EMA + AROON + ASH

Auteur:ChaoZhang est là., Date: 2022-05-10 à 10h34Les étiquettes:Le taux d'intérêtAROONCHA

Jh. " Le crédit pour chaque indicateur leur appartient, je viens de les modifier pour ajouter quelques options supplémentaires, paramètres, etc, aussi mis à jour tout le code à PineScript 5.

=== La stratégie === Les paramètres par défaut sont déjà tels que requis par TRADE KING, vous n'avez donc rien à changer. Pour les LONGS (fond vert montre les entrées LONGS).

- Le prix doit être au-dessus de l' EMA.

- Le croisement Aroon est haussier.

- La ligne de l'histogramme de la force absolue haussière doit être au-dessus de celle de la baisse.

Pour les courts métrages (sur fond rouge, les entrées sont des courts métrages).

- Le prix doit être en dessous de l' EMA.

- Un croisement baissier avec Aroon.

- La ligne d'histogramme de force absolue baissière doit être au-dessus de la ligne haussière.

Veuillez consulter la chaîne YouTube de Trade King pour plus d'informations.

=== Améliorations générales === Mettez à niveau vers PineScript 5. Quelques améliorations de performance.

=== Notes personnelles === L'auteur de cette stratégie recommande les graphiques 5M, cependant, 4H s'avère être le meilleur.

Merci encore aux auteurs des indicateurs qui composent ce scénario et à TRADE KING pour avoir créé cette stratégie.

test de retour

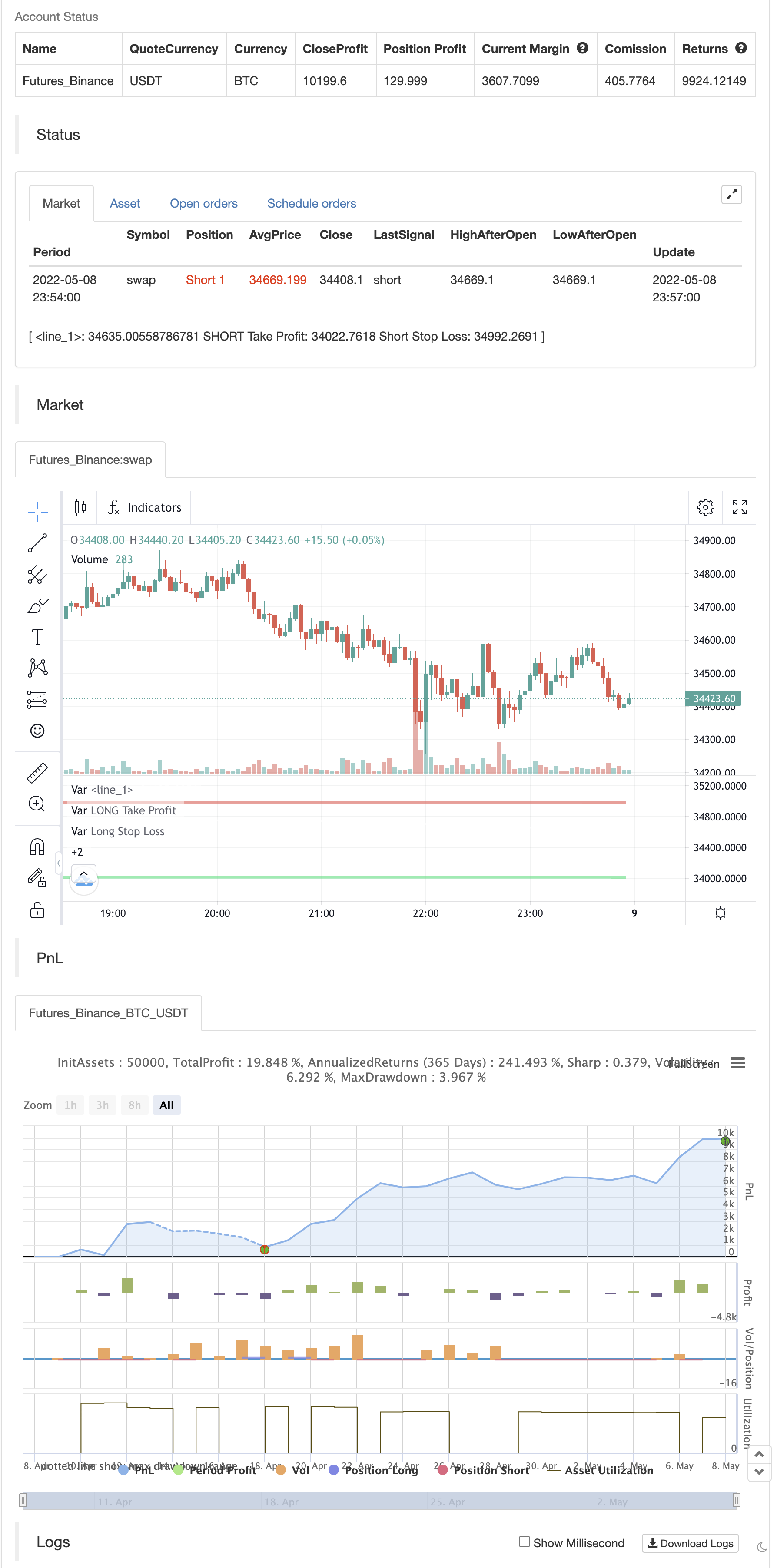

/*backtest

start: 2022-04-09 00:00:00

end: 2022-05-08 23:59:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © JoseMetal

//@version=5

//

//== Constantes

c_verde_radiactivo = color.rgb(0, 255, 0, 0)

c_verde = color.rgb(0, 128, 0, 0)

c_verde_oscuro = color.rgb(0, 80, 0, 0)

c_rojo_radiactivo = color.rgb(255, 0, 0, 0)

c_rojo = color.rgb(128, 0, 0, 0)

c_rojo_oscuro = color.rgb(80, 0, 0, 0)

//== Funciones

//== Declarar estrategia y período de testeo

//strategy("EMA + AROON + ASH (TRADE KING's STRATEGY)", shorttitle="EMA + AROON + ASH (TRADE KING's STRATEGY)", overlay=true, initial_capital=10000, pyramiding=0, default_qty_value=10, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.00075, max_labels_count=500, max_bars_back=1000)

//fecha_inicio = input.time(timestamp("1 Jan 2000"), title="• Start date", group="Test period", inline="periodo_de_pruebas")

vela_en_fecha = true

posicion_abierta = strategy.position_size != 0

LONG_abierto = strategy.position_size > 0

SHORT_abierto = strategy.position_size < 0

//== Condiciones de entrada y salida de estrategia

GRUPO_P = "Positions"

P_permitir_LONGS = input.bool(title="¿LONGS?", group=GRUPO_P, defval=true)

P_permitir_SHORTS = input.bool(title="¿SHORTS?", group=GRUPO_P, defval=true)

GRUPO_TPSL = "TP y SL"

TPSL_TP_pivot_lookback = input.int(title="• SL lookback for pivot / Mult. TP", group=GRUPO_TPSL, defval=20, minval=1, step=1, inline="tp_sl")

TPSL_SL_mult = input.float(title="", group=GRUPO_TPSL, defval=2.0, minval=0.1, step=0.2, inline="tp_sl")

//== Inputs de indicadores

// EMA

GRUPO_EMA = "Exponential Moving Average (EMA)"

EMA_length = input.int(200, minval=1, title="Length", group=GRUPO_EMA)

EMA_src = input(close, title="Source", group=GRUPO_EMA)

EMA = ta.ema(EMA_src, EMA_length)

// Aroon

GRUPO_Aroon = "Aroon"

Aroon_length = input.int(title="• Length", group=GRUPO_Aroon, defval=20, minval=1)

Aroon_upper = 100 * (ta.highestbars(high, Aroon_length+1) + Aroon_length) / Aroon_length

Aroon_lower = 100 * (ta.lowestbars(low, Aroon_length+1) + Aroon_length) / Aroon_length

// ASH

GRUPO_ASH = "Absolute Strength Histogram v2 | jh"

ASH_Length = input(9, title='Period of Evaluation', group=GRUPO_ASH)

ASH_Smooth = input(3, title='Period of Smoothing', group=GRUPO_ASH)

ASH_src = input(close, title='Source')

ASH_Mode = input.string(title='Indicator Method', defval='RSI', options=['RSI', 'STOCHASTIC', 'ADX'])

ASH_ma_type = input.string(title='MA', defval='WMA', options=['ALMA', 'EMA', 'WMA', 'SMA', 'SMMA', 'HMA'])

ASH_alma_offset = input.float(defval=0.85, title='* Arnaud Legoux (ALMA) Only - Offset Value', minval=0, step=0.01)

ASH_alma_sigma = input.int(defval=6, title='* Arnaud Legoux (ALMA) Only - Sigma Value', minval=0)

_MA(type, src, len) =>

float result = 0

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'SMMA' // Smoothed

w = ta.wma(src, len)

result := na(w[1]) ? ta.sma(src, len) : (w[1] * (len - 1) + src) / len

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'ALMA' // Arnaud Legoux

result := ta.alma(src, len, ASH_alma_offset, ASH_alma_sigma)

result

result

Price1 = _MA('SMA', ASH_src, 1)

Price2 = _MA('SMA', ASH_src[1], 1)

// RSI

Bulls0 = 0.5 * (math.abs(Price1 - Price2) + Price1 - Price2)

Bears0 = 0.5 * (math.abs(Price1 - Price2) - (Price1 - Price2))

// STOCHASTIC

Bulls1 = Price1 - ta.lowest(Price1, ASH_Length)

Bears1 = ta.highest(Price1, ASH_Length) - Price1

// ADX

Bulls2 = 0.5 * (math.abs(high - high[1]) + high - high[1])

Bears2 = 0.5 * (math.abs(low[1] - low) + low[1] - low)

Bulls = ASH_Mode == 'RSI' ? Bulls0 : ASH_Mode == 'STOCHASTIC' ? Bulls1 : Bulls2

Bears = ASH_Mode == 'RSI' ? Bears0 : ASH_Mode == 'STOCHASTIC' ? Bears1 : Bears2

AvgBulls = _MA(ASH_ma_type, Bulls, ASH_Length)

AvgBears = _MA(ASH_ma_type, Bears, ASH_Length)

SmthBulls = _MA(ASH_ma_type, AvgBulls, ASH_Smooth)

SmthBears = _MA(ASH_ma_type, AvgBears, ASH_Smooth)

difference = math.abs(SmthBulls - SmthBears)

//== Cálculo de condiciones

EMA_alcista = close > EMA

EMA_bajista = close < EMA

Aroon_cruce_alcista = ta.crossover(Aroon_upper, Aroon_lower)

Aroon_cruce_bajista = ta.crossunder(Aroon_upper, Aroon_lower)

ASH_alcista = SmthBulls > SmthBears

ASH_bajista = SmthBulls < SmthBears

//== Entrada (deben cumplirse todas para entrar)

longCondition1 = EMA_alcista

longCondition2 = Aroon_cruce_alcista

longCondition3 = ASH_alcista

long_conditions = longCondition1 and longCondition2 and longCondition3

entrar_en_LONG = P_permitir_LONGS and long_conditions and vela_en_fecha and not posicion_abierta

shortCondition1 = EMA_bajista

shortCondition2 = Aroon_cruce_bajista

shortCondition3 = ASH_bajista

short_conditions = shortCondition1 and shortCondition2 and shortCondition3

entrar_en_SHORT = P_permitir_SHORTS and short_conditions and vela_en_fecha and not posicion_abierta

var LONG_stop_loss = 0.0

var LONG_take_profit = 0.0

var SHORT_stop_loss = 0.0

var SHORT_take_profit = 0.0

//psl = ta.pivotlow(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

//psh = ta.pivothigh(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

psl = ta.lowest(TPSL_TP_pivot_lookback)

psh = ta.highest(TPSL_TP_pivot_lookback)

if (entrar_en_LONG)

LONG_stop_loss := psl - close*0.001

LONG_take_profit := close + ((close - LONG_stop_loss) * TPSL_SL_mult)

strategy.entry("+ Long", strategy.long)

strategy.exit("- Long", "+ Long", limit=LONG_take_profit, stop=LONG_stop_loss)

if (entrar_en_SHORT)

SHORT_stop_loss := psh + close*0.001

SHORT_take_profit := close - ((SHORT_stop_loss - close) * TPSL_SL_mult)

strategy.entry("+ Short", strategy.short)

strategy.exit("- Short", "+ Short", limit=SHORT_take_profit, stop=SHORT_stop_loss)

//== Ploteo en pantalla

// EMA

plot(EMA, color=color.white, linewidth=2)

// Símbolo de entrada (entre o no en compra)

bgcolor = color.new(color.black, 100)

if (entrar_en_LONG or entrar_en_SHORT)

bgcolor := color.new(color.green, 90)

bgcolor(bgcolor)

// Precio de compra, Take Profit, Stop Loss y relleno

avg_position_price_plot = plot(series=posicion_abierta ? strategy.position_avg_price : na, color=color.new(color.white, 25), style=plot.style_linebr, linewidth=2, title="Precio Entrada")

LONG_tp_plot = plot(LONG_abierto and LONG_take_profit > 0.0 ? LONG_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="LONG Take Profit")

LONG_sl_plot = plot(LONG_abierto and LONG_stop_loss > 0.0 ? LONG_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Long Stop Loss")

fill(avg_position_price_plot, LONG_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, LONG_sl_plot, color=color.new(color.maroon, 85))

SHORT_tp_plot = plot(SHORT_abierto and SHORT_take_profit > 0.0 ? SHORT_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="SHORT Take Profit")

SHORT_sl_plot = plot(SHORT_abierto and SHORT_stop_loss > 0.0 ? SHORT_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Short Stop Loss")

fill(avg_position_price_plot, SHORT_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, SHORT_sl_plot, color=color.new(color.maroon, 85))

- La tendance du score Z suivant la stratégie

- Système de tir à la fronde CM

- Stratégie dynamique d'entrée d'achat combinant le franchissement EMA et la pénétration du corps de la bougie

- 3EMA

- Le chef de file

- Jouer au cross

- Filtre de gamme Acheter et vendre 5 minutes [stratégie]

- Acheter ou vendre Strat

- La valeur de l'échange est la valeur de l'échange à la date de clôture de la transaction.

- Stratégie de négociation automatisée de l' EMA selon la tendance

- Point d'entrée BB-RSI-ADX

- Hull-4ema

- Indicateur de ligne d'attaque d'angle

- La ligne KijunSen avec la croix

- AMACD - Divergence de convergence de toutes les moyennes mobiles

- MA HYBRID par RAJ

- Tendance au diamant

- Nik Stoch est là.

- le stock est supérieur à 200 ma

- RSI MTF et stratégie STOCH

- Le momentum 2.0

- Stratégie de la gamme EHMA

- Moyenne mobile d'achat-vente

- Midas Mk. II - Le dernier Crypto Swing

- Le TMA-Legacy

- La stratégie de TV haut et bas

- Meilleure stratégie de tradingView

- Résultats de l'évaluation de la volatilité

- Chande Kroll Arrêtez

- CCI + EMA avec stratégie croisée RSI