python

- Una estrategia de equilibrio dinámico basada en la moneda digital