Indicador de divergencia de los índices de rentabilidad

El autor:¿ Qué pasa?, Fecha: 2022-05-31 18:54:21Las etiquetas:Indicador de riesgoEl eje

Gracias a Mohanee por el código base. Lo modificamos para no dar alertas de entrada, sino alertas sobre los propios divs.

Funciona muy bien con un detector de AO div.

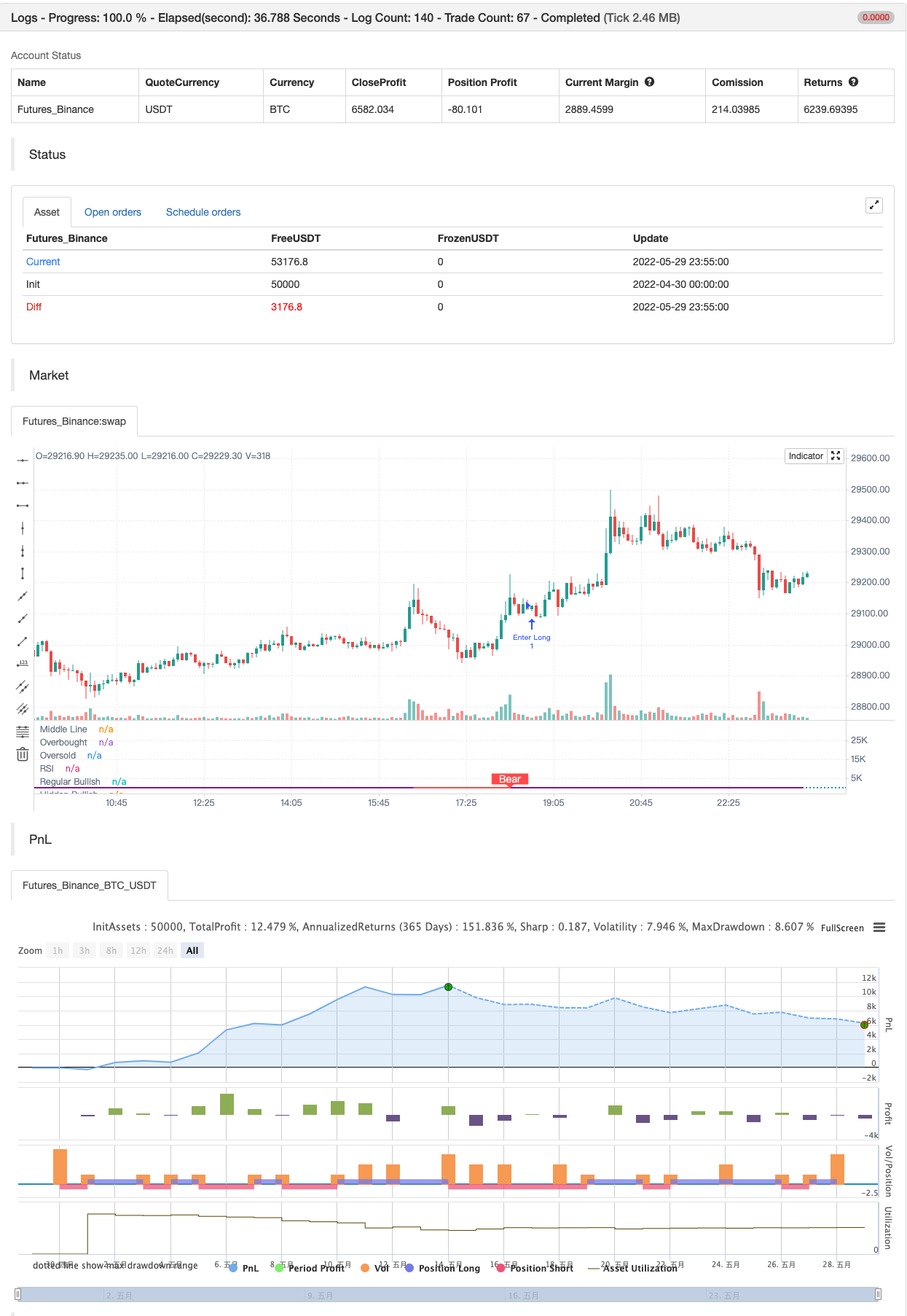

Prueba posterior

/*backtest

start: 2022-04-30 00:00:00

end: 2022-05-29 23:59:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © JayTradingCharts

//@version=4

//@version=4

//---- thank to mohanee for the base code. we modified this to not give entries but instead alert on the just the divs

study(title="RSI Divergence Indicator w/Alerts", format=format.price, resolution="")

len = input(title="RSI Period", minval=1, defval=14)

src = input(title="RSI Source", defval=close)

lbR = input(title="Pivot Lookback Right", defval=5)

lbL = input(title="Pivot Lookback Left", defval=5)

rangeUpper = input(title="Max of Lookback Range", defval=60)

rangeLower = input(title="Min of Lookback Range", defval=5)

plotBull = input(title="Plot Bullish", defval=true)

plotHiddenBull = input(title="Plot Hidden Bullish", defval=false)

plotBear = input(title="Plot Bearish", defval=true)

plotHiddenBear = input(title="Plot Hidden Bearish", defval=false)

bearColor = color.red

bullColor = color.green

hiddenBullColor = color.new(color.green, 80)

hiddenBearColor = color.new(color.red, 80)

textColor = color.white

noneColor = color.new(color.white, 100)

osc = rsi(src, len)

plot(osc, title="RSI", linewidth=2, color=#8D1699)

hline(50, title="Middle Line", linestyle=hline.style_dotted)

obLevel = hline(70, title="Overbought", linestyle=hline.style_dotted)

osLevel = hline(30, title="Oversold", linestyle=hline.style_dotted)

fill(obLevel, osLevel, title="Background", color=#9915FF, transp=90)

plFound = na(pivotlow(osc, lbL, lbR)) ? false : true

phFound = na(pivothigh(osc, lbL, lbR)) ? false : true

_inRange(cond) =>

bars = barssince(cond == true)

rangeLower <= bars and bars <= rangeUpper

//------------------------------------------------------------------------------

// Regular Bullish

// Osc: Higher Low

oscHL = osc[lbR] > valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Lower Low

priceLL = low[lbR] < valuewhen(plFound, low[lbR], 1)

bullCond = plotBull and priceLL and oscHL and plFound

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish",

linewidth=2,

color=(bullCond ? bullColor : noneColor),

transp=0

)

plotshape(

bullCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bullish Label",

text=" Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bullish

// Osc: Lower Low

oscLL = osc[lbR] < valuewhen(plFound, osc[lbR], 1) and _inRange(plFound[1])

// Price: Higher Low

priceHL = low[lbR] > valuewhen(plFound, low[lbR], 1)

hiddenBullCond = plotHiddenBull and priceHL and oscLL and plFound

plot(

plFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish",

linewidth=2,

color=(hiddenBullCond ? hiddenBullColor : noneColor),

transp=0

)

plotshape(

hiddenBullCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bullish Label",

text=" H Bull ",

style=shape.labelup,

location=location.absolute,

color=bullColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Regular Bearish

// Osc: Lower High

oscLH = osc[lbR] < valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Higher High

priceHH = high[lbR] > valuewhen(phFound, high[lbR], 1)

bearCond = plotBear and priceHH and oscLH and phFound

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish",

linewidth=2,

color=(bearCond ? bearColor : noneColor),

transp=0

)

plotshape(

bearCond ? osc[lbR] : na,

offset=-lbR,

title="Regular Bearish Label",

text=" Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

//------------------------------------------------------------------------------

// Hidden Bearish

// Osc: Higher High

oscHH = osc[lbR] > valuewhen(phFound, osc[lbR], 1) and _inRange(phFound[1])

// Price: Lower High

priceLH = high[lbR] < valuewhen(phFound, high[lbR], 1)

hiddenBearCond = plotHiddenBear and priceLH and oscHH and phFound

plot(

phFound ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish",

linewidth=2,

color=(hiddenBearCond ? hiddenBearColor : noneColor),

transp=0

)

plotshape(

hiddenBearCond ? osc[lbR] : na,

offset=-lbR,

title="Hidden Bearish Label",

text=" H Bear ",

style=shape.labeldown,

location=location.absolute,

color=bearColor,

textcolor=textColor,

transp=0

)

alertcondition(bullCond, title="Bull", message="Regular Bull Div {{ticker}} XXmin")

alertcondition(bearCond, title="Bear", message="Regular Bear Div {{ticker}} XXmin")

alertcondition(hiddenBullCond, title="H Bull", message="Hidden Bull Div {{ticker}} XXmin")

alertcondition(hiddenBearCond, title="H Bear", message="Hidden Bear Div {{ticker}} XXmin")

if bearCond

strategy.entry("Enter Long", strategy.long)

else if bullCond

strategy.entry("Enter Short", strategy.short)

Contenido relacionado

- La estrategia de la pirámide inteligente de múltiples indicadores

- Estrategias de trading de inversión de alta frecuencia basadas en el indicador RSI de movimiento

- Estrategias de cuantificación inversa y modelos de optimización de la volatilidad en el rango dinámico de RSI

- RSI y BB y simultáneamente sobrevendido

- RSI+Supertrend sigue las tendencias y estrategias de trading

- El RSI se aleja de la estrategia de ruptura

- El RSI cambia de dirección y cambia de estrategia

- La estrategia del índice RSI en relación a la fortaleza y la debilidad

- Indice de fuerza relativa - Divergencias - Libertus

- Estrategias de ajuste estadístico del RSI

Más contenido

- Filtro de doble alcance

- SAR - alto y bajo

- Sistema de negociación de oscilaciones preciso

- Tendencia lineal

- Patrón de tiempo de Fibonacci

- Caja Darvas Comprar Vender

- Indicador de configuración de demarque

- Las bandas de Bollinger RSI estocástico extremo

- Indicador MACD BB V 1,00

- SAR parabólico

- Indicador MACD del OBV

- Tendencia pivotal

- Estrategia de divergencia de precios v1.0

- La ruptura de soporte-resistencia

- Promedio móvil adaptativo de pendiente

- Estrategia del oscilador Delta-RSI

- Estrategia de escáner bajo cripto

- [blackcat] L2 estrategia de reversión de las etiquetas

- SuperB

- Alto SAR bajo