Stratégie de négociation à double sens basée sur RSI et SuperTrend

Auteur:ChaoZhang est là., Date: 2023-11-03 14h22: 50Les étiquettes:

Résumé

Il s'agit d'une stratégie de trading bidirectionnelle qui utilise de manière complète l'indicateur RSI et l'indicateur SuperTrend.

Principe de stratégie

La stratégie repose principalement sur les principes suivants:

-

Utilisez l'indicateur RSI pour déterminer la force et la faiblesse actuelles du marché.

-

Utilisez l'indicateur SuperTrend comme filtre de tendance. Les signaux de trading ne sont déclenchés que lorsque le prix franchit les lignes SuperTrend.

-

Lorsque le RSI donne un signal fort, allez long si le prix dépasse la bande supérieure, et fermez la position si elle dépasse la bande inférieure.

-

Lorsque le RSI donne un signal faible, allez court si le prix dépasse la bande inférieure, et fermez la position si elle dépasse la bande supérieure.

-

Capturez les points tournants en surveillant les transitions du RSI entre long et court, et effectuez des changements de position en temps opportun.

Mise en œuvre

-

Calculer les valeurs de l'indice de résistance avec une longueur de 14, en utilisant 50 comme seuil de force/faiblesse.

-

Calculer la SuperTrend avec une longueur de 10 et un multiplicateur de 2.

-

Allez long lorsque le RSI dépasse 50 et que le prix se déplace au-dessus de la bande supérieure de SuperTrend.

-

Lorsque vous êtes déjà long, si le RSI devient faible et que le prix tombe en dessous de la bande supérieure, fermez la position longue.

-

Configurable pour les modes longs ou courts.

Les avantages

Cette stratégie combine le suivi des tendances et l'analyse de la surachat/survente et présente les avantages suivants:

-

Peut saisir les changements de tendance en temps opportun et éviter les entrées inutiles.

-

L'indicateur de risque identifie efficacement les zones de surachat/survente afin d'éviter de poursuivre les hauts et les bas.

-

SuperTrend filtre bien le bruit du marché et suit les tendances à moyen et long terme.

-

La combinaison de l'indicateur RSI et de la SuperTrend améliore la stabilité.

-

La stratégie dispose d'un grand espace de réglage des paramètres pour différents produits et délais.

-

Prend en charge les modes long/courte pour gérer les différentes conditions de marché de manière flexible.

Les risques

Cette stratégie comporte également certains risques:

-

Le RSI peut générer facilement de faux signaux, nécessitant une confirmation de prix.

-

Les mauvais paramètres de SuperTrend peuvent entraîner des transactions manquées ou des poursuites.

-

Le risque de divergence existe lorsque deux indicateurs sont combinés.

-

Le placement d'un stop loss raisonnable est nécessaire.

-

Évitez de prendre des positions d'inversion près des niveaux de support/résistance majeurs.

Améliorations

La stratégie peut être encore optimisée dans les aspects suivants:

-

Ajustez les paramètres RSI pour trouver la longueur optimale pour filtrer les faux signaux.

-

Optimiser les paramètres de SuperTrend pour une meilleure capacité de suivi des tendances.

-

Testez différentes combinaisons de paramètres sur différents produits et délais pour trouver le meilleur.

-

Ajouter d'autres indicateurs comme MACD, KDJ pour améliorer la précision du signal.

-

Ajoutez l'analyse des principaux supports/résistances, des bandes de Bollinger, des moyennes mobiles, etc. pour qualifier les signaux de stratégie.

-

Optimiser la stratégie de stop loss pour réduire l'arrêt tout en maintenant l'efficacité.

Conclusion

Cette stratégie intègre les atouts de l'indice de stabilité et de la super tendance pour identifier efficacement les changements de tendance à moyen terme entre les marchés haussier et baissier. La stratégie est facile à mettre en œuvre avec une logique claire et a une forte valeur pratique.

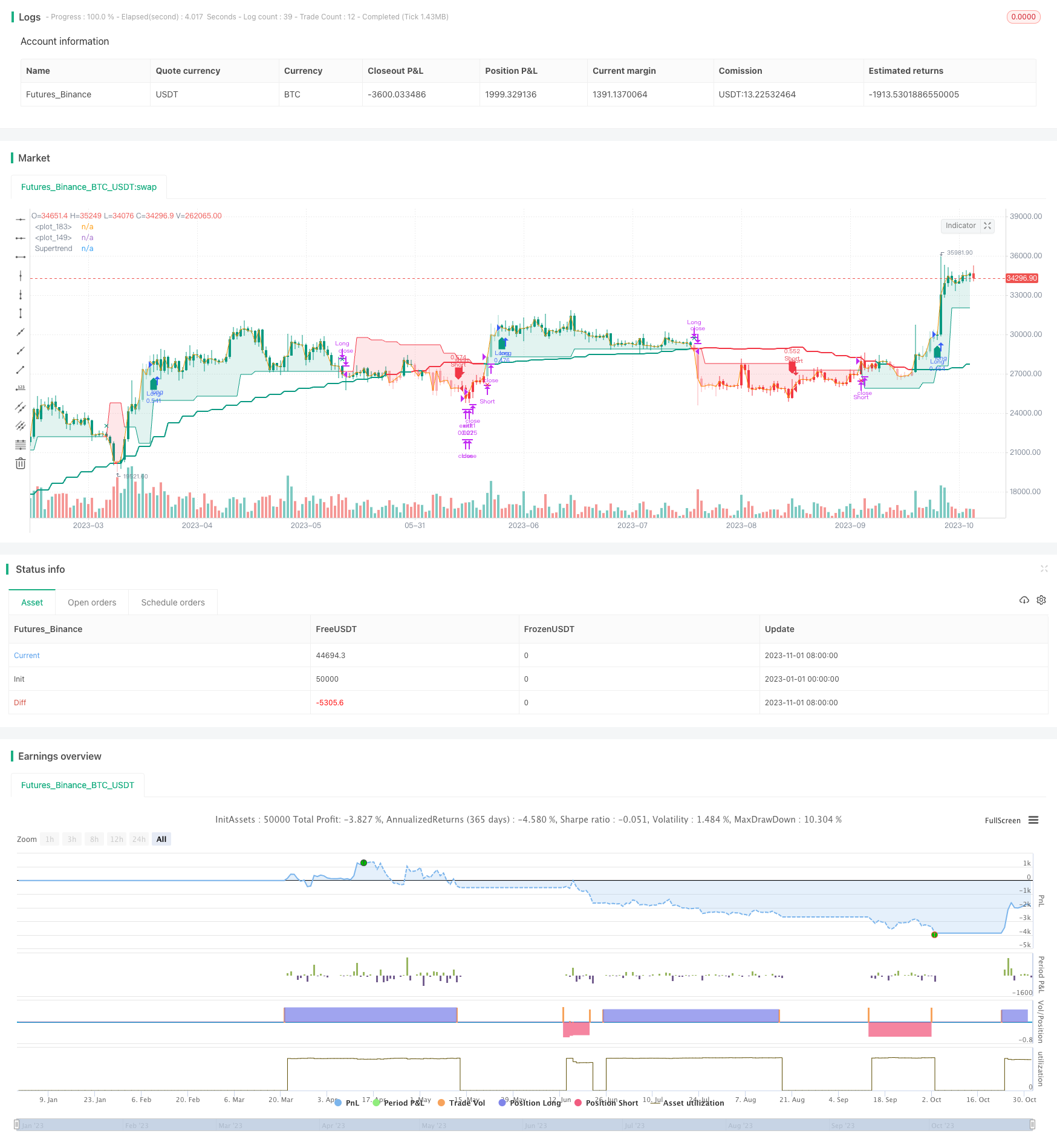

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//Created by @CITIAlgo

// —————————————————————————————————————————————————————————————————————————————————————————————————————————

strategy('CITI Trends A with RSI Candles', shorttitle = "CITI Trends A" , overlay = true ,

initial_capital = 10000,

commission_value = 0.025,

default_qty_value = 25,

slippage = 1,

pyramiding = 0,

max_lines_count = 500,

max_labels_count = 500,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity)

bullColor1 = #089981

bearColor1 = #f23645

bullColor2 = #3873e3

bearColor2 = #630ef5

neutralColor1 = #d5d5d5

//Base Settings

groupBase = "Base Settings ---------------------------------------"

Repaint_type = input.string('Non-Repainting', "Allow Repainting ?", options = ['Non-Repainting', 'Repainting'], inline ='repaint' , group = groupBase , tooltip = 'The default value is Non-Repainting. To learn more visit https://www.tradingview.com/pine-script-docs/en/v5/concepts/Repainting.html')

//Configure trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"] , group=groupBase , inline = 'Type' )

longOK = tradeDirection == "Long" or tradeDirection == "Both"

shortOK = tradeDirection == "Short" or tradeDirection == "Both"

var bool PlotEntries = input.bool (true, "Show Entries" ,group=groupBase , inline = 'Signals' )

var bool PlotExits = input.bool (true, "Show Exits" , group=groupBase, inline = 'Signals' )

//Display Settings

groupDisplay = "Display Settings ------------------------------------"

MomBars = input.bool( true , title="Apply Bar Colors", inline = 'candles' , group=groupDisplay)

cbullColor = input.color( bullColor1 , 'Candle Colors' , inline = 'candles1a',group=groupDisplay)

cbearColor = input.color( bearColor1 , '' , inline = 'candles1a',group=groupDisplay)

//Candle & label Colors

Bullish_Bars = color.new( cbullColor , 0)

WBullish_Bars = color.new( cbullColor , 60)

Bearish_Bars = color.new( cbearColor , 0)

WBearish_Bars = color.new( cbearColor , 60)

lbullColor = input.color( bullColor1 , 'Long/Short Labels' , group=groupDisplay, inline = 'Signals1' )

lbearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'Signals1' )

st_status = input.bool( true , title="Show Supertrend", inline = 'st' , group=groupDisplay)

st_bullColor = input.color( bullColor1 , '' , group=groupDisplay, inline = 'st' )

st_bearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'st' )

//Build Your Signals Settings

groupEntry = " Trend & Signal Settings---------------------"

Entry1a = input.bool(true, title= "Entry", inline='entry1a', group=groupEntry)

Exit1a = input.bool(false, title= "Exit | Strong/Weak Momentum", inline='entry1a', group=groupEntry)

Entry1b = input.bool(false, title= 'Entry' , inline='entry1b', group=groupEntry)

Exit1b = input.bool(false, title= 'Exit | Bull/Bear Momentum' , inline='entry1b', group=groupEntry)

Entry3a = input.bool(false, title= "Filter", inline='entry3a', group=groupEntry)

Exit3a = input.bool(false, title= "Exit | MA ", inline='entry3a', group=groupEntry)

Entry4a = input.bool(false, title= "Filter | Disable RSI Ranges ", inline='entry4a', group=groupEntry)

Entry4b = input.bool(true, title= "Filter", inline='entry4b', group=groupEntry)

Exit4b = input.bool(true, title= "Exit | Supertrend ", inline='entry4b', group=groupEntry)

Entry4c = input.bool(true, title= "Filter | Disable Supertrend Ranges ", inline='entry4c', group=groupEntry)

// —————————————————————————————————————MTF FUNCTIONS

// —————————— PineCoders MTF Selection Framework functions

// ————— Converts current "timeframe.multiplier" plus the TF into minutes of type float.

f_resInMinutes() =>

_resInMinutes = timeframe.multiplier * (timeframe.isseconds ? 1. / 60. : timeframe.isminutes ? 1. : timeframe.isdaily ? 1440. : timeframe.isweekly ? 10080. : timeframe.ismonthly ? 43800. : na)

_resInMinutes

// Get current resolution in float minutes.

var ResInMinutes = f_resInMinutes()

// ————— Returns resolution of _resolution period in minutes.

f_tfResInMinutes(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

request.security(syminfo.tickerid, _res, f_resInMinutes())

// ————— Returns a multiple of current resolution as a string in "timeframe.period" format usable with "security()".

f_multipleOfRes(_res, _mult) =>

// _res: current resolution in minutes, in the fractional format supplied by f_resInMinutes() companion function.

// _mult: Multiple of current TF to be calculated.

// Convert current float TF in minutes to target string TF in "timeframe.period" format.

_targetResInMin = _res * math.max(_mult, 1)

// Find best string to express the resolution.

_targetResInMin <= 0.083 ? '5S' : _targetResInMin <= 0.251 ? '15S' : _targetResInMin <= 0.501 ? '30S' : _targetResInMin <= 1440 ? str.tostring(math.round(_targetResInMin)) : _targetResInMin <= 43800 ? str.tostring(math.round(math.min(_targetResInMin / 1440, 365))) + 'D' : str.tostring(math.round(math.min(_targetResInMin / 43800, 12))) + 'M'

// ————— Converts current resolution

f_resInString(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

_res == "1" ? "1m" :

_res == "3" ? "3m" :

_res == "5" ? "5m" :

_res == "15" ? "15m" :

_res == "30" ? "30m" :

_res == "45" ? "45m" :

_res == "60" ? "1h" :

_res == "120" ? "2h" :

_res == "180" ? "3h" :

_res == "240" ? "4h" :

_res == "1D" ? "D" :

_res == "1W" ? "W" :

_res == "1M" ? "M" : _res

//Set repaint security function

repaint_sw = Repaint_type == 'Non-Repainting' ? false : true

f_security(_symbol, _res, _src, _repaint) => request.security(_symbol, _res, _src[_repaint ? 0 : barstate.isrealtime ? 1 : 0] , barmerge.gaps_off, barmerge.lookahead_on)[_repaint ? 0 : barstate.isrealtime ? 0 : 1]

f_source(_res , source) => f_security(syminfo.tickerid , _res , source , repaint_sw )

Type1 = 'Auto Multiplied TF'

Type2 = 'Fixed TF'

//---------------------------------------------------------------------------

//RSI Settings // INPUTS

groupRange = "RSI Settings ----------------------------------"

TF1type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf1' , group=groupRange)

setHTF1a = input.int( 4 , '' , inline ='tf1', group=groupRange)

setHTF1b = input.timeframe( 'D' , '' , inline ='tf1', group=groupRange)

// Get HTF from user-defined mode.

var TF1 = TF1type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF1a) : setHTF1b

mLength = input.int( 14 , "RSI Length" ,inline='lines', group=groupRange)

BullLevel = input.int( 50 , "Bullish Level | Above 50 ",inline='lines1a', group=groupRange)

BearLevel = input.int( 50 , "Bearish Level | Below 50 ",inline='lines1b', group=groupRange)

ma_length = input.int( 21 , "MA Length" ,inline='ma', group=groupRange)

ma_status = input.bool( true , "Show MA" ,inline='ma1', group=groupRange)

ma_bullColor = input.color( bullColor1 , '' , inline='ma1', group=groupRange)

ma_bearColor = input.color( bearColor1 , '' , inline='ma1', group=groupRange)

//--------------------------------------------------------------------------

//Momentum Calculations

f_momTF( _tf ) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

rsi_ = _isShow ? f_security(syminfo.tickerid , _tf, ta.rsi( close_, mLength) , repaint_sw) : na

ma = _isShow ? f_security(syminfo.tickerid , _tf, ta.vwma( hlc3 , ma_length ) , repaint_sw) : na

[rsi_ , ma]

[ rsi , ma ] = f_momTF(TF1)

ma_color = close > ma ? ma_bullColor : ma_bearColor

plot( ma_status ? ma : na , color = ma_color , linewidth = 2 , style = plot.style_line)

//---------------------------------------------------------------------------

//Supertrend Settings // INPUTS

groupST = "Supertrend Settings ----------------------------------"

TF2type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf2' , group=groupST)

setHTF2a = input.int( 4 , '' , inline ='tf2', group=groupST)

setHTF2b = input.timeframe( 'D' , '' , inline ='tf2', group=groupST)

// Get HTF from user-defined mode.

var TF2 = TF2type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF2a) : setHTF2b

stLength = input.int( 10 , "Supertrend Length" ,inline='lines', group=groupST)

stmult = input.int( 2 , "Mult" ,inline='lines', group=groupST)

stHighlights = input.bool( true , "Highlights",inline='lines1a', group=groupST)

f_st( _tf) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

atr= f_security(syminfo.tickerid , _tf, ta.atr(stLength) , repaint_sw)

Up=close_ -(stmult*atr)

Dn=close_ +(stmult*atr)

TrendUp = 0.0

TrendUp := close_[1]>TrendUp[1] ? math.max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := close_[1]<TrendDown[1]? math.min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := close_ > TrendDown[1] ? 1: close_< TrendUp[1]? -1: nz(Trend[1],1)

stLine = Trend==1? TrendUp: TrendDown

[Trend, stLine]

[Trend, stLine] = f_st( TF2 )

stTrend = close > stLine ? 1:-1

stplot = plot( st_status? stLine : na , color= stTrend ==1 ? st_bullColor : st_bearColor , linewidth=1 ,title ="Supertrend")

priceLineP = plot( close , color= na , linewidth=1 , display = display.none)

fill(priceLineP , stplot , color = stHighlights ? stTrend ==1 ? color.new(st_bullColor , 85) : color.new( st_bearColor , 85 ) : na )

//---------------------------------------------------------------------------

//Momentum BarColors

mom2a = rsi > BullLevel ? Bullish_Bars : WBullish_Bars

mom2b = rsi < BearLevel ? Bearish_Bars : WBearish_Bars

mom2_color = close > ma ? mom2a : mom2b

mom_color = MomBars ? mom2_color : na

barcolor(mom_color)

//-------------------------------------------------

//Momentum Strength & Values

momVal2a = rsi > BullLevel ? 2 : 1

momVal2b = rsi < BearLevel ? -2 : -1

momVal2 = close > ma ? momVal2a : momVal2b

momVal = momVal2

///==============================================================================================================

//Long Trend Conditions

Entry1aL = Entry1a ? momVal == 2 : true

Entry1bL = Entry1b ? momVal == 1 or momVal == 2 : true

Entry3aL = Entry3a ? close > ma : true

Entry4aL = Entry4a ? rsi > BullLevel : true

Entry4bL = Entry4b ? close > stLine : true

Entry4cL = Entry4c ? stLine > stLine[1] : true

//------

noEntry = Entry1a == false and Entry1b == false and Entry3a == false and Entry4a == false and Entry4b == false and Entry4c == false ? false : true

noExit = Exit1a == false and Exit1b == false and Exit3a == false and Exit4b == false ? false : true

//------

EntryL = noEntry and Entry1aL and Entry1bL and Entry3aL and Entry4aL and Entry4bL and Entry4cL

Exit1aL = Exit1a ? momVal == 1 and momVal[1] == 2 : true

Exit1bL = Exit1b ? momVal == -1 or momVal == -2 : true

Exit3aL = Exit3a ? close < ma : true

Exit4bL = Exit4b ? close < stLine : true

ExitL = noExit and Exit1aL and Exit3aL and Exit1bL and Exit4bL

//Short Trend Conditions

Entry1aS = Entry1a ? momVal == -2 : true

Entry1bS = Entry1b ? momVal == -1 or momVal == -2 : true

Entry3aS = Entry3a ? close < ma : true

Entry4aS = Entry4a ? rsi < BearLevel : true

Entry4bS = Entry4b ? close < stLine : true

Entry4cS = Entry4c ? stLine < stLine[1] : true

EntryS = noEntry and Entry1aS and Entry1bS and Entry3aS and Entry4aS and Entry4bS and Entry4cS

Exit1aS = Exit1a ? momVal == -1 and momVal[1] == -2 : true

Exit1bS = Exit1b ? momVal == 1 or momVal == 2 : true

Exit3aS = Exit3a ? close > ma : true

Exit4bS = Exit4b ? close > stLine : true

ExitS = noExit and Exit1aS and Exit3aS and Exit1bS and Exit4bS

///==============================================================================================================

//Entry & exit conditions

isLong = false

isLong := nz(isLong[1], false)

isShort = false

isShort := nz(isShort[1], false)

goLong = not isLong and EntryL and not ExitL and longOK and barstate.isconfirmed

goShort = not isShort and EntryS and not ExitS and shortOK and barstate.isconfirmed

longExit = isLong and ExitL and barstate.isconfirmed

shortExit = isShort and ExitS and barstate.isconfirmed

if (goLong)

isLong := true

isShort := false

if (goShort)

isLong := false

isShort := true

if (longExit)

isLong := false

if (shortExit)

isShort := false

//------------------------------------------------------------------------------

// ——Backtester

grouptime = 'Step 5 - 📆 Time Filter 📆-------------'

startTime = input (group=grouptime, title="Start Timeㅤㅤ", defval=timestamp('UTC 01 Jan 2020 00:00'), inline="Start")

endTime = input (group=grouptime, title="End Time ㅤ ㅤ", defval=timestamp('UTC 31 Dec 2025 23:45'), inline="End")

dateRange = true

//------------------------------------------------------------------------------

// Risk Managment

grouprisk = 'Step 6 - Risk Management-------------'

takeprofit = input.bool(true,title = "TP Price %",group=grouprisk, inline="profit")

tppercent = input.float(1, '', group=grouprisk, inline="profit") / 100

q1 = input.int (5 , "Quantity %",group=grouprisk , inline="profit")

stoploss = input.bool(false,title = "SL Price %",group=grouprisk, inline="loss")

stoppercent = input.float(5, '', group=grouprisk, inline="loss") / 100

// Determine where you've entered and in what direction

longtp = strategy.position_avg_price * (1 + tppercent)

longStop = strategy.position_avg_price * (1 - stoppercent)

shorttp = strategy.position_avg_price * (1 - tppercent)

shortStop = strategy.position_avg_price * (1 + stoppercent)

QTYMethod = input.string ('EQUITY', 'Order Size', group=grouprisk, inline=' ', options=['NONE', 'EQUITY', 'SIZE', 'CONTRACTS'])

useNetProfit = input.bool (true, 'Use Net Profit', group=grouprisk, inline=' ', tooltip='Use Net Profit- On/Off the use of profit in the following trades. *Only works if the type is EQUITY')

riskPerc = input.int (30, '🇪🇶🇺🇮🇹🇾 %', group=grouprisk, inline='.', minval=1, maxval=100)

riskSize = input.int (10000, '🇸🇮🇿🇪', group=grouprisk, inline='.', minval=1)

riskCntr = input.int (1, '🇨🇴🇳🇹🇷🇦🇨🇹🇸', group=grouprisk, inline='.', minval=1, tooltip='Order Size: \nNone- Use the default position size settings in Tab "Properties". \nEquity% - per trade from the initial capital. \nSize- Fixed size amount of trade. \nContracts- The fixed amount of the deal in contracts. \n')

// —————— Order Size

eqty = switch QTYMethod

'NONE' => na

'EQUITY' => riskPerc / close

'SIZE' => riskSize / close

'CONTRACTS' => riskCntr

//-----------------------------------------------------------------------------

// —————— Trade variables

entry = strategy.position_avg_price

sizePos = strategy.position_size

inLong = sizePos > 0

inShort = sizePos < 0

inTrade = inLong or inShort

inPos = (inLong and not inShort[1]) or (inShort and not inLong[1])

var ID = 'TradeID'

var tpPrice = float(na)

var slPrice = float(na)

///==============================================================================================================

// ALERTS

groupalerts = 'Step 7 - Alerts & Bot Trading Settings-------------'

broker = input.string('Binance', "Broker", options=['Binance', 'Alpaca', 'Kucoin', '3Commas'], group=groupalerts, tooltip = 'Choose which type you are using to send the correct Json Alert message for entry and exit alerts.')

my_sym = input("FTMM/USDT", "Ticker", group = 'Cloud Function Server', tooltip = 'Only used with Alerts to fix ticker ID in json message. Some exchanges use the forward slash and some do not.')

my_pass = input('Passphrase', "Passphrase" , group = 'Cloud Function Server', tooltip = 'Only enter your Passphrase and nothing else goes here. Only needed when using a Cloud Function Server.')

i_alert_3CID_txt = input('Bot ID', "Bot ID", group =groupalerts, tooltip = 'Only enter your 3Commas Bot ID and nothing else goes here.')

i_alert_3CET_txt = input('Bot Email Token', title = 'Bot Email Token', group =groupalerts , tooltip = 'Only enter your 3Commas Bot Email Token and nothing else goes here.')

Alert='{"passphrase": "'+str.tostring(my_pass)+'","symbol": "'+ str.tostring(my_sym) +'","type":"market", "side":"{{strategy.order.action}}","amount":"{{strategy.order.contracts}}","price": "' + str.tostring(close) + '"}'

//---------------------------------------------------------------------------------

// JSON alert message used for 3Commas Bots

C3_EntryAlert ='{"message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0 }'

C3_ExitAlert ='{"action": "close_at_market_price_all", "message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0}'

//---------------------------------------------------------------------------------

// JSON alert message used for setting up a Google Cloud Function Server works when using Alpaca Exchange

Alert_Alpaca = '{"symbol": "{{ticker}}", "quantity": "{{strategy.order.contracts}}", "side": "{{strategy.order.action}}", "order_type": "market", "time_in_force": "gtc", "passphrase": "' + str.tostring(my_pass) + '"}'

entryAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_EntryAlert

exitAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_ExitAlert

strategy.initial_capital = 50000

// —————— Entry's

goLongEntry = goLong and dateRange and barstate.isconfirmed

goShortEntry = goShort and dateRange and barstate.isconfirmed

eqty(qty) => QTYMethod=='EQUITY' ? qty / 100 * (strategy.initial_capital + (useNetProfit ? strategy.netprofit : 0)) : QTYMethod=='SIZE' ? qty / syminfo.pointvalue : qty

if goLongEntry

ID := 'Long'

strategy.entry(ID, strategy.long, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

if goShortEntry

ID := 'Short'

strategy.entry(ID, strategy.short, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

// —————— Exit's

qty(perc) => math.abs(sizePos*perc/100)

if longExit

strategy.close("Long",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Long", limit=takeprofit ? longtp : na, stop=stoploss ? longStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Long", stop=stoploss ? longStop : na, comment_loss='SL')

if shortExit

strategy.close("Short",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Short", limit=takeprofit ? shorttp : na, stop=stoploss ? shortStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Short", stop=stoploss ? shortStop : na, comment_loss='SL')

///==============================================================================================================

//Style- Plots on Chart

posH = high + 2 * stLine

posL = low - 2 * stLine

plotshape( goLong and PlotEntries ? posL : na ,'Long Entry Signals' , text= '' , location=location.belowbar, style=shape.labelup , size=size.small , color=lbullColor , textcolor = color.white )

plotshape( longExit and PlotExits ? posH : na ,'Long Exit' , location=location.abovebar, style= shape.xcross , size=size.small, color=lbullColor )

plotshape( goShort and PlotEntries ? posH : na ,'Short Entry Signals' , text= '' , location=location.abovebar, style=shape.labeldown , size=size.small , color=lbearColor , textcolor = color.white )

plotshape( shortExit and PlotExits ? posL : na ,'Short Exit' , location=location.belowbar, style=shape.xcross , size=size.small , color=lbearColor )

///==============================================================================================================

// Alerts

alertcondition( goLong , 'Long Entry Alerts', 'Long Alerts')

alertcondition( goShort , 'Short Entry Alerts', 'Short Alerts')

- Jupiter et Saturne Momentum MA Stratégie filtrée croisée

- Au-delà de la stratégie des nuages

- Stratégie de négociation dans l'ombre

- Stratégie de suivi de la rupture de tendance de la moyenne mobile

- Stratégie de suivi des tendances basée sur l'oscillateur de volume

- Tendance à la suite d'une stratégie à long terme basée sur la SuperTrend et la transformation Fisher

- Stratégie de négociation à double inversion de la croix d'or

- Fibonacci retire son scénario de stratégie commerciale

- RSI-BB: stratégie de rupture de l'élan

- Stratégie de rupture de bande fixe de stop-loss

- EMA 13 48 Tendance à la suite de la stratégie

- Stratégie d'accumulation et de distribution de Williams (Williams AD)

- Stratégie de l'indice de dynamique relative

- Système de suivi de tendance à double boîte

- Stratégie de Martingale avec plage de moyennes mobiles élargie pour la négociation d'actions

- Stratégie d'équilibre taureau-ours

- Stratégie de négociation du double rail d'Oma et Apollo

- Stratégie de croisement à double moyenne mobile

- Stratégie de suivi des tendances à double signal

- Tendance à la suite de la stratégie SMA