Las etiquetas:

Resumen general

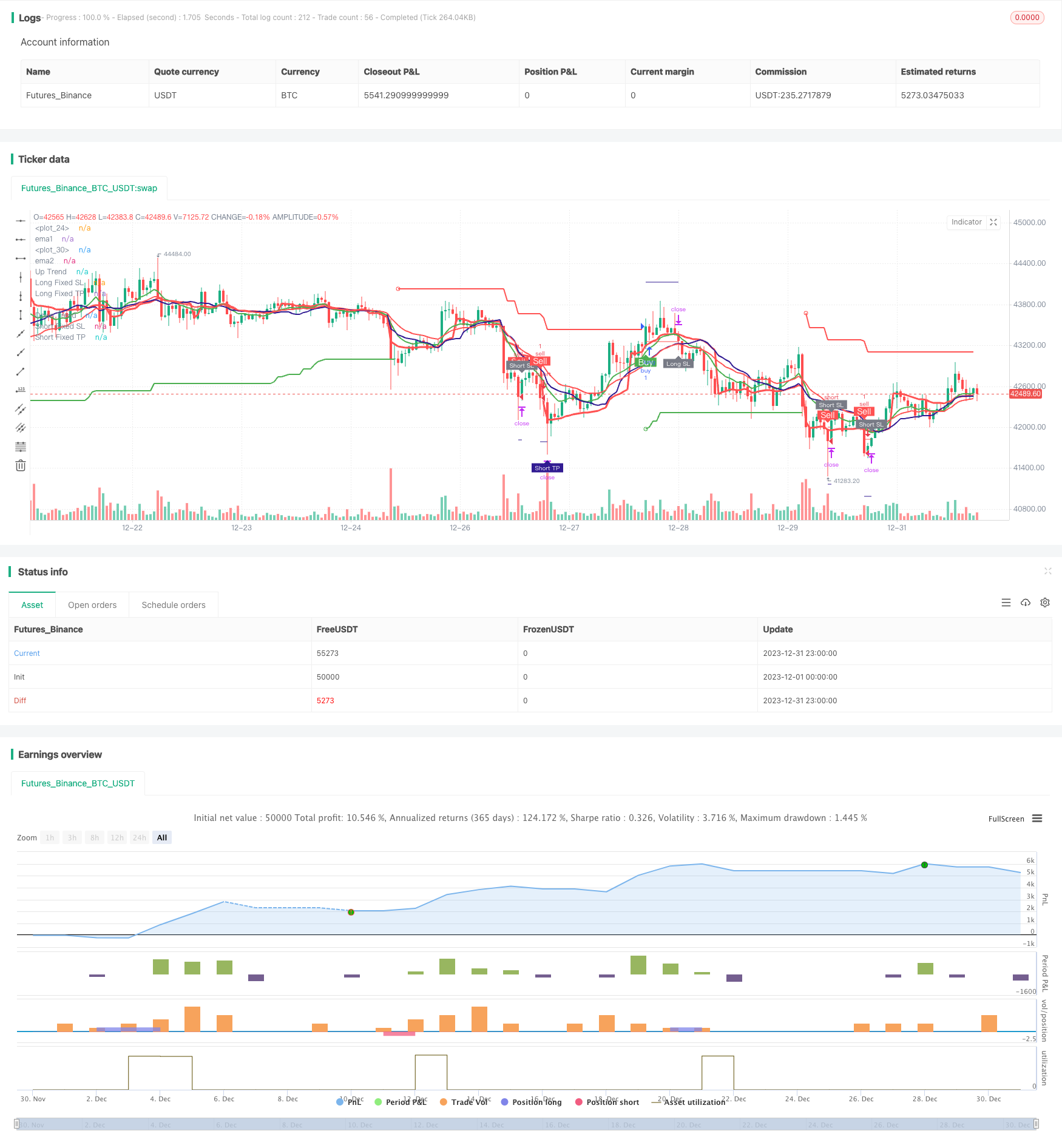

Esta estrategia utiliza múltiples indicadores técnicos para la negociación cuantitativa. Utiliza principalmente indicadores que incluyen cruces EMA, SuperTrend, RSI, MACD, etc. para generar señales comerciales.

Estrategia lógica

La lógica central se basa en los siguientes aspectos:

-

VWMA: Computa VWMA. Cuando el cruce de precio cerrado por encima de VWMA, es una señal de compra. Cuando el cruce de precio cerrado por debajo de VWMA, es una señal de venta.

-

RSI: Computa el indicador RSI. Cuando el RSI está por encima del nivel de sobrecompra, es señal de venta. Cuando el RSI está por debajo del nivel de sobreventa, es señal de compra.

-

Cuando la línea MACD se cruza por encima de la línea de señal, se genera compra. Cuando la línea MACD se cruza por debajo de la línea de señal, se genera venta.

Ventajas

Esta estrategia combina múltiples indicadores para filtrar el mercado y evitar señales falsas.

-

La combinación de varios indicadores evita los errores de un solo indicador.

-

La combinación de indicador de tendencia y oscilador captura ganancias adicionales durante las tendencias.

-

El uso de la lógica de stop loss limita la pérdida máxima por operación.

Los riesgos

Principales riesgos:

-

La lógica de Martingale puede llevar a pérdidas significativas.

-

El uso inadecuado del stop loss puede llevar a un stop out innecesario.

-

La sintonización incorrecta de los parámetros puede llevar a más señales falsas.

Optimización

La estrategia se puede optimizar aún más en los siguientes aspectos:

-

Prueba diferentes parámetros para cada indicador.

-

Agregue la lógica de stop loss adaptativa.

-

Añadir un mecanismo dinámico de dimensionamiento de la posición.

-

Aprovechar el aprendizaje automático para optimizar parámetros y modelos.

Resumen de las actividades

En resumen, esta es una estrategia comercial cuantitativa muy práctica. Combina la fortaleza de múltiples indicadores técnicos clásicos para el análisis de mercado.

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Pinku Buy', overlay=true)

fromMonth = input.int(defval=1, title='From Month', minval=1, maxval=12)

fromDay = input.int(defval=1, title='From Day', minval=1, maxval=31)

fromYear = input.int(defval=2021, title='From Year', minval=1970)

thruMonth = input.int(defval=1, title='Thru Month', minval=1, maxval=12)

thruDay = input.int(defval=1, title='Thru Day', minval=1, maxval=31)

thruYear = input.int(defval=2112, title='Thru Year', minval=1970)

showDate = input(defval=true, title='Show Date Range')

start = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59)

window() => true

// ema crossover

length1 = input.int(10)

length2 = input.int(20)

ema1 = ta.ema(close , length1)

ema2 = ta.ema(close , length2)

//vwap

VWAP = ta.vwap(hlc3)

plot(VWAP, color=color.new(color.red, 0), linewidth=3)

buy_1 = close > VWAP

sell_1 = close < VWAP

//vwma

len = input.int(20, 'VWMA_len', minval=1)

ma = ta.vwma(close, len)

plot(ma, color=color.new(color.navy, 0), linewidth=2)

buy_2 = close > ma

sell_2 = close < ma

//super trend

//inputs

Periods = input(title='STR Period', defval=22)

Source = input(hl2, title='Source')

Multiplier = input.float(title='STR Multiplier', step=0.1, defval=5.0)

//Compute ATR Levels

atr = ta.atr(Periods)

//Creating Upper Channel

up = Source - Multiplier * atr

up1 = nz(up[1], up)

up := close[1] > up1 ? math.max(up, up1) : up

//Creating Down Channel

dn = Source + Multiplier * atr

dn1 = nz(dn[1], dn)

dn := close[1] < dn1 ? math.min(dn, dn1) : dn

//Compute the Trend Stream +1/-1

trend = 1

trend := nz(trend[1], trend)

trend := trend == -1 and close > dn1 ? 1 : trend == 1 and close < up1 ? -1 : trend

//Create Stoploss for Longs

upPlot = plot(trend == 1 ? up : na, title='Up Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.green, 0))

//buy_a = close > upPlot

//Buy Signal

buy_3 = trend == 1 and trend[1] == -1

plotshape(buy_3 ? up : na, title='Go Long', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.green, 0))

dnPlot = plot(trend == 1 ? na : dn, title='Down Trend', style=plot.style_linebr, linewidth=2, color=color.new(color.red, 0))

//sell_a = close < dnPlot

//Sell Signal

sell_3 = trend == -1 and trend[1] == 1

plotshape(sell_3 ? dn : na, title='Go Short', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(color.red, 0))

// //paraboloic sar

// start = input(0.02)

// increment = input(0.02)

// maximum = input(0.2, 'Max Value')

// out = ta.sar(start, increment, maximum)

buy_4 = ema1 > ema2

//buy_4 = buy1 and not buy1[1]

//plotshape(buy_4 , color = color.green , text = "Buy" , location = location.belowbar , textcolor = color.white , style = shape.labelup , size = size.small)

sell_4 = close < ema2

//sell_4 = sell1 and not sell1[1]

//plotshape(sell_4, color = color.red , text = "Sell" , location = location.abovebar , textcolor = color.white , style = shape.labeldown , size = size.small)

plot(ema1, 'ema1', color=color.new(color.green, 0), linewidth=2)

plot(ema2, 'ema2', color=color.new(color.red, 0), linewidth=2)

// rsi

lenr = input(14, title='Rsi Period')

rs = ta.rsi(close, lenr)

over_sold = input(44)

over_bought = input(56)

buy_5 = rs > over_bought

sell_5 = rs < over_sold

// macd

slow_len_macd = input.int(12)

fast_len_macd = input.int(26)

signal_len_macd = input.int(9)

ema3 = ta.ema(close , slow_len_macd)

ema4 = ta.ema(close , fast_len_macd)

ema5 = ta.ema(close , signal_len_macd)

buy_6 = ema5 > ema4

sell_6 = ema5 < ema4

// adx

adxlen = input(14, title="ADX Smoothing")

dilen = input(14, title="DI Length")

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

truerange = ta.rma(ta.tr, len)

plus = fixnan(100 * ta.rma(plusDM, len) / truerange)

minus = fixnan(100 * ta.rma(minusDM, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adx = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

sig = adx(dilen, adxlen)

//plot(sig, color=color.red, title="ADX")

adx_Greater_than = input.int(25)

signal = sig > adx_Greater_than

// volume ema

volume_ema = input.int(10)

vema = ta.ema(volume,volume_ema)

signal_2 = volume > vema

//define buy sell

g = buy_1 and buy_2 and buy_4 and trend == 1 and buy_5 and buy_6 and signal and signal_2 and window()

r = sell_1 and sell_2 and sell_4 and trend == -1 and sell_5 and sell_6 and signal and signal_2 and window()

rg = 0

rg := r ? 1 : g ? 2 : nz(rg[1])

buy11 = 0

buy11 := r ? 0 : g ? 1 : nz(buy11[1])

sell11 = 0

sell11 := r ? 1 : g ? 0 : nz(sell11[1])

buy = buy11 and not buy11[1]

sell = sell11 and not sell11[1]

multiple_signals = input(true)

if multiple_signals

buy := g and not g[1] and window()

sell := r and not r[1] and window()

sell

else

buy := buy and window()

sell := sell and window()

sell

//plotshape(long , color = color.green , text = "Buy" , location = location.belowbar , textcolor = color.white , style = shape.labelup , size = size.small)

//plotshape(short , color = color.red , text = "Sell" , location = location.abovebar , textcolor = color.white , style = shape.labeldown , size = size.small)

Stop = input(0.5, title='StopLoss') / 100

ProfitPerc = input(defval=1.5, title='Profit') / 100

rev = input(1024,title = "Reverse Limit")

Averaging_position_ = input(true , title = "Averaging position ? ")

qn = 1

qn := nz(qn[1])

long_short = 0

long_last = buy and (nz(long_short[1]) == 0 or nz(long_short[1]) == -1)

short_last = sell and (nz(long_short[1]) == 0 or nz(long_short[1]) == 1)

long_short := long_last ? 1 : short_last ? -1 : long_short[1]

long_entered = false

long_entered := long_entered[1]

short_entered = false

short_entered := short_entered[1]

longPrice = ta.valuewhen(long_last, close, 0)

shortPrice = ta.valuewhen(short_last, close, 0)

longStop = longPrice * (1 - Stop)

shortStop = shortPrice * (1 + Stop)

longTake = longPrice * (1 + ProfitPerc)

shortTake = shortPrice * (1 - ProfitPerc)

plot(long_short == 1 ? longStop : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='Long Fixed SL')

plot(long_short == -1 ? shortStop : na, style=plot.style_linebr, color=color.new(color.red, 0), linewidth=1, title='Short Fixed SL')

plot(long_short == 1 ? longTake : na, style=plot.style_linebr, color=color.new(color.navy, 0), linewidth=1, title='Long Fixed TP')

plot(long_short == -1 ? shortTake : na, style=plot.style_linebr, color=color.new(color.navy, 0), linewidth=1, title='Short Fixed TP')

longBar1 = ta.barssince(long_last)

longBar2 = longBar1 >= 1 ? true : false

shortBar1 = ta.barssince(short_last)

shortBar2 = shortBar1 >= 1 ? true : false

longSLhit = long_short == 1 and longBar2 and low < longStop

if long_entered and sell

longSLhit := true

longSLhit

plotshape(longSLhit and not(sell and not short_entered and long_entered), style=shape.labelup, location=location.belowbar, color=color.new(color.gray, 0), size=size.tiny, title='Stop Loss', text='Long SL', textcolor=color.new(color.white, 0))

shortSLhit = long_short == -1 and shortBar2 and high > shortStop

if short_entered and buy

shortSLhit := true

shortSLhit

plotshape(shortSLhit and not(buy and not long_entered and short_entered), style=shape.labeldown, location=location.abovebar, color=color.new(color.gray, 0), size=size.tiny, title='Stop Loss', text='Short SL', textcolor=color.new(color.white, 0))

longTPhit = long_short == 1 and longBar2 and high > longTake

plotshape(longTPhit, style=shape.labeldown, location=location.abovebar, color=color.new(color.navy, 0), size=size.tiny, title='Target', text='Long TP', textcolor=color.new(color.white, 0))

shortTPhit = long_short == -1 and shortBar2 and low < shortTake

plotshape(shortTPhit, style=shape.labelup, location=location.belowbar, color=color.new(color.navy, 0), size=size.tiny, title='Target', text='Short TP', textcolor=color.new(color.white, 0))

long_short := (long_short == 1 or long_short == 0) and longBar2 and (longSLhit or longTPhit) ? 0 : (long_short == -1 or long_short == 0) and shortBar2 and (shortSLhit or shortTPhit) ? 0 : long_short

if(shortSLhit or longSLhit or (long_entered[1] and sell) or (short_entered[1] and buy ))

qn := qn*2

if(longTPhit or shortTPhit or qn > rev)

qn := 1

if Averaging_position_

qn := 1

plotshape(buy and not long_entered, color=color.new(color.green, 0), style=shape.labelup, text='Buy', textcolor=color.new(color.white, 0), location=location.belowbar)

plotshape(sell and not short_entered, color=color.new(color.red, 0), style=shape.labeldown, text='Sell', textcolor=color.new(color.white, 0), location=location.abovebar)

// plotshape(buy and not(long_entered) and (short_entered), color = color.green , style = shape.labelup , text = "FA Buy" , textcolor = color.white , location = location.belowbar)

// plotshape(sell and not(short_entered) and (long_entered), color = color.red , style = shape.labeldown , text = "FA Sell" , textcolor = color.white , location = location.abovebar)

// alertcondition(condition=buy and not(long_entered) and (short_entered), title="Fully Algo Buy")

// alertcondition(condition=sell and not(short_entered) and (long_entered), title="Fully Algo sell")

alertcondition(condition=buy and not long_entered, title='Buy')

alertcondition(condition=sell and not short_entered, title='Sell')

if long_last

long_entered := true

short_entered := false

short_entered

if short_last

short_entered := true

long_entered := false

long_entered

alertcondition(condition=longSLhit and not(sell and not short_entered and long_entered), title='Long SL')

alertcondition(condition=shortSLhit and not(buy and not long_entered and short_entered), title='Short SL')

alertcondition(condition=longTPhit, title='Long TP')

alertcondition(condition=shortTPhit, title='Short TP')

if longSLhit or longTPhit

long_entered := false

long_entered

if shortSLhit or shortTPhit

short_entered := false

short_entered

// if buy

// strategy.entry('buy', strategy.long)

// strategy.exit('exit', 'buy', limit=longTake, stop=longStop)

// if sell

// strategy.entry('sell', strategy.short)

// strategy.exit('exit', 'sell', limit=shortTake, stop=shortStop)

if(buy)

strategy.entry("buy",strategy.long,qty = qn)

strategy.exit("Stop","buy",limit = longTake,stop = longStop)

if(sell)

strategy.entry("sell",strategy.short,qty = qn)

strategy.exit("Stop","sell",limit = shortTake,stop = shortStop)

strategy.close("buy",when = longTPhit or sell or longSLhit, comment = "Target")

strategy.close("sell",when = shortSLhit or shortTPhit or buy , comment = "Stop Loss")

strategy.cancel("buy",when = longTPhit or sell or longSLhit)

strategy.cancel("sell",when = shortSLhit or shortTPhit or buy )

- Estrategia de negociación cuantitativa basada en el índice de rentabilidad de las acciones y en las IFM

- Estrategia de negociación compuesta de múltiples indicadores

- Estrategia de negociación a corto plazo de la EMA cruzada

- Tendencia de seguir una estrategia basada en la suspensión dinámica de pérdidas del cruce de dos EMA

- Estrategia de compra de la caja de Darvas

- La estrategia de impulso relativo

- Tendencia de onda y tendencia basada en la VWMA siguiendo la estrategia cuántica

- Estrategia de cruce de la media móvil

- Estrategia clave para la reversión de las pruebas de retroceso

- Estrategia de prueba de retroceso de candeleros de inversión

- Estrategia de negociación de reversión de impulso

- Estrategia de canal de regresión lineal adaptativa

- Estrategia cruzada de diferencia de media móvil cero

- Los indicadores múltiples siguen la estrategia