Combo 2/20 EMA y filtro de banda

El autor:¿ Qué pasa?, Fecha: 2022-05-12 15:27:19Las etiquetas:El EMA

Estas son estrategias combinadas para obtener una señal acumulada.

Primera estrategia Este indicador representa una media móvil exponencial de 2/20. En el caso del indicador AVG X 2/20, la barra EMA se pintará cuando se cumplan los criterios de Alerta.

Segunda estrategia El artículo relacionado es material con derechos de autor de Acciones y materias primas Mar 2010

Advertencia:

- Con el propósito de educar sólo

- Este guión para cambiar colores de barras.

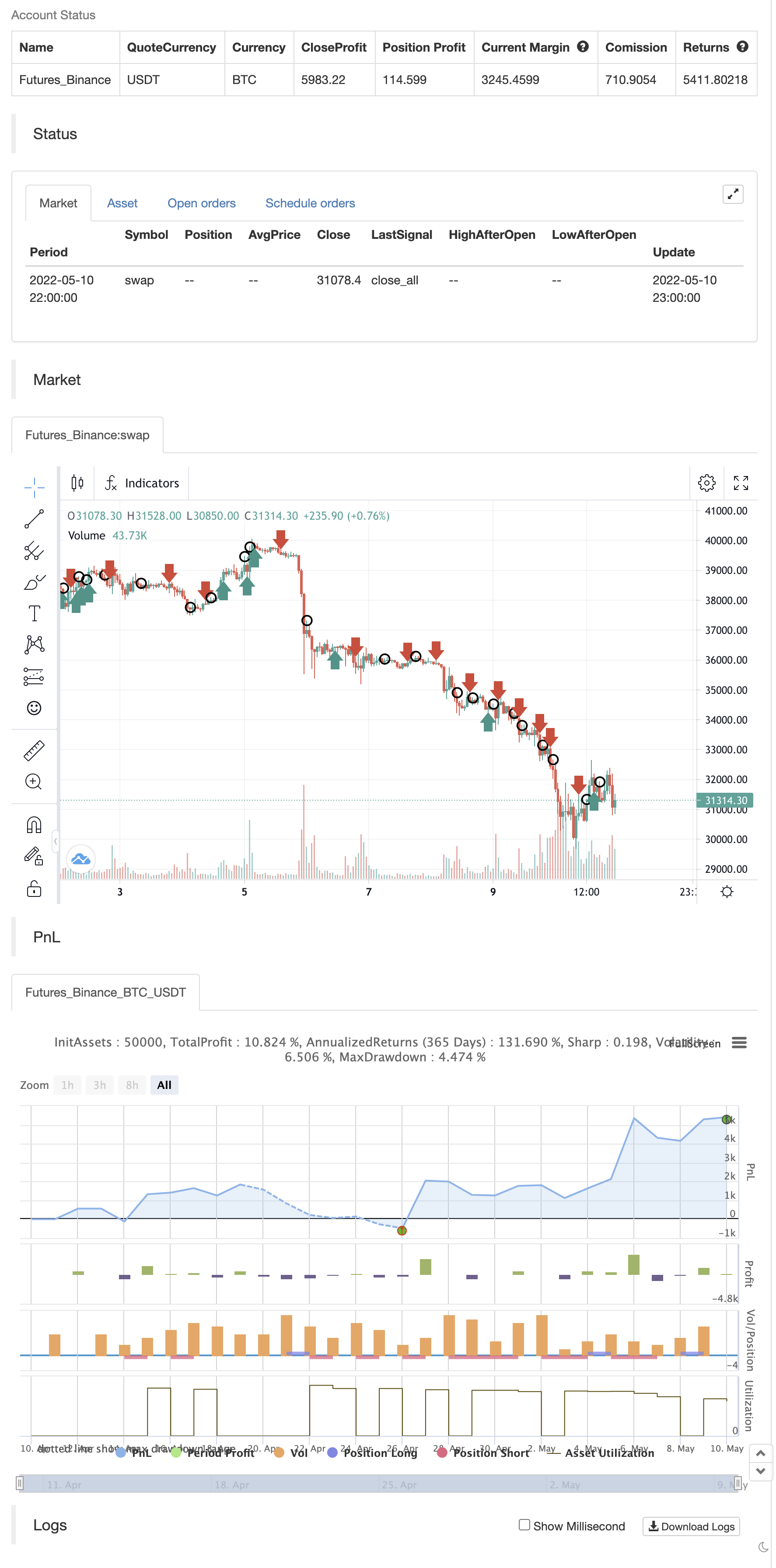

Prueba posterior

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 05/04/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// The related article is copyrighted material from

// Stocks & Commodities Mar 2010

//

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

BPF(Length,Delta,SellZone,BuyZone) =>

pos = 0.0

xPrice = hl2

beta = math.cos(3.14 * (360 / Length) / 180)

gamma = 1 / math.cos(3.14 * (720 * Delta / Length) / 180)

alpha = gamma - math.sqrt(gamma * gamma - 1)

BP = 0.0

BP := 0.5 * (1 - alpha) * (xPrice - xPrice[2]) + beta * (1 + alpha) * nz(BP[1]) - alpha * nz(BP[2])

pos:= BP > SellZone ? 1 :

BP <= BuyZone? -1 : nz(pos[1], 0)

pos

strategy(title='Combo 2/20 EMA & Bandpass Filter', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ Bandpass Filter ═════●'

LengthBPF = input.int(20, minval=1, group=I2)

Delta = input(0.5, group=I2)

SellZone = input.float(5, step = 0.01, group=I2)

BuyZone = input.float(-5, step = 0.01, group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosBPF = BPF(LengthBPF,Delta,SellZone,BuyZone)

iff_1 = posEMA20 == -1 and prePosBPF == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosBPF == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

//barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)

Relacionados

- Estrategia de negociación oscilante de seguimiento de tendencias multi-EMA con gestión del riesgo basada en ATR

- Tendencia adaptativa de seguimiento de la estrategia con sistema de control de extracción dinámico

- Estrategia de cruz de oro multi-EMA con rentabilidad por niveles

- Estrategia de entrada de compra dinámica que combina el cruce de la EMA y la penetración del cuerpo de la vela

- Estrategia de negociación cíclica de mediación del costo en dólares de tendencia de onda inteligente

- Estrategia de negociación de ruptura de posición dinámica adaptativa de la EMA

- Estrategia dinámica de seguimiento de tendencias de onda

- Estrategia de negociación de tendencia de stop-loss dinámico de múltiples indicadores

- Estrategia de negociación de promedios móviles inteligentes de avance de tendencia con múltiples filtros

- Estrategia dinámica de ruptura y reversión de la EMA

- Tendencia de múltiples indicadores a raíz de la estrategia cruzada de negociación de opciones de la EMA

Más.

- FTL - Filtro de rango X2 + EMA + UO

- BRAHMASTRA también

- Bandas de Mobo

- SAR + 3SMMA con SL y TP

- El SSS

- Plantilla de alertas de lanzamiento lunar [Indicador]

- HALFTREND + HEMA + SMA (Estrategia de la señal falsa)

- El índice de variación de las tasas de cambio de la media de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación.

- RSI y BB y simultáneamente sobrevendido

- Las velas de Heikin Ashi

- La AEVM

- 3EMA

- Bloques de orden por eje

- El número de unidades de producción

- El valor de las operaciones de mercado se calcula a partir de la media móvil de la EMA/SMA.

- Banda MAHL

- 3 Súper tendencia añadir en este guión único

- Indicador de fluctuación alta/baja con confirmaciones del MACD y del EMA

- La EMA triple + el MACD

- Jugar a la cruz