Estrategia de ruptura de supertrend en el marco temporal

El autor:¿ Qué pasa?, Fecha: 2023-11-24 10:27:52Las etiquetas:

Resumen general

La estrategia incorpora el indicador SuperTrend a través de múltiples marcos de tiempo y Bandas de Bollinger para identificar la dirección de la tendencia y los niveles clave de soporte / resistencia, y entra en operaciones en breakouts durante la volatilidad.

Estrategia lógica

Función personalizada de Pine Scriptpine_supertrend()Implementado para calcular la SuperTendencia a través de diferentes marcos de tiempo (por ejemplo, 1 min y 5 min) y determinar la dirección de la tendencia de marcos de tiempo más grandes.

Las bandas superiores/inferiores actúan como canales. Las rupturas indican la dirección de la tendencia. Cerrar por encima de la banda superior significa una ruptura alcista. Cerrar por debajo de la banda inferior significa una ruptura bajista.

Señales de entrada:

Largo: Cerrar > Banda superior Y cerrar > SuperTendencia (TF múltiple) Corto: Cerrar < Banda inferior Y Cerrar < SuperTendencia (TF múltiple)

Las salidas:

Salida larga: cerrado < 5m SuperTrend Salida corta: cerrado > 5m SuperTrend

Así que su objetivo es capturar las rupturas de resonancia entre SuperTrend y BB en momento volátil.

Análisis de ventajas

- Utiliza SuperTrend a través de los marcos de tiempo para determinar la direccionalidad de la tendencia de alta convicción

- Las bandas BB actúan como niveles clave de soporte/resistencia para evitar falsas rupturas

- SuperTrend actúa como stop loss dinámico para controlar el riesgo

Análisis de riesgos

- SuperTrend puede retrasarse puntos de inflexión y inversiones de tendencia

- Los parámetros BB subóptimos pueden causar demasiadas o pocas operaciones

- Las brechas bruscas durante la noche o los acontecimientos noticiosos pueden afectar el stop loss

Mitigación de riesgos:

- Añadir más indicadores para confirmar las señales y evitar falsos breakouts

- Optimiza los parámetros de BB para obtener el mejor equilibrio

- Ampliar el amortiguador de pérdidas para cubrir las lagunas

Oportunidades de mejora

- Prueba de otros indicadores de tendencia como el KDJ MACD para confirmar la señal adicional

- Añadir el modelo ML para la probabilidad de ruptura

- Ajuste de parámetros para el conjunto óptimo de parámetros

Conclusión

La estrategia combina el poder de SuperTrend y Bollinger Bands utilizando análisis de marcos de tiempo cruzados y rupturas de canal para operaciones de alta probabilidad.

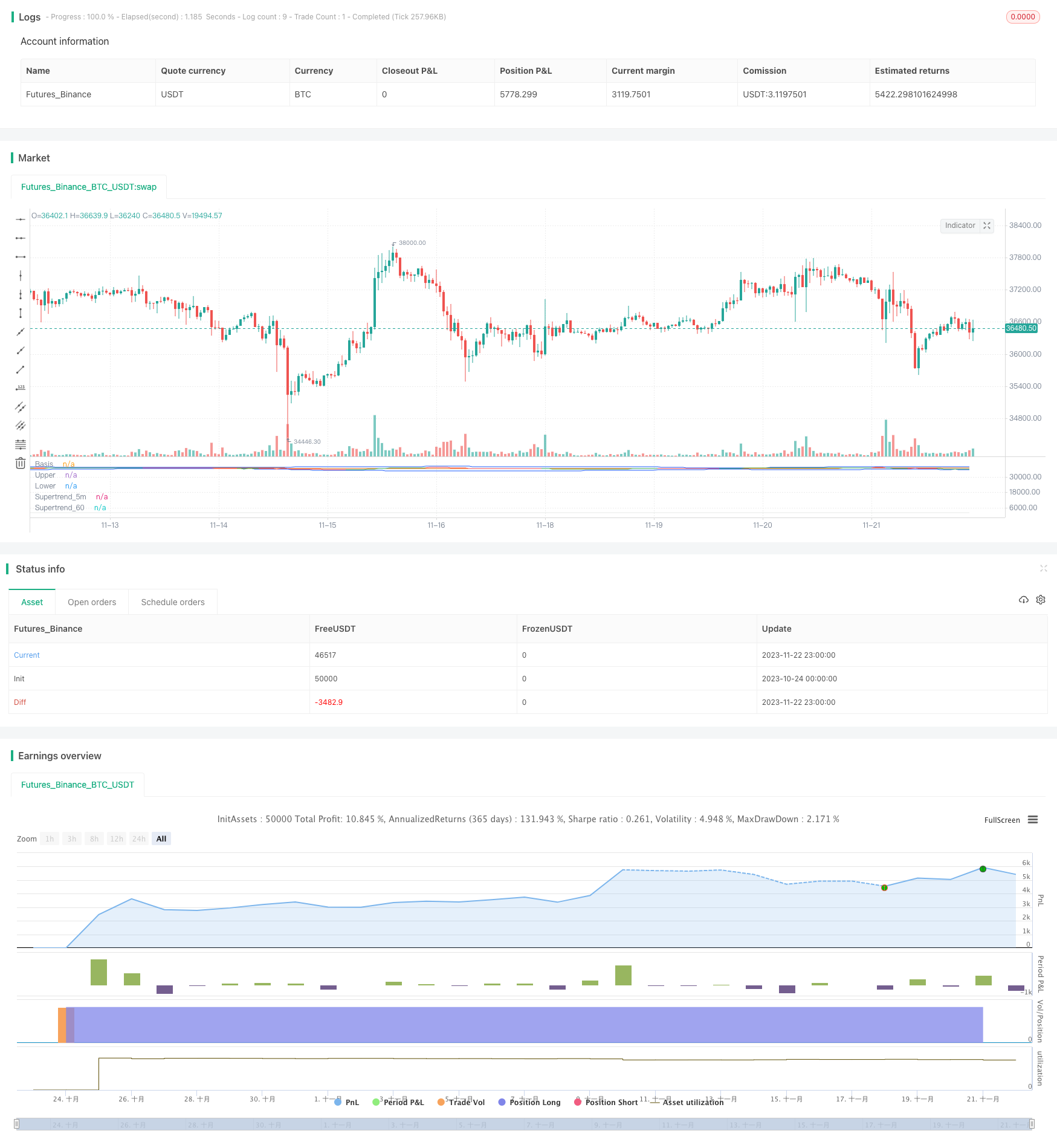

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ambreshc95

//@version=5

strategy("Comodity_SPL_Strategy_01", overlay=false)

// function of st

// [supertrend, direction] = ta.supertrend(3, 10)

// plot(direction < 0 ? supertrend : na, "Up direction", color = color.green, style=plot.style_linebr)

// plot(direction > 0 ? supertrend : na, "Down direction", color = color.red, style=plot.style_linebr)

// VWAP

// src_vwap = input(title = "Source", defval = hlc3, group="VWAP Settings")

// [_Vwap,stdv,_] = ta.vwap(src_vwap,false,1)

// plot(_Vwap, title="VWAP", color = color.rgb(0, 0, 0))

// The same on Pine Script®

pine_supertrend(factor, atrPeriod,len_ma) =>

h= ta.sma(high,len_ma)

l= ta.sma(low,len_ma)

hlc_3 = (h+l)/2

src = hlc_3

atr = ta.atr(atrPeriod)

upperBand = src + factor * atr

lowerBand = src - factor * atr

prevLowerBand = nz(lowerBand[1])

prevUpperBand = nz(upperBand[1])

lowerBand := lowerBand > prevLowerBand or close[1] < prevLowerBand ? lowerBand : prevLowerBand

upperBand := upperBand < prevUpperBand or close[1] > prevUpperBand ? upperBand : prevUpperBand

int direction = na

float superTrend = na

prevSuperTrend = superTrend[1]

if na(atr[1])

direction := 1

else if prevSuperTrend == prevUpperBand

direction := close > upperBand ? -1 : 1

else

direction := close < lowerBand ? 1 : -1

superTrend := direction == -1 ? lowerBand : upperBand

[superTrend, direction]

len_ma_given = input(75, title="MA_SMA_ST")

[Pine_Supertrend, pineDirection] = pine_supertrend(3, 10,len_ma_given)

// plot(pineDirection < 0 ? Pine_Supertrend : na, "Up direction", color = color.green, style=plot.style_linebr)

// plot(pineDirection > 0 ? Pine_Supertrend : na, "Down direction", color = color.red, style=plot.style_linebr)

//

// Define Supertrend parameters

atrLength = input(10, title="ATR Length")

factor = input(3.0, title="Factor")

// // Calculate Supertrend

[supertrend, direction] = ta.supertrend(factor, atrLength)

st_color = supertrend > close ? color.red : color.green

// // Plot Supertrend

// plot(supertrend, "Supertrend", st_color)

//

// BB Ploting

length = input.int(75, minval=1)

maType = input.string("SMA", "Basis MA Type", options = ["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult = input.float(2.5, minval=0.001, maxval=50, title="StdDev")

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

// h= ta.sma(high,60)

// l= ta.sma(low,60)

// c= sma(close,60)

// hlc_3 = (h+l)/2

// supertrend60 = request.security(syminfo.tickerid, supertrend)

// // Define timeframes for signals

tf1 = input(title="Timeframe 1", defval="1")

tf2 = input(title="Timeframe 2",defval="5")

// tf3 = input(title="Timeframe 3",defval="30")

// // // Calculate Supertrend on multiple timeframes

supertrend_60 = request.security(syminfo.tickerid, tf1, Pine_Supertrend)

supertrend_5m = request.security(syminfo.tickerid, tf2, supertrend)

// supertrend3 = request.security(syminfo.tickerid, tf3, supertrend)

// // Plot Supertrend_60

st_color_60 = supertrend_60 > close ? color.rgb(210, 202, 202, 69) : color.rgb(203, 211, 203, 52)

plot(supertrend_60, "Supertrend_60", st_color_60)

// // Plot Supertrend_5m

st_color_5m = supertrend_5m > close ? color.red : color.green

plot(supertrend_5m, "Supertrend_5m", st_color_5m)

ma21 = ta.sma(close,21)

// rsi = ta.rsi(close,14)

// rsima = ta.sma(rsi,14)

// Define the Indian Standard Time (IST) offset from GMT

ist_offset = 5.5 // IST is GMT+5:30

// Define the start and end times of the trading session in IST

// start_time = timestamp("GMT", year, month, dayofmonth, 10, 0) + ist_offset * 60 * 60

// end_time = timestamp("GMT", year, month, dayofmonth, 14, 0) + ist_offset * 60 * 60

// Check if the current time is within the trading session

// in_trading_session = timenow >= start_time and timenow <= end_time

in_trading_session = not na(time(timeframe.period, "0945-1430"))

// bgcolor(inSession ? color.silver : na)

out_trading_session = not na(time(timeframe.period, "1515-1530"))

// // // Define buy and sell signals

buySignal = close>upper and close > supertrend_5m and close > supertrend_60 and close > ma21 and in_trading_session //close > supertrend and

sellSignal = close<lower and close < supertrend_5m and close < supertrend_60 and close < ma21 and in_trading_session //close < supertrend and

var bool long_position = false

var bool long_exit = false

var float long_entry_price = 0

var float short_entry_price = 0

if buySignal and not long_position

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_label_up, color = color.green, size = size.small)

long_position := true

strategy.entry("Buy",strategy.long)

long_exit := (close < supertrend_5m)

if long_position and long_exit

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_xcross, color = color.green, size = size.tiny)

long_position := false

strategy.exit("Exit","Buy",stop = close)

var bool short_position = false

var bool short_exit = false

if sellSignal and not short_position

// label.new(bar_index, na, yloc = yloc.abovebar, style = label.style_label_down, color = color.red, size = size.small)

short_position := true

strategy.entry("Sell",strategy.short)

short_exit := (close > supertrend_5m)

if short_position and short_exit

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_xcross, color = color.red, size = size.tiny)

short_position := false

strategy.exit("Exit","Sell", stop = close)

if out_trading_session

long_position := false

strategy.exit("Exit","Buy",stop = close)

short_position := false

strategy.exit("Exit","Sell", stop = close)

// if long_position

// long_entry_price := close[1] + 50//bar_index

// if short_position

// short_entry_price := close[1] - 50//bar_index

// if (long_position and high[1] > long_entry_price)

// label.new(bar_index, na, yloc = yloc.abovebar, style = label.style_triangledown, color = color.yellow, size = size.tiny)

// if (short_position and low[1] < short_entry_price)

// label.new(bar_index, na, yloc = yloc.belowbar, style = label.style_triangleup, color = color.yellow, size = size.tiny)

- Estrategia de inversión cuantitativa basada en la fecha de compra mensual

- Estrategia de negociación por desviación estándar ponderada

- Estrategia de negociación cuantitativa de media móvil triple

- Estrategia cruzada de la EMA

- Estrategia de negociación cruzada a corto, mediano y largo plazo de la EMA

- Estrategia basada en la descomposición de series temporales y bandas de Bollinger ponderadas por volumen

- Estrategia de negociación cuantitativa del oscilador de precios desviado

- Tendencia de múltiples indicadores siguiendo la estrategia

- Tendencia del doble marco de tiempo de la CCI siguiendo la estrategia

- Estrategia de seguimiento de tendencias del T3-CCI

- Estrategia de combinación de promedio móvil de inversión de impulso

- Dinámica de la media móvil Retracement Estrategia de Martin

- Estrategia de coincidencia de doble carril de reversión de impulso combinado

- La estrategia de la nube de Ichimoku

- Estrategia adaptativa de toma de ganancias y parada de pérdidas basada en marcos de tiempo y indicadores de impulso duales

- Estrategia de negociación de la red de índices de interés de la renta variable de varios períodos

- Estrategia de cruce de la media móvil exponencial doble

- Estrategia de seguimiento de tendencias de RSI promedio móvil

- Estrategia de cruce de precios de cierre mensuales y promedio móvil

- Tendencia a corto plazo de las bandas de Bollinger Breakout tras la estrategia