Estrategia de negociación de oscilación de patrón triple

El autor:¿ Qué pasa?, Fecha: 2023-10-23 17:36:55Las etiquetas:

Resumen general

La estrategia de negociación de oscilación de patrón triple es una estrategia de negociación a corto plazo basada en una combinación de múltiples indicadores técnicos. Incorpora la súper tendencia, el promedio móvil híbrido SSL y la QQE mejorada para generar señales comerciales estables. La estrategia funciona bien con instrumentos comerciales volátiles como criptomonedas y acciones, especialmente durante los períodos posteriores a la ruptura.

Principios

Señales de entrada

Entrada larga:

- Super Tendencia volteando de abajo hacia arriba

- Cerrar por encima de la banda superior de SSL Hybrid

- El QQE mejorado es azul (bullish)

Entrada corta:

- Super Trend volteando de arriba hacia abajo

- Cierre por debajo de la banda baja SSL Hybrid

- El QQE mejorado es rojo (bajista)

Señales de salida

Salida larga: Super tendencia volteando de arriba a abajo

Salida corta: Super tendencia que gira de abajo hacia arriba

Detener pérdida

Opciones de porcentaje, ATR o precio más alto/más bajo reciente

Obtenga beneficios

Puede establecer una relación riesgo-recompensa para los niveles de toma de beneficios

Gestión de riesgos

Opción para permitir el tamaño de las posiciones basado en el riesgo de la cuenta

Planificación

- Trama de la línea Super Trend, bandas híbridas SSL

- Opción para la línea EMA

- Entrada de gráficos, stop loss y líneas de ganancia

- Etiquetas de la flecha de entrada

Ventajas

- Señales estables de múltiples indicadores

La combinación de Super Trend, SSL Hybrid MA y QQE mejorado verifica las señales a través de indicadores, filtrando las falsas rupturas.

- Apto para el comercio de instrumentos volátiles con oscilación

El enfoque comercial a corto plazo se centra en capturar los cambios de precios a mediano plazo. Super Trend sigue las tendencias sin problemas mientras que SSL Hybrid identifica claramente los niveles de soporte / resistencia.

- Stop loss y take profit flexibles

Opción de porcentaje, ATR o extremo reciente para el stop loss.

- Planificación clara

La gráfica limpia muestra visualmente los niveles de stop loss, take profit, flechas de entrada fáciles de identificar.

Riesgos y mejoras

- Pérdidas menores ocasionales

El comercio a corto plazo no puede evitar completamente las pérdidas normales del mercado, sino que puede optimizar el stop loss y la gestión de riesgos.

- Riesgos falsos de ruptura

Las breaks falsas pueden generar señales erróneas. Prueba los períodos de EMA para filtrar. Optimiza los parámetros de identificación de tendencias.

- Fallo del indicador del monitor

Los indicadores no válidos causan múltiples señales falsas. Compruebe regularmente la validez del indicador, ajuste rápidamente si se encuentran problemas.

- Optimizar el período de pruebas de retroceso

El período de backtest fijo actual no coincide con las horas activas de los instrumentos.

- Mejorar la adaptabilidad de los instrumentos

Para mejorar los parámetros de ajuste para las características de los datos de cada instrumento, mejora las tasas de ganancia.

Conclusión

Esta estrategia combina múltiples indicadores para señales sólidas, filtrando falsos breakouts. Se destaca por el comercio de criptomonedas volátiles y acciones a corto plazo. Numerosas opciones de stop loss y take profit proporcionan flexibilidad. En general, se generan señales estables para el comercio de rango a mediano plazo.

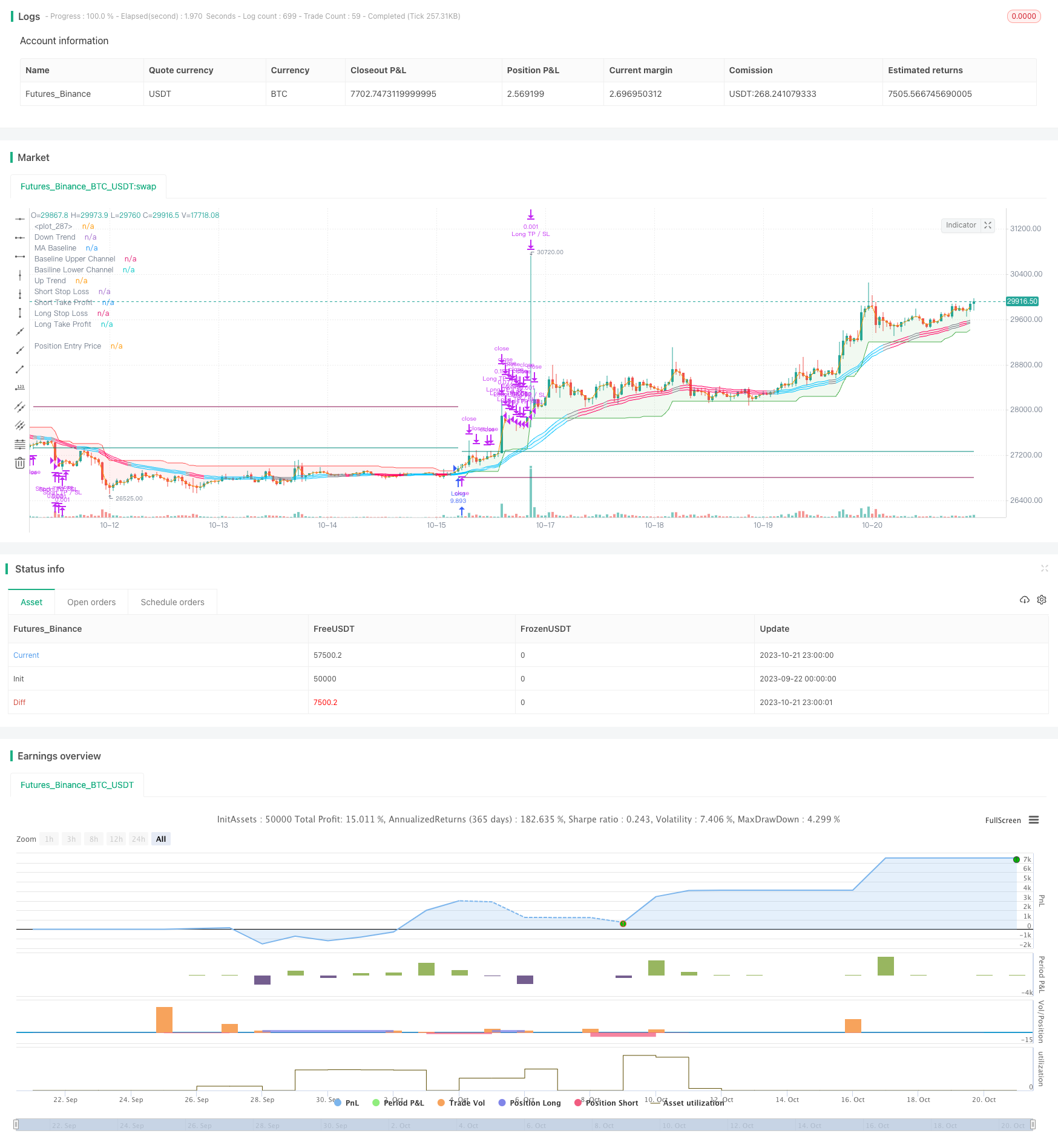

/*backtest

start: 2023-09-22 00:00:00

end: 2023-10-22 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fpemehd

// Thanks to myncrypto, jason5480, kevinmck100

// @version=5

strategy(title = '[D] SuperTrend + SSL Hybrid + QQE MOD',

shorttitle = '[D] SSQ Strategy',

overlay = true,

pyramiding = 0,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

commission_value = 0.1,

initial_capital = 100000,

max_bars_back = 500,

max_lines_count = 150,

max_labels_count = 300)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Time, Direction, Etc - Basic Settings Inputs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// 1. Time: Based on UTC +09:00

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

inTime = true

// 2. Inputs for direction: Long? Short? Both?

i_longEnabled = input.bool (defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "Long / Short", group = "Long / Short" )

i_shortEnabled = input.bool (defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "Long / Short", group = "Long / Short" )

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Filter - Inputs, Indicaotrs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// 3. Use Filters? What Filters?

//// 3-1. ATR Filter

i_ATRFilterOn = input.bool (defval = false , title = "ATR Filter On?", tooltip = "ATR Filter On? Order will not be made unless filter condition is fulfilled", inline = "1", group = "Filters")

i_ATRFilterLen = input.int (defval = 14, title = "Length for ATR Filter", minval = 1 , maxval = 100 , step = 1 , tooltip = "", inline = "2", group = "Filters")

i_ATRSMALen = input.int (defval = 40, title = "SMA Length for ATR SMA", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ATR should be bigger than this", inline = "2", group = "Filters")

bool ATRFilter = ta.atr(i_ATRFilterLen) >= ta.sma(ta.atr(length = i_ATRFilterLen), i_ATRSMALen) ? true : false

//// 3-2. EMA Filter

i_EMAFilterOn = input.bool (defval = false , title = "EMA Filter On?", tooltip = "EMA Filter On? Order will not be made unless filter condition is fulfilled", inline = "3", group = "Filters")

i_EMALen = input.int (defval = 200, title = "EMA Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "EMA Length", inline = "4", group = "Filters")

bool longEMAFilter = close >= ta.ema(source = close, length = i_EMALen) ? true : false

bool shortEMAFilter = close <= ta.ema(source = close, length = i_EMALen) ? true : false

plot(i_EMAFilterOn ? ta.ema(source = close, length = i_EMALen) : na, title = "EMA Filter", color = color.new(color = color.orange , transp = 0), linewidth = 1)

//// 3-3. ADX Filter

////3-4. DMI Filter (Uses same ADX Length)

i_ADXFilterOn = input.bool (defval = false , title = "ADX Filter On?", tooltip = "ADX Filter On? Order will not be made unless filter condition is fulfilled", inline = "5", group = "Filters")

i_DMIFilterOn = input.bool (defval = false , title = "DMI Filter On?", tooltip = "DMI (Directional Moving Index) Filter On? Order will not be made unless filter condition is fulfilled", inline = "6", group = "Filters")

i_ADXLength = input.int (defval = 20, title = "ADX Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ADX Length", inline = "7", group = "Filters")

i_ADXThreshold = input.int (defval = 25, title = "ADX Threshold", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ADX should be bigger than threshold", inline = "8", group = "Filters")

//// 3-4. SuperTrend Filter

// i_superTrendFilterOn = input.bool (defval = false , title = "Super Trend Filter On?", tooltip = "Super Trend Filter On? Order will not be made unless filter condition is fulfilled", inline = "9", group = "Filters")

// i_superTrendATRLen = input.int (defval = 10, title = "ATR Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "Super Trend ATR Length", inline = "10", group = "Filters")

// i_superTrendATRFactor = input.float (defval = 3, title = "Factor", minval = 1 , maxval = 100000 , step = 0.1 , tooltip = "Super Trend ATR Factor", inline = "11", group = "Filters")

// ADX and DI Thanks to @BeikabuOyaji

int len = i_ADXLength

float th = i_ADXThreshold

TR = math.max(math.max(high - low, math.abs(high - nz(close[1]))), math.abs(low - nz(close[1])))

DMPlus = high - nz(high[1]) > nz(low[1]) - low ? math.max(high - nz(high[1]), 0) : 0

DMMinus = nz(low[1]) - low > high - nz(high[1]) ? math.max(nz(low[1]) - low, 0) : 0

SmoothedTR = 0.0

SmoothedTR := nz(SmoothedTR[1]) - nz(SmoothedTR[1]) / len + TR

SmoothedDMPlus = 0.0

SmoothedDMPlus := nz(SmoothedDMPlus[1]) - nz(SmoothedDMPlus[1]) / len + DMPlus

SmoothedDMMinus = 0.0

SmoothedDMMinus := nz(SmoothedDMMinus[1]) - nz(SmoothedDMMinus[1]) / len + DMMinus

DIPlus = SmoothedDMPlus / SmoothedTR * 100

DIMinus = SmoothedDMMinus / SmoothedTR * 100

DX = math.abs(DIPlus - DIMinus) / (DIPlus + DIMinus) * 100

ADX = ta.sma(source = DX, length = len)

// plot(DIPlus, color=color.new(color.green, 0), title='DI+')

// plot(DIMinus, color=color.new(color.red, 0), title='DI-')

// plot(ADX, color=color.new(color.navy, 0), title='ADX')

// hline(th, color=color.white)

bool ADXFilter = ADX > th ? true : false

bool longDMIFilter = DIPlus >= DIMinus ? true : false

bool shortDMIFilter = DIPlus <= DIMinus ? true : false

// Calculate Super Trend for Filter

// i_superTrendFilterOn = input.bool (defval = false , title = "Super Trend Filter On?", tooltip = "Super Trend Filter On? Order will not be made unless filter condition is fulfilled", inline = "9", group = "Filters")

// i_superTrendATRLen = input.int (defval = 10, title = "ATR Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "Super Trend ATR Length", inline = "10", group = "Filters")

// i_superTrendATRFactor = input.float (defval = 3, title = "Factor", minval = 1 , maxval = 100000 , step = 0.1 , tooltip = "Super Trend ATR Factor", inline = "11", group = "Filters")

// [supertrend, direction] = ta.supertrend(factor = i_superTrendATRFactor, atrPeriod = i_superTrendATRLen)

// bodyMiddle = plot((open + close) / 2, display=display.none)

// upTrend = plot(i_superTrendFilterOn ? direction < 0 ? supertrend : na : na, "Up Trend", color = color.green, style=plot.style_linebr)

// downTrend = plot(i_superTrendFilterOn ? direction < 0 ? na : supertrend : na, "Down Trend", color = color.red, style=plot.style_linebr)

// fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

// fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

// bool longSTFilter = direction <= 0

// bool shortSTFilter = direction >= 0

// Filter

bool longFilterFilled = (not i_ATRFilterOn or ATRFilter) and (not i_EMAFilterOn or longEMAFilter) and (not i_ADXFilterOn or ADXFilter) and (not i_DMIFilterOn or longDMIFilter) // and (not i_superTrendFilterOn or longSTFilter)

bool shortFilterFilled = (not i_ATRFilterOn or ATRFilter) and (not i_EMAFilterOn or shortEMAFilter) and (not i_ADXFilterOn or ADXFilter) and (not i_DMIFilterOn or shortDMIFilter) // and (not i_superTrendFilterOn or shortSTFilter)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Strategy Logic (Entry & Exit Condition) - Inputs, Indicators for Strategy

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//// Indicators

// Inputs for Strategy Indicators

//// 1. Super Trend

i_superTrendATRLen = input.int (defval = 10, title = "ATR Length", minval = 1 , maxval = 100000 , step = 1 , tooltip = "Super Trend ATR Length", inline = "1", group = "1: SuperTrend")

i_superTrendATRFactor = input.float (defval = 3, title = "Factor", minval = 1 , maxval = 100000 , step = 0.1 , tooltip = "Super Trend ATR Factor", inline = "2", group = "1: SuperTrend")

[supertrend, direction] = ta.supertrend(factor = i_superTrendATRFactor, atrPeriod = i_superTrendATRLen)

//// 2. SSL Hybrid Baseline

i_useTrueRange = input.bool (defval = true, title = "use true range for Keltner Channel?", tooltip = "", inline = "1", group = "2: SSL Hybrid")

i_maType = input.string (defval ='EMA', title='Baseline Type', options=['SMA', 'EMA', 'DEMA', 'TEMA', 'LSMA', 'WMA', 'VAMA', 'TMA', 'HMA', 'McGinley'], inline="2", group = "2: SSL Hybrid")

i_len = input.int (defval =30, title='Baseline Length', inline="2", group = "2: SSL Hybrid")

i_multy = input.float (defval = 0.2, title='Base Channel Multiplier', minval = 0, maxval = 100, step=0.05, inline="3", group = "2: SSL Hybrid")

i_volatility_lookback = input.int (defval =10, title='Volatility lookback length(for VAMA)', inline='4',group="2: SSL Hybrid")

tema(src, len) =>

ema1 = ta.ema(src, len)

ema2 = ta.ema(ema1, len)

ema3 = ta.ema(ema2, len)

3 * ema1 - 3 * ema2 + ema3

f_ma(type, src, len) =>

float result = 0

if type == 'TMA'

result := ta.sma(ta.sma(src, math.ceil(len / 2)), math.floor(len / 2) + 1)

result

if type == 'LSMA'

result := ta.linreg(src, len, 0)

result

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'DEMA' // Double Exponential

e = ta.ema(src, len)

result := 2 * e - ta.ema(e, len)

result

if type == 'TEMA' // Triple Exponential

e = ta.ema(src, len)

result := 3 * (e - ta.ema(e, len)) + ta.ema(ta.ema(e, len), len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'VAMA' // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid = ta.ema(src, len)

dev = src - mid

vol_up = ta.highest(dev, i_volatility_lookback)

vol_down = ta.lowest(dev, i_volatility_lookback)

result := mid + math.avg(vol_up, vol_down)

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'McGinley'

mg = 0.0

mg := na(mg[1]) ? ta.ema(src, len) : mg[1] + (src - mg[1]) / (len * math.pow(src / mg[1], 4))

result := mg

result

result

//// 2-1. SSL Hybrid Keltner Baseline Channel

BBMC = f_ma (i_maType, close, i_len) // BaseLone

Keltma = f_ma (i_maType, close, i_len)

range_1 = i_useTrueRange ? ta.tr : high - low

rangema = ta.ema(range_1, i_len)

upperk = Keltma + rangema * i_multy

lowerk = Keltma - rangema * i_multy

//// 3. QQE MOD, thanks to Mihkel100

RSI_Period = input.int (defval = 6, title = 'RSI Length', inline = "1", group = "3: QQE MOD")

SF = input.int (defval = 5, title = 'RSI Smoothing', inline = "2", group = "3: QQE MOD")

QQE = input.float (defval = 3, title = 'Fast QQE Factor', inline = "3", group = "3: QQE MOD")

ThreshHold = input.int (defval = 3, title = 'Thresh-hold', inline = "4", group = "3: QQE MOD")

src = input (defval = close, title='RSI Source')

Wilders_Period = RSI_Period * 2 - 1

Rsi = ta.rsi(src, RSI_Period)

RsiMa = ta.ema(Rsi, SF)

AtrRsi = math.abs(RsiMa[1] - RsiMa)

MaAtrRsi = ta.ema(AtrRsi, Wilders_Period)

dar = ta.ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ? math.max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? math.min(shortband[1], newshortband) : newshortband

cross_1 = ta.cross(longband[1], RSIndex)

trend := ta.cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

////////////////////

length = input.int (defval = 50, minval = 1, title = 'Bollinger Length', group = "3: QQE MOD")

mult = input.float (defval = 0.35, minval = 0.01, maxval = 5, step = 0.1, title = 'BB Multiplier', group = "3: QQE MOD")

basis = ta.sma(FastAtrRsiTL - 50, length)

dev = mult * ta.stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

//

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

//

// Zero = hline(0, color=color.white, linestyle=hline.style_dotted, linewidth=1)

////////////////////////////////////////////////////////////////

RSI_Period2 = input.int (defval = 6, title = 'RSI 2 Length', group = "3: QQE MOD")

SF2 = input.int (defval = 5, title = 'RSI Smoothing', group = "3: QQE MOD")

QQE2 = input.float (defval = 1.61, title = 'Fast QQE2 Factor', group = "3: QQE MOD")

ThreshHold2 = input.int (defval = 3, title = 'Thresh-hold', group = "3: QQE MOD")

src2 = input (defval = close, title = 'RSI Source', group = "3: QQE MOD")

//

//

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = ta.rsi(src2, RSI_Period2)

RsiMa2 = ta.ema(Rsi2, SF2)

AtrRsi2 = math.abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ta.ema(AtrRsi2, Wilders_Period2)

dar2 = ta.ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ? math.max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ? math.min(shortband2[1], newshortband2) : newshortband2

cross_2 = ta.cross(longband2[1], RSIndex2)

trend2 := ta.cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

//

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

//

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver : RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

// Plot: Indicators

//// 1. Super Trend

bodyMiddle = plot((open + close) / 2, display=display.none)

upTrend = plot(direction < 0 ? supertrend : na, "Up Trend", color = color.green, style=plot.style_linebr)

downTrend = plot(direction < 0 ? na : supertrend, "Down Trend", color = color.red, style=plot.style_linebr)

fill(bodyMiddle, upTrend, color.new(color.green, 90), fillgaps=false)

fill(bodyMiddle, downTrend, color.new(color.red, 90), fillgaps=false)

//// 2. SSL Hybrid

var bullSSLColor = #00c3ff

var bearSSLColor = #ff0062

// color_bar = color.new(color = close > upperk ? bullSSLColor : close < lowerk ? bearSSLColor : color.gray, transp = 0)

// i_show_color_bar = input.bool(defval = true , title = "Color Bars")

// barcolor(i_show_color_bar ? color_bar : na)

plot(series = BBMC, title = 'MA Baseline', color = color_bar, linewidth = 1, style = plot.style_line)

up_channel = plot(upperk, color=color_bar, title='Baseline Upper Channel')

low_channel = plot(lowerk, color=color_bar, title='Basiline Lower Channel')

fill(up_channel, low_channel, color.new(color=color_bar, transp=90))

//// 3. QQE MOD: No Plotting because of overlay option

// plot(FastAtrRsi2TL - 50, title='QQE Line', color=color.new(color.white, 0), linewidth=2)

// plot(RsiMa2 - 50, color=hcolor2, title='Histo2', style=plot.style_columns, transp=50)

// plot(Greenbar1 and Greenbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Up', style=plot.style_columns, color=color.new(#00c3ff, 0))

// plot(Redbar1 and Redbar2 == 1 ? RsiMa2 - 50 : na, title='QQE Down', style=plot.style_columns, color=color.new(#ff0062, 0))

////// Entry, Exit

// Long, Short Logic with Indicator

bool longSTCond = direction[1] >= 0 and direction <= 0

bool shortSTCond = direction[1] <= 0 and direction >= 0

bool longSSLCond = close > upperk

bool shortSSLCond = close < lowerk

bool longQQECond = Greenbar1 and Greenbar2 == 1

bool shortQQECond = Redbar1 and Redbar2 == 1

// Basic Cond + Long, Short Entry Condition

bool longCond = (i_longEnabled and inTime) and (longSTCond and longSSLCond and longQQECond)

bool shortCond = (i_shortEnabled and inTime) and (shortSTCond and shortSSLCond and shortQQECond)

// Basic Cond + Long, Short Exit Condition

bool closeLong = (i_longEnabled) and (shortSTCond)

bool closeShort = (i_shortEnabled) and (longSTCond)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Position Control

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Long, Short Entry Condition + Not entered Position Yet

bool openLong = longCond and not (strategy.opentrades.size(strategy.opentrades - 1) > 0) and longFilterFilled

bool openShort = shortCond and not (strategy.opentrades.size(strategy.opentrades - 1) < 0) and shortFilterFilled

bool enteringTrade = openLong or openShort

float entryBarIndex = bar_index

// Long, Short Entry Fulfilled or Already Entered

bool inLong = openLong or strategy.opentrades.size(strategy.opentrades - 1) > 0 and not closeLong

bool inShort = openShort or strategy.opentrades.size(strategy.opentrades - 1) < 0 and not closeShort

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Stop Loss - Inputs, Indicaotrs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

//// Use SL? TSL?

i_useSLTP = input.bool (defval = true, title = "Enable SL & TP?", tooltip = "", inline = "1", group = "Stop Loss")

i_tslEnabled = input.bool (defval = false , title = "Enable Trailing SL?", tooltip = "Enable Stop Loss & Take Profit? \n\Enable Trailing SL?", inline = "1", group = "Stop Loss")

// i_breakEvenAfterTP = input.bool (defval = false, title = 'Enable Break Even After TP?', tooltip = 'When Take Profit price target is hit, move the Stop Loss to the entry price (or to a more strict price defined by the Stop Loss %/ATR Multiplier).', inline = '2', group = 'Stop Loss / Take Profit')

//// Sl Options

i_slType = input.string (defval = "ATR", title = "Stop Loss Type", options = ["Percent", "ATR", "Previous LL / HH"], tooltip = "Stop Loss based on %? ATR?", inline = "3", group = "Stop Loss")

i_slATRLen = input.int (defval = 14, title = "ATR Length", minval = 1 , maxval = 200 , step = 1, inline = "4", group = "Stop Loss")

i_slATRMult = input.float (defval = 3, title = "ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "4", group = "Stop Loss")

i_slPercent = input.float (defval = 3, title = "Percent", tooltip = "", inline = "5", group = "Stop Loss")

i_slLookBack = input.int (defval = 30, title = "Lowest Price Before Entry", group = "Stop Loss", inline = "6", minval = 30, step = 1, tooltip = "Lookback to find the Lowest Price. \nStopLoss is determined by the Lowest price of the look back period. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

// Functions for Stop Loss

float openAtr = ta.valuewhen(condition = enteringTrade, source = ta.atr(i_slATRLen), occurrence = 0)

float openLowest = ta.valuewhen(condition = openLong, source = ta.lowest(low, i_slLookBack), occurrence = 0)

float openHighest = ta.valuewhen(condition = openShort, source = ta.highest(high, i_slLookBack), occurrence = 0)

f_getLongSLPrice(source) =>

switch i_slType

"Percent" => source * (1 - (i_slPercent/100))

"ATR" => source - (i_slATRMult * openAtr)

"Previous LL / HH" => openLowest

=> na

f_getShortSLPrice(source) =>

switch i_slType

"Percent" => source * (1 + (i_slPercent/100))

"ATR" => source + (i_slATRMult * openAtr)

"Previous LL / HH" => openHighest

=> na

// Calculate Stop Loss

var float longSLPrice = na

var float shortSLPrice = na

bool longTPExecuted = false

bool shortTPExecuted = false

longSLPrice := if (inLong and i_useSLTP)

if (openLong)

f_getLongSLPrice (close)

else

// 1. Trailing Stop Loss

if i_tslEnabled

stopLossPrice = f_getLongSLPrice (high)

math.max(stopLossPrice, nz(longSLPrice[1]))

// 2. Normal StopLoss

else

nz(source = longSLPrice[1], replacement = 0)

else

na

shortSLPrice := if (inShort and i_useSLTP)

if (openShort)

f_getShortSLPrice (close)

else

// 1. Trailing Stop Loss

if i_tslEnabled

stopLossPrice = f_getShortSLPrice (low)

math.min(stopLossPrice, nz(shortSLPrice[1]))

// 2. Normal StopLoss

else

nz(source = shortSLPrice[1], replacement = 999999.9)

else

na

// Plot: Stop Loss of Long, Short Entry

var longSLPriceColor = color.new(color.maroon, 0)

plot(series = longSLPrice, title = 'Long Stop Loss', color = longSLPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

var shortSLPriceColor = color.new(color.maroon, 0)

plot(series = shortSLPrice, title = 'Short Stop Loss', color = shortSLPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Take Profit - Inputs, Indicaotrs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

i_useTPExit = input.bool (defval = true, title = "Use Take Profit?", tooltip = "", inline = "1", group = "Take Profit")

i_RRratio = input.float (defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "2", group = "Take Profit")

i_tpQuantityPerc = input.float (defval = 50, title = 'Take Profit Quantity %', minval = 0.0, maxval = 100, step = 1.0, tooltip = '% of position closed when tp target is met.', inline="34", group = 'Take Profit')

var float longTPPrice = na

var float shortTPPrice = na

f_getLongTPPrice() =>

close + i_RRratio * math.abs (close - f_getLongSLPrice (close))

f_getShortTPPrice() =>

close - i_RRratio * math.abs(close - f_getShortSLPrice (close))

longTPPrice := if (inLong and i_useSLTP)

if (openLong)

f_getLongTPPrice ()

else

nz(source = longTPPrice[1], replacement = f_getLongTPPrice ())

else

na

shortTPPrice := if (inShort and i_useSLTP)

if (openShort)

f_getShortTPPrice ()

else

nz(source = shortTPPrice[1], replacement = f_getShortTPPrice ())

else

na

// Plot: Take Profit of Long, Short Entry

var longTPPriceColor = color.new(color.teal, 0)

plot(series = longTPPrice, title = 'Long Take Profit', color = longTPPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

var shortTPPriceColor = color.new(color.teal, 0)

plot(series = shortTPPrice, title = 'Short Take Profit', color = shortTPPriceColor, linewidth = 1, style = plot.style_linebr, offset = 1)

// Plot: Entry Price

var posColor = color.new(color.white, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position Entry Price', color = posColor, linewidth = 1, style = plot.style_linebr)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Quantity - Inputs

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

i_useRiskManangement = input.bool (defval = true, title = "Use Risk Manangement?", tooltip = "", inline = "1", group = "Quantity")

i_riskPerTrade = input.float (defval = 3, title = "Risk Per Trade (%)", minval = 0, maxval = 100, step = 0.1, tooltip = "Use Risk Manangement by Quantity Control?", inline = "2", group = "Quantity")

// i_leverage = input.float (defval = 2, title = "Leverage", minval = 0, maxval = 100, step = 0.1, tooltip = "Leverage", inline = "3", group = "Quantity")

float qtyPercent = na

float entryQuantity = na

f_calQtyPerc() =>

if (i_useRiskManangement)

riskPerTrade = (i_riskPerTrade) / 100 // 1번 거래시 3% 손실

stopLossPrice = openLong ? f_getLongSLPrice (close) : openShort ? f_getShortSLPrice (close) : na

riskExpected = math.abs((close-stopLossPrice)/close) // 손절가랑 6% 차이

riskPerTrade / riskExpected // 0 ~ 1

else

1

f_calQty(qtyPerc) =>

math.min (math.max (0.000001, strategy.equity / close * qtyPerc), 1000000000)

// TP Execution

longTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) > 0 and (longTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) < strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and high >= longTPPrice)

shortTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) < 0 and (shortTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) > strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and low <= shortTPPrice)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Plot Label, Boxes, Results, Etc

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

i_showSimpleLabel = input.bool(false, "Show Simple Label for Entry?", group = "Strategy: Drawings", inline = "1", tooltip ="")

i_showLabels = input.bool(true, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "1", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

i_showDashboard = input.bool(true, "Show Dashboard", group = "Strategy: Drawings", inline = "2", tooltip = "Show Backtest Results. Backtest Dates, Win/Lose Rates, Etc.")

// Plot: Label for Long, Short Entry

var openLongColor = color.new(#2962FF, 0)

var openShortColor = color.new(#FF1744, 0)

var entryTextColor = color.new(color.white, 0)

if (openLong and i_showSimpleLabel)

label.new (x = bar_index, y = na, text = 'Open', yloc = yloc.belowbar, color = openLongColor, style = label.style_label_up, textcolor = entryTextColor)

entryBarIndex := bar_index

if (openShort and i_showSimpleLabel)

label.new (x = bar_index, y = na, text = 'Close', yloc = yloc.abovebar, color = openShortColor, style = label.style_label_down, textcolor = entryTextColor)

entryBarIndex := bar_index

float prevEntryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

float pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

float prevExitPrice = strategy.closedtrades.exit_price (strategy.closedtrades - 1)

f_enteringTradeLabel(x, y, qty, entryPrice, slPrice, tpPrice, rrRatio, direction) =>

if i_showLabels

labelStr = ("Trade Start"

+ "\nDirection: " + direction

+ "\nRisk Per Trade: " + str.tostring (i_useRiskManangement ? i_riskPerTrade : 100, "#.##") + "%"

+ "\nExpected Risk: " + str.tostring (math.abs((close-slPrice)/close) * 100, "#.##") + "%"

+ "\nEntry Position Qty: " + str.tostring(math.abs(qty * 100), "#.##") + "%"

+ "\nEntry Price: " + str.tostring(entryPrice, "#.##"))

+ "\nStop Loss Price: " + str.tostring(slPrice, "#.##")

+ "\nTake Profit Price: " + str.tostring(tpPrice, "#.##")

+ "\nRisk - Reward Ratio: " + str.tostring(rrRatio, "#.##")

label.new(x = x, y = y, text = labelStr, color = color.new(color.blue, 60) , textcolor = color.white, style = label.style_label_up)

f_exitingTradeLabel(x, y, entryPrice, exitPrice, direction) =>

if i_showLabels

labelStr = ("Trade Result"

+ "\nDirection: " + direction

+ "\nEntry Price: " + str.tostring(entryPrice, "#.##")

+ "\nExit Price: " + str.tostring(exitPrice,"#.##")

+ "\nGain %: " + str.tostring(direction == 'Long' ? -(entryPrice-exitPrice) / entryPrice * 100 : (entryPrice-exitPrice) / entryPrice * 100 ,"#.##") + "%")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

f_fillCell(_table, _column, _row, _title, _value, _bgcolor, _txtcolor) =>

_cellText = _title + " " + _value

table.cell(_table, _column, _row, _cellText, bgcolor=_bgcolor, text_color=_txtcolor, text_size=size.auto)

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Orders

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

if (inTime)

if (openLong)

qtyPercent := f_calQtyPerc()

entryQuantity := f_calQty(qtyPercent)

strategy.entry(id = "Long", direction = strategy.long, qty = entryQuantity, comment = 'Long(' + syminfo.ticker + '): Started', alert_message = 'Long(' + syminfo.ticker + '): Started')

f_enteringTradeLabel(x = bar_index + 1, y = close-3*ta.tr, entryPrice = close, qty = qtyPercent, slPrice = longSLPrice, tpPrice = longTPPrice, rrRatio = i_RRratio, direction = "Long")

if (openShort)

qtyPercent := f_calQtyPerc()

entryQuantity := f_calQty(qtyPercent)

strategy.entry(id = "Short", direction = strategy.short, qty = entryQuantity, comment = 'Short(' + syminfo.ticker + '): Started', alert_message = 'Short(' + syminfo.ticker + '): Started')

f_enteringTradeLabel(x = bar_index + 1, y = close-3*ta.tr, entryPrice = close, qty = qtyPercent, slPrice = shortSLPrice, tpPrice = shortTPPrice, rrRatio = i_RRratio, direction = "Short")

if (closeLong)

strategy.close(id = 'Long', comment = 'Close Long', alert_message = 'Long: Closed at market price')

strategy.position_size > 0 ? f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Long') : na

if (closeShort)

strategy.close(id = 'Short', comment = 'Close Short', alert_message = 'Short: Closed at market price')

strategy.position_size < 0 ? f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Short') : na

if (inLong)

strategy.exit(id = 'Long TP / SL', from_entry = 'Long', qty_percent = i_tpQuantityPerc, limit = longTPPrice, stop = longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Long SL', from_entry = 'Long', stop = longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Stop Loss executed')

if (inShort)

strategy.exit(id = 'Short TP / SL', from_entry = 'Short', qty_percent = i_tpQuantityPerc, limit = shortTPPrice, stop = shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Short SL', from_entry = 'Short', stop = shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Stop Loss executed')

if strategy.position_size[1] > 0 and strategy.position_size == 0

f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Long')

if strategy.position_size[1] < 0 and strategy.position_size == 0

f_exitingTradeLabel(x = bar_index, y = close+3*ta.tr, entryPrice = prevEntryPrice, exitPrice = prevExitPrice, direction = 'Short')

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// Backtest Result Dashboard

// ░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░░

// if i_showDashboard

// var bgcolor = color.new(color = color.black, transp = 100)

// var greenColor = color.new(color = #02732A, transp = 0)

// var redColor = color.new(color = #D92332, transp = 0)

// var yellowColor = color.new(color = #F2E313, transp = 0)

// // Keep track of Wins/Losses streaks

// newWin = (strategy.wintrades > strategy.wintrades[1]) and (strategy.losstrades == strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// newLoss = (strategy.wintrades == strategy.wintrades[1]) and (strategy.losstrades > strategy.losstrades[1]) and (strategy.eventrades == strategy.eventrades[1])

// varip int winRow = 0

// varip int lossRow = 0

// varip int maxWinRow = 0

// varip int maxLossRow = 0

// if newWin

// lossRow := 0

// winRow := winRow + 1

// if winRow > maxWinRow

// maxWinRow := winRow

// if newLoss

// winRow := 0

// lossRow := lossRow + 1

// if lossRow > maxLossRow

// maxLossRow := lossRow

// // Prepare stats table

// var table dashTable = table.new(position.top_right, 1, 15, border_width=1)

// if barstate.islastconfirmedhistory

// dollarReturn = strategy.netprofit

// f_fillCell(dashTable, 0, 0, "Start:", str.format("{0,date,long}", strategy.closedtrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.closedtrades.entry_time(0))

// f_fillCell(dashTable, 0, 1, "End:", str.format("{0,date,long}", strategy.opentrades.entry_time(0)) , bgcolor, color.white) // + str.format(" {0,time,HH:mm}", strategy.opentrades.entry_time(0))

// _profit = (strategy.netprofit / strategy.initial_capital) * 100

// f_fillCell(dashTable, 0, 2, "Net Profit:", str.tostring(_profit, '##.##') + "%", _profit > 0 ? greenColor : redColor, color.white)

// _numOfDaysInStrategy = (strategy.opentrades.entry_time(0) - strategy.closedtrades.entry_time(0)) / (1000 * 3600 * 24)

// f_fillCell(dashTable, 0, 3, "Percent Per Day", str.tostring(_profit / _numOfDaysInStrategy, '#########################.#####')+"%", _profit > 0 ? greenColor : redColor, color.white)

// _winRate = ( strategy.wintrades / strategy.closedtrades ) * 100

// f_fillCell(dashTable, 0, 4, "Percent Profitable:", str.tostring(_winRate, '##.##') + "%", _winRate < 50 ? redColor : _winRate < 75 ? greenColor : yellowColor, color.white)

// f_fillCell(dashTable, 0, 5, "Profit Factor:", str.tostring(strategy.grossprofit / strategy.grossloss, '##.###'), strategy.grossprofit > strategy.grossloss ? greenColor : redColor, color.white)

// f_fillCell(dashTable, 0, 6, "Total Trades:", str.tostring(strategy.closedtrades), bgcolor, color.white)

// f_fillCell(dashTable, 0, 8, "Max Wins In A Row:", str.tostring(maxWinRow, '######') , bgcolor, color.white)

// f_fillCell(dashTable, 0, 9, "Max Losses In A Row:", str.tostring(maxLossRow, '######') , bgcolor, color.white)

- Estrategia de combinación de media móvil cruzada y MACD

- Tendencia cruzada promedio móvil de impulso siguiendo la estrategia

- Tendencia siguiendo una estrategia basada en el cruce de la media móvil

- Estrategia de doble media móvil de punto de inflexión

- Estrategia para el avance rápido de los índices de rentabilidad

- Estrategia de seguimiento de la media móvil para detener pérdidas

- Estrategia de negociación cuantitativa de múltiples factores

- Tendencia siguiendo una estrategia basada en el cruce de la media móvil

- Estrategia de canal de precios de Noro v1.1

- Estrategia de inversión de la media móvil doble

- Sistema de reversión de tendencia

- Estrategia SMA de ruptura del canal

- Estrategia de reversión de tendencia del RSI

- RSI MACD Crossover Estrategia de seguimiento de doble MA

- Estrategia de tendencia de marcos de tiempo múltiples

- La estrategia de inversión de la media de la RSI doble

- Heikin Ashi ROC Estrategia de negociación en porcentaje

- Estrategia de ruptura de tendencia basada en la desviación de la media móvil

- Estrategia de retroceso de la media móvil contra la tendencia

- Tendencia de promedio móvil siguiendo la estrategia Golden Cross Long