La versión Python de la estrategia de cobertura intertemporal de Bollinger de futuros de materias primas (sólo para fines de estudio)

El autor:La bondad, Creado: 2020-06-20 10:52:34, Actualizado: 2025-01-14 20:40:43

La estrategia de arbitraje intertemporal previamente escrita requiere la entrada manual del spread de cobertura para la apertura y cierre de posiciones. Juzgar la diferencia de precio es más subjetiva. En este artículo, cambiaremos la estrategia de cobertura anterior a la estrategia de usar el indicador BOLL para abrir y cerrar posiciones.

class Hedge:

'Hedging control class'

def __init__(self, q, e, initAccount, symbolA, symbolB, maPeriod, atrRatio, opAmount):

self.q = q

self.initAccount = initAccount

self.status = 0

self.symbolA = symbolA

self.symbolB = symbolB

self.e = e

self.isBusy = False

self.maPeriod = maPeriod

self.atrRatio = atrRatio

self.opAmount = opAmount

self.records = []

self.preBarTime = 0

def poll(self):

if (self.isBusy or not exchange.IO("status")) or not ext.IsTrading(self.symbolA):

Sleep(1000)

return

insDetailA = exchange.SetContractType(self.symbolA)

if not insDetailA:

return

recordsA = exchange.GetRecords()

if not recordsA:

return

insDetailB = exchange.SetContractType(self.symbolB)

if not insDetailB:

return

recordsB = exchange.GetRecords()

if not recordsB:

return

# Calculate the spread price K line

if recordsA[-1]["Time"] != recordsB[-1]["Time"]:

return

minL = min(len(recordsA), len(recordsB))

rA = recordsA.copy()

rB = recordsB.copy()

rA.reverse()

rB.reverse()

count = 0

arrDiff = []

for i in range(minL):

arrDiff.append(rB[i]["Close"] - rA[i]["Close"])

arrDiff.reverse()

if len(arrDiff) < self.maPeriod:

return

# Calculate Bollinger Bands indicator

boll = TA.BOLL(arrDiff, self.maPeriod, self.atrRatio)

ext.PlotLine("upper trail", boll[0][-2], recordsA[-2]["Time"])

ext.PlotLine("middle trail", boll[1][-2], recordsA[-2]["Time"])

ext.PlotLine("lower trail", boll[2][-2], recordsA[-2]["Time"])

ext.PlotLine("Closing price spread", arrDiff[-2], recordsA[-2]["Time"])

LogStatus(_D(), "upper trail:", boll[0][-1], "\n", "middle trail:", boll[1][-1], "\n", "lower trail:", boll[2][-1], "\n", "Current closing price spread:", arrDiff[-1])

action = 0

# Signal trigger

if self.status == 0:

if arrDiff[-1] > boll[0][-1]:

Log("Open position A buy B sell", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 2

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A buy B sell", "Positive")

elif arrDiff[-1] < boll[2][-1]:

Log("Open position A sell B buy", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 1

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A sell B buy", "Negative")

elif self.status == 1 and arrDiff[-1] > boll[1][-1]:

Log("Close position A buy B sell", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 2

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A buy B sell", "Close Negative")

elif self.status == 2 and arrDiff[-1] < boll[1][-1]:

Log("Close position A sell B buy", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 1

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A sell B buy", "Close Positive")

# Execute specific instructions

if action == 0:

return

self.isBusy = True

tasks = []

if action == 1:

tasks.append([self.symbolA, "sell" if self.status == 0 else "closebuy"])

tasks.append([self.symbolB, "buy" if self.status == 0 else "closesell"])

elif action == 2:

tasks.append([self.symbolA, "buy" if self.status == 0 else "closesell"])

tasks.append([self.symbolB, "sell" if self.status == 0 else "closebuy"])

def callBack(task, ret):

def callBack(task, ret):

self.isBusy = False

if task["action"] == "sell":

self.status = 2

elif task["action"] == "buy":

self.status = 1

else:

self.status = 0

account = _C(exchange.GetAccount)

LogProfit(account["Balance"] - self.initAccount["Balance"], account)

self.q.pushTask(self.e, tasks[1][0], tasks[1][1], self.opAmount, callBack)

self.q.pushTask(self.e, tasks[0][0], tasks[0][1], self.opAmount, callBack)

def main():

SetErrorFilter("ready|login|timeout")

Log("Connecting to the trading server...")

while not exchange.IO("status"):

Sleep(1000)

Log("Successfully connected to the trading server")

initAccount = _C(exchange.GetAccount)

Log(initAccount)

def callBack(task, ret):

Log(task["desc"], "success" if ret else "failure")

q = ext.NewTaskQueue(callBack)

p = ext.NewPositionManager()

if CoverAll:

Log("Start closing all remaining positions...")

p.CoverAll()

Log("Operation complete")

t = Hedge(q, exchange, initAccount, SA, SB, MAPeriod, ATRRatio, OpAmount)

while True:

q.poll()

t.poll()

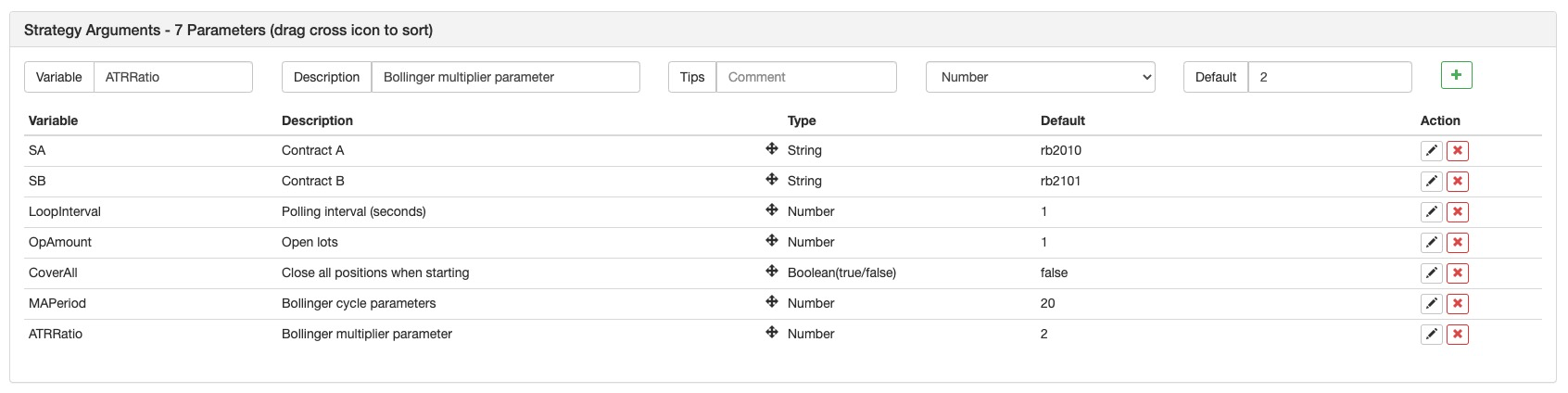

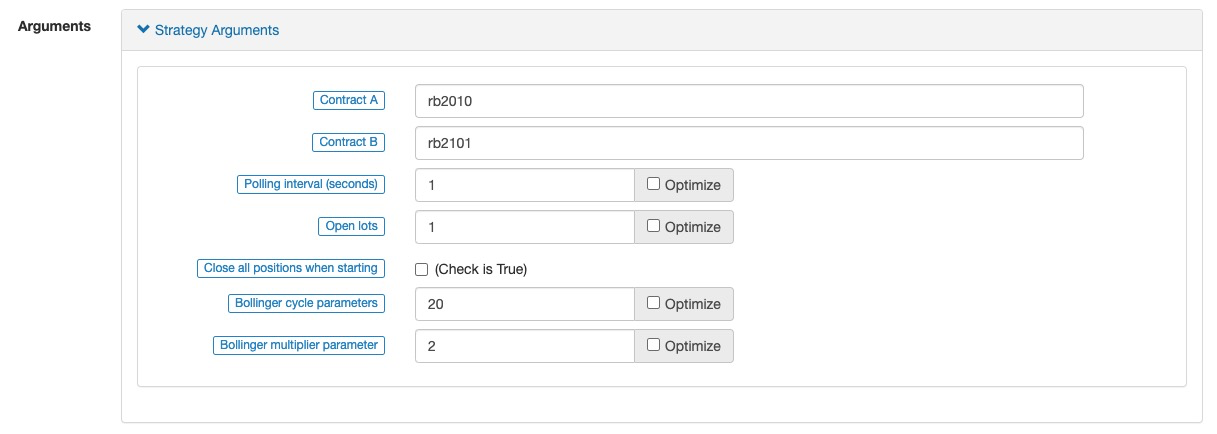

Configuración de parámetros de estrategia:

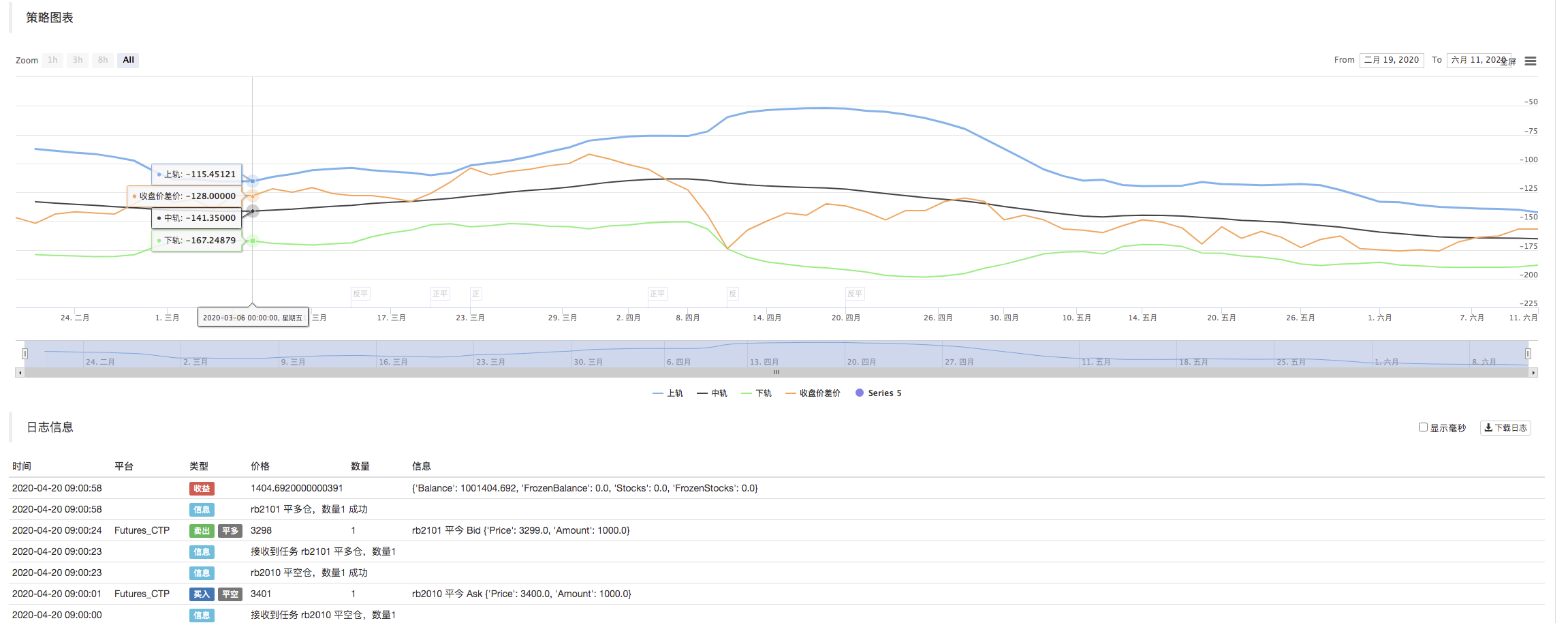

El marco general de la estrategia es básicamente el mismo que el de laVersión Python de la estrategia de cobertura intertemporal de futuros de materias primasCuando la estrategia se ejecuta, se obtienen los datos de la línea K de los dos contratos, y luego se calcula la diferencia de precio para calcular el diferencial.TA.BOLLCuando el spread exceda el carril superior de la banda de Bollinger, será cubierto, y cuando toque el carril inferior, se opondrá al funcionamiento.

Prueba posterior:

Este artículo se utiliza principalmente sólo para fines de estudio. Estrategia completa:https://www.fmz.com/strategy/213826

- Práctica cuantitativa de los intercambios DEX (2) -- Guía de usuario de hiperlíquidos

- Prácticas de cuantificación en el mercado DEX ((2) -- Guía de uso de Hyperliquid

- Práctica cuantitativa de los intercambios DEX (1) -- Guía de usuario de dYdX v4

- Introducción al arbitraje de lead-lag en criptomonedas (3)

- Prácticas de cuantificación de las bolsas DEX ((1) -- dYdX v4 Guía de uso

- Introducción al conjunto de Lead-Lag en las monedas digitales (3)

- Introducción al arbitraje de lead-lag en criptomonedas (2)

- Introducción al conjunto de Lead-Lag en las monedas digitales (2)

- Discusión sobre la recepción de señales externas de la plataforma FMZ: una solución completa para recibir señales con servicio HTTP incorporado en la estrategia

- Exploración de la recepción de señales externas de la plataforma FMZ: estrategias para una solución completa de recepción de señales de servicios HTTP integrados

- Introducción al arbitraje de lead-lag en criptomonedas (1)

- El comercio en FMEX desbloquea la optimización óptima del volumen de pedidos

- Análisis y realización de los futuros de materias primas Gráfico de huella de volumen

- FMEX para desbloquear la orden al mínimo óptimo y optimizar el volumen

- El bot puede enviar mensajes mediante una interfaz llamada pin.

- Optimización de la cantidad de transacciones de FMEX

- Estrategia EMV de volatilidad simple

- La mano a la mano te enseña cómo envuelven una política de Python en un archivo barato

- Estrategia de negociación BIAS de tasa de desviación

- Evaluación de la curva de capital de prueba posterior utilizando la herramienta "pyfolio"

- FMZ Cuantificación de mi lenguaje - Interfaz gráfica

- Interfaz con el robot FMZ utilizando el indicador "Tradingview"

- FMZ Cuantificación de la lengua maya (My) - Parámetros de la biblioteca de transacciones de la lengua maya

- Gráfico de arbitraje de futuros y spot de materias primas basado en datos fundamentales de la FMZ

- Sistema de backtest de alta frecuencia basado en cada transacción y los defectos del backtest de línea K

- Versión Python de la estrategia de cobertura intertemporal de futuros de materias primas

- Algunos pensamientos sobre la lógica del comercio de futuros de criptomonedas

- Herramienta de análisis mejorada basada en el desarrollo gramatical de Alpha101

- Enseñarle a actualizar el colector de mercado backtest la fuente de datos personalizados

- Defectos de los sistemas de resonancia de alta frecuencia basados en transacciones por letra y resonancia de línea K

- Explicación del mecanismo de ensayo posterior de nivel de simulación FMZ