概述

本策略是一个基于移动平均线的趋势追随型交易策略。它使用三条不同参数设置的Hull移动平均线,判断价格趋势方向,并结合快速ATR滤波器实现潜在趋势反转的提前识别。当快中慢三条均线发生向上或向下交叉时,発出买入或卖出信号。该策略同时具有移动止损和移动止盈功能,可以有效控制风险。

策略原理

该策略使用三条Hull移动平均线判断价格趋势,包括一条较快的Hull MA,一条中速的Hull MA和一条较慢的Hull MA。根据它们的交叉情况判断趋势方向:

当快线上穿中线时,表示价格进入上升趋势,发出买入信号。

当快线下穿中线时,表示价格进入下跌趋势,发出卖出信号。

为了提高识别趋势反转的灵敏度,策略引入了基于RSI的快速ATR滤波器。该滤波器能够测量价位的变动性,当价格趋势发生转变时,它的数值会发生明显变化。因此,我们可以根据ATR滤波器的上下突破情况提前判断价格趋势的反转。

具体来说,filtr函数实现了该快速ATR滤波器的计算逻辑。它基于RSI的数值,计算ATR的大小。当ATR数值上穿或下穿RSI曲线时,就可能预示着价格趋势的转变。

此外,策略中设置了移动止损和移动止盈条件,可以按照设定的止损百分比和止盈百分比,实现自动的风险管理。

优势分析

使用三条Hull MA均线判断趋势方向,可以有效过滤市场噪音,识别中长线趋势

快速ATR滤波器的应用,可以提高对趋势反转的提前判断能力

自动把握趋势反转机会,及时调整仓位,不漏买不漏卖

移动止损止盈设置了风险与回报的动态平衡

可自定义参数,适用于不同市场和交易品种

风险分析

MA交叉策略容易产生多头假信号和空头假信号,需要ATR滤波器进行辅助验证

大幅震荡市场中,MA容易发生频繁交叉,应密切关注ATR曲线走势

停损点过小易被止损,过大又难以控制损失。需根据具体情况调整参数

本策略更适合趋势性行情,不宜用于震荡行情

可通过参数优化,选择最佳的MA和ATR周期组合,降低假信号率

优化方向

可尝试将MA类型改为DEMA、TEMA等EMA变体,看是否能过滤更多噪音

ATR滤波器可改用Keltner通道MIDDLE线,检验对趋势反转判断的提高

可测试不同的MA参数组合,找到最佳参数对

可测试ATR周期参数,找到最佳的平滑效果

可加入量能指标,辅助判断真假突破的可能性

可测试是否加入MACD等其他指标,提高信号的可靠性

总结

本策略整合了移动平均线判断趋势方向、ATR滤波器提前探测反转和自动止损止盈管理风险的多项功能。它可以自动跟踪趋势,及时把握反转机会,通过参数优化可以适用于不同品种和周期,是一种非常实用的趋势追随型交易策略。其优点是简单清晰的策略逻辑和高效的风险控制手段。但也需要注意错觉信号和止损点设置的问题。通过进一步优化,可望得到更好的策略效果。

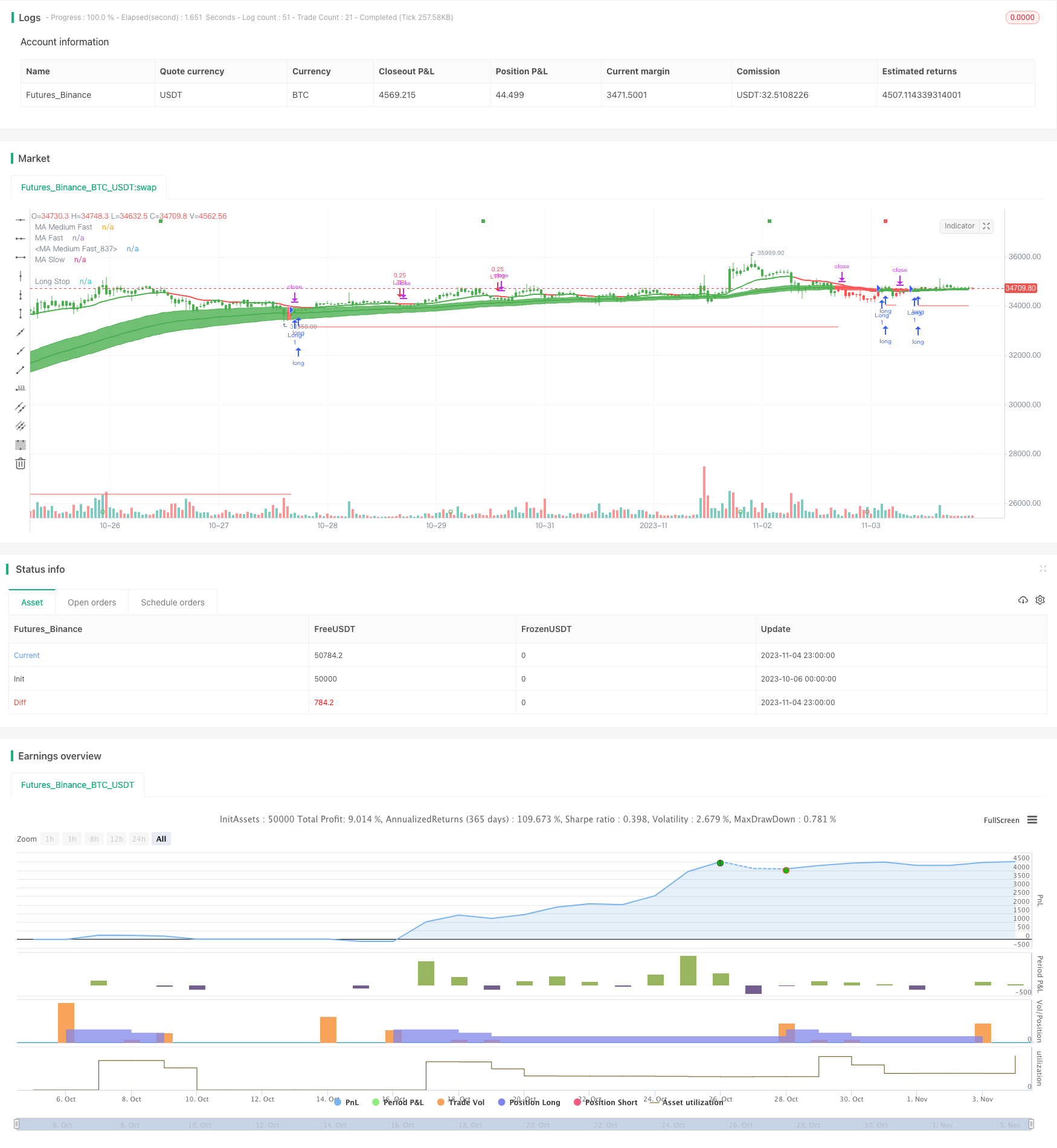

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//

//*** START of COMMENT OUT [Alerts]

//strategy(title="[Backtest]QQE Cross v6.0 by JustUncleL", shorttitle="[BT]QQEX v6.0", overlay=true,

// pyramiding=0, default_qty_value=1000, commission_value=0.1,

// commission_type=strategy.commission.percent, initial_capital=10000)

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [BackTest]

strategy(

title="[Alerts]QQE Cross v6.0 by JustUncleL",

shorttitle="[AL]QQEX v6.0",

overlay=true)

FromMonth = input(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input(defval=2009, title="From Year")

ToMonth = input(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input(defval=9999, title="To Year")

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window = true // create function "within window of time"

trade_dir = input('Long Only', options=['Long Only', 'Short Only', 'Long and Short'], title='Trade Direction')

tp1_perc = input(25, step=0.25, minval=0, title='Take Profit Signal 1 Qty Percent')/100

tp2_perc = input(25, step=0.25, minval=0, title='Take Profit Signal 2 Qty Percent')/100

sl_perc = input(2, step=0.25, minval=0, title='Stop Loss Percent')/100

dir = trade_dir == 'Long Only' ? strategy.direction.long :

trade_dir == 'Short Only' ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(dir)

//*** END of COMMENT OUT [BackTest]

//

// Author: JustUncleL

// Date: 10-July-2016

// Version: v6, Major Release Nov-2018

//

// Description:

// A following indicator is Trend following that uses fast QQE crosses with Moving Averages

// for trend direction filtering. QQE or Qualitative Quantitative Estimation is based

// on the relative strength index (RSI), but uses a smoothing technique as an additional

// transformation. Three crosses can be selected (all selected by default):

// - Smooth RSI signal crossing ZERO (XZ)

// - Smooth RSI signal crossing Fast QQE line (XQ), this is like an early warning swing signal.

// - Smooth RSI signal exiting the RSI Threshhold Channel (XC), this is like a confirmed swing signal.

// An optimumal Smooth RSI threshold level is between 5% and 10% (default=10), it helps reduce

// the false swings.

// These signals can be selected to Open Short/Long and/or Close a trade, default is XC open

// trade and XQ (or opposite open) to Close trade.

//

// The (LONG/SHORT) alerts can be optionally filtered by the Moving Average Ribbons:

// - For LONG alert the Close must be above the fast MA Ribbon and

// fast MA Ribbon must be above the slow MA Ribbon.

// - For SHORT alert the Close must be below the fast MA Ribbon and

// fast MA Ribbon must be below the slow MA Ribbon.

// and/or directional filter:

// - For LONG alert the Close must be above the medium MA and the

// directional of both MA ribbons must be Bullish.

// - For SELL alert the Close must be below the medium MA and the

// directional of both MA ribbons must be Bearish.

//

// This indicator is designed to be used as a Signal to Signal trading BOT

// in automatic or semi-automatic way (start and stop when conditions are suitable).

// - For LONG and SHORT alerts I recommend you use "Once per Bar" alarm option

// - For CLOSE alerts I recommend you use "Once per Bar Close" alarm option

// (* The script has been designed so that long/short signals come at start of candles *)

// (* and close signals come at the end of candles *)

//

// Mofidifications:

// 6.0 - Major Release Version

// - Added second MA ribbon to help filter signals to the trend direction.

// - Modified Alert filtering to include second MA Ribbon

// - Change default settings to reflect Signal to Signal BOT parameters.

// - Removed older redunant alerts.

//

// 5.0 - Development series

//

// 4.1 - Fix bug with painting Buy/Sell arrows when non-repaint shunt mode selected.

// - Added option to alert just the first Buy/Sell alert after a trend swing

// - Added Long and Short Alarms. When combined with the "first Buy/Sell" in trend option,

// It is now possible to use this indicator to interface with AutoView

// or ProfitView. I suggest using the "QQEX XZ Alert" alarm to exit Long or Short

// trade. Use only "Once per bar Close" option for Alarms. This is not a full

// fledged trading BOT though with TP/SL settings.

//

// - Changed QQE defaults to be a bit smoother (14, 8, 5) instead of (6, 3, 2.618)

// which is more suited to Forex and Crypto trading.

//

// 4.0 - Added implied GPL copyright notice.

// - Changed defaults to use HullMAs instead of EMAs.

// 3.0 - No repaint on BUY/SELL alert, however, now trades should be taken when the BUY/SELL

// Alert is displayed. The alarm is still generated on the previous candle so you can

// still get a pre-warning, this enables you time to analyse the pending alert.

// - Added option to test success of alerted trades, highlight successful and failed trade bars

// and show simple stats: success rate and number of trades (out of 5000), this will help

// tune the settings for timeframe and currency PAIR.

// 2.0 - Added code to use the medium moving average (EMA20) rising/falling for additional

// trend direction filter.

// - Remove Moving Average cross over signals and other options not used in this indicator.

// - Added code to distinguish between the crosses, now only show Thresh Hold crosses as BUY/SELL

// alerts.

// - Modidied default settings to more well known MA's and slightly different QQE settings, these

// work well at lower timeframes.

// - Added circle plots at bottom of chart to show when actual BUY/SELL alerts occur.

// 1.0 - original

//

// References:

// Some Code borrowed from:

// - "Scalp Jockey - MTF MA Cross Visual Strategizer by JayRogers"

// - "QQE MT4 by glaz"

// Inspiration from:

// - http://www.forexstrategiesresources.com/binary-options-strategies-ii/189-aurora-binary-trading/

// - http://www.forexstrategiesresources.com/metatrader-4-trading-systems-v/652-qqe-smoothed-trading/

// - http://dewinforex.com/forex-indicators/qqe-indicator-not-quite-grail-but-accurately-defines-trend-and-flat.html

// - "Binary option trading by two previous bars" by radixvinni

//

//

// -----------------------------------------------------------------------------

// Copyright 2015 Glaz,JayRogers

//

// Copyright 2016,2017,2018 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

// Use Alternate Anchor TF for MAs

anchor = input(4,minval=0,maxval=100,title="Relative TimeFrame Multiplier for Second MA Ribbon (0=none, max=100)")

//

// - INPUTS START

// Fast MA - type, source, length

showAvgs = input(true,title="Show Moving Average Lines")

type1 = input(defval="EMA", title="Fast MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len1 = input(defval=16, title="Fast - Length", minval=1)

gamma1 = 0.33

// Medium Fast MA - type, source, length

type2 = input(defval="EMA", title="Medium MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len2 = input(defval=21, title="Medium - Length", minval=1)

gamma2 = 0.55

// Slow MA - type, source, length

type3 = input(defval="EMA", title="Slow MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "HullMA", "ZEMA", "TMA", "SSMA"])

len3 = input(defval=26, title="Slow Length", minval=1)

gamma3 = 0.77

//

// QQE rsi Length, Smoothing, fast ATR factor, source

RSILen = input(14,title='RSI Length')

SF = input(8,title='RSI Smoothing Factor')

QQEfactor = input(5.0,type=float,title='Fast QQE Factor')

threshhold = input(10, title="RSI Threshhold")

//

sQQEx = input(true,title="Show QQE Signal crosses")

sQQEz = input(false,title="Show QQE Zero crosses")

sQQEc = input(true,title="Show QQE Thresh Hold Channel Exits")

//

tradeSignal = input("XC", title="Select which QQE signal to Buy/Sell", options=["XC","XQ","XZ"])

closeSignal = input("XQ", title="Select which QQE signal to Close Order", options=["XC","XQ","XZ"])

//

xfilter = input(true, title="Filter XQ Buy/Sell Orders by Threshold" )

filter = input(false,title="Use Moving Average Filter")

dfilter = input(true, title="Use Trend Directional Filter" )

ufirst = input(false, title="Only Alert First Buy/Sell in a new Trend")

RSIsrc = input(close,title="Source")

src = RSIsrc // MA source

srcclose= RSIsrc

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by JustUncleL*//

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

//*** START of COMMENT OUT [Alerts]

//testStartYear = input(2018, "Backtest Start Year",minval=1980)

//testStartMonth = input(6, "Backtest Start Month",minval=1,maxval=12)

//testStartDay = input(12, "Backtest Start Day",minval=1,maxval=31)

//testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

//testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

//testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

//testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

//testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

//testPeriod = time >= testPeriodStart and time <= testPeriodStop ? true : false

//*** END of COMMENT OUT [Alerts]

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

// - INPUTS END

gold = #FFD700

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier, base on time in mins

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := not isintraday? 1 : mult // Only available Daily or less

// Anchor is a relative multiplier based on current TF.

mult = anchor>0 ? anchor : 1

// - FUNCTIONS END

// - Fast ATR QQE

//

Wilders_Period = RSILen * 2 - 1

//

Rsi = rsi(RSIsrc,RSILen)

RSIndex = ema(Rsi, SF)

AtrRsi = abs(RSIndex[1] - RSIndex)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

DeltaFastAtrRsi = ema(MaAtrRsi,Wilders_Period) * QQEfactor

//

newshortband= RSIndex + DeltaFastAtrRsi

newlongband= RSIndex - DeltaFastAtrRsi

longband = 0.0

shortband=0.0

trend = 0

longband:=RSIndex[1] > longband[1] and RSIndex > longband[1] ? max(longband[1],newlongband) : newlongband

shortband:=RSIndex[1] < shortband[1] and RSIndex < shortband[1] ? min(shortband[1],newshortband) : newshortband

trend:=cross(RSIndex, shortband[1])? 1 : cross(longband[1], RSIndex) ? -1 : nz(trend[1],1)

FastAtrRsiTL = trend==1 ? longband : shortband

// - SERIES VARIABLES

// MA's

ma_fast = variant(type1, srcclose, len1, gamma1)

ma_medium = variant(type2, srcclose, len2, gamma2)

ma_slow = variant(type3, srcclose, len3, gamma3)

// MA's

ma_fast_alt = variant(type1, srcclose, len1*mult, gamma1)

ma_medium_alt = variant(type2, srcclose, len2*mult, gamma2)

ma_slow_alt = variant(type3, srcclose, len3*mult, gamma3)

// Get Direction From Medium Moving Average

direction = rising(ma_medium,3) ? 1 : falling(ma_medium,3) ? -1 : 0

altDirection = rising(ma_medium_alt,3) ? 1 : falling(ma_medium_alt,3) ? -1 : 0

//

// Find all the QQE Crosses

QQExlong = 0, QQExlong := nz(QQExlong[1])

QQExshort = 0, QQExshort := nz(QQExshort[1])

QQExlong := FastAtrRsiTL< RSIndex ? QQExlong+1 : 0

QQExshort := FastAtrRsiTL> RSIndex ? QQExshort+1 : 0

// Zero cross

QQEzlong = 0, QQEzlong := nz(QQEzlong[1])

QQEzshort = 0, QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex>=50 ? QQEzlong+1 : 0

QQEzshort := RSIndex<50 ? QQEzshort+1 : 0

//

// Thresh Hold channel Crosses give the BUY/SELL alerts.

QQEclong = 0, QQEclong := nz(QQEclong[1])

QQEcshort = 0, QQEcshort := nz(QQEcshort[1])

QQEclong := RSIndex>(50+threshhold) ? QQEclong+1 : 0

QQEcshort := RSIndex<(50-threshhold) ? QQEcshort+1 : 0

//

// Check Filtering.

QQEflong = mult == 1 ? (not filter or (srcclose>ma_medium and ma_medium>ma_slow and ma_fast>ma_medium)) and (not dfilter or (direction>0 )) :

(not filter or (ma_medium>ma_medium_alt and srcclose>ma_fast and ma_fast>ma_medium)) and (not dfilter or (direction>0 and altDirection>0 and srcclose>ma_medium))

QQEfshort = mult == 1 ? (not filter or (srcclose<ma_medium and ma_medium<ma_slow and ma_fast<ma_medium)) and (not dfilter or (direction<0 )) :

(not filter or (ma_medium<ma_medium_alt and srcclose<ma_fast and ma_fast<ma_medium)) and (not dfilter or (direction<0 and altDirection<0 and srcclose<ma_medium))

QQExfilter = (not xfilter or RSIndex>(50+threshhold) or RSIndex<(50-threshhold))

//

// Get final BUY / SELL alert determination

buy_ = 0, buy_ := nz(buy_[1])

sell_ = 0, sell_ := nz(sell_[1])

// Make sure Buy/Sell are non-repaint and occur after close signal.

buy_ := tradeSignal=="XC"? (QQEclong[1]==1 and QQEflong[1] ? buy_+1 : 0) :

tradeSignal=="XQ"? (QQExlong[1]==1 and QQEflong[1] and QQExfilter[1]? buy_+1 : 0) :

tradeSignal=="XZ"? (QQEzlong[1]==1 and QQEflong[1] ? buy_+1 : 0) : 0

sell_ := tradeSignal=="XC"? (QQEcshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) :

tradeSignal=="XQ"? (QQExshort[1]==1 and QQEfshort[1] and QQExfilter[1]? sell_+1 : 0) :

tradeSignal=="XZ"? (QQEzshort[1]==1 and QQEfshort[1] ? sell_+1 : 0) : 0

//

// Find the first Buy/Sell in trend swing.

Buy = 0, Buy := nz(Buy[1])

Sell = 0, Sell := nz(Sell[1])

Buy := sell_>0 ? 0 : buy_==1 or Buy>0 ? Buy+1 : Buy

Sell := buy_>0 ? 0 : sell_==1 or Sell>0 ? Sell+1 : Sell

// Select First or all buy/sell alerts.

buy = ufirst ? Buy : buy_

sell = ufirst ? Sell : sell_

closeLong = 0, closeLong := nz(closeLong[1])

closeShort = 0, closeShort := nz(closeShort[1])

closeLong := closeSignal=="XC" ? (QQEcshort==1 ? closeLong+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExshort==1 ? closeLong+1 : 0) : ((QQExshort==1 or QQEzshort or QQEcshort) ? closeLong+1 : 0) :

closeSignal=="XZ" ? (QQEzshort==1 ? closeLong+1 : 0) : 0

closeShort := closeSignal=="XC" ? (QQEclong==1 ? closeShort+1 : 0) :

closeSignal=="XQ" ? tradeSignal=="XQ" ? (QQExlong==1 ? closeShort+1 : 0) : ((QQExlong==1 or QQEzlong or QQEclong==1) ? closeShort+1 : 0) :

closeSignal=="XZ" ? (QQEzlong==1 ? closeShort+1 : 0) : 0

tradestate = 0, tradestate := nz(tradestate[1])

tradestate := tradestate==0 ? (buy==1 ? 1 : sell==1 ? 2 : 0) : (tradestate==1 and closeLong==1) or (tradestate==2 and closeShort==1)? 0 : tradestate

isLong = change(tradestate) and tradestate==1

isShort = change(tradestate) and tradestate==2

isCloseLong = change(tradestate) and tradestate==0 and nz(tradestate[1])==1

isCloseShort = change(tradestate) and tradestate==0 and nz(tradestate[1])==2

// - SERIES VARIABLES END

// - PLOTTING

// Ma's

tcolor = direction<0?red:green

// ma1=plot(showAvgs?ma_fast:na, title="MA Fast", color=tcolor, linewidth=1, transp=0)

ma2=plot(showAvgs?ma_medium:na, title="MA Medium Fast", color=tcolor, linewidth=2, transp=0)

// ma3=plot(showAvgs?ma_slow:na, title="MA Slow", color=tcolor, linewidth=1, transp=0)

// fill(ma1,ma3,color=tcolor,transp=90)

// Ma's

altTcolor=altDirection<0?red:green

barcolor(altDirection<0? red:green)

ma4=plot(showAvgs and mult>1?ma_fast_alt:na, title="MA Fast", color=altTcolor, linewidth=1, transp=0)

ma5=plot(showAvgs and mult>1?ma_medium_alt:na, title="MA Medium Fast", color=altTcolor, linewidth=2, transp=0)

ma6=plot(showAvgs and mult>1?ma_slow_alt:na, title="MA Slow", color=altTcolor, linewidth=1, transp=0)

fill(ma4,ma6,color=altTcolor,transp=90)

// Color Changes

turned_aqua = altTcolor[1] == red and altTcolor == green

turned_blue = altTcolor[1] == green and altTcolor == red

take_profit_long = ma_slow > ma_fast_alt and ma_slow > ma_slow_alt and tcolor[1] == green and tcolor == red

take_profit_short = ma_slow < ma_fast_alt and ma_slow < ma_slow_alt and tcolor[1] == red and tcolor == green

// plotshape(turned_aqua, title="MA's Green Buy", style=shape.triangleup, location=location.belowbar, text="Long", color=green, transp=20, size=size.normal)

// plotshape(turned_blue, title="MA's Red Sell", style=shape.triangledown, location=location.abovebar, text="Short", color=red, transp=20, size=size.normal)

// plotshape(take_profit_long, title="Take Profit Long", style=shape.triangledown, location=location.abovebar, text="Take Profit Long", color=purple, transp=20, size=size.tiny)

// plotshape(take_profit_short, title="Take Profit Short", style=shape.triangleup, location=location.belowbar, text="Take Profit Short", color=purple, transp=20, size=size.tiny)

strategy.entry("Long", strategy.long, when=turned_aqua and window)

strategy.entry("short", strategy.short, when=turned_blue and window)

entered_long = strategy.position_size[1] <= 0 and strategy.position_size > 0

entered_short = strategy.position_size[1] >= 0 and strategy.position_size < 0

long_tp_count = 0

long_tp_count := entered_long ? 0 : take_profit_long ? long_tp_count[1] + 1 : long_tp_count[1]

short_tp_count = 0

short_tp_count := entered_short ? 0 : take_profit_short ? short_tp_count[1] + 1 : short_tp_count[1]

// take_off_long = long_tp_count == 0 ? tp1_perc : long_tp_count == 1 ? tp2_perc : na

// take_off_short = short_tp_count == 0 ? tp1_perc : short_tp_count == 1 ? tp2_perc : na

long_tp1_qty = na

long_tp2_qty = na

short_tp1_qty = na

short_tp2_qty = na

long_tp1_qty := entered_long ? strategy.position_size * tp1_perc : long_tp1_qty[1]

long_tp2_qty := entered_long ? strategy.position_size * tp2_perc : long_tp2_qty[1]

short_tp1_qty := entered_short ? -strategy.position_size * tp1_perc : short_tp1_qty[1]

short_tp2_qty := entered_short ? -strategy.position_size * tp2_perc : short_tp2_qty[1]

long_sl_level = sl_perc == 0 ? na : strategy.position_avg_price * (1 - sl_perc)

short_sl_level = sl_perc == 0 ? na : strategy.position_avg_price * (1 + sl_perc)

strategy.order("LTP1", strategy.short, qty=long_tp1_qty, when=strategy.position_size > 0 and take_profit_long and long_tp_count[1]==0 and not turned_blue)

strategy.order("LTP2", strategy.short, qty=long_tp2_qty, when=strategy.position_size > 0 and take_profit_long and long_tp_count[1]==1 and not turned_blue)

strategy.order("STP1", strategy.long, qty=short_tp1_qty, when=strategy.position_size < 0 and take_profit_short and short_tp_count[1]==0 and not turned_aqua)

strategy.order("STP2", strategy.long, qty=short_tp2_qty, when=strategy.position_size < 0 and take_profit_short and short_tp_count[1]==1 and not turned_aqua)

strategy.exit("L-SL", "Long", stop=long_sl_level)

strategy.exit("S-SL", "Short", stop=short_sl_level)

// SL PLOTS

// --------

plot(strategy.position_size > 0 ? long_sl_level : na, color=red, style=linebr, title="Long Stop")

plot(strategy.position_size < 0 ? short_sl_level : na, color=maroon, style=linebr, title="Short Stop")

// ALERTS (STUDY ONLY)

alertcondition(turned_aqua, title="Long", message="Ma's Turned Green")

alertcondition(turned_blue, title="Short", message="Ma's Turned Red")

alertcondition(take_profit_long, title="Take Profit Long", message="Take Profit Long")

alertcondition(take_profit_short, title="Take Profit Short", message="Take Profit Short")

alertcondition(isLong, title="QQEX Long", message="QQEX LONG") // use "Once per Bar" option

alertcondition(isShort, title="QQEX Short", message="QQEX SHORT") // use "Once per Bar" option

alertcondition(isCloseLong, title="QQEX Close Long", message="QQEX CLOSE LONG") // use "Once per Bar Close" option

alertcondition(isCloseShort, title="QQEX Close Short", message="QQEX CLOSE SHORT") // use "Once per Bar Close" option

// show only when alert condition is met and bar closed.

plotshape(isLong or isShort,title= "Cross Alert Completed", location=location.bottom, color=isShort?red:green, transp=0, style=shape.circle,size=size.auto,offset=0)

plotshape(isCloseShort[1] or isCloseLong[1],title= "Close Order", location=location.top, color=isCloseShort[1]?red:green, transp=0, style=shape.square,size=size.auto,offset=-1)

// Test Plots

// ---------

// plot(long_tp_count)

// plot(short_tp_count, color=red)

//EOF