Estrategia progresiva de obtención de beneficios

El autor:¿ Qué pasa?, Fecha: 2023-10-24 14:14:00Las etiquetas:

Estrategia progresiva de obtención de beneficios

Resumen general

Esta estrategia combina el indicador RSI y el promedio móvil de precios para identificar oportunidades de sobreventa cuando el precio se rompe por debajo de la línea de promedio móvil. A medida que el precio disminuye aún más, la estrategia piramidará progresivamente más posiciones largas basadas en porcentajes preestablecidos para lograr un promedio de costos. Cuando la ganancia de las posiciones alcanza el porcentaje de ganancia de toma configurado, la estrategia cerrará las posiciones. También introduce un mecanismo progresivo de ganancia de toma que ajusta dinámicamente el precio de stop profit general basado en las ganancias realizadas por posición. Esto puede reducir eficazmente el riesgo de pérdidas y lograr una salida gradual.

Estrategia lógica

-

Cuando el RSI cae por debajo de la línea de sobreventa de 29 y el precio de cierre está por debajo del promedio móvil, abra la primera posición larga.

-

Cuando el precio cae un 2% por debajo del primer precio de entrada, añadir una segunda posición larga, y así sucesivamente hasta un máximo de 8 entradas.

-

Después de cada entrada, registre el precio de entrada. Estos precios sirven como precios de referencia para las entradas.

-

Después de las entradas, calcule el precio promedio de la tenencia, utilizando el 3% del precio promedio como beneficio para cada posición y el 4% para la posición general.

-

Cuando el precio sube por encima del precio de ganancia de una posición, cierre esa posición.

-

Calculación progresiva de beneficios: después de cerrar cada posición, deduzca el beneficio realizado del precio total de beneficios. Esto arrastra lentamente la línea de beneficios. Solo cuando el beneficio total cubre la pérdida máxima, la estrategia obtendrá beneficios por completo.

-

Cuando el precio llegue a la línea de ganancia progresiva, cierre todas las posiciones.

Ventajas

-

El RSI es bueno para identificar zonas de sobreventa / sobrecompra, lo que permite buenas entradas para las reversiones.

-

Las entradas múltiples permiten un promedio de costos a precios bajos.

-

Las pérdidas están contenidas dentro de un rango.

-

Las tasas de rentabilidad y de entrada personalizables permiten ajustar el riesgo.

-

Las líneas de entrada y toma de ganancias planeadas ofrecen una guía visual de las posiciones.

Los riesgos

-

Los mercados de Whipsaw pueden desencadenar entradas y salidas excesivas, causando deslizamiento.

-

La mala configuración de los pasos de entrada y las proporciones pueden causar un exceso de operaciones.

-

Continuar la pirámide durante los declives conlleva riesgos de pérdidas ilimitadas.

-

Tome ganancias demasiado ajustadas puede salir prematuramente.

Mejoras

-

Añadir filtros como el MACD para evitar malas señales RSI.

-

Incorporar el stop loss basado en el ATR para limitar los eventos de pérdidas extremas.

-

Optimizar la entrada, obtener beneficios y otros parámetros para diferentes activos.

-

Ajuste dinámico tomar ganancias basado en la volatilidad.

Conclusión

La estrategia utiliza completamente el RSI para identificar la sobreventa, combinándose con MA para la negociación de inversión. Los mecanismos de toma de ganancias piramidal y progresiva controlan el riesgo al tiempo que permiten entradas largas efectivas.

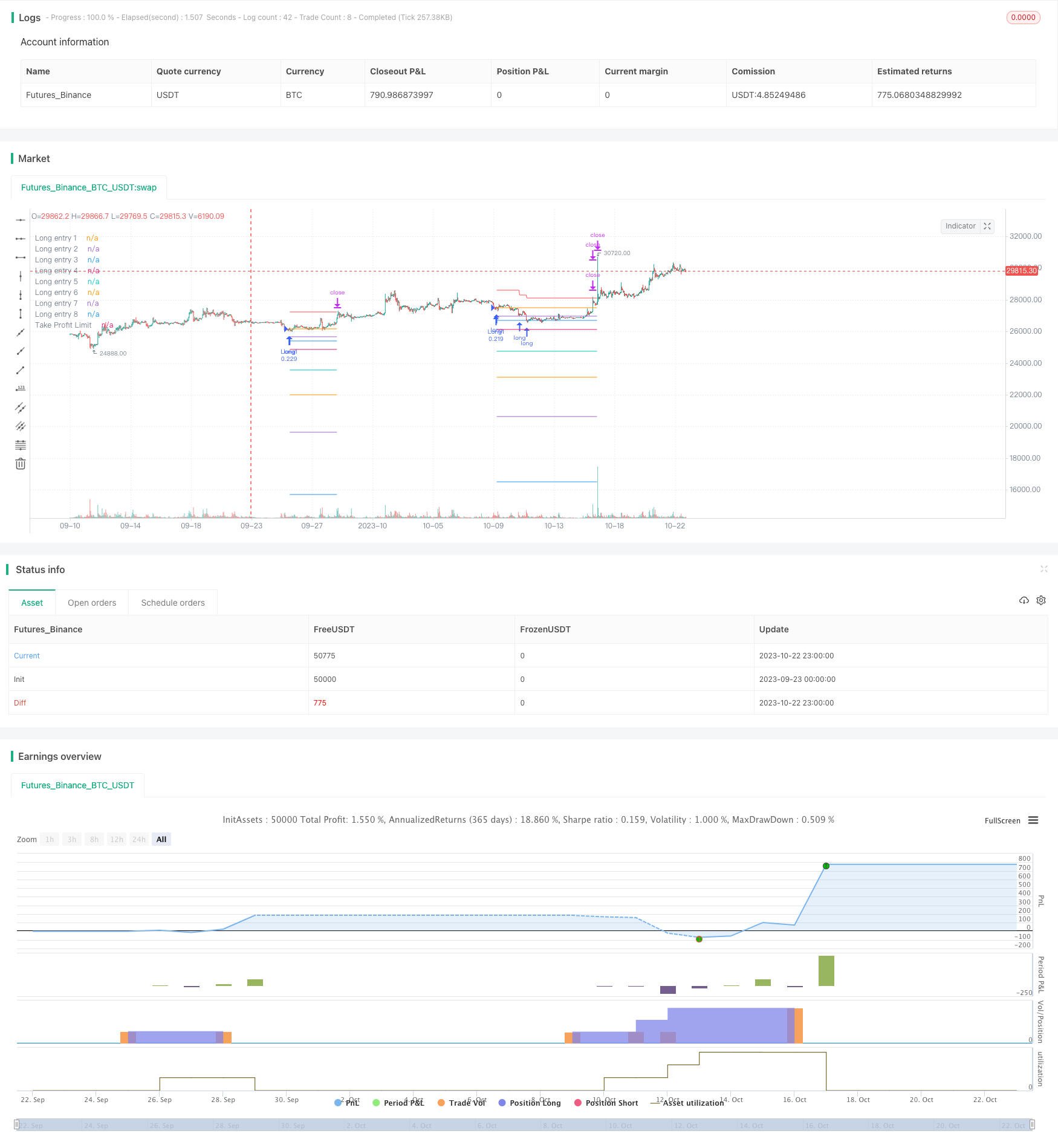

/*backtest

start: 2023-09-23 00:00:00

end: 2023-10-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

// © A3Sh

// RSI Strategy that buys the dips, uses Price Averaging and Pyramiding.

// When the price drops below specified percentages of the price (8 PA layers), new entries are openend to average the price of the assets.

// Open entries are closed by a specified take profit.

// Entries can be reopened, after closing and consequently crossing a PA layer again.

// This strategy is based on the RSI+PA+DCA strategy I created earlier. The difference is the way the Take Profit is calculated.

// Instead of directly connecting the take profit limit to the decreasing average price level with an X percent above the average price,

// the take profit is calculated for a part on the decreasing average price and for another part on the deduction

// of the profits of the individual closed positions.

// The Take Profit Limit drop less significant then the average price level and the full position only completely exits

// when enough individual closed positions made up for the losses.

// This makes it less risky and more conservative and great for a long term trading strategy

// RSI code is adapted from the build in Relative Strength Index indicator

// MA Filter and RSI concept adapted from the Optimized RSI Buy the Dips strategy, by Coinrule

// https://www.tradingview.com/script/Pm1WAtyI-Optimized-RSI-Strategy-Buy-The-Dips-by-Coinrule/

// Pyramiding entries code adapted from Pyramiding Entries on Early Trends startegy, by Coinrule

// Pyramiding entries code adapted from Pyramiding Entries on Early Trends startegy, by Coinrule

// https://www.tradingview.com/script/7NNJ0sXB-Pyramiding-Entries-On-Early-Trends-by-Coinrule/

// Plot entry layers code adapted from HOWTO Plot Entry Price by vitvlkv

// https://www.tradingview.com/script/bHTnipgY-HOWTO-Plot-Entry-Price/

strategy(title='RSI+PA+PTP', pyramiding=16, overlay=true, initial_capital=400, default_qty_type=strategy.percent_of_equity, default_qty_value=15, commission_type=strategy.commission.percent, commission_value=0.075, close_entries_rule='FIFO')

port = input.float(12, group = "Risk", title='Portfolio % Used To Open The 8 Positions', step=0.1, minval=0.1, maxval=100)

q = strategy.equity / 100 * port / open

// Long position PA entry layers. Percentage from the entry price of the the first long

ps2 = input.float(2, group = "Long Position Entry Layers", title='2nd Long Entry %', step=0.1)

ps3 = input.float(3, group = "Long Position Entry Layers", title='3rd Long Entry %', step=0.1)

ps4 = input.float(5, group = "Long Position Entry Layers", title='4th Long Entry %', step=0.1)

ps5 = input.float(10, group = "Long Position Entry Layers", title='5th Long Entry %', step=0.1)

ps6 = input.float(16, group = "Long Position Entry Layers", title='6th Long Entry %', step=0.1)

ps7 = input.float(25, group = "Long Position Entry Layers" ,title='7th Long Entry %', step=0.1)

ps8 = input.float(40, group = "Long Position Entry Layers", title='8th Long Entry %', step=0.1)

// Calculate Moving Averages

plotMA = input.bool(group = "Moving Average Filter", title='Plot Moving Average', defval=false)

movingaverage_signal = ta.sma(close, input(100, group = "Moving Average Filter", title='MA Length'))

plot (plotMA ? movingaverage_signal : na, color = color.new (color.green, 0))

// RSI inputs and calculations

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

overSold = input.int(29, title="Oversold, Trigger to Enter First Position", group = "RSI Settings")

// Long trigger (co)

co = ta.crossover(rsi, overSold) and close < movingaverage_signal

// Store values to create and plot the different PA layers

long1 = ta.valuewhen(co, close, 0)

long2 = ta.valuewhen(co, close - close / 100 * ps2, 0)

long3 = ta.valuewhen(co, close - close / 100 * ps3, 0)

long4 = ta.valuewhen(co, close - close / 100 * ps4, 0)

long5 = ta.valuewhen(co, close - close / 100 * ps5, 0)

long6 = ta.valuewhen(co, close - close / 100 * ps6, 0)

long7 = ta.valuewhen(co, close - close / 100 * ps7, 0)

long8 = ta.valuewhen(co, close - close / 100 * ps8, 0)

eps1 = 0.00

eps1 := na(eps1[1]) ? na : eps1[1]

eps2 = 0.00

eps2 := na(eps2[1]) ? na : eps2[1]

eps3 = 0.00

eps3 := na(eps3[1]) ? na : eps3[1]

eps4 = 0.00

eps4 := na(eps4[1]) ? na : eps4[1]

eps5 = 0.00

eps5 := na(eps5[1]) ? na : eps5[1]

eps6 = 0.00

eps6 := na(eps6[1]) ? na : eps6[1]

eps7 = 0.00

eps7 := na(eps7[1]) ? na : eps7[1]

eps8 = 0.00

eps8 := na(eps8[1]) ? na : eps8[1]

plot(strategy.position_size > 0 ? eps1 : na, title='Long entry 1', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps2 : na, title='Long entry 2', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps3 : na, title='Long entry 3', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps4 : na, title='Long entry 4', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps5 : na, title='Long entry 5', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps6 : na, title='Long entry 6', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps7 : na, title='Long entry 7', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps8 : na, title='Long entry 8', style=plot.style_linebr)

// Take Profit Settings

ProfitTarget_Percent = input.float(3.0, group = "Take Profit Settings", title='Take Profit % (Per Position)')

ProfitTarget_Percent_All = input.float(4.0, group = "Take Profit Settings", title='Take Profit % (Exit All, Progressive Take Profit Limit')

TakeProfitProgression = input.float(12, group = "Take Profit Settings", title='Take Profit Progression', tooltip = 'Progression is defined by the position size. By default 12% of the start equity (portfolio) is used to open a position, see Risk. This same % percentage is used to calculate the profit amount that will be deducted from the Take Profit Limit.')

entryOn = input.bool (true, group = "Take Profit Settings", title='New entries affect Take Profit limit', tooltip = 'This option changes the behaviour of the Progressive Take Profit. When switchted on, the difference between the former and current original Take Profit is deducted from the Progressive Take Profit. When switchted off, the Progressive Take Profit is only affected by the profit deduction or each closed position.')

avPricePlot = input.bool (false, group = "Take Profit Settings", title='Plot Average Price (FIFO)')

// Original Take Profit Limit

tpLimit = strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All)

// Create variables to calculate the Take Profit Limit Progresssion

var endVal = 0.0

var startVal = 0.0

// The value at the the start of the loop is the value of the end of the previous loop

startVal := endVal

// Set variable to the original Take Profit Limit when the first position opens.

if strategy.position_size > 0 and strategy.position_size[1] ==0

endVal := tpLimit

// Everytime a specific position opens, the difference of the previous (original) Take Profit price and the current (original) Take Profit price will be deducted from the Progressive Take Profit Limit

// This feature can be toggled on and off in the settings panel. By default it is toggled on.

entryAmount = 0.0

for i = 1 to strategy.opentrades

entryAmount := i

if entryOn and strategy.position_size > 0 and strategy.opentrades[1] == (entryAmount) and strategy.opentrades == (entryAmount + 1)

endVal := startVal - (tpLimit[1] - tpLimit)

// Everytime a specific position closes, the amount of profit from that specific position will be deducted from the Progressive Take Profit Limit.

exitAmount = 0.0

for id = 1 to strategy.opentrades

exitAmount := id

if strategy.opentrades[1] ==(exitAmount + 1) and strategy.opentrades == (exitAmount)

endVal := startVal - (TakeProfitProgression / 100 * strategy.opentrades.entry_price (id - 1) / 100 * ProfitTarget_Percent )

// The Final Take Profit Price

tpn = (strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All)) - (strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All) - endVal)

plot (strategy.position_size > 0 ? tpn : na, title = "Take Profit Limit", color=color.new(color.red, 0), style = plot.style_linebr, linewidth = 1)

// Plot position average price as reference

plot (avPricePlot ? strategy.position_avg_price : na, title= "Average price", color = color.new(color.white, 0), style = plot.style_linebr, linewidth = 1)

// When to trigger the Take Profit per position or the Progressive Take Profit

tpl1 = close < tpn ? eps1 + close * (ProfitTarget_Percent / 100) : tpn

tpl2 = close < tpn ? eps2 + close * (ProfitTarget_Percent / 100) : tpn

tpl3 = close < tpn ? eps3 + close * (ProfitTarget_Percent / 100) : tpn

tpl4 = close < tpn ? eps4 + close * (ProfitTarget_Percent / 100) : tpn

tpl5 = close < tpn ? eps5 + close * (ProfitTarget_Percent / 100) : tpn

tpl6 = close < tpn ? eps6 + close * (ProfitTarget_Percent / 100) : tpn

tpl7 = close < tpn ? eps7 + close * (ProfitTarget_Percent / 100) : tpn

tpl8 = close < tpn ? eps8 + close * (ProfitTarget_Percent / 100) : tpn

// Submit Entry Orders

if co and strategy.opentrades == 0

eps1 := long1

eps2 := long2

eps3 := long3

eps4 := long4

eps5 := long5

eps6 := long6

eps7 := long7

eps8 := long8

strategy.entry('Long1', strategy.long, q)

if strategy.opentrades == 1

strategy.entry('Long2', strategy.long, q, limit=eps2)

if strategy.opentrades == 2

strategy.entry('Long3', strategy.long, q, limit=eps3)

if strategy.opentrades == 3

strategy.entry('Long4', strategy.long, q, limit=eps4)

if strategy.opentrades == 4

strategy.entry('Long5', strategy.long, q, limit=eps5)

if strategy.opentrades == 5

strategy.entry('Long6', strategy.long, q, limit=eps6)

if strategy.opentrades == 6

strategy.entry('Long7', strategy.long, q, limit=eps7)

if strategy.opentrades == 7

strategy.entry('Long8', strategy.long, q, limit=eps8)

// Submit Exit orders

if strategy.position_size > 0

strategy.exit(id='Exit 1', from_entry='Long1', limit=tpl1)

strategy.exit(id='Exit 2', from_entry='Long2', limit=tpl2)

strategy.exit(id='Exit 3', from_entry='Long3', limit=tpl3)

strategy.exit(id='Exit 4', from_entry='Long4', limit=tpl4)

strategy.exit(id='Exit 5', from_entry='Long5', limit=tpl5)

strategy.exit(id='Exit 6', from_entry='Long6', limit=tpl6)

strategy.exit(id='Exit 7', from_entry='Long7', limit=tpl7)

strategy.exit(id='Exit 8', from_entry='Long8', limit=tpl8)

// Make sure that all open limit orders are canceled after exiting all the positions

longClose = strategy.position_size[1] > 0 and strategy.position_size == 0 ? 1 : 0

if longClose

strategy.cancel_all()

- Estrategia de fuga basada en canales de Camarilla

- Estrategia de cruce de promedio móvil con la tendencia

- Estrategia de ruptura de tendencia mensual

- Estrategia del índice de volatilidad de la DEMA

- Una tendencia que sigue una estrategia

- Estrategia de cruce estocástico de varios plazos

- Estrategia de negociación de media móvil de seguimiento

- SMA cruzando el RSI Estrategia de negociación Golden Cross Death Cross

- Siguiendo la estrategia de supertendencia

- Estrategia de combinación de volatilidad de inversión de tendencia

- Estrategia de avance de doble posición

- Tendencia siguiendo la estrategia Buy Dip Sell Peak

- Estrategia de combinación de media móvil cruzada y MACD

- Tendencia cruzada promedio móvil de impulso siguiendo la estrategia

- Tendencia siguiendo una estrategia basada en el cruce de la media móvil

- Estrategia de doble media móvil de punto de inflexión

- Estrategia para el avance rápido de los índices de rentabilidad

- Estrategia de seguimiento de la media móvil para detener pérdidas

- Estrategia de negociación cuantitativa de múltiples factores

- Tendencia siguiendo una estrategia basada en el cruce de la media móvil