RSI动态区间反转量化策略与波动率优化模型

Author: ChaoZhang, Date: 2024-11-12 15:55:34Tags: RSI

概述

该策略是一个基于RSI指标的动态区间反转交易系统,通过设定可调节的超买超卖区间,结合收敛/发散敏感度参数来捕捉市场的转折点。策略采用固定合约数量进行交易,并在特定的回测时间范围内运行。该模型的核心在于通过RSI指标的动态变化来识别市场的超买超卖状态,并在适当的时机进行反转交易。

策略原理

策略采用14周期的RSI指标作为核心指标,设定了80和30作为超买超卖的基准水平。通过引入收敛/发散敏感度参数(设定为3.0),在传统RSI策略基础上增加了动态调节能力。当RSI突破超买水平时建立多头仓位,在RSI跌破超卖水平时平仓。同样,当RSI跌破超卖水平时建立多头仓位,在RSI突破超买水平时平仓。每次交易固定使用10个合约,确保资金利用的稳定性。

策略优势

- 动态区间调节:通过收敛/发散参数实现超买超卖区间的动态调整,提高策略适应性

- 风险控制明确:采用固定合约数量交易,便于资金管理

- 时间区间限制:通过设定具体的回测期间,避免在非目标时间段进行交易

- 信号明确性:使用RSI交叉信号作为交易触发条件,减少假信号

- 可视化支持:通过图表展示RSI走势和关键水平,便于监控和分析

策略风险

- 震荡市场风险:在横盘震荡市场可能频繁交易,增加交易成本

- 趋势延续风险:在强趋势市场中,反转信号可能导致过早平仓

- 固定合约风险:不考虑市场波动率变化,可能在高波动期过度承担风险

- 参数敏感性:RSI周期和超买超卖水平的设定对策略表现影响较大

- 时间依赖性:策略效果可能受限于特定的回测时间段

策略优化方向

- 引入波动率自适应:建议根据市场波动率动态调整合约数量

- 增加趋势过滤器:结合其他技术指标判断市场趋势,避免在强趋势中反转

- 优化信号确认:可以添加成交量等辅助指标确认信号

- 动态时间周期:根据不同市场阶段自动调整RSI计算周期

- 止损机制:增加动态止损来控制单次交易风险

总结

这是一个基于RSI指标的动态区间反转策略,通过灵活的参数设置和明确的交易规则,实现了一个相对完整的交易系统。策略的主要优势在于其动态调节能力和明确的风险控制,但同时也需要注意震荡市场和趋势市场中的潜在风险。通过引入波动率调整、趋势过滤等优化手段,策略还有进一步提升的空间。整体而言,这是一个具有实用价值的量化交易策略框架,适合进行深入研究和实践验证。

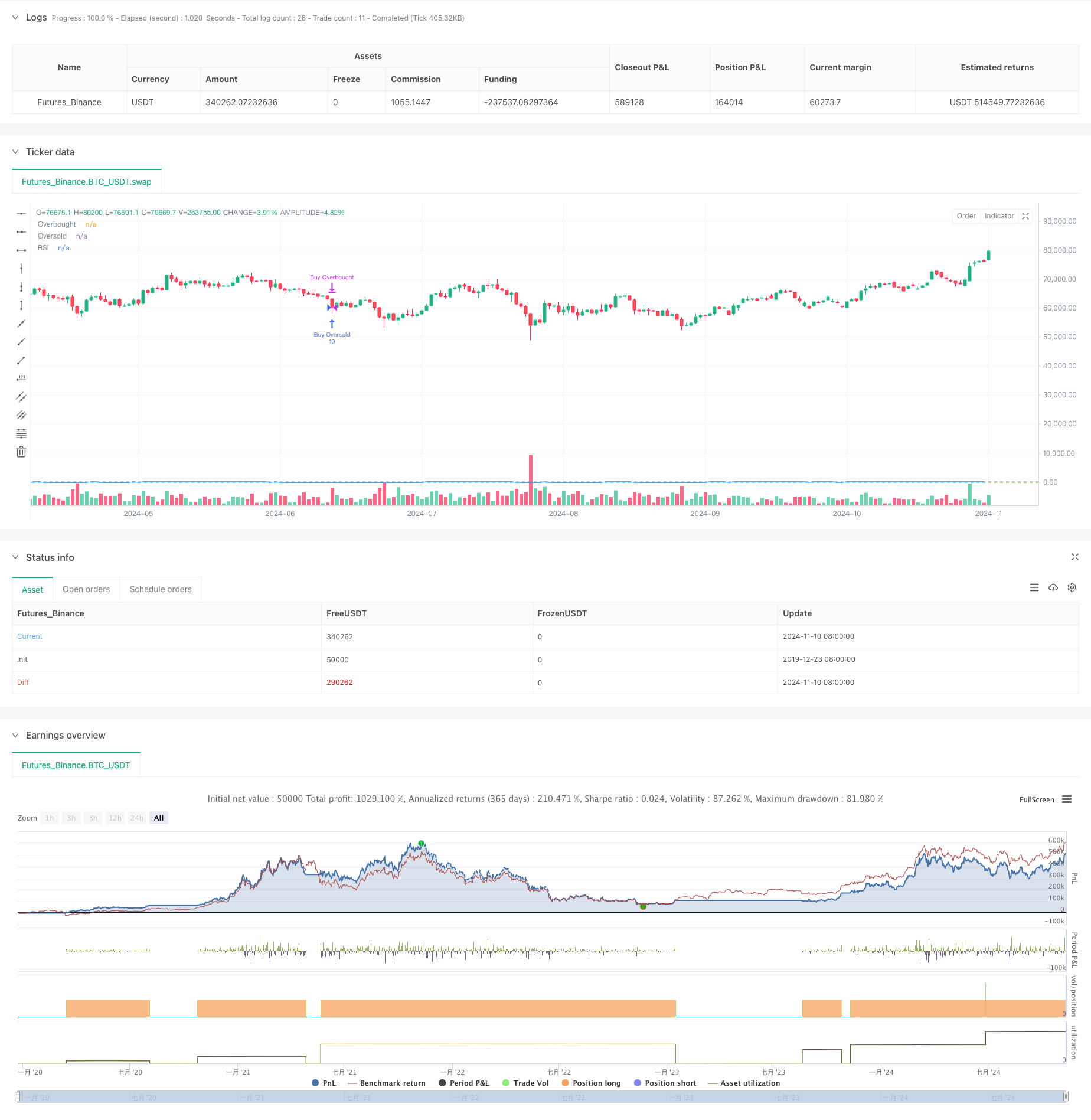

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-11 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("RSI Options Strategy", overlay=true)

// RSI settings

rsiLength = input(14, title="RSI Length")

rsiOverbought = input(80, title="Overbought Level")

rsiOversold = input(30, title="Oversold Level")

rsiSource = input(close, title="RSI Source")

rsi = ta.rsi(rsiSource, rsiLength)

// Convergence/Divergence Input

convergenceLevel = input(3.0, title="Convergence/Divergence Sensitivity")

// Order size (5 contracts)

contracts = 10

// Date Range for Backtesting

startDate = timestamp("2024-09-10 00:00")

endDate = timestamp("2024-11-09 23:59")

// Limit trades to the backtesting period

inDateRange = true

// RSI buy/sell conditions with convergence/divergence sensitivity

buySignalOverbought = ta.crossover(rsi, rsiOverbought - convergenceLevel)

sellSignalOversold = ta.crossunder(rsi, rsiOversold + convergenceLevel)

buySignalOversold = ta.crossunder(rsi, rsiOversold - convergenceLevel)

sellSignalOverbought = ta.crossover(rsi, rsiOverbought + convergenceLevel)

// Execute trades only within the specified date range

if (inDateRange)

// Buy when RSI crosses above 80 (overbought)

if (buySignalOverbought)

strategy.entry("Buy Overbought", strategy.long, qty=contracts)

// Sell when RSI crosses below 30 (oversold)

if (sellSignalOversold)

strategy.close("Buy Overbought")

// Buy when RSI crosses below 30 (oversold)

if (buySignalOversold)

strategy.entry("Buy Oversold", strategy.long, qty=contracts)

// Sell when RSI crosses above 80 (overbought)

if (sellSignalOverbought)

strategy.close("Buy Oversold")

// Plot the RSI for visualization

plot(rsi, color=color.blue, title="RSI")

hline(rsiOverbought, "Overbought", color=color.red)

hline(rsiOversold, "Oversold", color=color.green)

相关内容

- 双指标动量趋势量化策略系统

- 双均线-RSI多重信号趋势交易策略

- 动态均线系统结合RSI动量指标的日内交易优化策略

- 多重技术指标交叉动量趋势跟踪策略

- 动态调整止损的大象柱形态趋势跟踪策略

- 双周期RSI趋势动量强度策略结合金字塔式仓位管理系统

- 多均线交叉辅助RSI动态参数量化交易策略

- 动态趋势判定RSI指标交叉策略

- 多维度K近邻算法与烛台形态的量价分析交易策略

- 自适应多策略动态切换系统:融合趋势跟踪与区间震荡的量化交易策略

- 多指标多维度趋势交叉高级量化策略

更多内容

- 智能时间周期多空轮动均衡交易策略

- MACD动态趋势量化交易策略进阶版

- 趋势突破交易系统(移动平均线突破策略)

- 基于ATR的多重趋势跟踪策略与止盈止损优化系统

- 基于 RSI 动量和多层级止盈止损的智能自适应交易系统

- 自适应RSI震荡阈值动态交易策略

- RSI与AO协同趋势追踪型量化交易策略

- 适应性趋势动量RSI策略结合均线过滤系统

- 双均线交叉RSI动量策略与风险收益优化系统

- 多重指标交叉动态策略系统:基于EMA、RVI和交易信号的量化交易模型

- 布林带动量趋势跟踪量化策略

- 多周期技术分析与市场情绪结合的交易策略

- 基于123点位反转的动态持仓期策略

- 多重技术指标交叉动量量化交易策略-基于EMA、RSI和ADX的整合分析

- 抛物线SAR指标背离交易策略

- 组合动量均线交叉策略结合市场情绪与阻力位优化系统

- 多周期RSI动量与三重EMA趋势跟踪复合策略

- 多重均线动量趋势跟踪策略

- E9鲨鱼32形态量化价格突破策略

- 开放市场曝光度动态调仓量化交易策略