EMAC Stratégie optimisée pour la moyenne mobile exponentielle

Auteur:ChaoZhang est là., Date: 2023-11-07 15:16:03 Je suis désolé.Les étiquettes:

Résumé

La stratégie optimisée pour les moyennes mobiles exponentielles d'EMAC est une version optimisée basée sur la stratégie EMAC de base. Elle intègre le jugement de tendance, le filtrage multiple des moyennes mobiles et les sorties stop loss / take profit, visant à suivre les tendances à moyen et long terme.

La logique de la stratégie

-

Jugez la direction de la tendance récente: calculez le pourcentage d'augmentation/de diminution du prix de clôture au cours des 26 dernières semaines pour déterminer la tendance haussière, la tendance baissière ou la tendance latérale.

-

Filtre de moyenne mobile multiple: calculer l'EMA à 10 périodes, à 20 périodes et à 34 périodes et attendre qu'elle dépasse la SMA à 50 périodes pour déclencher des signaux d'achat.

-

ATR stop loss: lorsque le signal d'entrée apparaît, régler le stop loss à la barre d'entrée basse ou haute moins 2,5ATR.

-

Trailing stop loss: augmenter progressivement la ligne de stop loss à mesure que le prix augmente.

-

Profitez: lorsque le signal d'entrée apparaît, fixez la cible au prix de clôture plus 3ATR.

-

Exit de retraite de la MA: sortie active lorsque le prix se déplace en dessous de la EMA à 10 jours.

Les avantages

-

Le filtre MA multiple augmente la fiabilité du signal, évitant les fausses éruptions.

-

L'ATR permet une distance d'arrêt raisonnable en fonction de la volatilité du marché.

-

L'arrêt de traînée garantit des profits à mesure qu'il monte.

-

Un objectif de profit raisonnable évite de rendre trop de profit.

-

La sortie de MA pullback permet une sortie en temps opportun lorsque la tendance est inversée.

Risques et solutions

-

Les croisements de la EMA peuvent provoquer des pertes consécutives sur les marchés latéraux, augmenter les périodes de la EMA ou ajouter un filtre de croisement de la MA.

-

Des valeurs d'ATR élevées peuvent entraîner des arrêts trop éloignés, ce qui augmente le risque de perte.

-

Le risque d'écart d'un jour sur l'autre n'est pas pris en compte.

-

Le régime de marché n'est pas pris en compte.

Directions d'optimisation

-

Testez les combinaisons EMA pour trouver des longueurs optimales pour différents produits.

-

Tester les moyennes mobiles ATR ou les coefficients de réduction pour optimiser la distance d'arrêt.

-

Ajouter de la logique pour éviter les signaux pendant les périodes de non-échange.

-

Ajoutez le filtre de tendance du marché pour changer de stratégie lorsque le marché est défavorable.

-

Les combinaisons de paramètres testées en arrière pendant de nombreuses années pour trouver une stabilité optimale.

Résumé

L'EMAC Exponential Moving Average Cross Optimized Strategy combine le jugement de tendance, le filtrage multiple de MA et les arrêts dynamiques pour suivre les tendances à moyen et long terme. Par rapport à la version originale, il a subi une optimisation des paramètres pour améliorer les performances de négociation réelles.

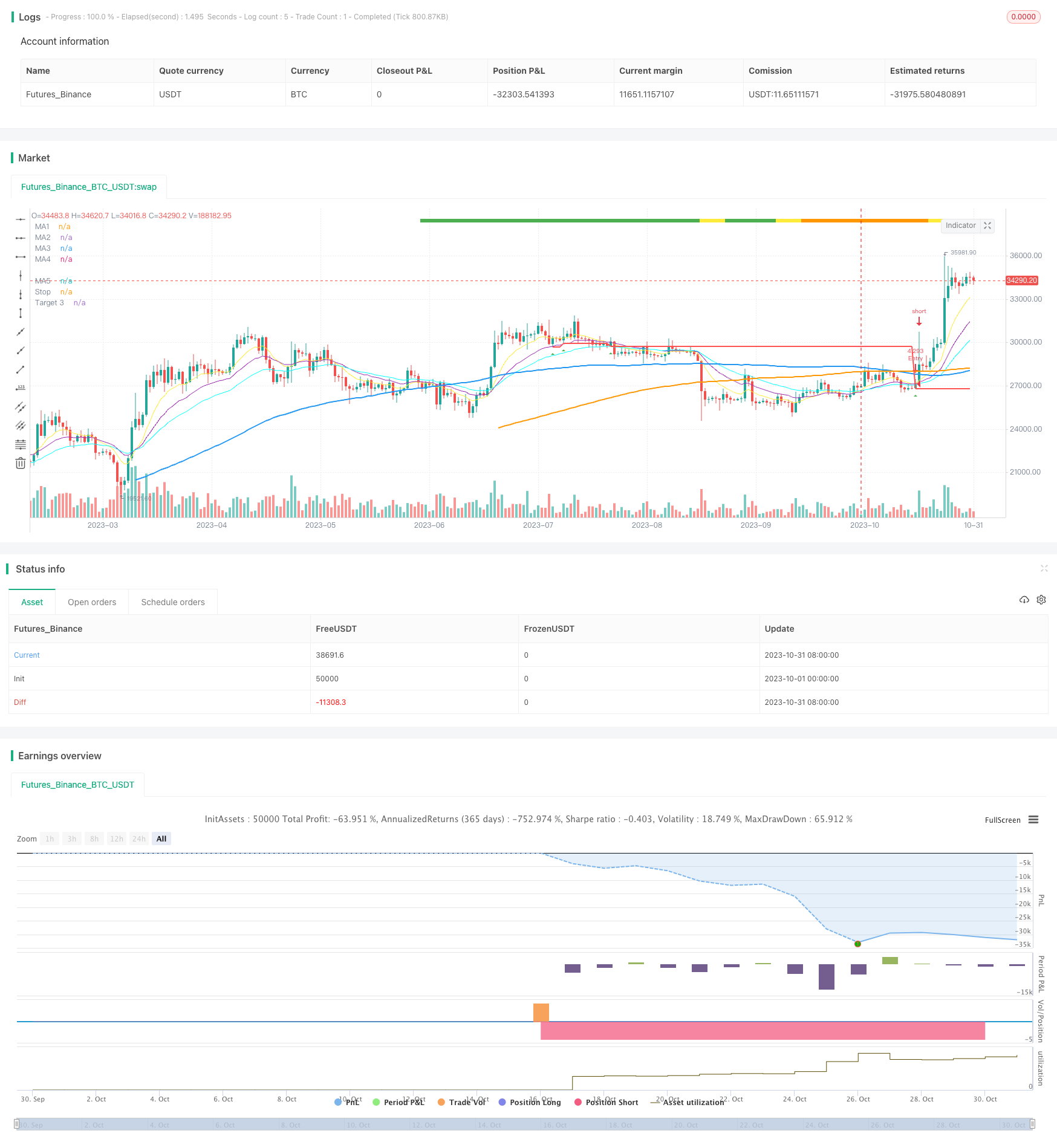

/*backtest

start: 2023-10-01 00:00:00

end: 2023-10-31 23:59:59

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//Author = Dustin Drummond https://www.tradingview.com/u/Dustin_D_RLT/

//Strategy based in part on original 10ema Basic Swing Trade Strategy by Matt Delong: https://www.tradingview.com/u/MattDeLong/

//Link to original 10ema Basic Swing Trade Strategy: https://www.tradingview.com/script/8yhGnGCM-10ema-Basic-Swing-Trade-Strategy/

//This is the Original EMAC - Exponential Moving Average Cross Strategy built as a class for reallifetrading dot com and so has all the default settings and has not been optimized

//I would not recomend using this strategy with the default settings and is for educational purposes only

//For the fully optimized version please come back around the same time tomorrow 6/16/21 for the EMAC - Exponential Moving Average Cross - Optimized

//EMAC - Exponential Moving Average Cross

strategy(title="EMAC - Exponential Moving Average Cross", shorttitle = "EMAC", overlay = true, calc_on_every_tick=false, default_qty_value = 100, initial_capital = 100000, default_qty_type = strategy.fixed, pyramiding = 0, process_orders_on_close=true)

//creates a time filter to prevent "too many orders error" and allows user to see Strategy results per year by changing input in settings in Stratey Tester

startYear = input(2015, title="Start Year", minval=1980, step=1)

timeFilter = true

//R Size (Risk Amount)

rStaticOrPercent = input(title="R Static or Percent", defval="Percent", options=["Static", "Percent"])

rSizeStatic = input(2000, title="R Size Static", minval=1, step=100)

rSizePercent = input(3, title="R Size Percent", minval=.01, step=.01)

rSize = rStaticOrPercent == "Static" ? rSizeStatic : rStaticOrPercent == "Percent" ? (rSizePercent * .01 * strategy.equity) : 1

//Recent Trend Indicator "See the standalone version for detailed description"

res = input(title="Trend Timeframe", type=input.resolution, defval="W")

trend = input(26, minval=1, title="# of Bars for Trend")

trendMult = input(15, minval=0, title="Trend Growth %", step=.25) / 100

currentClose = security(syminfo.tickerid, res, close)

pastClose = security(syminfo.tickerid, res, close[trend])

//Trend Indicator

upTrend = (currentClose >= (pastClose * (1 + trendMult)))

downTrend = (currentClose <= (pastClose * (1 - trendMult)))

sidewaysUpTrend = (currentClose < (pastClose * (1 + trendMult)) and (currentClose > pastClose))

sidewaysDownTrend = (currentClose > (pastClose * (1 - trendMult)) and (currentClose < pastClose))

//Plot Trend on Chart

plotshape(upTrend, "Up Trend", style=shape.square, location=location.top, color=color.green, size=size.small)

plotshape(downTrend, "Down Trend", style=shape.square, location=location.top, color=color.red, size=size.small)

plotshape(sidewaysUpTrend, "Sideways Up Trend", style=shape.square, location=location.top, color=color.yellow, size=size.small)

plotshape(sidewaysDownTrend, "Sideways Down Trend", style=shape.square, location=location.top, color=color.orange, size=size.small)

//What trend signals to use in entrySignal

trendRequired = input(title="Trend Required", defval="Red", options=["Green", "Yellow", "Orange", "Red"])

goTrend = trendRequired == "Orange" ? upTrend or sidewaysUpTrend or sidewaysDownTrend : trendRequired == "Yellow" ? upTrend or sidewaysUpTrend : trendRequired == "Green" ? upTrend : trendRequired == "Red" ? upTrend or sidewaysUpTrend or sidewaysDownTrend or downTrend : na

//MAs Inputs Defalt is 10 EMA, 20 EMA, 50 EMA, 100 SMA and 200 SMA

ma1Length = input(10, title="MA1 Period", minval=1, step=1)

ma1Type = input(title="MA1 Type", defval="EMA", options=["SMA", "EMA", "WMA"])

ma2Length = input(20, title="MA2 Period", minval=1, step=1)

ma2Type = input(title="MA2 Type", defval="EMA", options=["SMA", "EMA", "WMA"])

ma3Length = input(34, title="MA3 Period", minval=1, step=1)

ma3Type = input(title="MA3 Type", defval="EMA", options=["SMA", "EMA", "WMA"])

ma4Length = input(100, title="MA4 Period", minval=1, step=1)

ma4Type = input(title="MA4 Type", defval="SMA", options=["SMA", "EMA", "WMA"])

ma5Length = input(200, title="MA5 Period", minval=1, step=1)

ma5Type = input(title="MA5 Type", defval="SMA", options=["SMA", "EMA", "WMA"])

//MAs defined

ma1 = ma1Type == "EMA" ? ema(close, ma1Length) : ma1Type == "SMA" ? sma(close, ma1Length) : wma(close, ma1Length)

ma2 = ma2Type == "EMA" ? ema(close, ma2Length) : ma2Type == "SMA" ? sma(close, ma2Length) : wma(close, ma2Length)

ma3 = ma3Type == "EMA" ? ema(close, ma3Length) : ma3Type == "SMA" ? sma(close, ma3Length) : wma(close, ma3Length)

ma4 = ma4Type == "SMA" ? sma(close, ma4Length) : ma4Type == "EMA" ? ema(close, ma4Length) : wma(close, ma4Length)

ma5 = ma5Type == "SMA" ? sma(close, ma5Length) : ma5Type == "EMA" ? ema(close, ma5Length) : wma(close, ma5Length)

//Plot MAs

plot(ma1, title="MA1", color=color.yellow, linewidth=1, style=plot.style_line)

plot(ma2, title="MA2", color=color.purple, linewidth=1, style=plot.style_line)

plot(ma3, title="MA3", color=#00FFFF, linewidth=1, style=plot.style_line)

plot(ma4, title="MA4", color=color.blue, linewidth=2, style=plot.style_line)

plot(ma5, title="MA5", color=color.orange, linewidth=2, style=plot.style_line)

//Allows user to toggle on/off ma1 > ma2 filter

enableShortMAs = input(title="Enable Short MA Cross Filter", defval="No", options=["Yes", "No"])

shortMACross = enableShortMAs == "Yes" and ma1 > ma2 or enableShortMAs == "No"

//Allows user to toggle on/off ma4 > ma5 filter

enableLongMAs = input(title="Enable Long MA Cross Filter", defval="No", options=["Yes", "No"])

longMACross = enableLongMAs == "Yes" and ma4 >= ma5 or enableLongMAs == "No"

//Entry Signals

entrySignal = (strategy.position_size <= 0 and close[1] < ma1[1] and close > ma1 and close > ma2 and close > ma3 and shortMACross and ma1 > ma3 and longMACross and goTrend)

secondSignal = (strategy.position_size > 0 and close[1] < ma1[1] and close > ma1 and close > ma2 and close > ma3 and shortMACross and ma1 > ma3 and longMACross and goTrend)

plotshape(entrySignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(secondSignal, style=shape.triangleup, location=location.belowbar, color=color.lime, size=size.small)

//ATR for Stops

atrValue = (atr(14))

//to test ATR enable next line

//plot(atrValue, linewidth=1, color=color.black, style=plot.style_line)

atrMult = input(2.5, minval=.25, step=.25, title="Stop ATR Multiple")

//Only target3Mult is used in current strategy target1 and target2 might be used in the future with pyramiding

//target1Mult = input(1.0, minval=.25, step=.25, title="Targert 1 Multiple")

//target2Mult = input(2.0, minval=.25, step=.25, title="Targert 2 Multiple")

target3Mult = input(3.0, minval=.25, step=.25, title="Target Multiple")

enableAtrStop = input(title="Enable ATR Stops", defval="No", options=["Yes", "No"])

//Intitial Recomended Stop Location

atrStop = entrySignal and ((high - (atrMult * atrValue)) < low) ? (high - (atrMult * atrValue)) : low

//oneAtrStop is used for testing only enable next 2 lines to test

//oneAtrStop = entrySignal ? (high - atrValue) : na

//plot(oneAtrStop, "One ATR Stop", linewidth=2, color=color.orange, style=plot.style_linebr)

initialStop = entrySignal and enableAtrStop == "Yes" ? atrStop : entrySignal ? low : na

//Stops changed to stoploss to hold value for orders the next line is old code "bug"

//plot(initialStop, "Initial Stop", linewidth=2, color=color.red, style=plot.style_linebr)

//Set Initial Stop and hold value "debug code"

stoploss = valuewhen(entrySignal, initialStop, 0)

plot(stoploss, title="Stop", linewidth=2, color=color.red)

enableStops = input(title="Enable Stops", defval="No", options=["Yes", "No"])

yesStops = enableStops == "Yes" ? 1 : enableStops == "No" ? 0 : na

//Calculate size of trade based on R Size

//Original buggy code:

//positionSize = (rSize/(close - initialStop))

//Added a minimum order size of 1 "debug code"

positionSize = (rSize/(close - initialStop)) > 1 ? (rSize/(close - initialStop)) : 1

//Targets

//Enable or Disable Targets

enableTargets = input(title="Enable Targets", defval="No", options=["Yes", "No"])

yesTargets = enableTargets == "Yes" ? 1 : enableTargets == "No" ? 0 : na

//Only target3 is used in current strategy target1 and target2 might be used in the future with pyramiding

//target1 = entrySignal ? (close + ((close - initialStop) * target1Mult)) : na

//target2 = entrySignal ? (close + ((close - initialStop) * target2Mult)) : na

target3 = entrySignal ? (close + ((close - initialStop) * target3Mult)) : na

//plot(target1, "Target 1", linewidth=2, color=color.green, style=plot.style_linebr)

//plot(target2, "Target 2", linewidth=2, color=color.green, style=plot.style_linebr)

plot(target3, "Target 3", linewidth=2, color=color.green, style=plot.style_linebr)

//Set Target and hold value "debug code"

t3 = valuewhen(entrySignal, target3, 0)

//To test t3 and see plot enable next line

//plot(t3, title="Target", linewidth=2, color=color.green)

//MA1 Cross Exit

enableEarlyExit = input(title="Enable Early Exit", defval="Yes", options=["Yes", "No"])

earlyExit = enableEarlyExit == "Yes" ? 1 : enableEarlyExit == "No" ? 0 : na

ma1CrossExit = strategy.position_size > 0 and close < ma1

//Entry Order

strategy.order("Entry", long = true, qty = positionSize, when = (strategy.position_size <= 0 and entrySignal and timeFilter))

//Early Exit Order

strategy.close_all(when = ma1CrossExit and timeFilter and earlyExit, comment = "MA1 Cross Exit")

//Stop and Target Orders

//strategy.cancel orders are needed to prevent bug with Early Exit Order

strategy.order("Stop Loss", false, qty = strategy.position_size, stop=stoploss, oca_name="Exit", when = timeFilter and yesStops, comment = "Stop Loss")

strategy.cancel("Stop Loss", when = ma1CrossExit and timeFilter and earlyExit)

strategy.order("Target", false, qty = strategy.position_size, limit=t3, oca_name="Exit", when = timeFilter and yesTargets, comment = "Target")

strategy.cancel("Target", when = ma1CrossExit and timeFilter and earlyExit)

- Tendance à la DI à double échéancier

- Stratégie de négociation de notation multi-indicateur

- Stratégie combinée de l'inversion de tendance et de l'indicateur principal d'Ehlers

- Système de suivi de l'inversion de la moyenne mobile double

- Stratégie de croisement des moyennes mobiles

- Stratégie d'inversion de l'impulsion du RSI

- Stratégie croisée de la Turtle Breakout EMA

- Stratégie de croisement des moyennes mobiles RSI

- Aucun décalage du nuage Ichimoku avec stratégie de filtrage RSI

- Stratégie à deux stochastiques

- Stratégie de rupture des bandes de Bollinger

- Stratégie de négociation de la réversion décentralisée de Gauss

- Stratégie de la tendance du dragon volant

- Stratégie de croisement de la moyenne mobile

- Tendance des canaux de moyenne mobile triple suivant la stratégie

- Stratégie double SSL avec EMA Stop Loss

- Stratégie de renvoi de Kijun

- Stratégie de négociation croisée de moyenne mobile

- Super stratégie Ichi

- La CBMA a adopté une stratégie de rupture des bandes de Bollinger.