Stratégie de trading à volume dirigé par plusieurs MA

Aperçu

Cette stratégie de trading utilise la combinaison de plusieurs moyennes mobiles et d’indicateurs de dynamisme pour identifier la direction et la force d’une tendance, établir une position au début de la tendance, puis optimiser les bénéfices et contrôler les risques en utilisant des arrêts mobiles, des arrêts mobiles, etc. L’objectif est de capturer des mouvements de prix importants dans les tendances de la ligne moyenne et longue.

Principe de stratégie

Les lignes rapides et les lignes lentes sont construites à l’aide de combinaisons de moyennes mobiles avec deux ensembles de paramètres différents:

- Les lignes rapides sont constituées de moyennes mobiles à 5 cycles et de moyennes mobiles pondérées à 25 cycles et représentent les tendances à court terme.

- La ligne lente est composée d’une moyenne mobile à 28 cycles et d’une moyenne mobile pondérée à 72 cycles, représentant une tendance à moyen et long terme.

Lorsque la ligne rapide traverse la ligne lente, cela indique que la tendance à court terme commence à être plus forte que la tendance à moyen et long terme, ce qui est un signal d’entrée.

En combinaison avec l’indicateur de dynamique RSI, il n’entre en jeu que lorsque le RSI est bas (signal d’achat) ou élevé (signal de vente), afin de filtrer les fausses ruptures.

Une fois entrés, les pertes sont compressées par des arrêts mobiles et les bénéfices sont bloqués par des arrêts mobiles.

Lorsque la ligne rapide traverse la ligne lente, elle indique un renversement de tendance, à ce moment-là, le stop loss ou le stop stop stop est retiré.

Analyse des avantages

- Les doubles moyennes mobiles combinent le filtrage du bruit pour identifier la direction et la force de la partie médiane de la tendance.

- Il est préférable d’établir une position seulement au début de la tendance pour éviter les pertes inutiles causées par une fausse rupture.

- Les indicateurs de dynamique sont combinés avec des filtres d’entries pour améliorer la qualité des entries.

- Le stop-loss mobile est utilisé pour réduire les pertes individuelles en comprimant les pertes individuelles.

- Les stop-loss mobiles permettent de réaliser des bénéfices considérables et d’augmenter les bénéfices lorsque les conditions sont favorables.

Analyse des risques

- Les moyennes mobiles doubles sont retardées à un tournant de tendance et risquent de manquer une occasion de revenir en arrière.

- Les moyennes mobiles peuvent être raccourcies de manière appropriée pour les rendre plus sensibles.

- Une fausse intrusion entraîne une entrée inutile.

- Vous pouvez ajouter d’autres paramètres de filtrage.

- La distance d’arrêt ou de freinage n’est pas optimisée et peut être trop lâche ou trop serrée.

- On peut trouver l’optimum de la distance de freinage de stop-loss en rallongeant les paramètres d’optimisation.

- La stratégie est orientée vers les marchés tendances.

- La stratégie peut être choisie en fonction des enjeux.

Direction d’optimisation

- Optimiser les paramètres des moyennes mobiles pour trouver la meilleure combinaison de paramètres pour les représentations de la tendance.

- Ajout de filtres de tendance tels que l’arrêt ATR dynamique, l’indicateur de marée énergétique, etc.

- Optimiser les paramètres de stop-loss pour trouver la meilleure combinaison de paramètres.

- Pour augmenter le jugement sur la situation générale, choisissez d’activer ou non cette stratégie.

- Augmenter le jugement global sur plusieurs périodes de temps, en utilisant des tendances à plus grande échelle pour orienter les stratégies à court terme.

Résumer

Cette stratégie intègre des moyennes mobiles et des indicateurs de dynamique, a pour but d’identifier les entrées précoces pendant les tendances émergentes et de gérer les risques et les bénéfices par des arrêts et arrêts en temps opportun. Bien que les paramètres et les règles doivent encore être optimisés pour s’adapter aux conditions plus larges du marché, le cadre et l’orientation de base pour capturer les tendances de la ligne médiane et longue sont déjà disponibles.

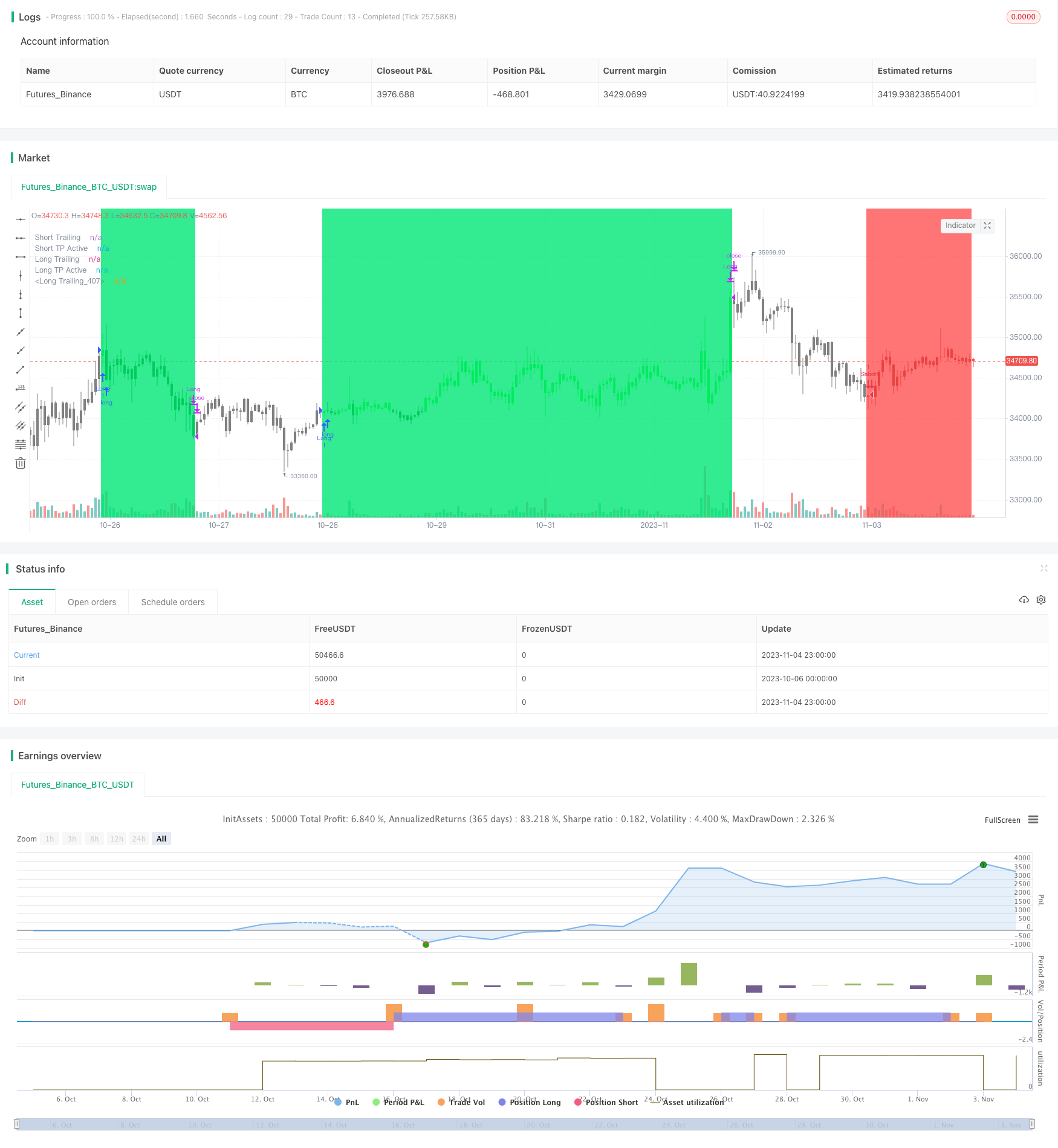

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="[WAI GUA]", shorttitle="[EOS] 1.0", overlay=true)

//study(title="[WAI GUA]", shorttitle="[EOS] 1.0", overlay=true)

//

// Use Alternate Anchor TF for MAs

uRenko = input(true, title="IS This a RENKO Chart")

//

anchor = input(0,minval=0,maxval=1440,title="Alternate TimeFrame Multiplier (0=none)")

//

src = close //input(close, title="EMA Source")

showRibbons = input(false,title="Show Coloured MA Ribbons")

showAvgs = input(false,title="Show Ribbon Median MA Lines")

//

// Fast Ribbon MAs

// Lower MA - type, length

typeF1 = input(defval="EMA", title="FAST MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF1 = input(defval=5, title="FAST Ribbon Lower MA Length", minval=1)

gammaF1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeF11 = typeF1 //input(defval="WMA", title="FAST Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF11 = input(defval=25, title="FAST Ribbon Upper Length", minval=2)

gammaF11 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// Slow Ribbon MAs

// Lower MA - type, length

typeS1 = input(defval="EMA", title="SLOW MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS1 = input(defval=28, title="SLOW Ribbon Lower MA Length", minval=1)

gammaS1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeS16 = typeS1 //input(defval="WMA", title="SLOW Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS16 = input(defval=72, title="SLOW Ribbon Upper Length", minval=2)

gammaS16 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// - Constants

gold = #FFD700

// - FUNCTIONS

// - variant(type, src, len, gamma)

// 返回MA输入选择变量,默认为SMA,如果空白或键入。

// SuperSmoother filter

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier.

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := isdwm? 1 : mult // Only available Daily or less

mult = anchor>0 ? anchor : 1

//

high_ = uRenko? max(close,open) : high

low_ = uRenko? min(close,open) : low

//用锚乘器调整MA长度

//Fast MA Ribbon

emaF1 = variant(typeF1, src, lenF1*mult, gammaF1)

emaF11 = variant(typeF11, src, lenF11*mult,gammaF11)

emafast = (emaF1+emaF11)/2 // Average of Upper and Lower MAs

//

//Slow MA Ribbon

emaS1 = variant(typeS1,src, lenS1*mult,gammaS1)

emaS16 = variant(typeS16, src, lenS16*mult, gammaS16)

emaslow = (emaS1+emaS16)/2 // Average of Upper and Lower MAs

//

// Count crossover candles

xup = 0

xdn = 0

fup = 0

fdn = 0

sup = 0

sdn = 0

//

xup := (emafast-emaslow)>0 and (emafast-emaslow)>(emafast[1]-emaslow[1]) ? nz(xup[1])+1 : 0

xdn := (emafast-emaslow)<0 and (emafast-emaslow)<(emafast[1]-emaslow[1]) ? nz(xdn[1])+1 : 0

fup := (emaF1-emaF11)>0 and (emaF1-emaF11)>(emaF1[1]-emaF11[1]) ? nz(fup[1])+1 : 0

fdn := (emaF1-emaF11)<0 and (emaF1-emaF11)<(emaF1[1]-emaF11[1]) ? nz(fdn[1])+1 : 0

sup := (emaS1-emaS16)>0 and (emaS1-emaS16)>(emaS1[1]-emaS16[1]) ? nz(sup[1])+1 : 0

sdn := (emaS1-emaS16)<0 and (emaS1-emaS16)<(emaS1[1]-emaS16[1]) ? nz(sdn[1])+1 : 0

//Fast EMA Final Color Rules

colFinal = fup>=2 ? aqua : fdn>=2 ? blue : gray

//Slow EMA Final Color Rules

colFinal2 = sup>=2 ? lime : sdn>=2 ? red : gray

//Fast EMA Plots

p1=plot(showRibbons?emaF1:na, title="Fast Ribbon Lower MA", style=line, linewidth=1, color=colFinal,transp=10)

p2=plot(showRibbons?emaF11:na, title="Fast Ribbon Upper MA", style=line, linewidth=1, color=colFinal,transp=10)

plot(showAvgs?emafast:na, title="Fast Ribbon Avg MA", style=circles,join=true, linewidth=1, color=gold,transp=10)

//

//fill(p1,p2,color=colFinal, transp=90)

//Slow EMA Plots

p3=plot(showRibbons?emaS1:na, title="Slow Ribbon Lower MA", style=line, linewidth=1, color=colFinal2,transp=10)

p4=plot(showRibbons?emaS16:na, title="Slow Ribbon Upper MA", style=line, linewidth=1, color=colFinal2,transp=10)

plot(showAvgs?emaslow:na, title="Slow Ribbon Avg MA", style=circles,join=true, linewidth=1, color=fuchsia,transp=10)

//

//fill(p3,p4, color=colFinal2, transp=90)

// Generate Buy Sell signals,

buy = 0

sell=0

//

buy := xup>=2 and sup>=2 and fup>=2 ? nz(buy[1])>0?buy[1]+1 :1 : 0

sell := xdn>=2 and sdn>=2 and fdn>=2 ? nz(sell[1])>0?sell[1]+1 :1 : 0

////////////////////////

//* 反测试周期选择器 *//

////////////////////////

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

///////////////

//* RSI策略 *//

///////////////

//指示器 1

lowerpc = lowest(low, 21)

upperpc = highest(high, 21)

midpc = avg(upperpc, lowerpc)

//指示器 2

ma = sma(close, 50)

petd = ema(close,13)

rangema = ema(tr, 50)

upperkc = ma + rangema * 0.25

lowerkc = ma - rangema * 0.25

//指示器 3

up = rma(max(change(close), 0), 5)

down = rma(-min(change(close), 0), 5)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

// PET-D

petdcolor = close > petd ? green : red

barcolor (petdcolor)

//Slope

SlopeL = midpc > midpc[5]

SlopeS = midpc < midpc[5]

//条件

CL = SlopeL == 1 and close > lowerkc and close < midpc and rsi < 35

CS = SlopeS == 1 and close < upperkc and close > midpc and rsi > 65

//Setup

RsiSL = CL == 1 and CL[1] != 1

RsiSS = CS == 1 and CS[1] != 1

/////////////////////

//* RSA抛物线指标 *//

/////////////////////

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

psar = sar(start, increment, maximum)

RSALE = false

RSASE = false

if (psar > high)

RSALE = true

else

RSALE = false

if (psar < low)

RSASE = true

else

RSASE = false

////////////////

//* 策略组件 *//

////////////////

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

//

fastExit = input(false,title="Use Opposite Trade as a Close Signal")

clrBars = input(true,title="Colour Candles to Trade Order state")

orderType = input("Longs+Shorts",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//////////////////////////

//* 贸易状态引擎 *//

//////////////////////////

// 追踪当前贸易状态

longClose = false, longClose := nz(longClose[1],false)

shortClose = false, shortClose := nz(shortClose[1],false)

tradeState = 0, tradeState := nz(tradeState[1])

tradeState := tradeState==0 ? buy==1 and (barstate.isconfirmed or barstate.ishistory) and isLong and not longClose and not shortClose? 1 :

sell==1 and (barstate.isconfirmed or barstate.ishistory) and isShort and not longClose and not shortClose? -1 :

tradeState : tradeState

////////////////////////////////////

//* 在这里设置入口和特殊出口条件 *//

////////////////////////////////////

//进入状态,当状态改变方向时。

longCondition = false

shortCondition = false

//longCondition := longCondition != true ? change(tradeState) and tradeState==1 : true

//shortCondition := shortCondition != true ? change(tradeState) and tradeState==-1 : true

longCondition := change(tradeState) and tradeState==1

shortCondition := change(tradeState) and tradeState==-1

if orderType=="Flip"

temp = longCondition

longCondition := shortCondition

shortCondition := temp

//end if

// 卖出信号退出

longExitC = (emafast[1]<emaslow[1] and open<emaslow[1]) ? 1 : 0

shortExitC = (emafast[1]>emaslow[1] and open>emaslow[1]) ? 1 : 0

// change退出条件。

longExit = change(longExitC) and longExitC==1 and tradeState==1

shortExit = change(shortExitC) and shortExitC==1 and tradeState==-1

// -- debugs

//plotchar(tradeState,"tradeState at Event",location=location.bottom, color=#FF0000FF)

//plotchar(longCondition, title="longCondition",color=#FF0000FF)

//plotchar(shortCondition, title="shortCondition",color=#FF0000FF)

//plotchar(tradeState, title="tradeState",color=#006400FF)

// -- /debugs

////////////////////////////////

//======[ 交易入门价格 ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

////////////////////////////

//======[ 位置状态 ]======//

////////////////////////////

in_longCondition = tradeState == 1

in_shortCondition = tradeState == -1

////////////////////////

//======[ 尾停 ]======//

////////////////////////

isTS = input(true, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

last_high = na

last_low = na

last_high_short = na

last_low_long = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

last_low_long := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

long_ts = isTS and in_longCondition and not na(last_high) and (low_ <= last_high - last_high * ts) //and (last_high >= last_open_longCondition + last_open_longCondition * tsi)

short_ts = isTS and in_shortCondition and not na(last_low) and (high_ >= last_low + last_low * ts) //and (last_low <= last_open_shortCondition - last_open_shortCondition * tsi)

////////////////////////

//======[ 获利 ]======//

////////////////////////

isTP = input(true, "Take Profit")

tp = input(3.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(1.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and in_longCondition and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and in_shortCondition and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

////////////////////////////

//======[ 停止损耗 ]======//

////////////////////////////

isSL = input(false, "Stop Loss")

sl = input(3.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and in_longCondition and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and in_shortCondition and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////

//======[ 对峙 ]======//

////////////////////////

//注:短出口信号不重漆,无需用力,如果锥体继续进行。

long_sos = (fastExit or (not isTS and not isSL)) and longExit and in_longCondition

short_sos = (fastExit or (not isTS and not isSL)) and shortExit and in_shortCondition

////////////////////////////

//======[ 关闭信号 ]======//

////////////////////////////

// 为所有不同的关闭条件创建一个单独的关闭,这里的所有条件都不重漆。

longClose := isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose := isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

////////////////////////////

//======[ 情节色彩 ]======//

////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ 策略图 ]======//

//////////////////////////////////

plot(isTS and in_longCondition?

last_high - last_high * ts : na, "Long Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_longCondition and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_longCondition and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Long Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_longCondition and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=2,offset=1)

plot(isTS and in_shortCondition?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_shortCondition and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_shortCondition and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_shortCondition and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=2,offset=1)

bclr = not clrBars ? na : tradeState==0 ? GRAY :

in_longCondition ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

//////////////////////////////////

//======[ 战略进入与退出 ]======//

//////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose )

if testPeriod() and isShort

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Short", when=shortClose )

// --- Debugs

//plotchar(longExit,title="longExit",location=location.bottom,color=na)

//plotchar(longCondition,title="longCondition",location=location.bottom,color=na)

//plotchar(in_longCondition,title="in_longCondition",location=location.bottom,color=na)

//plotchar(longClose,title="longClose",location=location.bottom,color=na,color=na)

//plotchar(buy,title="buy",location=location.bottom,color=na)

// --- /Debugs

//开单时改变背景

bgcolor( in_longCondition ? lime : na, transp=90)

bgcolor( in_shortCondition ? red : na, transp=90)

////////////////////////////

//======[ 重置变量 ]======//

////////////////////////////

if longClose or not in_longCondition

last_high := na

last_high_short := na

if shortClose or not in_shortCondition

last_low := na

last_low_long := na

if longClose or shortClose

tradeState := 0

in_longCondition := false

in_shortCondition := false

//plotchar(tradeState,"tradeState at EOF",location=location.bottom, color=na)

// EOF