Estrategia de seguimiento de tendencia de canal de triple media móvil

Descripción general

La estrategia utiliza una combinación de tres medias móviles para determinar la dirección de la tendencia en función de la relación secuencial de las medias móviles y realizar el seguimiento de la tendencia. Cuando las medias móviles rápidas, medias móviles y medias móviles lentas se ordenan, haga más; cuando las medias móviles lentas, medias móviles y medias móviles rápidas se ordenan, haga vacío.

El principio de estrategia

La estrategia utiliza tres promedios móviles de diferentes períodos, que incluyen promedios móviles rápidos, promedios móviles medios y promedios móviles lentos.

Condiciones de entrada:

- Haga más: cuando el promedio móvil rápido > promedio móvil medio > promedio móvil lento, considere que la situación está en una tendencia alcista, haga más.

- Hacer un descuento: cuando el promedio móvil lento < promedio móvil medio < promedio móvil rápido, se considera que el mercado está en una tendencia a la baja, hacer un descuento.

Condiciones de juego:

- Aparición de la media móvil: la posición se estabiliza cuando se invierte la secuencia de tres medias móviles.

- La salida de stop-loss: establece un punto de stop-loss fijo, como un stop-loss del 12% y un stop-loss del 1% después de alcanzar el precio de stop-loss o stop-loss.

La estrategia es sencilla y directa, utiliza tres medias móviles para determinar la dirección de la tendencia del mercado y permite realizar operaciones de seguimiento de tendencias para mercados con una tendencia más fuerte.

Análisis de ventajas

- Utiliza tres medias móviles para juzgar tendencias, filtrar el ruido del mercado e identificar la dirección de las tendencias.

- El uso de diferentes medias móviles periódicas permite determinar con mayor precisión el punto de inflexión de la tendencia.

- La combinación de un indicador de media móvil y un stop-loss fijo para administrar el riesgo de los fondos.

- La estrategia es simple, intuitiva y fácil de entender.

- Puede optimizar los parámetros de los ciclos de las medias móviles para adaptarse a diferentes situaciones de ciclo.

Riesgos y mejoras

- En un escenario de grandes ciclos, las medias móviles pueden producir más errores de cálculo y causar pérdidas innecesarias.

- Se puede considerar la inclusión de otros indicadores o condiciones de filtración para aumentar la tasa de ganancias.

- La combinación de parámetros periódicos de la media móvil se puede optimizar para adaptarse a una situación de mercado más amplia.

- El indicador de tendencia fuerte puede combinarse con el indicador de tendencia débil para evitar la caída de la cima.

- Se puede agregar un alto automático para evitar la expansión de las pérdidas.

Conclusión

La triple media móvil sigue una estrategia clara y fácil de entender, utiliza una media móvil para determinar la dirección de la tendencia y realizar un comercio sencillo de seguimiento de la tendencia. La ventaja de la estrategia es que es fácil de implementar y puede adaptarse a diferentes situaciones de ciclo mediante el ajuste de los parámetros del ciclo de la media móvil.

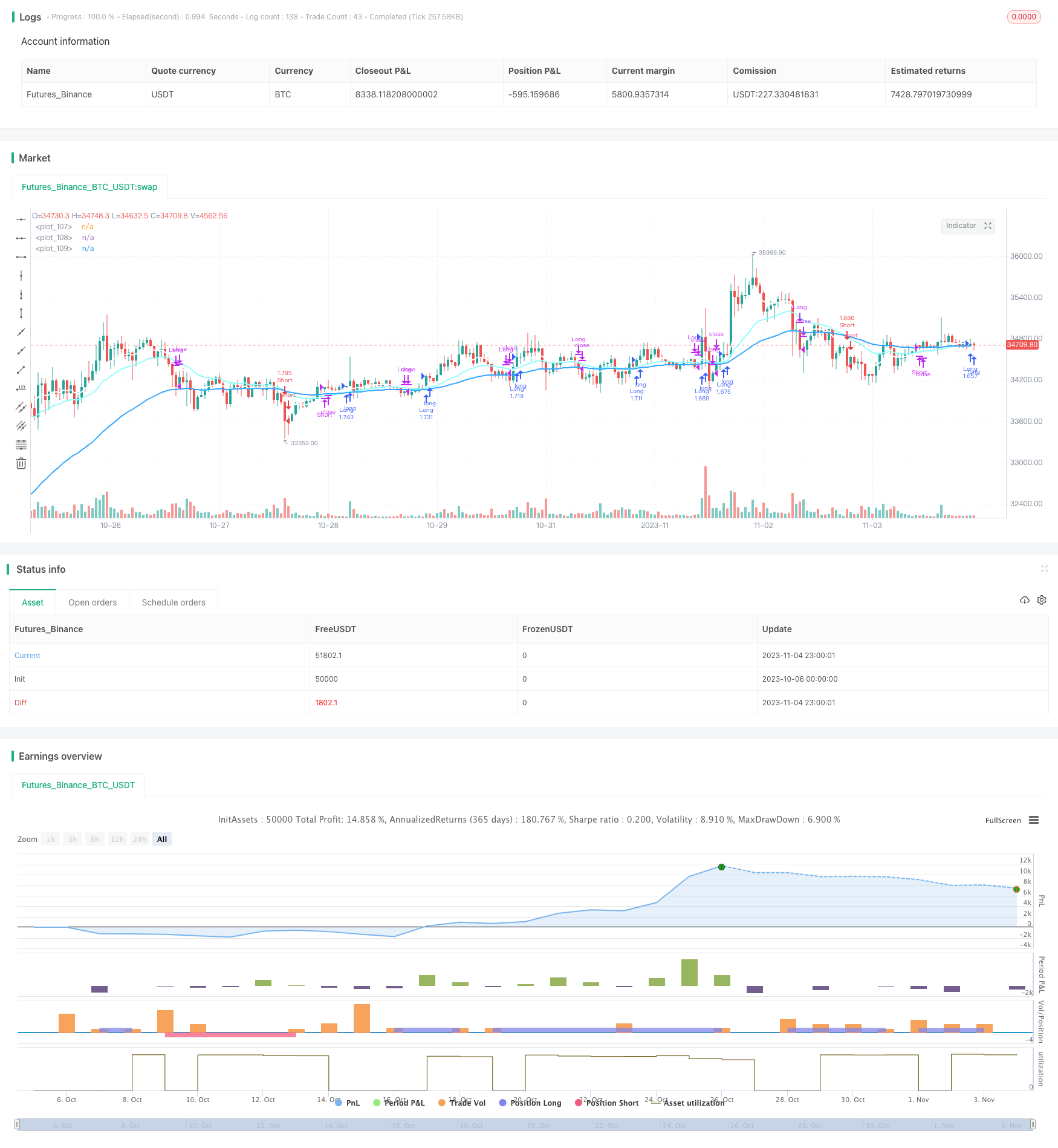

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Jompatan

//@version=5

strategy('Strategy Triple Moving Average', overlay=true, initial_capital = 1000, commission_value=0.04, max_labels_count=200)

//INPUTS

mov_ave = input.string(defval="EMA", title='Moving Average type:', options= ["EMA", "SMA"])

period_1 = input.int(9, title='Period 1', inline="1", group= "============== Moving Average Inputs ==============")

period_2 = input.int(21, title='Period 2', inline="2", group= "============== Moving Average Inputs ==============")

period_3 = input.int(50, title='Period 3', inline="3", group= "============== Moving Average Inputs ==============")

source_1 = input.source(close, title='Source 1', inline="1", group= "============== Moving Average Inputs ==============")

source_2 = input.source(close, title='Source 2', inline="2", group= "============== Moving Average Inputs ==============")

source_3 = input.source(close, title='Source 3', inline="3", group= "============== Moving Average Inputs ==============")

//EXIT CONDITIONS

exit_ma = input.bool(true, title= "Exit by Moving average condition", group="================ EXIT CONDITIONS ================")

exit_TPSL = input.bool(false, title= "Exit by Take Profit and StopLoss", group="================ EXIT CONDITIONS ================")

TP = input.int(12, title='Take Profit', step=1, group="================ EXIT CONDITIONS ================")

SL = input.int(1, title='Stop Loss', step=1, group="================ EXIT CONDITIONS ================")

plot_TPSL = input.bool(false, title='Show TP/SL lines', group="================ EXIT CONDITIONS ================")

//Date filters

desde = input(defval= timestamp("01 Jan 2023 00:00 -3000"), title="From", inline="12", group= "============= DATE FILTERS =============")

hasta = input(defval= timestamp("01 Oct 2099 00:00 -3000"), title="To ", inline="13", group= "============= DATE FILTERS =============")

enRango = true

//COMMENTS

//entry_long_comment = input.string(defval=" ", title="Entry Long comment: ", inline="14", group="============= COMMENTS =============")

//exit_long_comment = input.string(defval=" ", title="Exit Long comment: ", inline="15", group="============= COMMENTS =============")

//entry_short_comment = input.string(defval=" ", title="Entry Short comment:", inline="16", group="============= COMMENTS =============")

//exit_short_comment = input.string(defval=" ", title="Exit Short comment: ", inline="17", group="============= COMMENTS =============")

//============================================================

//Selecting Moving average type

ma1 = mov_ave == "EMA" ? ta.ema(source_1, period_1) : ta.sma(source_1, period_1)

ma2 = mov_ave == "EMA" ? ta.ema(source_2, period_2) : ta.sma(source_2, period_2)

ma3 = mov_ave == "EMA" ? ta.ema(source_3, period_3) : ta.sma(source_3, period_3)

//============================================================

//Entry Long condition: Grouped Moving average from: (ma fast > ma middle > ma slow)

long_condition = (ma1 > ma2) and (ma2 > ma3)

//Entry Short condition: Grouped Moving average from: (ma fast < ma middle < ma slow)

short_condition = (ma1 < ma2) and (ma2 < ma3)

//============================================================

cantidad = strategy.equity / close

comprado_long = strategy.position_size > 0

comprado_short = strategy.position_size < 0

var long_profit_price = 0.0

var long_stop_price = 0.0

var short_profit_price = 0.0

var short_stop_price = 0.0

//============================================================

//ENTRY LONG

if not comprado_long and not comprado_short and long_condition and not long_condition[1] and enRango

strategy.entry('Long', strategy.long, qty=cantidad, comment= "Entry Long")

if exit_TPSL

long_profit_price := close * (1 + TP/100)

long_stop_price := close * (1 - SL/100)

else

long_profit_price := na

long_stop_price := na

//============================================================

//ENTRY SHORT

if not comprado_long and not comprado_short and short_condition and not short_condition[1] and enRango

strategy.entry('Short', strategy.short, qty=cantidad, comment= "Entry Short")

if exit_TPSL

short_profit_price := close * (1 - TP/100)

short_stop_price := close * (1 + SL/100)

else

short_profit_price := na

short_stop_price := na

//============================================================

//EXIT LONG

if comprado_long and exit_ma and long_condition[1] and not long_condition

strategy.close('Long', comment='Exit-Long(MA)')

if comprado_long and exit_TPSL

strategy.exit('Long', limit=long_profit_price, stop=long_stop_price, comment='Exit-Long(TP/SL)')

//============================================================

//EXIT SHORT

if comprado_short and exit_ma and short_condition[1] and not short_condition

strategy.close('Short', comment='Exit-Short(MA)')

if comprado_short and exit_TPSL

strategy.exit('Short', limit=short_profit_price, stop=short_stop_price, comment='Exit-Short(TP/SL)')

//============================================================

//PLOTS

plot(ma1, linewidth=2, color=color.rgb(255, 255, 255))

plot(ma2, linewidth=2, color=color.rgb(144, 255, 252))

plot(ma3, linewidth=2, color=color.rgb(49, 167, 255))

//Plot Take Profit line

plot(plot_TPSL ? comprado_long ? long_profit_price : comprado_short ? short_profit_price : na : na, color=color.new(color.lime, 30), style= plot.style_linebr)

//Plot StopLoss line

plot(plot_TPSL ? comprado_long ? long_stop_price : comprado_short ? short_stop_price : na : na, color=color.new(color.red, 30), style= plot.style_linebr)