Estrategia optimizada de la media móvil exponencial EMAC

El autor:¿ Qué pasa?, Fecha: 2023-11-07 15:16:03Las etiquetas:

Resumen general

La estrategia optimizada de media móvil exponencial de EMAC es una versión optimizada basada en la estrategia básica de EMAC. Incorpora juicio de tendencia, filtro de media móvil múltiple y salidas de pérdida / ganancia, con el objetivo de seguir las tendencias a medio y largo plazo.

Estrategia lógica

-

Juzgar la dirección de la tendencia reciente: calcular el porcentaje de aumento/disminución del precio de cierre durante las últimas 26 semanas para determinar la tendencia alcista, bajista o lateral.

-

Filtro de media móvil múltiple: calcular EMA de 10 períodos, 20 períodos y 34 períodos y esperar a que crucen por encima de la SMA de 50 períodos para activar las señales de compra.

-

Pérdida de parada ATR: cuando aparezca la señal de entrada, fije la pérdida de parada en la barra de entrada baja o alta menos 2,5ATR.

-

Trailing stop loss: moverse gradualmente hacia arriba de la línea de stop loss a medida que aumenta el precio.

-

Tome ganancias: cuando aparezca la señal de entrada, establezca el objetivo al precio de cierre más 3ATR.

-

Salida de retroceso de MA: salida activa cuando el precio vuelve a caer por debajo de la EMA de 10 días.

Ventajas

-

El filtro de MA múltiple aumenta la fiabilidad de la señal, evitando falsos brotes.

-

El ATR permite una distancia de parada razonable basada en la volatilidad del mercado.

-

El trailing stop bloquea algunas ganancias a medida que se mueve hacia arriba.

-

Un objetivo de ganancia razonable evita devolver demasiada ganancia.

-

La salida de retroceso de MA permite una salida oportuna cuando la tendencia se invierte.

Riesgos y soluciones

-

Los cruces de la EMA pueden hacer que los mercados se inclinen hacia los laterales, causando pérdidas consecutivas. Puede aumentar los períodos de la EMA o agregar un filtro de cruce de la MA.

-

Los valores de ATR grandes pueden causar paradas demasiado lejos, aumentando el riesgo de pérdida.

-

No se considera el riesgo de brecha durante la noche, puede agregar lógica para evitar señales durante los períodos de no negociación.

-

No se considera el régimen de mercado, puede añadir un filtro de tendencia de mercado como cambio de estrategia.

Direcciones de optimización

-

Prueba las combinaciones de EMA para encontrar longitudes óptimas para diferentes productos.

-

Prueba las medias móviles ATR o los coeficientes de reducción para optimizar la distancia de parada.

-

Añadir lógica para evitar señales durante los períodos de no negociación.

-

Añadir un filtro de tendencia de mercado como cambio de estrategia cuando el mercado es desfavorable.

-

Prueba posterior de combinaciones de parámetros durante muchos años para encontrar una estabilidad óptima.

Resumen de las actividades

La Estrategia Optimizada de Promedio Móvil Exponencial de EMAC combina el juicio de tendencias, el filtrado múltiple de MA y las paradas dinámicas para seguir las tendencias a medio y largo plazo. En comparación con la versión original, se ha sometido a optimización de parámetros para mejorar el rendimiento comercial real. Pero se necesitan más optimizaciones y mejoras al agregar más lógica para manejar diferentes situaciones de mercado, reducir riesgos y mejorar la estabilidad y la rentabilidad.

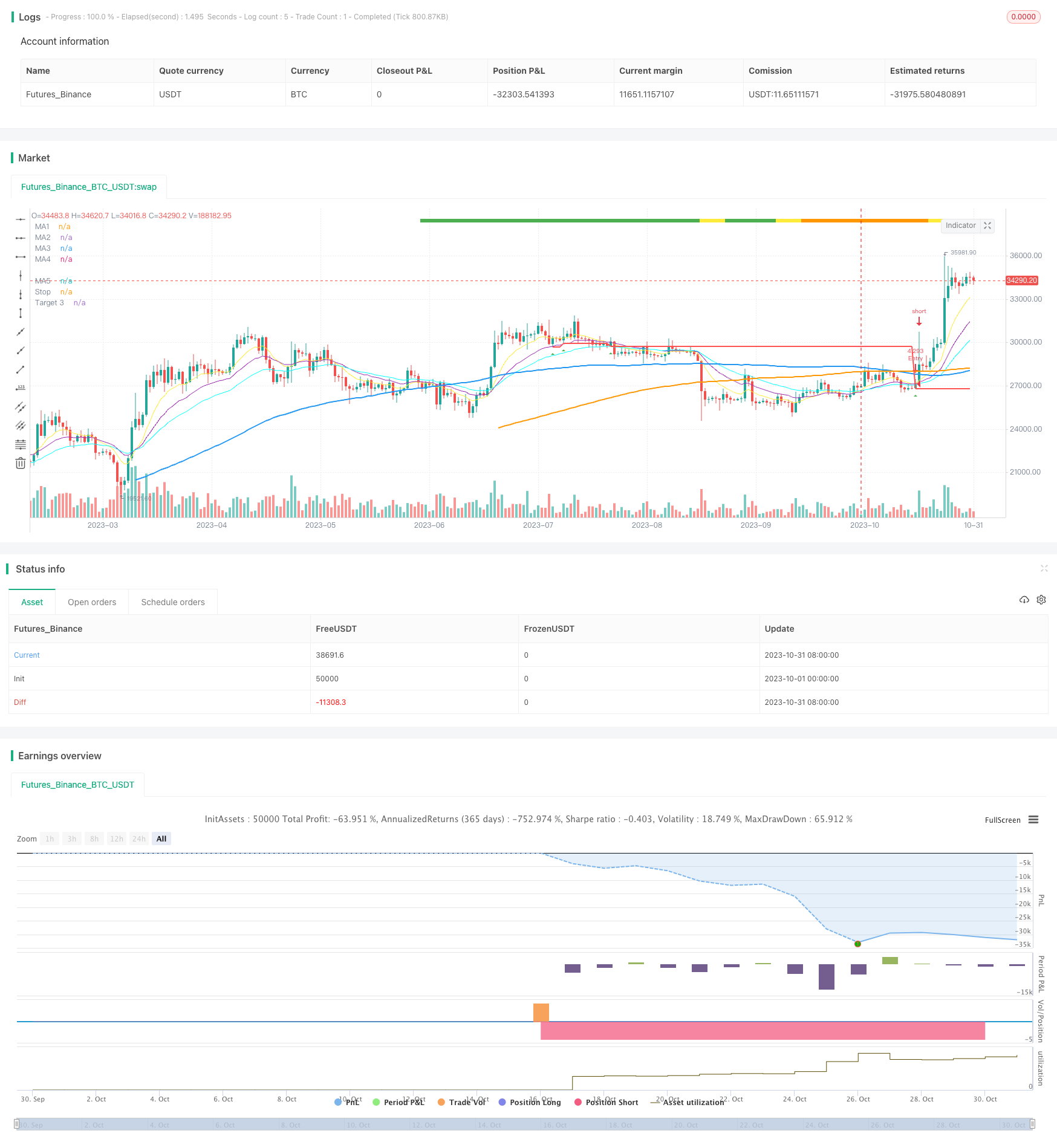

/*backtest

start: 2023-10-01 00:00:00

end: 2023-10-31 23:59:59

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Author = Dustin Drummond https://www.tradingview.com/u/Dustin_D_RLT/

//Strategy based in part on original 10ema Basic Swing Trade Strategy by Matt Delong: https://www.tradingview.com/u/MattDeLong/

//Link to original 10ema Basic Swing Trade Strategy: https://www.tradingview.com/script/8yhGnGCM-10ema-Basic-Swing-Trade-Strategy/

//This is the Original EMAC - Exponential Moving Average Cross Strategy built as a class for reallifetrading dot com and so has all the default settings and has not been optimized

//I would not recomend using this strategy with the default settings and is for educational purposes only

//For the fully optimized version please come back around the same time tomorrow 6/16/21 for the EMAC - Exponential Moving Average Cross - Optimized

//EMAC - Exponential Moving Average Cross

strategy(title="EMAC - Exponential Moving Average Cross", shorttitle = "EMAC", overlay = true, calc_on_every_tick=false, default_qty_value = 100, initial_capital = 100000, default_qty_type = strategy.fixed, pyramiding = 0, process_orders_on_close=true)

//creates a time filter to prevent "too many orders error" and allows user to see Strategy results per year by changing input in settings in Stratey Tester

startYear = input(2015, title="Start Year", minval=1980, step=1)

timeFilter = true

//R Size (Risk Amount)

rStaticOrPercent = input(title="R Static or Percent", defval="Percent", options=["Static", "Percent"])

rSizeStatic = input(2000, title="R Size Static", minval=1, step=100)

rSizePercent = input(3, title="R Size Percent", minval=.01, step=.01)

rSize = rStaticOrPercent == "Static" ? rSizeStatic : rStaticOrPercent == "Percent" ? (rSizePercent * .01 * strategy.equity) : 1

//Recent Trend Indicator "See the standalone version for detailed description"

res = input(title="Trend Timeframe", type=input.resolution, defval="W")

trend = input(26, minval=1, title="# of Bars for Trend")

trendMult = input(15, minval=0, title="Trend Growth %", step=.25) / 100

currentClose = security(syminfo.tickerid, res, close)

pastClose = security(syminfo.tickerid, res, close[trend])

//Trend Indicator

upTrend = (currentClose >= (pastClose * (1 + trendMult)))

downTrend = (currentClose <= (pastClose * (1 - trendMult)))

sidewaysUpTrend = (currentClose < (pastClose * (1 + trendMult)) and (currentClose > pastClose))

sidewaysDownTrend = (currentClose > (pastClose * (1 - trendMult)) and (currentClose < pastClose))

//Plot Trend on Chart

plotshape(upTrend, "Up Trend", style=shape.square, location=location.top, color=color.green, size=size.small)

plotshape(downTrend, "Down Trend", style=shape.square, location=location.top, color=color.red, size=size.small)

plotshape(sidewaysUpTrend, "Sideways Up Trend", style=shape.square, location=location.top, color=color.yellow, size=size.small)

plotshape(sidewaysDownTrend, "Sideways Down Trend", style=shape.square, location=location.top, color=color.orange, size=size.small)

//What trend signals to use in entrySignal

trendRequired = input(title="Trend Required", defval="Red", options=["Green", "Yellow", "Orange", "Red"])

goTrend = trendRequired == "Orange" ? upTrend or sidewaysUpTrend or sidewaysDownTrend : trendRequired == "Yellow" ? upTrend or sidewaysUpTrend : trendRequired == "Green" ? upTrend : trendRequired == "Red" ? upTrend or sidewaysUpTrend or sidewaysDownTrend or downTrend : na

//MAs Inputs Defalt is 10 EMA, 20 EMA, 50 EMA, 100 SMA and 200 SMA

ma1Length = input(10, title="MA1 Period", minval=1, step=1)

ma1Type = input(title="MA1 Type", defval="EMA", options=["SMA", "EMA", "WMA"])

ma2Length = input(20, title="MA2 Period", minval=1, step=1)

ma2Type = input(title="MA2 Type", defval="EMA", options=["SMA", "EMA", "WMA"])

ma3Length = input(34, title="MA3 Period", minval=1, step=1)

ma3Type = input(title="MA3 Type", defval="EMA", options=["SMA", "EMA", "WMA"])

ma4Length = input(100, title="MA4 Period", minval=1, step=1)

ma4Type = input(title="MA4 Type", defval="SMA", options=["SMA", "EMA", "WMA"])

ma5Length = input(200, title="MA5 Period", minval=1, step=1)

ma5Type = input(title="MA5 Type", defval="SMA", options=["SMA", "EMA", "WMA"])

//MAs defined

ma1 = ma1Type == "EMA" ? ema(close, ma1Length) : ma1Type == "SMA" ? sma(close, ma1Length) : wma(close, ma1Length)

ma2 = ma2Type == "EMA" ? ema(close, ma2Length) : ma2Type == "SMA" ? sma(close, ma2Length) : wma(close, ma2Length)

ma3 = ma3Type == "EMA" ? ema(close, ma3Length) : ma3Type == "SMA" ? sma(close, ma3Length) : wma(close, ma3Length)

ma4 = ma4Type == "SMA" ? sma(close, ma4Length) : ma4Type == "EMA" ? ema(close, ma4Length) : wma(close, ma4Length)

ma5 = ma5Type == "SMA" ? sma(close, ma5Length) : ma5Type == "EMA" ? ema(close, ma5Length) : wma(close, ma5Length)

//Plot MAs

plot(ma1, title="MA1", color=color.yellow, linewidth=1, style=plot.style_line)

plot(ma2, title="MA2", color=color.purple, linewidth=1, style=plot.style_line)

plot(ma3, title="MA3", color=#00FFFF, linewidth=1, style=plot.style_line)

plot(ma4, title="MA4", color=color.blue, linewidth=2, style=plot.style_line)

plot(ma5, title="MA5", color=color.orange, linewidth=2, style=plot.style_line)

//Allows user to toggle on/off ma1 > ma2 filter

enableShortMAs = input(title="Enable Short MA Cross Filter", defval="No", options=["Yes", "No"])

shortMACross = enableShortMAs == "Yes" and ma1 > ma2 or enableShortMAs == "No"

//Allows user to toggle on/off ma4 > ma5 filter

enableLongMAs = input(title="Enable Long MA Cross Filter", defval="No", options=["Yes", "No"])

longMACross = enableLongMAs == "Yes" and ma4 >= ma5 or enableLongMAs == "No"

//Entry Signals

entrySignal = (strategy.position_size <= 0 and close[1] < ma1[1] and close > ma1 and close > ma2 and close > ma3 and shortMACross and ma1 > ma3 and longMACross and goTrend)

secondSignal = (strategy.position_size > 0 and close[1] < ma1[1] and close > ma1 and close > ma2 and close > ma3 and shortMACross and ma1 > ma3 and longMACross and goTrend)

plotshape(entrySignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(secondSignal, style=shape.triangleup, location=location.belowbar, color=color.lime, size=size.small)

//ATR for Stops

atrValue = (atr(14))

//to test ATR enable next line

//plot(atrValue, linewidth=1, color=color.black, style=plot.style_line)

atrMult = input(2.5, minval=.25, step=.25, title="Stop ATR Multiple")

//Only target3Mult is used in current strategy target1 and target2 might be used in the future with pyramiding

//target1Mult = input(1.0, minval=.25, step=.25, title="Targert 1 Multiple")

//target2Mult = input(2.0, minval=.25, step=.25, title="Targert 2 Multiple")

target3Mult = input(3.0, minval=.25, step=.25, title="Target Multiple")

enableAtrStop = input(title="Enable ATR Stops", defval="No", options=["Yes", "No"])

//Intitial Recomended Stop Location

atrStop = entrySignal and ((high - (atrMult * atrValue)) < low) ? (high - (atrMult * atrValue)) : low

//oneAtrStop is used for testing only enable next 2 lines to test

//oneAtrStop = entrySignal ? (high - atrValue) : na

//plot(oneAtrStop, "One ATR Stop", linewidth=2, color=color.orange, style=plot.style_linebr)

initialStop = entrySignal and enableAtrStop == "Yes" ? atrStop : entrySignal ? low : na

//Stops changed to stoploss to hold value for orders the next line is old code "bug"

//plot(initialStop, "Initial Stop", linewidth=2, color=color.red, style=plot.style_linebr)

//Set Initial Stop and hold value "debug code"

stoploss = valuewhen(entrySignal, initialStop, 0)

plot(stoploss, title="Stop", linewidth=2, color=color.red)

enableStops = input(title="Enable Stops", defval="No", options=["Yes", "No"])

yesStops = enableStops == "Yes" ? 1 : enableStops == "No" ? 0 : na

//Calculate size of trade based on R Size

//Original buggy code:

//positionSize = (rSize/(close - initialStop))

//Added a minimum order size of 1 "debug code"

positionSize = (rSize/(close - initialStop)) > 1 ? (rSize/(close - initialStop)) : 1

//Targets

//Enable or Disable Targets

enableTargets = input(title="Enable Targets", defval="No", options=["Yes", "No"])

yesTargets = enableTargets == "Yes" ? 1 : enableTargets == "No" ? 0 : na

//Only target3 is used in current strategy target1 and target2 might be used in the future with pyramiding

//target1 = entrySignal ? (close + ((close - initialStop) * target1Mult)) : na

//target2 = entrySignal ? (close + ((close - initialStop) * target2Mult)) : na

target3 = entrySignal ? (close + ((close - initialStop) * target3Mult)) : na

//plot(target1, "Target 1", linewidth=2, color=color.green, style=plot.style_linebr)

//plot(target2, "Target 2", linewidth=2, color=color.green, style=plot.style_linebr)

plot(target3, "Target 3", linewidth=2, color=color.green, style=plot.style_linebr)

//Set Target and hold value "debug code"

t3 = valuewhen(entrySignal, target3, 0)

//To test t3 and see plot enable next line

//plot(t3, title="Target", linewidth=2, color=color.green)

//MA1 Cross Exit

enableEarlyExit = input(title="Enable Early Exit", defval="Yes", options=["Yes", "No"])

earlyExit = enableEarlyExit == "Yes" ? 1 : enableEarlyExit == "No" ? 0 : na

ma1CrossExit = strategy.position_size > 0 and close < ma1

//Entry Order

strategy.order("Entry", long = true, qty = positionSize, when = (strategy.position_size <= 0 and entrySignal and timeFilter))

//Early Exit Order

strategy.close_all(when = ma1CrossExit and timeFilter and earlyExit, comment = "MA1 Cross Exit")

//Stop and Target Orders

//strategy.cancel orders are needed to prevent bug with Early Exit Order

strategy.order("Stop Loss", false, qty = strategy.position_size, stop=stoploss, oca_name="Exit", when = timeFilter and yesStops, comment = "Stop Loss")

strategy.cancel("Stop Loss", when = ma1CrossExit and timeFilter and earlyExit)

strategy.order("Target", false, qty = strategy.position_size, limit=t3, oca_name="Exit", when = timeFilter and yesTargets, comment = "Target")

strategy.cancel("Target", when = ma1CrossExit and timeFilter and earlyExit)

- Tendencia de la IDE en el doble marco temporal siguiendo la estrategia

- Estrategia de negociación de puntuación por múltiples indicadores

- Estrategia combinada de inversión de tendencia y indicadores líderes de Ehlers

- Sistema de seguimiento de la inversión de la media móvil doble

- Estrategia de cruce de la media móvil

- Estrategia de reversión del impulso del RSI

- Estrategia cruzada de la EMA para la ruptura de la tortuga

- Estrategia de cruce de la media móvil del RSI

- Sin offset Ichimoku Cloud con estrategia de filtro RSI

- Estrategia de doble estocástica

- Estrategia de ruptura de la banda de Bollinger

- Estrategia de negociación de reversión de Gauss

- Estrategia de tendencia del dragón volador

- Estrategia de cruce de la media móvil

- Tendencia del canal de media móvil triple siguiendo la estrategia

- Estrategia SSL doble con EMA para el stop loss

- Estrategia de regreso de Kijun

- Estrategia de negociación cruzada de promedio móvil

- Estrategia Super Ichi

- Estrategia de ruptura de bandas de Bollinger de la CBMA