La stratégie de l'évasion de Qullamaggie V2

Auteur:ChaoZhang est là., Date: 2023-10-24 16:30:32 Je suis désoléLes étiquettes:

Résumé

Cette stratégie combine les avantages des stratégies de rupture et de suivi de tendance pour capturer les signaux de rupture de support/résistance sur des délais plus longs tout en utilisant des moyennes mobiles pour le suivi de la rupture de perte afin de réaliser des bénéfices dans le sens de la tendance à plus long terme tout en contrôlant le risque.

La logique de la stratégie

-

La stratégie calcule d'abord plusieurs moyennes mobiles avec des paramètres différents pour la détermination de la tendance, le support/résistance et le stop loss.

-

Il identifie ensuite les points les plus élevés et les plus bas au cours d'une période spécifiée comme les zones de rupture de support/résistance.

-

La stratégie achète lorsque le prix dépasse le plus haut niveau et vend lorsque le prix dépasse le plus bas.

-

Après l'entrée, le plus bas est utilisé comme stop loss initial pour la position.

-

Une fois que la position devient rentable, le stop loss passe à la moyenne mobile.

-

Cela permet à la position d'obtenir des bénéfices tout en lui donnant suffisamment de marge pour suivre la tendance.

-

La stratégie intègre également une plage moyenne vraie pour le filtrage afin de garantir que seules les ruptures de plage appropriées sont prises afin d'éviter des ruptures prolongées.

Analyse des avantages

-

Combine les avantages des stratégies de rupture et de trailing stop.

-

Peut acheter des écarts en fonction des tendances à plus long terme pour une probabilité plus élevée.

-

La stratégie de trailing stop protège la position tout en laissant assez d'espace pour courir.

-

Le filtrage ATR permet d'éviter des fuites prolongées défavorables.

-

Commerce automatisé adapté à la pratique à temps partiel.

-

Paramètres de moyenne mobile personnalisables.

-

Mécanismes d'arrêt de traction flexibles.

Analyse des risques

-

Les stratégies d'évasion sont sujettes à de faux risques d'évasion.

-

La volatilité suffisante nécessaire pour générer des signaux peut échouer dans les marchés agités.

-

Certaines évasions peuvent être de trop courte durée pour être capturées.

-

Les arrêts à la traîne peuvent être arrêtés trop fréquemment sur les marchés à courte portée.

-

Le filtrage ATR peut manquer certaines transactions potentielles.

Directions d'optimisation

-

Testez différentes combinaisons de moyennes mobiles pour obtenir des paramètres optimaux.

-

Explorez différentes confirmations de rupture comme les canaux, les modèles de chandeliers, etc.

-

Essayez différents mécanismes d'arrêt de trailing pour trouver le meilleur stop loss.

-

Optimiser les stratégies de gestion de l'argent comme le score de position.

-

Ajouter des filtres d'indicateurs techniques pour améliorer la qualité des signaux.

-

Tester l'efficacité sur différents produits.

-

Incorporer des algorithmes d'apprentissage automatique pour améliorer les performances de la stratégie.

Conclusion

Cette stratégie combine les philosophies des stratégies de rupture et de suivi de tendance. Avec une détermination de tendance appropriée, elle optimise le potentiel de profit tout en maintenant un risque contrôlé. Les clés sont de trouver les ensembles de paramètres optimaux et d'intégrer une gestion prudente de l'argent.

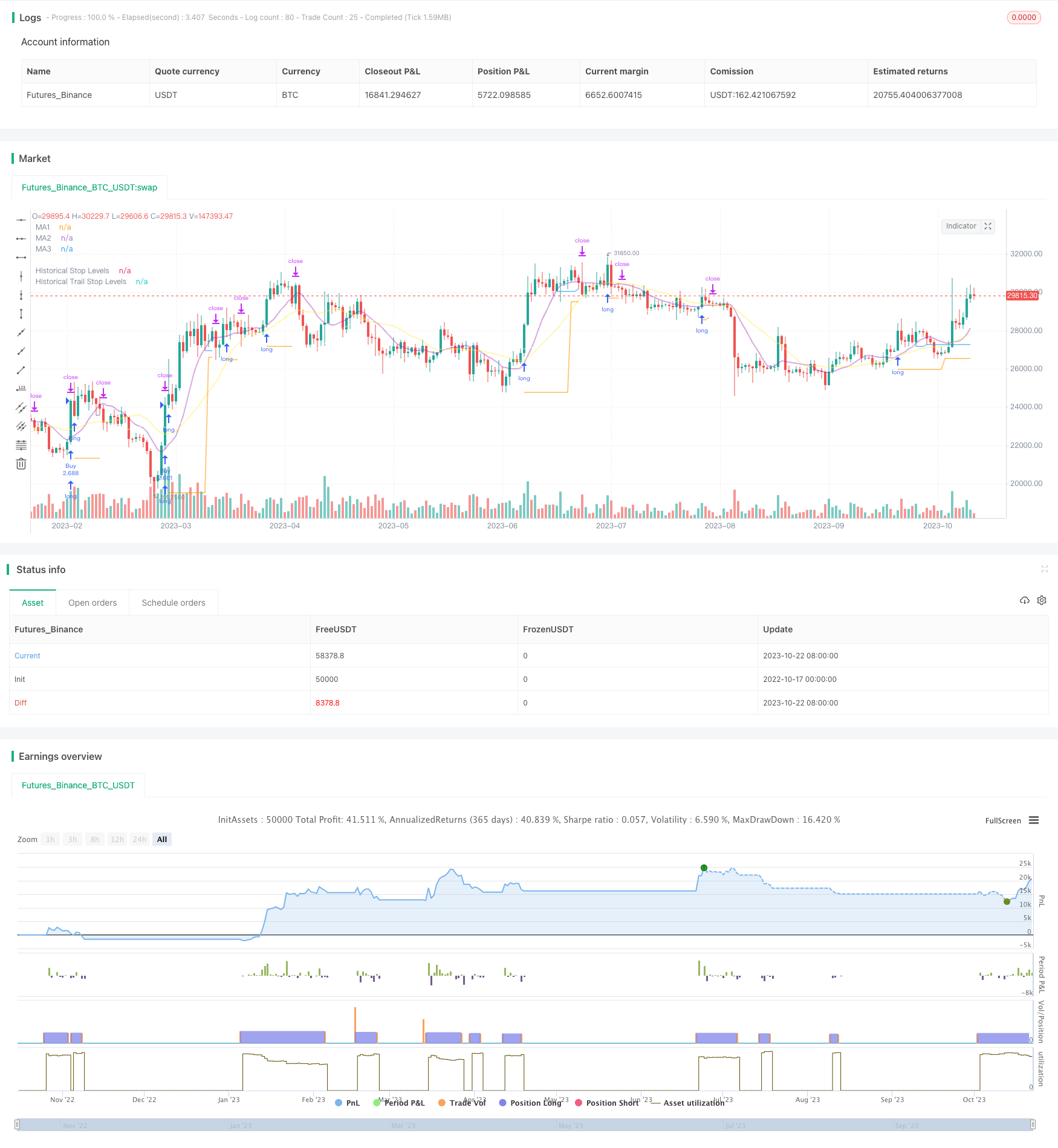

/*backtest

start: 2022-10-17 00:00:00

end: 2023-10-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © millerrh

// The intent of this strategy is to buy breakouts with a tight stop on smaller timeframes in the direction of the longer term trend.

// Then use a trailing stop of a close below either the 10 MA or 20 MA (user choice) on that larger timeframe as the position

// moves in your favor (i.e. whenever position price rises above the MA).

// Option of using daily ADR as a measure of finding contracting ranges and ensuring a decent risk/reward.

// (If the difference between the breakout point and your stop level is below a certain % of ATR, it could possibly find those consolidating periods.)

// V2 - updates code of original Qullamaggie Breakout to optimize and debug it a bit - the goal is to remove some of the whipsaw and poor win rate of the

// original by incorporating some of what I learned in the Breakout Trend Follower script.

//@version=4

strategy("Qullamaggie Breakout V2", overlay=true, initial_capital=100000, currency='USD', calc_on_every_tick = true,

default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1)

// === BACKTEST RANGE ===

Start = input(defval = timestamp("01 Jan 2019 06:00 +0000"), title = "Backtest Start Date", type = input.time, group = "backtest window and pivot history")

Finish = input(defval = timestamp("01 Jan 2100 00:00 +0000"), title = "Backtest End Date", type = input.time, group = "backtest window and pivot history")

// Inputs

showPivotPoints = input(title = "Show Historical Pivot Points?", type = input.bool, defval = false, group = "backtest window and pivot history",

tooltip = "Toggle this on to see the historical pivot points that were used. Change the Lookback Periods to adjust the frequency of these points.")

htf = input(defval="D", title="Timeframe of Moving Averages", type=input.resolution, group = "moving averages",

tooltip = "Allows you to set a different time frame for the moving averages and your trailing stop.

The default behavior is to identify good tightening setups on a larger timeframe

(like daily) and enter the trade on a breakout occuring on a smaller timeframe, using the moving averages of the larger timeframe to trail your stop.")

maType = input(defval="SMA", options=["EMA", "SMA"], title = "Moving Average Type", group = "moving averages")

ma1Length = input(defval = 10, title = "1st Moving Average Length", minval = 1, group = "moving averages")

ma2Length = input(defval = 20, title = "2nd Moving Average Length", minval = 1, group = "moving averages")

ma3Length = input(defval = 50, title = "3rd Moving Average Length", minval = 1, group = "moving averages")

useMaFilter = input(title = "Use 3rd Moving Average for Filtering?", type = input.bool, defval = true, group = "moving averages",

tooltip = "Signals will be ignored when price is under this slowest moving average. The intent is to keep you out of bear periods and only

buying when price is showing strength or trading with the longer term trend.")

trailMaInput = input(defval="1st Moving Average", options=["1st Moving Average", "2nd Moving Average"], title = "Trailing Stop", group = "stops",

tooltip = "Initial stops after entry follow the range lows. Once in profit, the trade gets more wiggle room and

stops will be trailed when price breaches this moving average.")

trailMaTF = input(defval="Same as Moving Averages", options=["Same as Moving Averages", "Same as Chart"], title = "Trailing Stop Timeframe", group = "stops",

tooltip = "Once price breaches the trail stop moving average, the stop will be raised to the low of that candle that breached. You can choose to use the

chart timeframe's candles breaching or use the same timeframe the moving averages use. (i.e. if daily, you wait for the daily bar to close before setting

your new stop level.)")

currentColorS = input(color.new(color.orange,50), title = "Current Range S/R Colors: Support", type = input.color, group = "stops", inline = "lineColor")

currentColorR = input(color.new(color.blue,50), title = " Resistance", type = input.color, group = "stops", inline = "lineColor")

// Pivot lookback

lbHigh = 3

lbLow = 3

// MA Calculations (can likely move this to a tuple for a single security call!!)

ma(maType, src, length) =>

maType == "EMA" ? ema(src, length) : sma(src, length) //Ternary Operator (if maType equals EMA, then do ema calc, else do sma calc)

ma1 = security(syminfo.tickerid, htf, ma(maType, close, ma1Length))

ma2 = security(syminfo.tickerid, htf, ma(maType, close, ma2Length))

ma3 = security(syminfo.tickerid, htf, ma(maType, close, ma3Length))

plot(ma1, color=color.new(color.purple, 60), style=plot.style_line, title="MA1", linewidth=2)

plot(ma2, color=color.new(color.yellow, 60), style=plot.style_line, title="MA2", linewidth=2)

plot(ma3, color=color.new(color.white, 60), style=plot.style_line, title="MA3", linewidth=2)

// === USE ADR FOR FILTERING ===

// The idea here is that you want to buy in a consolodating range for best risk/reward. So here you can compare the current distance between

// support/resistance vs. the ADR and make sure you aren't buying at a point that is too extended.

useAdrFilter = input(title = "Use ADR for Filtering?", type = input.bool, defval = false, group = "adr filtering",

tooltip = "Signals will be ignored if the distance between support and resistance is larger than a user-defined percentage of ADR (or monthly volatility

in the stock screener). This allows the user to ensure they are not buying something that is too extended and instead focus on names that are consolidating more.")

adrPerc = input(defval = 120, title = "% of ADR Value", minval = 1, group = "adr filtering")

tableLocation = input(defval="Bottom", options=["Top", "Bottom"], title = "ADR Table Visibility", group = "adr filtering",

tooltip = "Place ADR table on the top of the pane, the bottom of the pane, or off.")

adrValue = security(syminfo.tickerid, "D", sma((high-low)/abs(low) * 100, 21)) // Monthly Volatility in Stock Screener (also ADR)

adrCompare = (adrPerc * adrValue) / 100

// === PLOT SWING HIGH/LOW AND MOST RECENT LOW TO USE AS STOP LOSS EXIT POINT ===

ph = pivothigh(high, lbHigh, lbHigh)

pl = pivotlow(low, lbLow, lbLow)

highLevel = valuewhen(ph, high[lbHigh], 0)

lowLevel = valuewhen(pl, low[lbLow], 0)

barsSinceHigh = barssince(ph) + lbHigh

barsSinceLow = barssince(pl) + lbLow

timeSinceHigh = time[barsSinceHigh]

timeSinceLow = time[barsSinceLow]

//Removes color when there is a change to ensure only the levels are shown (i.e. no diagonal lines connecting the levels)

pvthis = fixnan(ph)

pvtlos = fixnan(pl)

hipc = change(pvthis) != 0 ? na : color.new(color.maroon, 0)

lopc = change(pvtlos) != 0 ? na : color.new(color.green, 0)

// Display Pivot lines

plot(showPivotPoints ? pvthis : na, color=hipc, linewidth=1, offset=-lbHigh, title="Top Levels")

plot(showPivotPoints ? pvthis : na, color=hipc, linewidth=1, offset=0, title="Top Levels 2")

plot(showPivotPoints ? pvtlos : na, color=lopc, linewidth=1, offset=-lbLow, title="Bottom Levels")

plot(showPivotPoints ? pvtlos : na, color=lopc, linewidth=1, offset=0, title="Bottom Levels 2")

// BUY AND SELL CONDITIONS

buyLevel = valuewhen(ph, high[lbHigh], 0) //Buy level at Swing High

// Conditions for entry

stopLevel = float(na) // Define stop level here as "na" so that I can reference it in the ADR calculation before the stopLevel is actually defined.

buyConditions = (useMaFilter ? buyLevel > ma3 : true) and

(useAdrFilter ? (buyLevel - stopLevel[1]) < adrCompare : true)

buySignal = crossover(high, buyLevel) and buyConditions

// Trailing stop points - when price punctures the moving average, move stop to the low of that candle - Define as function/tuple to only use one security call

trailMa = trailMaInput == "1st Moving Average" ? ma1 : ma2

f_getCross() =>

maCrossEvent = crossunder(low, trailMa)

maCross = valuewhen(maCrossEvent, low, 0)

maCrossLevel = fixnan(maCross)

maCrossPc = change(maCrossLevel) != 0 ? na : color.new(color.blue, 0) //Removes color when there is a change to ensure only the levels are shown (i.e. no diagonal lines connecting the levels)

[maCrossEvent, maCross, maCrossLevel, maCrossPc]

crossTF = trailMaTF == "Same as Moving Averages" ? htf : ""

[maCrossEvent, maCross, maCrossLevel, maCrossPc] = security(syminfo.tickerid, crossTF, f_getCross())

plot(showPivotPoints ? maCrossLevel : na, color = maCrossPc, linewidth=1, offset=0, title="Ma Stop Levels")

// == STOP AND PRICE LEVELS ==

inPosition = strategy.position_size > 0

buyLevel := inPosition ? buyLevel[1] : buyLevel

stopDefine = valuewhen(pl, low[lbLow], 0) //Stop Level at Swing Low

inProfit = strategy.position_avg_price <= stopDefine[1]

// stopLevel := inPosition ? stopLevel[1] : stopDefine // Set stop loss based on swing low and leave it there

stopLevel := inPosition and not inProfit ? stopDefine : inPosition and inProfit ? stopLevel[1] : stopDefine // Trail stop loss until in profit

trailStopLevel = float(na)

// trying to figure out a better way for waiting on the trail stop - it can trigger if above the stopLevel even if the MA hadn't been breached since opening the trade

notInPosition = strategy.position_size == 0

inPositionBars = barssince(notInPosition)

maCrossBars = barssince(maCrossEvent)

trailCross = inPositionBars > maCrossBars

// trailCross = trailMa > stopLevel

trailStopLevel := inPosition and trailCross ? maCrossLevel : na

plot(inPosition ? stopLevel : na, style=plot.style_linebr, color=color.new(color.orange, 50), linewidth = 2, title = "Historical Stop Levels", trackprice=false)

plot(inPosition ? trailStopLevel : na, style=plot.style_linebr, color=color.new(color.blue, 50), linewidth = 2, title = "Historical Trail Stop Levels", trackprice=false)

// == PLOT SUPPORT/RESISTANCE LINES FOR CURRENT CHART TIMEFRAME ==

// Use a function to define the lines

// f_line(x1, y1, y2, _color) =>

// var line id = na

// line.delete(id)

// id := line.new(x1, y1, time, y2, xloc.bar_time, extend.right, _color)

// highLine = f_line(timeSinceHigh, highLevel, highLevel, currentColorR)

// lowLine = f_line(timeSinceLow, lowLevel, lowLevel, currentColorS)

// == ADR TABLE ==

tablePos = tableLocation == "Top" ? position.top_right : position.bottom_right

var table adrTable = table.new(tablePos, 2, 1, border_width = 3)

lightTransp = 90

avgTransp = 80

heavyTransp = 70

posColor = color.rgb(38, 166, 154)

negColor = color.rgb(240, 83, 80)

volColor = color.new(#999999, 0)

f_fillCellVol(_table, _column, _row, _value) =>

_transp = abs(_value) > 7 ? heavyTransp : abs(_value) > 4 ? avgTransp : lightTransp

_cellText = tostring(_value, "0.00") + "%\n" + "ADR"

table.cell(_table, _column, _row, _cellText, bgcolor = color.new(volColor, _transp), text_color = volColor, width = 6)

srDistance = (highLevel - lowLevel)/highLevel * 100

f_fillCellCalc(_table, _column, _row, _value) =>

_c_color = _value >= adrCompare ? negColor : posColor

_transp = _value >= adrCompare*0.8 and _value <= adrCompare*1.2 ? lightTransp :

_value >= adrCompare*0.5 and _value < adrCompare*0.8 ? avgTransp :

_value < adrCompare*0.5 ? heavyTransp :

_value > adrCompare*1.2 and _value <= adrCompare*1.5 ? avgTransp :

_value > adrCompare*1.5 ? heavyTransp : na

_cellText = tostring(_value, "0.00") + "%\n" + "Range"

table.cell(_table, _column, _row, _cellText, bgcolor = color.new(_c_color, _transp), text_color = _c_color, width = 6)

if barstate.islast

f_fillCellVol(adrTable, 0, 0, adrValue)

f_fillCellCalc(adrTable, 1, 0, srDistance)

// f_fillCellVol(adrTable, 0, 0, inPositionBars)

// f_fillCellCalc(adrTable, 1, 0, maCrossBars)

// == STRATEGY ENTRY AND EXIT ==

strategy.entry("Buy", strategy.long, stop = buyLevel, when = buyConditions)

stop = stopLevel > trailStopLevel ? stopLevel : close[1] > trailStopLevel and close[1] > trailMa ? trailStopLevel : stopLevel

strategy.exit("Sell", from_entry = "Buy", stop=stop)

- Stratégie d'inversion de pivot améliorée de SuperTrend

- Analyse de la stratégie d'arbitrage de l'élan

- Stratégie des bandes de Bollinger pour la réversion moyenne

- Stratégie de négociation de moyenne mobile à régression linéaire

- Stratégie du filtre à double bande passante

- Stratégie de négociation croisée sur deux moyennes mobiles

- Stratégie d'ajustement des bandes de Bollinger

- Stratégie de contre-test de la puissance des taureaux et des ours

- Stratégie de croisement des moyennes mobiles

- Stratégie de rupture de la dynamique stochastique

- Stratégie de rupture basée sur les canaux de la Camarilla

- Suivre la tendance de la stratégie de croisement de la moyenne mobile

- Stratégie mensuelle de rupture de tendance

- Stratégie de l'indice de volatilité du DEMA

- Une tendance qui suit une stratégie

- Stratégie de croisement stochastique sur plusieurs délais

- Stratégie de négociation de la moyenne mobile de suivi

- La stratégie de négociation de l'indice RSI de la croix d'or et de la croix de la mort

- Suivre la stratégie des super tendances

- Stratégie combinée de volatilité de renversement de tendance