Estrategia de optimización cruzada de escalas de tiempo múltiples con promedios móviles

Fecha de creación:

2024-01-05 12:05:42

Última modificación:

2024-01-05 12:05:42

Copiar:

0

Número de Visitas:

739

1

Seguir

1629

Seguidores

Descripción general

La estrategia se basa en la reescritura del famoso indicador CM_Ultimate_MA_MTF, que permite trazar promedios móviles en varias escalas de tiempo, permitiendo la operación cruzada de MA de diferentes períodos de tiempo. La estrategia también tiene una función de seguimiento de stop loss.

Principio de estrategia

- De acuerdo con la elección del usuario, las líneas MA se dibujan en el ciclo principal y en el ciclo superior, respectivamente, a través de diferentes tipos de indicadores MA.

- Cuando la línea MA de ciclo rápido atraviesa la línea MA de ciclo lento, haga más; cuando la línea MA de ciclo rápido atraviesa la línea MA de ciclo lento, haga vacío.

- Añadir un mecanismo de seguimiento de pérdidas para controlar aún más el riesgo.

Análisis de las ventajas

- El cruce de MA en múltiples escalas de tiempo mejora la calidad de la señal y reduce las señales falsas.

- La combinación de diferentes tipos de MA puede aprovechar las ventajas de sus respectivos indicadores para mejorar la estabilidad.

- El seguimiento de las pérdidas ayuda a detener las pérdidas a tiempo y reducir la probabilidad de grandes pérdidas.

Análisis de riesgos

- Los indicadores de MA están rezagados y pueden haber perdido la oportunidad de operar en la línea corta.

- Se requiere una optimización adecuada de los parámetros del ciclo MA, de lo contrario se puede generar demasiada señal falsa.

- La configuración de puntos de parada no razonables puede causar pérdidas innecesarias.

Dirección de optimización

- Se pueden probar combinaciones de MA de diferentes parámetros para encontrar el mejor parámetro.

- Se pueden añadir filtros de otros indicadores para mejorar la calidad de la señal.

- Se puede optimizar la estrategia de stop loss para que se ajuste mejor a las características del mercado.

Resumir

La estrategia integra el análisis de múltiples marcos de tiempo de las medias móviles y el seguimiento de los métodos de stop loss con el objetivo de mejorar la calidad de la señal y controlar el nivel de riesgo. La optimización de los parámetros y la adición de otros indicadores pueden aumentar aún más la eficacia de la estrategia.

Código Fuente de la Estrategia

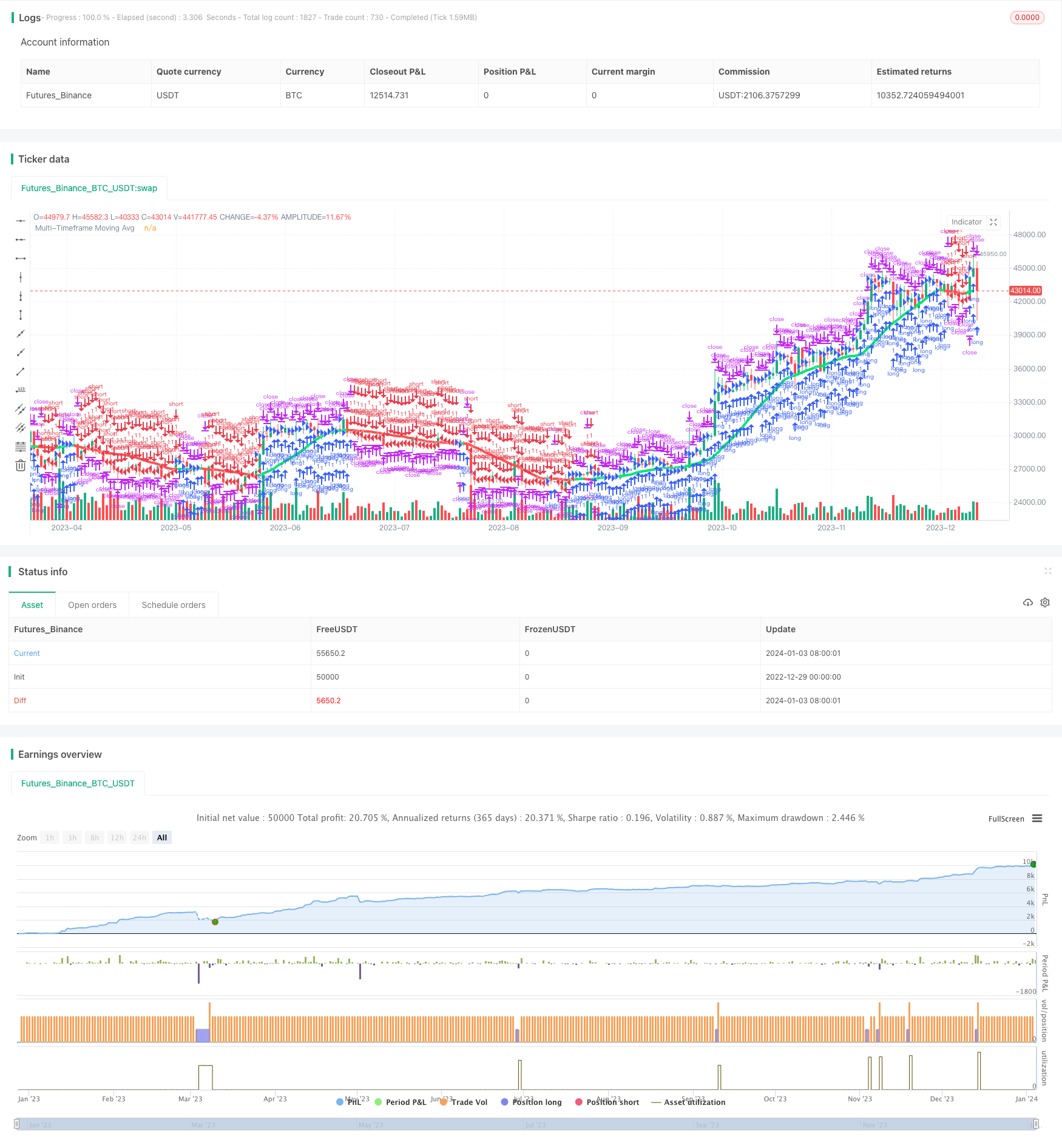

/*backtest

start: 2022-12-29 00:00:00

end: 2024-01-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Ultimate Moving Average Strategy", shorttitle = "UMA Strategy", overlay = true)

//Created by user ChrisMoody 4-24-2014

//Converted to strategy by Virtual_Machinist 7-11-2018

//Plots The Majority of Moving Averages

//Defaults to Current Chart Time Frame --- But Can Be Changed to Higher Or Lower Time Frames

//2nd MA Capability with Show Crosses Feature

//inputs

src = close

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="D")

len = input(20, title="Moving Average Length - LookBack Period")

atype = input(1,minval=1,maxval=7,title="1=SMA, 2=EMA, 3=WMA, 4=HullMA, 5=VWMA, 6=RMA, 7=TEMA")

cc = input(true,title="Change Color Based On Direction?")

smoothe = input(2, minval=1, maxval=10, title="Color Smoothing - 1 = No Smoothing")

doma2 = input(false, title="Optional 2nd Moving Average")

len2 = input(50, title="Moving Average Length - Optional 2nd MA")

atype2 = input(1,minval=1,maxval=7,title="1=SMA, 2=EMA, 3=WMA, 4=HullMA, 5=VWMA, 6=RMA, 7=TEMA")

cc2 = input(true,title="Change Color Based On Direction 2nd MA?")

warn = input(false, title="***You Can Turn On The Show Dots Parameter Below Without Plotting 2nd MA to See Crosses***")

warn2 = input(false, title="***If Using Cross Feature W/O Plotting 2ndMA - Make Sure 2ndMA Parameters are Set Correctly***")

sd = input(false, title="Show Dots on Cross of Both MA's")

useStop = input(defval = true, title = "Use Trailing Stop?")

slPoints = input(defval = 200, title = "Stop Loss Trail Points", minval = 1)

slOffset = input(defval = 400, title = "Stop Loss Trail Offset", minval = 1)

res = useCurrentRes ? timeframe.period : resCustom

//hull ma definition

hullma = wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len)))

//TEMA definition

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

tema = 3 * (ema1 - ema2) + ema3

avg = atype == 1 ? sma(src,len) : atype == 2 ? ema(src,len) : atype == 3 ? wma(src,len) : atype == 4 ? hullma : atype == 5 ? vwma(src, len) : atype == 6 ? rma(src,len) : tema

//2nd Ma - hull ma definition

hullma2 = wma(2*wma(src, len2/2)-wma(src, len2), round(sqrt(len2)))

//2nd MA TEMA definition

sema1 = ema(src, len2)

sema2 = ema(sema1, len2)

sema3 = ema(sema2, len2)

stema = 3 * (sema1 - sema2) + sema3

avg2 = atype2 == 1 ? sma(src,len2) : atype2 == 2 ? ema(src,len2) : atype2 == 3 ? wma(src,len2) : atype2 == 4 ? hullma2 : atype2 == 5 ? vwma(src, len2) : atype2 == 6 ? rma(src,len2) : tema

out = avg

out_two = avg2

out1 = request.security(syminfo.tickerid, res, out)

out2 = request.security(syminfo.tickerid, res, out_two)

ma_up = out1 >= out1[smoothe]

ma_down = out1 < out1[smoothe]

col = cc ? ma_up ? lime : ma_down ? red : aqua : aqua

col2 = cc2 ? ma_up ? lime : ma_down ? red : aqua : aqua

circleYPosition = out2

plot(out1, title="Multi-Timeframe Moving Avg", style=line, linewidth=4, color = col)

plot(doma2 and out2 ? out2 : na, title="2nd Multi-TimeFrame Moving Average", style=circles, linewidth=4, color=col2)

plot(sd and cross(out1, out2) ? circleYPosition : na,style=cross, linewidth=5, color=yellow)

// Strategy conditions

longCond = ma_up

shortCond = ma_down

// entries and base exit

strategy.entry("long", strategy.long, when = longCond)

strategy.entry("short", strategy.short, when = shortCond)

if (useStop)

strategy.exit("XL", from_entry = "long", trail_points = slPoints, trail_offset = slOffset)

strategy.exit("XS", from_entry = "short", trail_points = slPoints, trail_offset = slOffset)

// not sure needed, but just incase..

strategy.exit("XL", from_entry = "long", when = shortCond)

strategy.exit("XS", from_entry = "short", when = longCond)