Estrategia de doble media móvil combinada con el indicador estocástico

El autor:¿ Qué pasa?, Fecha: 2024-01-12 11:16:52Las etiquetas:

Resumen general

Este artículo presenta una estrategia de negociación cuantitativa que combina la doble estrategia de promedio móvil y el indicador estocástico.

Principio de la estrategia

La estrategia consta de dos partes:

-

Estrategia de media móvil doble

Utilizando promedios móviles rápidos y lentos para generar señales de compra cruz dorada y señales de venta cruz muerta.

-

Indicador estocástico

Utilizando la característica de oscilación del estocástico para identificar situaciones de sobrecompra y sobreventa. Un estocástico superior a la línea lenta indica una señal de sobrecompra, mientras que un estocástico inferior a la línea lenta indica una señal de sobreventa.

Las señales de ambas partes se combinan para formar las señales finales de negociación.

Análisis de ventajas

- Combina las ventajas de las medias móviles duales y estocásticas, más estables.

- Los promedios móviles para seguir la tendencia, los estocásticos para confirmar, buen efecto.

- Los parámetros personalizables se adaptan a las diferentes condiciones del mercado.

Análisis de riesgos

- Las medias móviles dobles pueden generar fácilmente señales falsas.

- Las configuraciones incorrectas de los parámetros estocásticos pueden perder las tendencias.

- Necesidad de ajustar los parámetros para adaptarse a los cambios del mercado.

Los riesgos pueden reducirse optimizando las combinaciones de parámetros y añadiendo stop loss a las pérdidas de control.

Direcciones de optimización

La estrategia se puede optimizar en los siguientes aspectos:

- Prueba los efectos de los diferentes parámetros de la media móvil en la estrategia.

- Prueba los efectos de diferentes parámetros estocásticos en la estabilidad de la estrategia.

- Añadir indicadores de filtro de tendencia para mejorar la tasa de ganancia.

- Construir un mecanismo dinámico para controlar las pérdidas.

Resumen de las actividades

Esta estrategia combina las ventajas de las medias móviles duales y estocásticas. Mientras se sigue la tendencia principal del mercado, se evitan inversiones desfavorables. Se pueden obtener mejores resultados de la estrategia a través de la optimización de parámetros.

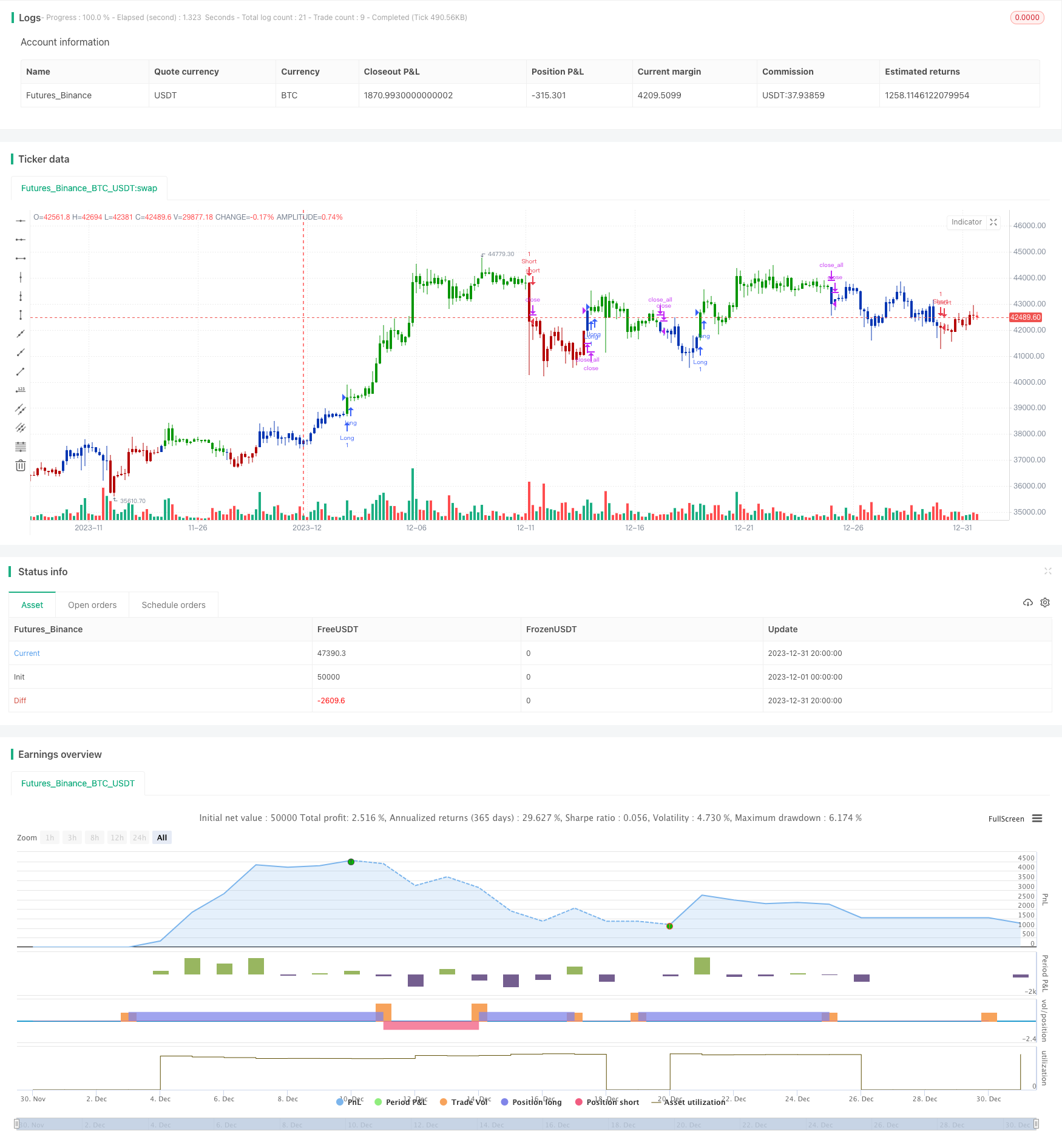

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 4h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 24/11/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// As the name suggests, High low bands are two bands surrounding the underlying’s

// price. These bands are generated from the triangular moving averages calculated

// from the underlying’s price. The triangular moving average is, in turn, shifted

// up and down by a fixed percentage. The bands, thus formed, are termed as High

// low bands. The main theme and concept of High low bands is based upon the triangular

// moving average.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

HLB(Length, PercentShift) =>

pos = 0.0

xTMA = sma(sma(close, Length), Length)

xHighBand = xTMA + (xTMA * PercentShift / 100)

xLowBand = xTMA - (xTMA * PercentShift / 100)

pos :=iff(close > xHighBand, 1,

iff(close <xLowBand, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & High Low Bands", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Length_HLB = input(14, minval=1)

PercentShift = input(1, minval = 0.01, step = 0.01)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posHLB = HLB(Length_HLB, PercentShift)

pos = iff(posReversal123 == 1 and posHLB == 1 , 1,

iff(posReversal123 == -1 and posHLB == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Estrategia de negociación de inversión de la relación volumen

- Estrategia de cruce de la media móvil ponderada por impulso dinámico

- Estrategia de negociación de poder alcista

- Estrategia de seguimiento de la media móvil diaria para el valor del oro

- Promedio móvil de varios plazos combinado con las horas de negociación Estrategia cuantitativa de negociación

- Estrategia de negociación de varios plazos basada en el MACD

- Estrategia de seguimiento de la potencia del oso

- Tendencia de la estrategia de negociación basada en múltiples indicadores

- Estrategia de negociación de fluctuación con cruce de la EMA 20/50

- Estrategia optimizada de seguimiento de tendencias dinámicas

- Estrategia de seguimiento de tendencias basada en la media móvil y el rango verdadero de la media

- Estrategia de tendencia cuantitativa basada en múltiples factores

- Estrategia de negociación basada en derivados

- Estrategia de MACD sólo larga

- Estrategia de tendencia cruzada de la media móvil

- Estrategia de negociación cuantitativa basada en el intercambio de SMA

- Estrategia de pérdida de pérdidas traseras

- Estrategia de soporte y resistencia con ruptura de volumen y pérdida de parada de seguimiento

- Movimiento de la estrategia de stop loss basada en puntos de tomar ganancias y stop loss

- Porcentaje de estrategia de pérdidas de parada de seguimiento