Stratégie de la tendance du dragon volant

Auteur:ChaoZhang est là., Date: 2023-11-07 14:57:23 Je suis désoléLes étiquettes:

Résumé

La stratégie Flying Dragon Trend génère des signaux de trading en dessinant des bandes de tendance de différentes couleurs en fonction de la configuration des moyennes mobiles en termes de types, de longueur et de décalage.

La logique de la stratégie

La stratégie utilise deux moyennes mobiles pour tracer les bandes de tendance, désignées comme MA1 et MA4. MA1 est la moyenne mobile la plus rapide et MA4 est la plus lente. Pendant ce temps, MA1 a 3 paramètres de décalage (Offset1, Offset2, Offset3) qui forment MA2 et MA3.

Il existe 5 niveaux de risque parmi lesquels choisir. Un signal de trading n'est déclenché que lorsque le prix traverse différentes moyennes mobiles sous différents niveaux de risque, de haut en bas: MA1 Offset1, MA2, MA3, MA4, toutes bandes de tendance de la même couleur.

La stratégie permet également des arrêts de perte et des options pour long seulement, court seulement ou dans les deux sens.

Analyse des avantages

- Trouve des ensembles de paramètres optimaux sur différentes périodes, adaptables à plus de conditions de marché

- Différents types d'AM disponibles pour optimisation pour différents produits

- Le décalage, le noyau de cette stratégie, rend le jugement de tendance plus précis

- Les niveaux de risque atteignent un équilibre entre risque et avantage

- Très personnalisable avec diverses combinaisons de paramètres

- Les bandes de tendance intuitives forment des signaux de trading visuels clairs

- Risque de contrôle des pertes par arrêt

Analyse des risques

- Des niveaux de risque élevés peuvent générer de faux signaux, si le niveau de risque est réduit ou si les paramètres sont ajustés

- Risque de sorties de stop loss consécutives en cas d'inversion de tendance

- Différents produits nécessitent des essais et une optimisation de paramètres distincts

- Pour les opérations à haute fréquence, une MA rapide devrait conduire à une MA lente

- Une optimisation inadéquate des paramètres peut entraîner une sursensibilité ou une lenteur.

Les risques peuvent être gérés en abaissant progressivement les niveaux de risque, en testant plus de combinaisons de paramètres et en optimisant les paramètres séparément pour différents produits.

Directions d'optimisation

- Tester différentes combinaisons de types de moyennes mobiles

- Essayez plus de valeurs de longueur pour trouver des longueurs optimales

- Ajustez soigneusement les décalages, clé d'optimisation

- Optimiser les paramètres séparément pour les différents produits

- Optimiser les points de stop-loss, envisager de prendre des profits

- Testez différentes combinaisons de règles d'entrée

- Évaluer si des filtres sont nécessaires à l'optimisation

- Considérer l'ajout d'indicateurs de force de tendance pour l'aide

Résumé

La stratégie Flying Dragon Trend combine habilement les moyennes mobiles dans un système de trading de tendance visualisable. Sa haute adaptabilité aux paramètres permet une optimisation fine pour différents produits et régimes de marché afin de trouver un équilibre optimal entre stabilité et sensibilité. Les combinaisons abondantes de paramètres fournissent suffisamment d'espace d'optimisation. En résumé, cette stratégie a une logique nouvelle et une grande utilité pratique. Lorsqu'elle est optimisée correctement, elle peut devenir un système de suivi de tendance très puissant.

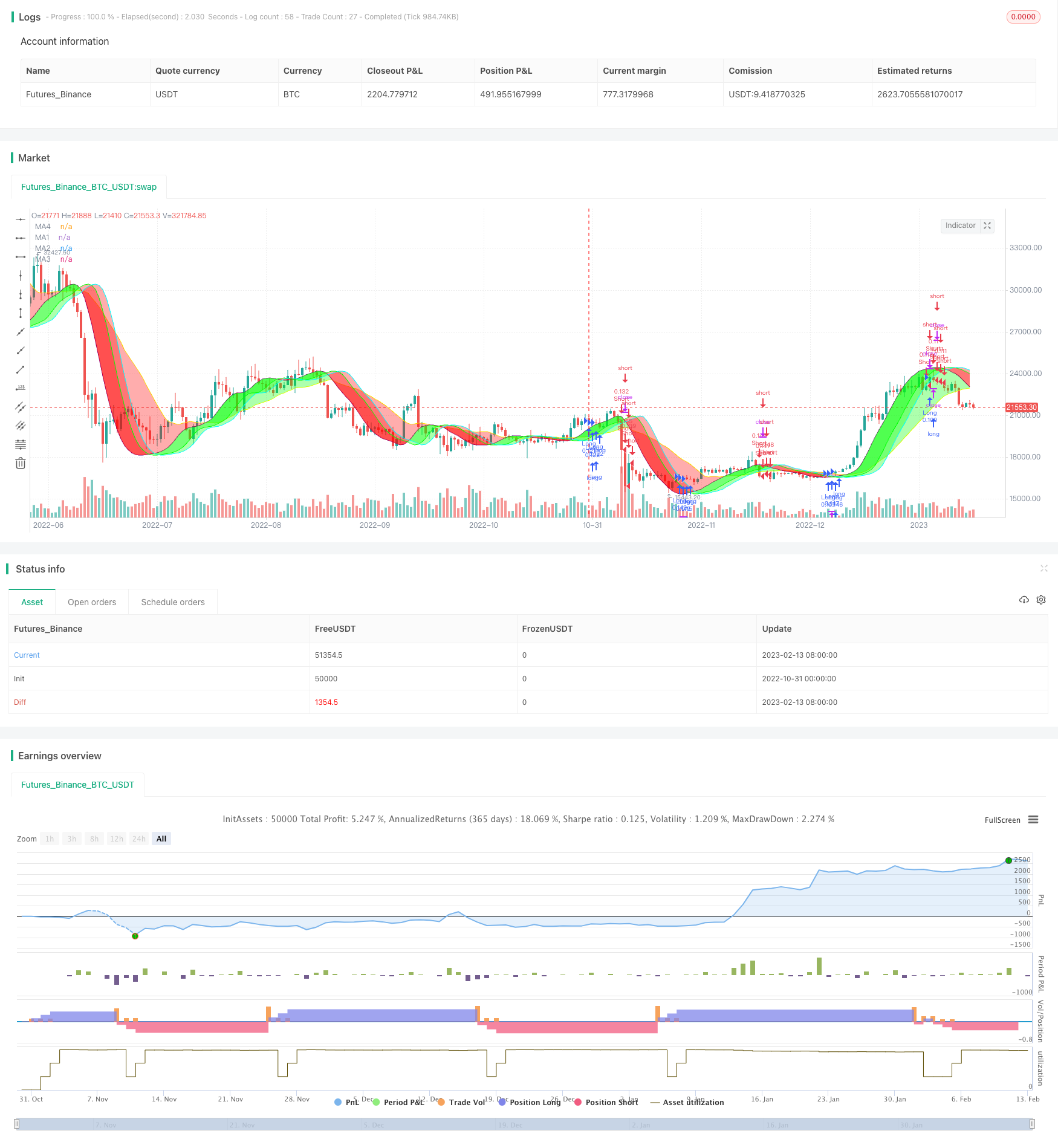

/*backtest

start: 2022-10-31 00:00:00

end: 2023-02-14 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MarkoP010 2023

//@version=5

//The basic idea of the strategy is to select the best set of MAs, types, lenghts and offsets, which draws red trend bands for downtrend (and green for uptrend).

//Strategy executes by selected risk level either when there is MA crossover with price (MA1 Offset1 on Highest risk level, MA2 on Low risk level) or three bands with the same color on at the same time (on Lowest risk level).

//Strategy plots user selectable Moving Average lines and a colored trend band between the MA lines. The trend bands can be turned off individually if required.

//The Offset option shifts the selected MA with the set number of steps to the right. That is where the Magic happens and the Dragon roars!

//Strategy version 1.0

strategy("Flying Dragon Trend Strategy", shorttitle="FD Trend Strategy", overlay=true, pyramiding=3, initial_capital=100000, default_qty_type=strategy.percent_of_equity, default_qty_value=5, commission_type=strategy.commission.cash_per_order, commission_value=10, calc_on_order_fills=false, process_orders_on_close=true)

strDirection = input.string(defval="Both", title="Strategy Direction", options=["Both", "Long", "Short"], group="Strategy") //Strategy direction selector by DashTrader

strSelection = strDirection == "Long" ? strategy.direction.long : strDirection == "Short" ? strategy.direction.short : strategy.direction.all //Strategy direction selector by DashTrader

strategy.risk.allow_entry_in(strSelection)

riskLevel = input.string(defval="Medium", title="Risk Level", options=["Highest", "High", "Medium", "Low", "Lowest"], tooltip="Strategy execution criteria. When Highest then MA1 Offset1 crossover with price, when Low then MA2 Offset crossover, when Lowest then all the Bands are the same color.", group="Strategy")

useStop = input(defval=false, title="Use Stop Loss", inline="SL", group="Strategy")

stopPrct = input.int(defval=10, title=" %", minval=0, maxval=100, step=1, inline="SL", group="Strategy") / 100

//Moving Averages function

MA(source, length, type) =>

type == "EMA" ? ta.ema(source, length) :

type == "HMA" ? ta.hma(source, length) :

type == "RMA" ? ta.rma(source, length) :

type == "SMA" ? ta.sma(source, length) :

type == "SWMA" ? ta.swma(source) :

type == "VWMA" ? ta.vwma(source, length) :

type == "WMA" ? ta.wma(source, length) :

na

//Inputs

ma1Type = input.string(defval="HMA", title="", inline="MA1", options=["EMA", "HMA", "RMA", "SMA","SWMA", "VWMA", "WMA"], group="Leading Moving Average")

ma1Length = input.int(defval=35, title="",minval=1, inline="MA1", group="Leading Moving Average")

ma1Source = input(defval=close, title="", tooltip="For short timeframes, minutes to hours, instead of Default values try Lowest risk level and HMA75 with Offsets 0,1,4 and SMA12 with Offset 6.", inline="MA1", group="Leading Moving Average")

ma1Color = input(defval=color.purple, title="", inline="MA-1", group="Leading Moving Average")

//useMa1Offset = input(defval=false, title="Use offset to MA-1", inline="MA1", group="Leading Moving Average")

ma1Offset = input.int(defval=0, title="Offset1 Steps", minval=0, maxval=10, step=1, tooltip="The Magic happens here! The offset to move the line to the right.", inline="MA-1", group="Leading Moving Average")

ma1 = MA(ma1Source, ma1Length, ma1Type)[ma1Offset]

ma2Color = input(defval=color.lime, title="", inline="MA-2", group="Leading Moving Average")

//useMa2Offset = input(defval=true, title="Use offset to MA2", inline="MA-2", group="Leading Moving Average")

ma2Offset = input.int(defval=4, title="Offset2 Steps", minval=0, maxval=10, step=1, tooltip="The Magic happens here! The offset to move the line to the right.", inline="MA-2", group="Leading Moving Average")

ma2 = ma1[ma2Offset]

ma3Color = input(defval=color.aqua, title="", inline="MA-3", group="Leading Moving Average")

//useMa3Offset = input(defval=false, title="Use offset to MA3", inline="MA-3", group="Leading Moving Average")

ma3Offset = input.int(defval=6, title="Offset3 Steps", minval=0, maxval=10, step=1, tooltip="The Magic happens here! The offset to move the line to the right.", inline="MA-3", group="Leading Moving Average")

ma3 = ma1[ma3Offset]

ma4Type = input.string(defval="SMA", title="", inline="MA4", options=["EMA", "HMA", "RMA", "SMA","SWMA", "VWMA", "WMA"], group="Lagging Moving Average")

ma4Length = input.int(defval=22, title="",minval=1, inline="MA4", group="Lagging Moving Average")

ma4Source = input(defval=close, title="", inline="MA4", group="Lagging Moving Average")

ma4Color = input(defval=color.yellow, title="", inline="MA-4", group="Lagging Moving Average")

//useMa4Offset = input(defval=true, title="Use offset to MA4", inline="MA-4", group="Lagging Moving Average")

ma4Offset = input.int(defval=2, title="Offset Steps", minval=0, maxval=10, step=1, tooltip="The Magic happens here! The offset to move the line to the right.", inline="MA-4", group="Lagging Moving Average")

ma4 = MA(ma4Source, ma4Length, ma4Type)[ma4Offset]

bandTransp = input.int(defval=60, title="Band Transparency", minval=20, maxval=80, step=10, group="Banding")

useBand1 = input(defval=true, title="Band 1", inline="Band", group="Banding")

band1Transp = useBand1 ? bandTransp : 100

band1clr = ma1 > ma2 ? color.new(#00ff00, transp=band1Transp) : color.new(#ff0000, transp=band1Transp)

useBand2 = input(defval=true, title="Band 2", inline="Band", group="Banding")

band2Transp = useBand2 ? bandTransp : 100

band2clr = ma1 > ma3 ? color.new(#00ff00, transp=band2Transp) : color.new(#ff0000, transp=band2Transp)

useBand3 = input(defval=true, title="Band 3", tooltip="Up trend green, down trend red. Colors get reversed if MA1 lenght is greater than MA2 lenght, or they are different type and MA2 quicker. In that case, just reverse your selections for MA1 and MA2, or let it be as is.", inline="Band", group="Banding")

band3Transp = useBand3 ? bandTransp : 100

band3clr = ma1 > ma4 ? color.new(#00ff00, transp=band3Transp) : color.new(#ff0000, transp=band3Transp)

//Graphs

piirto1 = plot(ma1, color = ma1Color, title="MA1")

piirto2 = plot(ma2, color = ma2Color, title="MA2")

piirto3 = plot(ma3, color = ma3Color, title="MA3")

piirto4 = plot(ma4, color = ma4Color, title="MA4")

fill(piirto1, piirto2, color=band1clr)

fill(piirto1, piirto3, color=band2clr)

fill(piirto1, piirto4, color=band3clr)

//Strategy entry and stop conditions

longCondition = riskLevel == "Highest" ? ma1Source > ma1 : riskLevel == "High" ? ma1Source > ma2 : riskLevel == "Medium" ? ma1Source > ma3 : riskLevel == "Low" ? ma1Source > ma4 : riskLevel == "Lowest" ? ma1 > ma2 and ma1 > ma3 and ma1 > ma4 : na

shortCondition = riskLevel == "Highest" ? ma1Source < ma1 : riskLevel == "High" ? ma1Source < ma2 : riskLevel == "Medium" ? ma1Source < ma3 : riskLevel == "Low" ? ma1Source < ma4 : riskLevel == "Lowest" ? ma1 < ma2 and ma1 < ma3 and ma1 < ma4 : na

stopLprice = useStop == true ? strategy.position_avg_price * (1-stopPrct) : na

stopSprice = useStop == true ? strategy.position_avg_price * (1+stopPrct) : na

if (longCondition)

strategy.entry("Long",strategy.long)

strategy.exit("Long Stop", "Long", stop=stopLprice)

if (shortCondition)

strategy.entry("Short",strategy.short)

strategy.exit("Short Stop", "Short", stop=stopSprice)

//End

- Système de suivi de l'inversion de la moyenne mobile double

- Stratégie de croisement des moyennes mobiles

- Stratégie d'inversion de l'impulsion du RSI

- Stratégie croisée de la Turtle Breakout EMA

- Stratégie de croisement des moyennes mobiles RSI

- Aucun décalage du nuage Ichimoku avec stratégie de filtrage RSI

- Stratégie à deux stochastiques

- EMAC Stratégie optimisée pour la moyenne mobile exponentielle

- Stratégie de rupture des bandes de Bollinger

- Stratégie de négociation de la réversion décentralisée de Gauss

- Stratégie de croisement de la moyenne mobile

- Tendance des canaux de moyenne mobile triple suivant la stratégie

- Stratégie double SSL avec EMA Stop Loss

- Stratégie de renvoi de Kijun

- Stratégie de négociation croisée de moyenne mobile

- Super stratégie Ichi

- La CBMA a adopté une stratégie de rupture des bandes de Bollinger.

- Stratégie d'inversion bidirectionnelle et de moyenne mobile dynamique

- Stratégie de négociation de la fourchette RSI

- Stratégie de rendement mensuel bipolaire