La version Python de la stratégie de couverture intertemporelle Bollinger sur les contrats à terme sur matières premières (uniquement à des fins d'étude)

Auteur:La bonté, Créé: 2020-06-20 10:52:34, Mis à jour: 2025-01-14 20:40:43

La stratégie d'arbitrage intertemporel précédemment écrite nécessite l'entrée manuelle de l'écart de couverture pour l'ouverture et la fermeture des positions.

class Hedge:

'Hedging control class'

def __init__(self, q, e, initAccount, symbolA, symbolB, maPeriod, atrRatio, opAmount):

self.q = q

self.initAccount = initAccount

self.status = 0

self.symbolA = symbolA

self.symbolB = symbolB

self.e = e

self.isBusy = False

self.maPeriod = maPeriod

self.atrRatio = atrRatio

self.opAmount = opAmount

self.records = []

self.preBarTime = 0

def poll(self):

if (self.isBusy or not exchange.IO("status")) or not ext.IsTrading(self.symbolA):

Sleep(1000)

return

insDetailA = exchange.SetContractType(self.symbolA)

if not insDetailA:

return

recordsA = exchange.GetRecords()

if not recordsA:

return

insDetailB = exchange.SetContractType(self.symbolB)

if not insDetailB:

return

recordsB = exchange.GetRecords()

if not recordsB:

return

# Calculate the spread price K line

if recordsA[-1]["Time"] != recordsB[-1]["Time"]:

return

minL = min(len(recordsA), len(recordsB))

rA = recordsA.copy()

rB = recordsB.copy()

rA.reverse()

rB.reverse()

count = 0

arrDiff = []

for i in range(minL):

arrDiff.append(rB[i]["Close"] - rA[i]["Close"])

arrDiff.reverse()

if len(arrDiff) < self.maPeriod:

return

# Calculate Bollinger Bands indicator

boll = TA.BOLL(arrDiff, self.maPeriod, self.atrRatio)

ext.PlotLine("upper trail", boll[0][-2], recordsA[-2]["Time"])

ext.PlotLine("middle trail", boll[1][-2], recordsA[-2]["Time"])

ext.PlotLine("lower trail", boll[2][-2], recordsA[-2]["Time"])

ext.PlotLine("Closing price spread", arrDiff[-2], recordsA[-2]["Time"])

LogStatus(_D(), "upper trail:", boll[0][-1], "\n", "middle trail:", boll[1][-1], "\n", "lower trail:", boll[2][-1], "\n", "Current closing price spread:", arrDiff[-1])

action = 0

# Signal trigger

if self.status == 0:

if arrDiff[-1] > boll[0][-1]:

Log("Open position A buy B sell", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 2

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A buy B sell", "Positive")

elif arrDiff[-1] < boll[2][-1]:

Log("Open position A sell B buy", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 1

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A sell B buy", "Negative")

elif self.status == 1 and arrDiff[-1] > boll[1][-1]:

Log("Close position A buy B sell", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 2

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A buy B sell", "Close Negative")

elif self.status == 2 and arrDiff[-1] < boll[1][-1]:

Log("Close position A sell B buy", ", A latest price:", recordsA[-1]["Close"], ", B latest price:", recordsB[-1]["Close"], "#FF0000")

action = 1

# Add chart markers

ext.PlotFlag(recordsA[-1]["Time"], "A sell B buy", "Close Positive")

# Execute specific instructions

if action == 0:

return

self.isBusy = True

tasks = []

if action == 1:

tasks.append([self.symbolA, "sell" if self.status == 0 else "closebuy"])

tasks.append([self.symbolB, "buy" if self.status == 0 else "closesell"])

elif action == 2:

tasks.append([self.symbolA, "buy" if self.status == 0 else "closesell"])

tasks.append([self.symbolB, "sell" if self.status == 0 else "closebuy"])

def callBack(task, ret):

def callBack(task, ret):

self.isBusy = False

if task["action"] == "sell":

self.status = 2

elif task["action"] == "buy":

self.status = 1

else:

self.status = 0

account = _C(exchange.GetAccount)

LogProfit(account["Balance"] - self.initAccount["Balance"], account)

self.q.pushTask(self.e, tasks[1][0], tasks[1][1], self.opAmount, callBack)

self.q.pushTask(self.e, tasks[0][0], tasks[0][1], self.opAmount, callBack)

def main():

SetErrorFilter("ready|login|timeout")

Log("Connecting to the trading server...")

while not exchange.IO("status"):

Sleep(1000)

Log("Successfully connected to the trading server")

initAccount = _C(exchange.GetAccount)

Log(initAccount)

def callBack(task, ret):

Log(task["desc"], "success" if ret else "failure")

q = ext.NewTaskQueue(callBack)

p = ext.NewPositionManager()

if CoverAll:

Log("Start closing all remaining positions...")

p.CoverAll()

Log("Operation complete")

t = Hedge(q, exchange, initAccount, SA, SB, MAPeriod, ATRRatio, OpAmount)

while True:

q.poll()

t.poll()

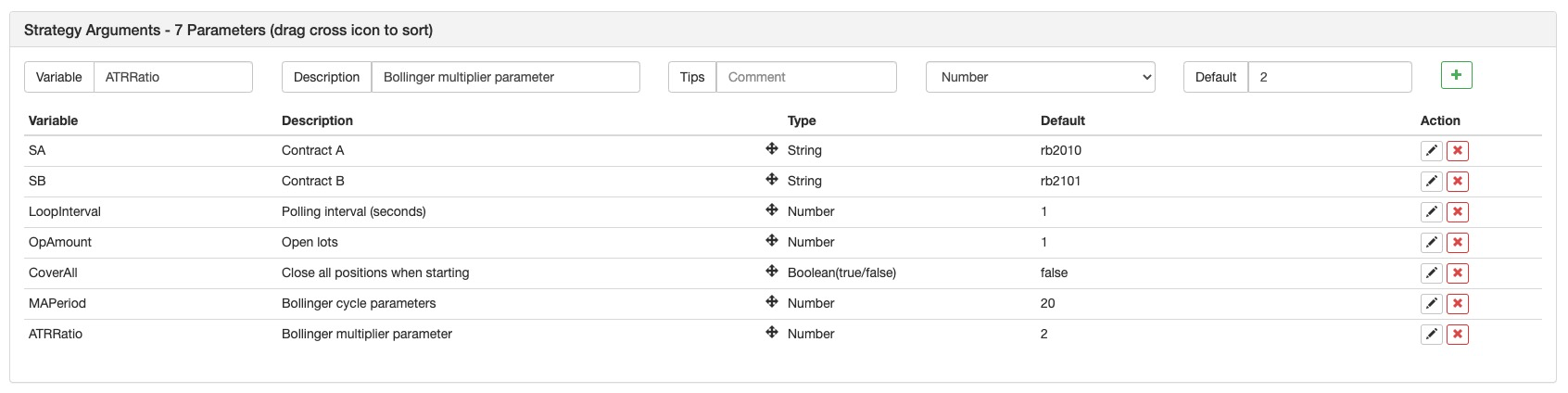

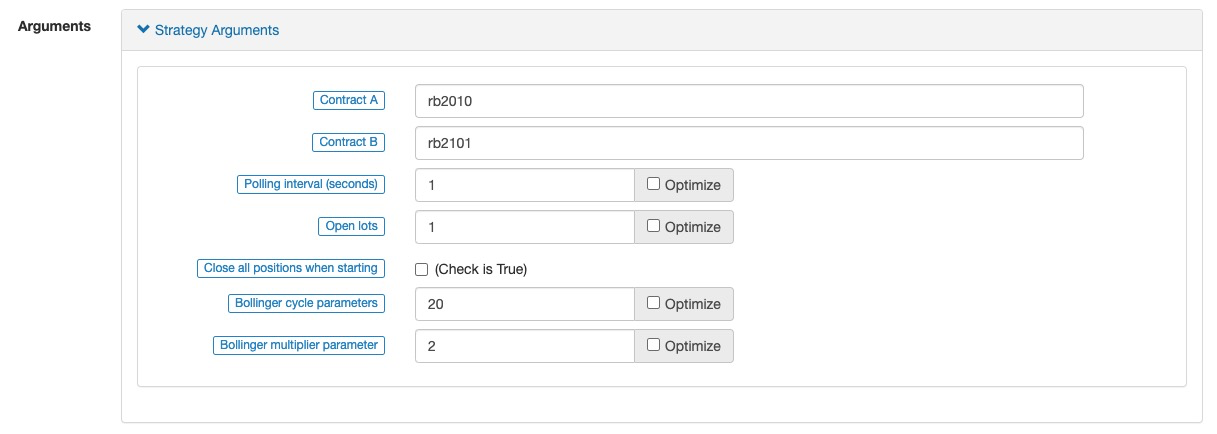

Réglage des paramètres de stratégie:

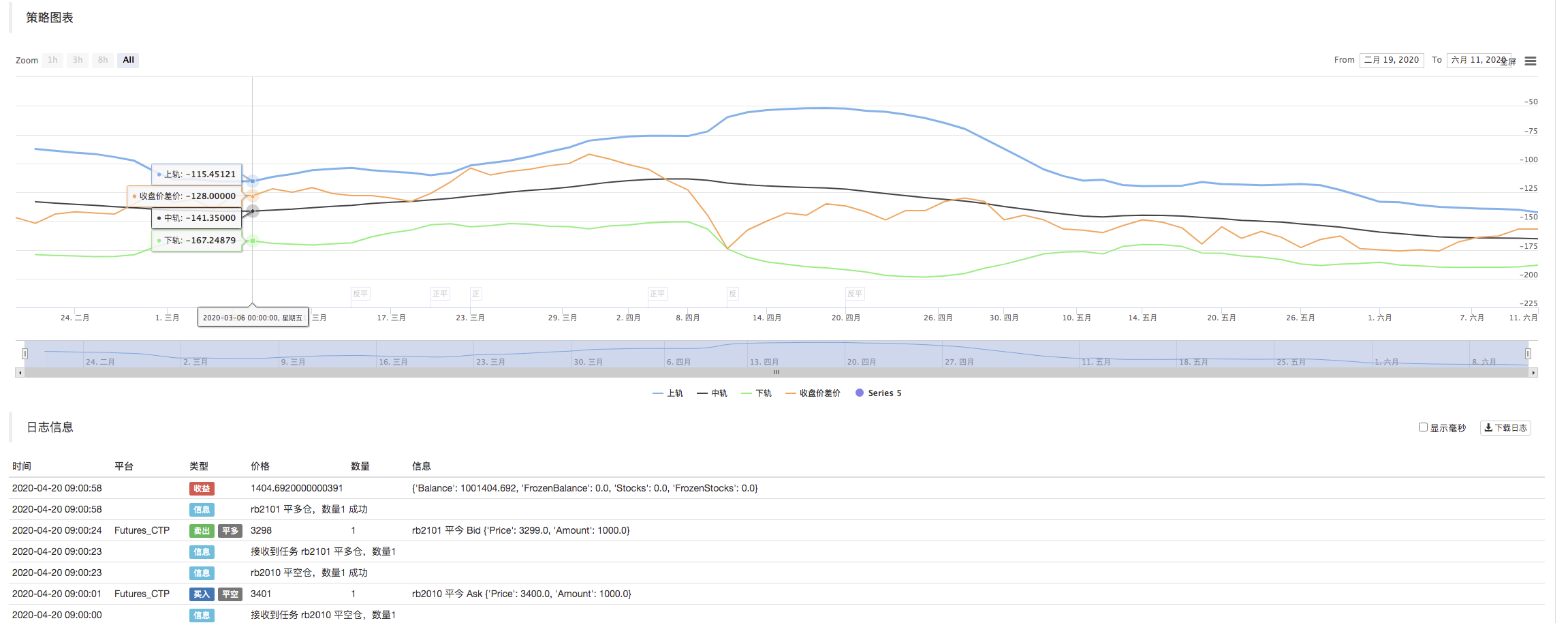

Le cadre global de la stratégie est essentiellement le même que celui de la stratégie deVersion Python de la stratégie de couverture intertemporelle des contrats à terme sur matières premièresLorsque la stratégie est en cours d'exécution, les données de la ligne K des deux contrats sont obtenues, puis la différence de prix est calculée pour calculer l'écart.TA.BOLLLorsque l'écart dépasse le rail supérieur de la bande de Bollinger, il sera couvert, et lorsqu'il touche le rail inférieur, il sera opposé à l'opération.

Test de retour:

Cet article est principalement destiné à des fins d'étude. Stratégie complète:https://www.fmz.com/strategy/213826

- Pratiques quantitatives des échanges DEX (2) -- Guide de l'utilisateur des hyperliquides

- Expérience de la quantification sur les échanges DEX (2) -- Guide d'utilisation de Hyperliquid

- Pratique quantitative des échanges DEX (1) -- Guide de l'utilisateur dYdX v4

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (3)

- Pratiques de quantification de l'échange DEX ((1) -- dYdX v4 Guide d'utilisation

- Introduction à la suite de Lead-Lag dans les monnaies numériques (3)

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (2)

- Introduction à la suite de Lead-Lag dans les monnaies numériques (2)

- Discussion sur la réception de signaux externes de la plateforme FMZ: une solution complète pour la réception de signaux avec un service Http intégré dans la stratégie

- Exploration de la réception de signaux externes sur la plateforme FMZ: stratégie intégrée pour la réception de signaux sur le service HTTP

- Introduction à l'arbitrage au retard de plomb dans les crypto-monnaies (1)

- Le trading sur la FMEX débloque l'optimisation optimale du volume des ordres

- Analyse et réalisation des contrats à terme sur matières premières

- FMEX séquence de déverrouillage pour optimiser la quantité de l'optimisation

- Appel à l'interface de clôture pour envoyer des messages à un robot

- Optimisation de la quantité d'opérations pour le déblocage des transactions FMEX

- Stratégie EMV de volatilité simple

- Les mains en main vous apprennent à envelopper une stratégie Python dans un document peu coûteux

- Stratégie de négociation BIAS pour le taux d'écart

- Évaluation de la courbe de capital de backtest à l'aide de l'outil "pyfolio"

- FMZ quantifier le My langage - graphique d'interface

- Interface avec le robot FMZ à l'aide de l'indicateur "Tradingview"

- Paramètres de la bibliothèque de négociation de la langue My

- Commodity "futures and spots" Tableau d'arbitrage basé sur les données fondamentales du FMZ

- Système de backtest à haute fréquence basé sur chaque transaction et les défauts du backtest en ligne K

- Version Python de la stratégie de couverture intertemporelle des contrats à terme sur matières premières

- Quelques réflexions sur la logique du trading à terme de crypto-monnaie

- Outil d'analyse amélioré basé sur le développement de la grammaire Alpha101

- Apprendre à mettre à niveau le collecteur de marché backtest la source de données personnalisée

- Les défauts du système de retouche haute fréquence basé sur les transactions à la lettre et de la retouche K-line

- Explication du mécanisme de backtest au niveau de simulation FMZ