El índice de variación de las tasas de cambio de la media de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación de las tasas de variación.

El autor:¿ Qué pasa?, Fecha: 2022-05-12 17:17:05Las etiquetas:La SMAEl EMAEl número de personas afectadasLa WMAVWMAEl Boll

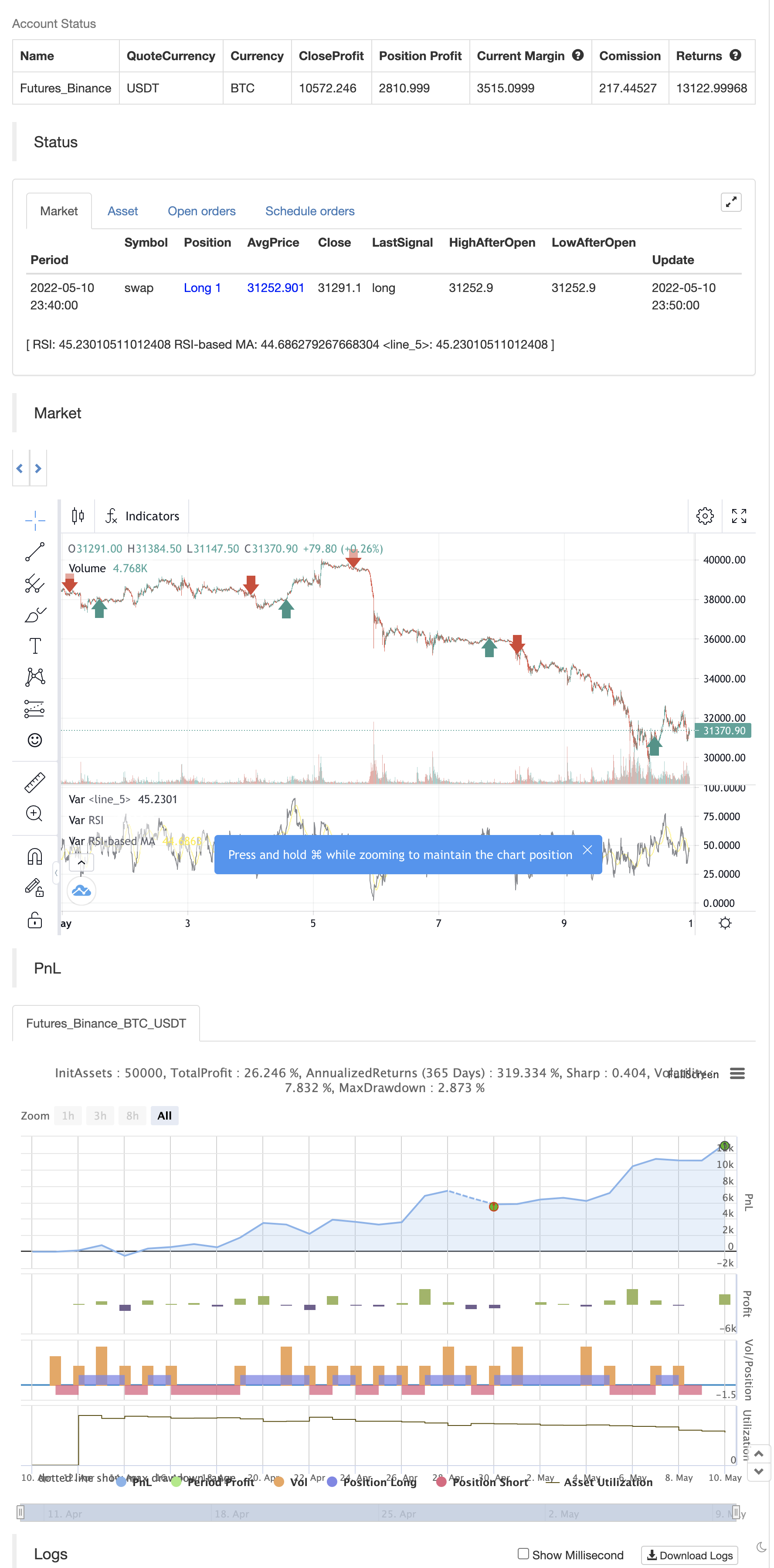

RSI Divergencias con Pivots, BB, MA es un oscilador básico de RSI con algunas características útiles, permite al usuario mostrar divergencias, pivotes y promedio móvil directamente en el indicador RSI.

Los promedios móviles que puede mostrar en el oscilador RSI son: La SMA La EMA El número de personas La WMA VWMA Las bandas de Bollinger

/*backtest

start: 2022-04-11 00:00:00

end: 2022-05-10 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////////////////////////////////////////////

// //

// ====== My Crypto Succubus ====== //

// ====== RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA ====== //

// //

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

// //

// My Crypto Succubus is a project based on the community and participatory //

// aspect, knowledge sharing is the core of the project, the act of sharing //

// is destined to get richer, either on the intellectual or the wealth //

// side, the ultimate goal of MCS is that every single one of our members //

// can reach the financial freedom we all deserve. //

// //

// ====== Join us on our Discord : https://discord.gg/TmW6RQeyXp ====== //

// //

////////////////////////////////////////////////////////////////////////////////

//@version=5

indicator(title="RSI Divergences with Pivots, BB, MA [My Crypto Succubus]", shorttitle="RSI Div, Pivot, BB, MA [My Crypto Succubus]", format=format.price, precision=2)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

plot(rsi, "RSI", color=#ffffff, linewidth=1)

plot(rsiMA, "RSI-based MA", color=color.yellow)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

fill(rsiUpperBand, rsiLowerBand, color=color.rgb(178, 8, 120, 90), title="RSI Background Fill")

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

fill(bbUpperBand, bbLowerBand, color= isBB ? color.new(color.green, 90) : na, title="Bollinger Bands Background Fill")

///////////////////////////////////////////////////////////////////////////////////////////////////////

len = input.int(14, minval=1, title='RSI Length', group="RSI Settings")

ob = input.int(defval=70, title='Overbought', minval=0, maxval=100, group="RSI Settings")

os = input.int(defval=30, title='Oversold', minval=0, maxval=100, group="RSI Settings")

// RSI code

band1 = hline(ob)

band0 = hline(os)

plot(rsi, color=rsi > ob or rsi < os ? color.rgb(255, 0, 0, 0) : color.new(color.black, 100), linewidth=1)

fill(band1, band0, color=color.new(color.purple, 97))

// DIVS code

piv = input(false, 'Hide pivots?')

shrt = input(false, 'Shorter labels?')

hidel = input(true, 'Hide labels and color background')

xbars = input.int(defval=90, title='Div lookback period (bars)?', minval=1)

hb = math.abs(ta.highestbars(rsi, xbars)) // Finds bar with highest value in last X bars

lb = math.abs(ta.lowestbars(rsi, xbars)) // Finds bar with lowest value in last X bars

// Defining variable values, mandatory in Pine 3

max = float(na)

max_rsi = float(na)

min = float(na)

min_rsi = float(na)

pivoth = bool(na)

pivotl = bool(na)

divbear = bool(na)

divbull = bool(na)

// If bar with lowest / highest is current bar, use it's value

max := hb == 0 ? close : na(max[1]) ? close : max[1]

max_rsi := hb == 0 ? rsi : na(max_rsi[1]) ? rsi : max_rsi[1]

min := lb == 0 ? close : na(min[1]) ? close : min[1]

min_rsi := lb == 0 ? rsi : na(min_rsi[1]) ? rsi : min_rsi[1]

// Compare high of current bar being examined with previous bar's high

// If curr bar high is higher than the max bar high in the lookback window range

if close > max // we have a new high

max := close // change variable "max" to use current bar's high value

max

if rsi > max_rsi // we have a new high

max_rsi := rsi // change variable "max_rsi" to use current bar's RSI value

max_rsi

if close < min // we have a new low

min := close // change variable "min" to use current bar's low value

min

if rsi < min_rsi // we have a new low

min_rsi := rsi // change variable "min_rsi" to use current bar's RSI value

min_rsi

// Finds pivot point with at least 2 right candles with lower value

pivoth := max_rsi == max_rsi[2] and max_rsi[2] != max_rsi[3] ? true : na

pivotl := min_rsi == min_rsi[2] and min_rsi[2] != min_rsi[3] ? true : na

// Detects divergences between price and indicator with 1 candle delay so it filters out repeating divergences

if max[1] > max[2] and rsi[1] < max_rsi and rsi <= rsi[1]

divbear := true

divbear

if min[1] < min[2] and rsi[1] > min_rsi and rsi >= rsi[1]

divbull := true

divbull

// Alerts

alertcondition(divbear, title='Bear div', message='Bear div')

alertcondition(divbull, title='Bull div', message='Bull div')

alertcondition(pivoth, title='Pivot high', message='Pivot high')

alertcondition(pivotl, title='Pivot low', message='Pivot low')

// Plots divergences and pivots with offest

//l = divbear ? label.new(bar_index - 1, rsi[1] + 1, 'BEAR', color=color.red, textcolor=color.white, style=label.style_label_down, yloc=yloc.price, size=size.small) : divbull ? label.new(bar_index - 1, rsi[1] - 1, 'BULL', color=color.green, textcolor=color.white, style=label.style_label_up, yloc=yloc.price, size=size.small) : pivoth ? label.new(bar_index - 2, max_rsi + 1, 'PIVOT', color=color.blue, textcolor=color.white, style=label.style_label_down, yloc=yloc.price, size=size.small) : pivotl ? label.new(bar_index - 2, min_rsi - 1, 'PIVOT', color=color.blue, textcolor=color.white, style=label.style_label_up, yloc=yloc.price, size=size.small) : na

// Shorter labels

//if shrt

// label.set_text(l, na)

// Hides pivots or labels

//if piv and (pivoth or pivotl) or hidel

// label.delete(l)

// Colors indicator background

//bgcolor(hidel ? divbear ? color.new(color.red, 50) : divbull ? color.new(color.green, 50) : na : na, offset=-1, transp=90)

//bgcolor(hidel ? piv ? na : pivoth or pivotl ? color.new(color.blue, 50) : na : na, offset=-2, transp=90)

// Debug tools

// plot(max, color=blue, linewidth=2)

// plot(max_rsi, color=red, linewidth=2)

// plot(hb, color=orange, linewidth=2)

// plot(lb, color=purple, linewidth=1)

// plot(min_rsi, color=lime, linewidth=1)

// plot(min, color=black, linewidth=1)

////////////////////////////////////////////////////////////////////////////////

// //

// ====== My Crypto Succubus ====== //

// ====== RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA ====== //

// //

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

// //

// My Crypto Succubus is a project based on the community and participatory //

// aspect, knowledge sharing is the core of the project, the act of sharing //

// is destined to get richer, either on the intellectual or the wealth //

// side, the ultimate goal of MCS is that every single one of our members //

// can reach the financial freedom we all deserve. //

// //

// ====== Join us on our Discord : https://discord.gg/TmW6RQeyXp ====== //

// //

////////////////////////////////////////////////////////////////////////////////

if divbear

strategy.entry("Enter Long", strategy.long)

else if divbull

strategy.entry("Enter Short", strategy.short)

Contenido relacionado

- La súper tendencia de Crodl

- El SSS

- La banda azul ha logrado un avance en la estrategia de seguimiento de movimiento

- Estrategias de negociación de la banda oscilante de múltiples niveles

- Estrategias de seguimiento de movimiento cuantificado de doble cruce equilátero

- Estrategias de seguimiento de tendencias transversal de línea recta multicircular

- Estrategias de cruce de la media móvil para adaptarse

- Estrategias de seguimiento de tendencias y filtración de fluctuaciones multilíneas

- Estrategia R5.1 del OCC

- 2 Detección de la dirección del color de la media móvil

Más contenido

- Estrategia de supertrend de pivote dinámico de Villa

- La súper tendencia de Crodl

- RSI por zdmre

- FTL - Filtro de rango X2 + EMA + UO

- BRAHMASTRA también

- Bandas de Mobo

- SAR + 3SMMA con SL y TP

- El SSS

- Plantilla de alertas de lanzamiento lunar [Indicador]

- HALFTREND + HEMA + SMA (Estrategia de la señal falsa)

- RSI y BB y simultáneamente sobrevendido

- Las velas de Heikin Ashi

- Combo 2/20 EMA y filtro de banda

- La AEVM

- 3EMA

- Bloques de orden por eje

- El número de unidades de producción

- El valor de las operaciones de mercado se calcula a partir de la media móvil de la EMA/SMA.

- Banda MAHL

- 3 Súper tendencia añadir en este guión único