Stratégie de négociation quantitative basée sur Ichimoku avec plusieurs signaux

Auteur:ChaoZhang est là., Date: 2023-11-13 10h24 et 35 minLes étiquettes:

Résumé

Cette stratégie intègre les indicateurs Ichimoku Kinko Hyo et plusieurs autres indicateurs techniques pour combiner divers signaux de trading, afin de tirer parti des avantages du système Ichimoku tout en confirmant les entrées avec plusieurs signaux pour filtrer efficacement les faux signaux et contrôler les risques tout en poursuivant un taux de gain élevé.

La logique de la stratégie

Les éléments clés de cette stratégie sont les suivants:

-

Calcul des indicateurs Ichimoku Kinko Hyo, notamment Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B et Kumo.

-

Plusieurs filtres, y compris Kumo, Kijun, MACD, RSI, fractales, SuperTrend, SAR parabolique et ADX, pour confirmer la direction de la tendance et éviter les sauts.

-

Plusieurs signaux de négociation, y compris les ruptures de prix, les relations Chikou, les relations Tenkan et Kijun totalisant 23 signaux Ichimoku, ainsi que des signaux du MACD, du RSI, des fractales, etc., pour identifier les opportunités de négociation potentielles.

-

Filtres à deux étages pour les signaux d'entrée afin d'éviter d'être piégés à l'entrée.

-

Filtres à deux étages pour les signaux de sortie similaires aux filtres d'entrée.

-

Combinaison de signaux de négociation sélectionnés et de confirmations filtrées pour prendre des décisions commerciales finales.

-

Configurable pour prendre des profits et arrêter les pertes.

-

Paramètres de la période de test.

Les avantages

Les avantages de cette stratégie sont les suivants:

-

Utiliser les indicateurs et les signaux d'Ichimoku tout en combinant le suivi des tendances et le filtrage des signaux.

-

Éviter les pièges lors de l'entrée à travers des filtres à deux étages et un contrôle efficace des risques.

-

Fournir plusieurs signaux négociables adaptés à différentes conditions de marché.

-

Offrir plusieurs filtres sélectionnables optimisés pour les stocks individuels.

-

Prenez des bénéfices et arrêtez les pertes pour aider à bloquer les bénéfices et à contrôler les risques.

-

Période d'essai de retour facilitant l'optimisation de la stratégie.

Les risques

Les risques de cette stratégie comprennent:

-

Les signaux Ichimoku peuvent être lents et manquer des opportunités à court terme.

-

Un filtrage excessif peut entraîner des entrées incertaines, et les paramètres du filtre peuvent devoir être ajustés.

-

Le stop loss statique peut ne pas bien s'adapter à une action de prix complexe.

-

Les limites des tests en arrière dans la simulation précise des marchés en direct nécessitent plusieurs itérations d'optimisation.

Directions d'optimisation

Des moyens possibles d'optimiser la stratégie:

-

Ajustez les paramètres Ichimoku comme la période Tenkan pour les transactions à court terme.

-

Testez les combinaisons de signaux pour trouver la meilleure correspondance pour chaque stock.

-

Optimiser les paramètres du filtre pour équilibrer l'effet de filtration et la certitude d'entrée.

-

Essayez un stop loss dynamique pour mieux vous adapter aux changements du marché.

-

Utilisez des périodes de backtest plus longues ou des données à cocher pour des simulations plus précises.

-

Ajoutez la taille des positions pour une meilleure utilisation du capital.

-

Optimisation automatique des paramètres pour un réglage plus intelligent.

Conclusion

Cette stratégie combine les indicateurs et les signaux d'Ichimoku avec des filtres supplémentaires et des confirmations d'autres indicateurs techniques, réalisant un système quantitatif fusionnant les signaux de tendance et de rupture.

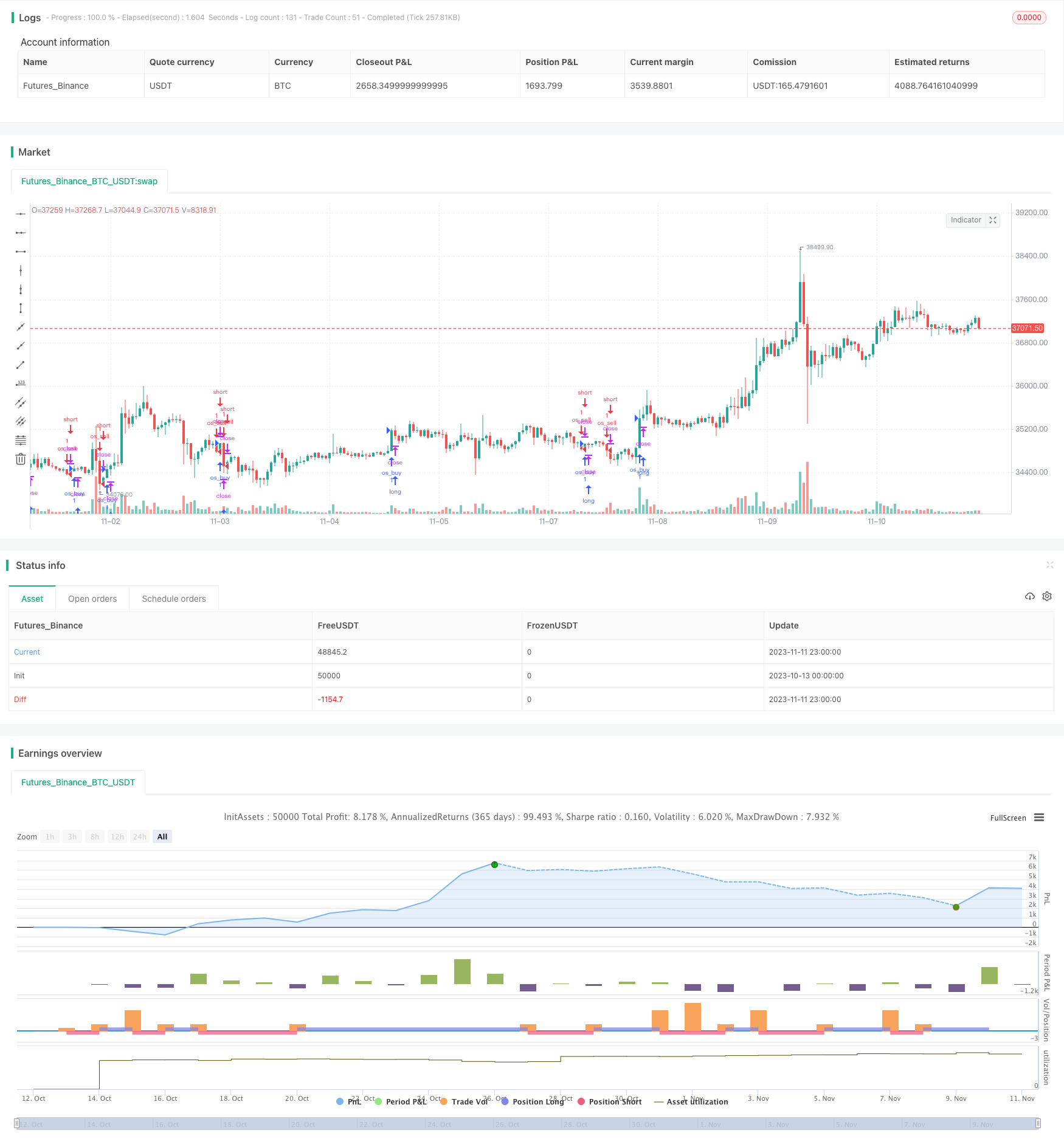

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ramsay09

//@version=4

strategy(title="The Strategy - Ichimoku Kinko Hyo and more",shorttitle="Strategy ", overlay=true)

backtest = input(title= "Backtest (no comment-string)", type= input.bool, defval= false)

entry_type = input("Both", title= "Long/Short Entry", options= ["Both", "Long", "Short"])

shared_param = input(false, title= " Shared Filter and Entry Parameters :", type= input.bool)

fr_period = input(2, title= "Fractals Period (Filter/Entry)", minval= 1)

rsi_period = input(14, title= "RSI Period (Filter/Entry)", minval= 1)

mult = input(2, type= input.float, title= "SuperTrend multiplier (Filter/Entry)", minval= 1)

len = input(5, type= input.integer, title= "SuperTrend length (Filter/Entry)", minval= 1)

start = 0.02//input(0.02, title= "PSAR Start (Filter/Entry)", minval= 0)

inc = 0.02//input(0.02, title= "PSAR Increment (Filter/Entry)", minval= 0)

max = 0.2//input(.2, title= "PSAR Maximum (Filter/Entry)", minval= 0)

adx_period = input(10, title= "ADX Period (Filter/Entry)", minval= 1)

adx_tres = input(25, title= "ADX threshold (Filter/Entry)", minval= 1)

X_opt = input("Price X Kumo sig", title="Signal", options= ["---", "Inside Bar sig", "Outside Bar sig", "Sandwich Bar sig", "Bar sig", "SMA50 sig", "RSI50 sig",

"Fractals sig", "Parabolic SAR sig", "SuperTrend sig", "Price X Kijun sig", "Price X Kumo sig", "Kumo flip sig",

"Price filtered Kumo flip sig", "Chikou X Price sig", "Chikou X Kumo sig", "Price X Tenkan sig", "Tenkan X Kumo sig",

"Tenkan X Kijun sig", "Kumo filtered Tenkan X Kijun sig", "CB/CS sig", "IB/IS sig", "B1/S1 sig", "B2/S2 sig"])

entry_f_1 = input("---", title="Entry filter 1", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

entry_f_2 = input("---", title="Entry filter 2", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

exit_f_1 = input("---", title="Exit filter 1", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

exit_f_2 = input("---", title="Exit filter 2", options= ["---", "SMA50 filter", "MACD filter", "RSI50 filter", "Fractals filter",

"SuperTrend filter", "Parabolic SAR filter", "Cloud filter", "Kijun filter", "ADX filter"])

//-------------------- Ichimoku --------------------

TKlength = 9 //input(9, "Tenkan-sen length", minval= 1)

KJlength = 26 //input(26, "Kijun-sen length", minval= 1)

CSHSlength = 26 //input(26, "Chikouspan length/horizontal shift", minval= 1)

SBlength = 52 //input(52, "SenkouspanB length", minval= 1)

SAlength = 26 //input(26, "SenkouspanA length", minval= 1)

// calculation

TK = avg(lowest(TKlength), highest(TKlength))

KJ = avg(lowest(KJlength), highest(KJlength))

CS = close

SB = avg(lowest(SBlength), highest(SBlength))

SA = avg(TK,KJ)

kumo_high = max(SA[CSHSlength-1], SB[CSHSlength-1])

kumo_low = min(SA[CSHSlength-1], SB[CSHSlength-1])

//------------------------------------- Filters and entry signals --------------------------------------

//---------------------- Kumo filter ------------------------

kumo_buy = close > kumo_high

kumo_sell = close < kumo_low

//--------------------- Kijun filter ----------------------

kijun_buy = close > KJ

kijun_sell = close < KJ

//----------------------- macd filter -----------------------

[macdLine_f, signalLine_f, histLine_f] = macd(close, 12, 26, 9)

macd_buy = macdLine_f > signalLine_f

macd_sell = macdLine_f < signalLine_f

//---------------------- rsi filter and entry signal------------------------

rsi_f_buy = rsi(close, rsi_period) > 50

rsi_f_sell = rsi(close, rsi_period) < 50

//---------------- Bill Williams Fractals (filter and entry signal) -----------------

up_fr = pivothigh(fr_period, fr_period)

dn_fr = pivotlow(fr_period, fr_period)

fractal_up_v = valuewhen(up_fr, high[fr_period],0)

fractal_dn_v = valuewhen(dn_fr, low[fr_period],0)

fr_upx = high > fractal_up_v

fr_dnx = low < fractal_dn_v

//-------------------- SuperTrend filter and entry signal ---------------------

[SuperTrend, Dir] = supertrend(mult, len)

sup_buy = close > SuperTrend

sup_sell = close < SuperTrend

//--------------------- Heikin Ashi -----------------------

//heikin_close = security(heikinashi(syminfo.tickerid), timeframe.period, close)

//heikin_open = security(heikinashi(syminfo.tickerid), timeframe.period, open)

//h_buy = heikin_close[1] > heikin_open[1]

//h_sell = heikin_close[1] < heikin_open[1]

//----------------- Parabolic SAR Signal (pb/ps) and filter -------------------

psar_buy = high > sar(start, inc, max)[0]

psar_sell = low < sar(start, inc, max)[0]

//-------------------------- ADX filter ---------------------------

[diplus_f, diminus_f, adx_f] = dmi(adx_period, adx_period)

//-------------------------- SMA50 filter and entry---------------------------

sma50_buy = close[2] > sma(close, 50)

sma50_sell = close[2] < sma(close, 50)

//-------------------------- entry filter -------------------------------

//entry buy filter 1 options

entry_filter_buy_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_buy :

entry_f_1 == "RSI50 filter" ? rsi_f_buy :

entry_f_1 == "Fractals filter" ? fr_upx :

entry_f_1 == "SuperTrend filter" ? sup_buy :

entry_f_1 == "Parabolic SAR filter" ? psar_buy :

entry_f_1 == "Cloud filter" ? kumo_buy :

entry_f_1 == "Kijun filter" ? kijun_buy :

entry_f_1 == "SMA50 filter" ? sma50_buy :

entry_f_1 == "ADX filter" ? adx_f > 25 : true

//entry sell filter 1 options

entry_filter_sell_1 =

entry_f_1 == "---" ? true :

entry_f_1 == "MACD filter" ? macd_sell :

entry_f_1 == "RSI50 filter" ? rsi_f_sell :

entry_f_1 == "Fractals filter" ? fr_dnx :

entry_f_1 == "SuperTrend filter" ? sup_sell :

entry_f_1 == "Parabolic SAR filter" ? psar_sell :

entry_f_1 == "Cloud filter" ? kumo_sell :

entry_f_1 == "Kijun filter" ? kijun_sell :

entry_f_1 == "SMA50 filter" ? sma50_sell :

entry_f_1 == "ADX filter" ? adx_f > 25 : true

//entry buy filter 2 options

entry_filter_buy_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_buy :

entry_f_2 == "RSI50 filter" ? rsi_f_buy :

entry_f_2 == "Fractals filter" ? fr_upx :

entry_f_2 == "SuperTrend filter" ? sup_buy :

entry_f_2 == "Parabolic SAR filter" ? psar_buy :

entry_f_2 == "Cloud filter" ? kumo_buy :

entry_f_2 == "Kijun filter" ? kijun_buy :

entry_f_2 == "SMA50 filter" ? sma50_buy :

entry_f_2 == "ADX filter" ? adx_f > 25 : true

//entry sell filter 2 options

entry_filter_sell_2 =

entry_f_2 == "---" ? true :

entry_f_2 == "MACD filter" ? macd_sell :

entry_f_2 == "RSI50 filter" ? rsi_f_sell :

entry_f_2 == "Fractals filter" ? fr_dnx :

entry_f_2 == "SuperTrend filter" ? sup_sell :

entry_f_2 == "Parabolic SAR filter" ? psar_sell :

entry_f_2 == "Cloud filter" ? kumo_sell :

entry_f_2 == "Kijun filter" ? kijun_sell :

entry_f_2 == "SMA50 filter" ? sma50_sell :

entry_f_2 == "ADX filter" ? adx_f > 25 : true

//------------------------- exit filter -----------------------

//exit buy filter 1 options

exit_filter_buy_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "MACD filter" ? macd_buy :

exit_f_1 == "RSI50 filter" ? rsi_f_buy :

exit_f_1 == "Fractals filter" ? fr_upx :

exit_f_1 == "SuperTrend filter" ? sup_buy :

exit_f_1 == "Parabolic SAR filter" ? psar_buy :

exit_f_1 == "Cloud filter" ? kumo_buy :

exit_f_1 == "Kijun filter" ? kijun_buy :

exit_f_1 == "SMA50 filter" ? sma50_buy :

exit_f_1 == "ADX filter" ? adx_f > 25 : false

//exit sell filter 1 options

exit_filter_sell_1 =

exit_f_1 == "---" ? false :

exit_f_1 == "MACD filter" ? macd_sell :

exit_f_1 == "RSI50 filter" ? rsi_f_sell :

exit_f_1 == "Fractals filter" ? fr_dnx :

exit_f_1 == "SuperTrend filter" ? sup_sell :

exit_f_1 == "Parabolic SAR filter" ? psar_sell :

exit_f_1 == "Cloud filter" ? kumo_sell :

exit_f_1 == "Kijun filter" ? kijun_sell :

exit_f_1 == "SMA50 filter" ? sma50_sell :

exit_f_1 == "ADX filter" ? adx_f > 25 : false

//exit buy filter 2 options

exit_filter_buy_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "MACD filter" ? macd_buy :

exit_f_2 == "RSI50 filter" ? rsi_f_buy :

exit_f_2 == "Fractals filter" ? fr_upx :

exit_f_2 == "SuperTrend filter" ? sup_buy :

exit_f_2 == "Parabolic SAR filter" ? psar_buy :

exit_f_2 == "Cloud filter" ? kumo_buy :

exit_f_2 == "Kijun filter" ? kijun_buy :

exit_f_2 == "SMA50 filter" ? sma50_buy :

exit_f_2 == "ADX filter" ? adx_f > 25 : false

//exit sell filter 2 options

exit_filter_sell_2 =

exit_f_2 == "---" ? false :

exit_f_2 == "MACD filter" ? macd_sell :

exit_f_2 == "RSI50 filter" ? rsi_f_sell :

exit_f_2 == "Fractals filter" ? fr_dnx :

exit_f_2 == "SuperTrend filter" ? sup_sell :

exit_f_2 == "Parabolic SAR filter" ? psar_sell :

exit_f_2 == "Cloud filter" ? kumo_sell :

exit_f_2 == "Kijun filter" ? kijun_sell :

exit_f_2 == "SMA50 filter" ? sma50_sell :

exit_f_2 == "ADX filter" ? adx_f > 25 : false

//----------------------- i-o-s signals ------------------------

i_bar_buy = high[1] < high[2] and low[1] > low[2] and close > high[1]

i_bar_sell = high[1] < high[2] and low[1] > low[2] and close < low[1]

o_bar_buy = high[1] > high[2] and low[1] < low[2] and high > high[1]

o_bar_sell = high[1] > high[2] and low[1] < low[2] and low < low[1]

s_bar_buy = high[2] < high[3] and low[2] > low[3] and high[1] > high[2] and low[1] < low[2] and high > high[1]

s_bar_sell = high[2] < high[3] and low[2] > low[3] and high[1] > high[2] and low[1] < low[2] and low < low[1]

//----------------- Ichimoku Signal B1/S1 -----------------

buy_strong_B1 = (TK >= KJ) and close > kumo_high and CS > high[(26-1)] and CS > kumo_high[26-1] and SA > SB

sell_strong_S1 = (TK <= KJ) and close < kumo_low and CS < low[(26-1)] and CS < kumo_low[26-1] and SA < SB

var buy_sig = true

var sell_sig = true

B1_a = buy_strong_B1 and buy_sig

S1_a = sell_strong_S1 and sell_sig

if sell_strong_S1

buy_sig := true, sell_sig := false

if buy_strong_B1

sell_sig := true, buy_sig := false

//----------------- Ichimoku Signal B2/S2 -----------------

buy_strong_B2 = (TK >= KJ) and close > kumo_high and CS > high[26-1]

sell_strong_S2 = (TK <= KJ) and close < kumo_low and CS < low[26-1]

var buy_sig_B2 = true

var sell_sig_S2 = true

B2_a = buy_strong_B2 and buy_sig_B2

S2_a = sell_strong_S2 and sell_sig_S2

if sell_strong_S2

buy_sig_B2 := true, sell_sig_S2 := false

if buy_strong_B2

sell_sig_S2 := true, buy_sig_B2 := false

//---------------------------- Confluence Signal ----------------------------

long_short_trig = 7 //input(7, type= input.float, title= "Confluence signal trigger Level", step= 0.1)

trig_gap_cbcs = input(2, type= input.float, title= "CB/CS signal sesitivity", minval= 0, maxval= 6, step= 1)

//Indicators

// ma

sma1 = sma(close, 50)

sma2 = sma(close, 200)

ema1 = ema(close, 50)

ema2 = ema(close, 200)

[macdLine, signalLine, histLine] = macd(close, 12, 26, 9)

rsi = rsi(close, 14)

[diplus, diminus, adx] = dmi(7, 7)

[superTrend, dir] = supertrend(2, 5)

//Klinger Oszillator

sv = change(hlc3) >= 0 ? volume : -volume

kvo = ema(sv, 34) - ema(sv, 55)

sig = ema(kvo, 13)

//Vortex Indicator

VMP = sum( abs( high - low[1]), 14 )

VMM = sum( abs( low - high[1]), 14 )

STR = sum( atr(1), 14 )

VIP = VMP / STR

VIM = VMM / STR

//Signals

var float sma_sig_w = na

var float ema_sig_w = na

var float p_kj_sig_w = na

var float tk_kj_sig_w = na

var float B1_S1_sig_w = na

var float B2_S2_sig_w = na

var float psar_sig_w = na

var float frac_sig_w = na

var float macd_sig_w = na

var float rsi_sig_w = na

var float p_tk_sig_w = na

var float dmi_sig_w = na

var float klin_sig_w = na

var float vort_sig_w = na

var float sup_sig_w = na

if sma1 > sma2

sma_sig_w := 1

else if sma1 < sma2

sma_sig_w := 0

if ema1 > ema2

ema_sig_w := 1

else if ema1 < ema2

ema_sig_w := 0

if close > KJ

p_kj_sig_w := 1

else if close < KJ

p_kj_sig_w := 0

if TK > KJ

tk_kj_sig_w := 1

else if TK < KJ

tk_kj_sig_w := 0

if buy_strong_B1

B1_S1_sig_w := 1

else if sell_strong_S1

B1_S1_sig_w := 0

if buy_strong_B2

B2_S2_sig_w := 1

else if sell_strong_S2

B2_S2_sig_w := 0

if high >= sar(start, inc, max)[0]

psar_sig_w := 1

else if low <= sar(start, inc, max)[0]

psar_sig_w := 0

if high > fractal_up_v

frac_sig_w := 1

else if low < fractal_dn_v

frac_sig_w := 0

if macdLine > signalLine

macd_sig_w := 1

else if macdLine < signalLine

macd_sig_w := 0

if rsi > 50

rsi_sig_w := 1

else if rsi < 50

rsi_sig_w := 0

if close[2] > TK

p_tk_sig_w := 1

else if close[2] < TK

p_tk_sig_w := 0

if diplus > diminus

dmi_sig_w := 1

else if diplus < diminus

dmi_sig_w := 0

if sig > 0

klin_sig_w := 1

else if sig < 0

klin_sig_w := 0

if VIP > VIM

vort_sig_w := 1

else if VIP < VIM

vort_sig_w := 0

if close > superTrend

sup_sig_w := 1

else if close < superTrend

sup_sig_w := 0

bs_conf_sig = sma_sig_w + ema_sig_w + p_kj_sig_w + tk_kj_sig_w + B1_S1_sig_w + B2_S2_sig_w + psar_sig_w + frac_sig_w + macd_sig_w +

rsi_sig_w + dmi_sig_w + klin_sig_w + vort_sig_w + sup_sig_w + p_tk_sig_w

long_c = bs_conf_sig > long_short_trig + trig_gap_cbcs //with +- signal is less fluctuating

short_c = bs_conf_sig < long_short_trig - trig_gap_cbcs

//---------------------------- Pure Ichimoku Confluence Signal ----------------------------

pic_l_s_trig = 4 //input(4, type= input.float, title= "Ichimoku confluence signal trigger Level", step= 0.1)

trig_gap_ibis = input(0, type= input.float, title= "IB/IS signal sesitivity", minval= 0, maxval= 3, step= 1)

//Signals

var float tkkh_sig_w = na

var float csh_sig_w = na

var float cskh_sig_w = na

var float pkj_sig_w = na

var float ptk_sig_w = na

var float tkkj_sig_w = na

var float sasb_sig_w = na

var float ckh_sig_w = na

if TK > kumo_high

tkkh_sig_w := 1

else if TK < kumo_low

tkkh_sig_w := 0

if CS > high[(26-1)]

csh_sig_w := 1

else if CS < low[(26-1)]

csh_sig_w := 0

if CS > kumo_high[26-1]

cskh_sig_w := 1

else if CS < kumo_low[26-1]

cskh_sig_w := 0

if close > TK

ptk_sig_w := 1

else if close < TK

ptk_sig_w := 0

if close > KJ

pkj_sig_w := 1

else if close < KJ

pkj_sig_w := 0

if TK > KJ

tkkj_sig_w := 1

else if TK < KJ

tkkj_sig_w := 0

if SA > SB

sasb_sig_w := 1

else if SA < SB

sasb_sig_w := 0

if close > kumo_high

ckh_sig_w := 1

else if close < kumo_low

ckh_sig_w := 0

bs_pic_sig = tkkh_sig_w + csh_sig_w + cskh_sig_w + ptk_sig_w + pkj_sig_w + tkkj_sig_w + sasb_sig_w + ckh_sig_w

long_pic = bs_pic_sig > pic_l_s_trig + trig_gap_ibis

short_pic = bs_pic_sig < pic_l_s_trig - trig_gap_ibis

//--------------------------- Entry Signal Options ---------------------------

var buy_sig_opt = true

var sell_sig_opt = true

// cross conditions for "Strong" bg's

var bool sasb_x = true

if crossover(SA, SB) and low > kumo_high

sasb_x := true

if crossunder(SA, SB) and high < kumo_low

sasb_x := false

var bool tkkj_x = true

if crossover(TK, KJ) and TK > kumo_high and KJ > kumo_high

tkkj_x := true

if crossunder(TK, KJ) and TK < kumo_low and KJ < kumo_low

tkkj_x := false

// buy signal options

opt_sig_buy =

X_opt == "---" ? na :

X_opt == "Inside Bar sig" ? i_bar_buy :

X_opt == "Outside Bar sig" ? o_bar_buy :

X_opt == "Sandwich Bar sig" ? s_bar_buy :

X_opt == "Bar sig" ? close > high[1] :

X_opt == "SMA50 sig" ? close[2] > sma(close, 50) :

X_opt == "Fractals sig" ? fr_upx :

X_opt == "RSI50 sig" ? rsi_f_buy :

X_opt == "Parabolic SAR sig" ? psar_buy :

X_opt == "SuperTrend sig" ? sup_buy :

X_opt == "Price X Kijun sig" ? close > KJ :

X_opt == "Price X Kumo sig" ? close > kumo_high :

X_opt == "Kumo flip sig" ? SA > SB :

X_opt == "Price filtered Kumo flip sig" ? sasb_x and low > kumo_high :

X_opt == "Chikou X price sig" ? CS > high[(26-1)] :

X_opt == "Chikou X Kumo sig" ? CS > kumo_high[26-1] :

X_opt == "Price X Tenkan sig" ? close > TK :

X_opt == "Tenkan X Kumo sig" ? TK > kumo_high :

X_opt == "Tenkan X Kijun sig" ? TK > KJ :

X_opt == "Kumo filtered Tenkan X Kijun sig" ? tkkj_x and TK > kumo_high and KJ > kumo_high and TK > KJ :

X_opt == "CB/CS sig" ? long_c :

X_opt == "IB/IS sig" ? long_pic :

X_opt == "B1/S1 sig" ? buy_strong_B1 :

X_opt == "B2/S2 sig" ? buy_strong_B2 : na

// sell signal options

opt_sig_sell =

X_opt == "---" ? na :

X_opt == "Inside Bar sig" ? i_bar_sell :

X_opt == "Outside Bar sig" ? o_bar_sell :

X_opt == "Sandwich Bar sig" ? s_bar_sell :

X_opt == "Bar sig" ? close < low[1] :

X_opt == "SMA50 sig" ? close[2] < sma(close, 50) :

X_opt == "Fractals sig" ? fr_dnx :

X_opt == "RSI50 sig" ? rsi_f_sell :

X_opt == "Parabolic SAR sig" ? psar_sell :

X_opt == "SuperTrend sig" ? sup_sell :

X_opt == "Price X Kijun sig" ? close < KJ :

X_opt == "Price X Kumo sig" ? close < kumo_low :

X_opt == "Kumo flip sig" ? SA < SB :

X_opt == "Price filtered Kumo flip sig" ? not sasb_x and high < kumo_low :

X_opt == "Chikou X price sig" ? CS < low[(26-1)] :

X_opt == "Chikou X Kumo sig" ? CS < kumo_high[26-1] :

X_opt == "Price X Tenkan sig" ? close < TK :

X_opt == "Tenkan X Kumo sig" ? TK < kumo_low :

X_opt == "Tenkan X Kijun sig" ? TK < KJ :

X_opt == "Kumo filtered Tenkan X Kijun sig" ? not tkkj_x and TK < kumo_low and KJ < kumo_low and TK < KJ :

X_opt == "CB/CS sig" ? short_c :

X_opt == "IB/IS sig" ? short_pic :

X_opt == "B1/S1 sig" ? sell_strong_S1 :

X_opt == "B2/S2 sig" ? sell_strong_S2 : na

if opt_sig_sell

buy_sig := true, sell_sig_opt := false

if opt_sig_buy

sell_sig := true, buy_sig_opt := false

//---------------------------- Take profit and stop loss ------------------------------

tp_en = input(title= "Enable take profit", type= input.bool, defval= false)

qty_tp = input(50, title= "Take profit - quantity of position (percent)", type= input.float, minval= 1, maxval= 100, step= 5)

tp_ticks = input(1000, title= "Take profit - ticks", type= input.integer, minval= 0, step= 10)

sl_en = input(title= "Enable stop loss", type= input.bool, defval= false)

sl_ticks = input(1000, title= "Stop loss - ticks", type= input.integer, minval= 0, step= 10)

//----------------------- Backtest periode --------------------------------

start_year = input(2018, "Start year")

start_month = input(1, "Start month", minval= 1, maxval= 12)

start_day = input(1, "Start day", minval= 1, maxval= 31)

period_start = timestamp(start_year, start_month, start_day, 0, 0)

stop_year = input(2021, "Stop year")

stop_month = input(12, "Stop month", minval= 1, maxval= 12)

stop_day = input(31, "Stop day", minval= 1, maxval= 31)

period_stop = timestamp(stop_year, stop_month, stop_day, 0, 0)

backtest_period() => time >= period_start and time <= period_stop ? true : false

//--------------------- strategy entry ---------------------

long = entry_type != "Short"

short = entry_type != "Long"

not_both = entry_type != "Both"

if not backtest

if long

strategy.entry("os_buy", strategy.long, when = opt_sig_buy and entry_filter_buy_1 and entry_filter_buy_2,

comment= "")

strategy.close("os_buy", when = exit_filter_sell_1 or exit_filter_sell_2 or not_both ? opt_sig_sell : na

, comment= "")

strategy.exit("tpl", "os_buy", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

if short

strategy.entry("os_sell",strategy.short, when = opt_sig_sell and entry_filter_sell_1 and entry_filter_sell_2,

comment= "")

strategy.close("os_sell", when = exit_filter_buy_1 or exit_filter_buy_2 or not_both ? opt_sig_buy : na

, comment= "")

strategy.exit("tps", "os_sell", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

if backtest_period() and backtest

if long

strategy.entry("os_buy", strategy.long, when = opt_sig_buy and entry_filter_buy_1 and entry_filter_buy_2)

strategy.close("os_buy", when = exit_filter_sell_1 or exit_filter_sell_2 or not_both ? opt_sig_sell : na)

strategy.exit("tpl", "os_buy", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

if short

strategy.entry("os_sell",strategy.short, when = opt_sig_sell and entry_filter_sell_1 and entry_filter_sell_2)

strategy.close("os_sell", when = exit_filter_buy_1 or exit_filter_buy_2 or not_both ? opt_sig_buy : na)

strategy.exit("tps", "os_sell", qty_percent= tp_en ? qty_tp : na, profit= tp_en ? tp_ticks : na, loss= sl_en ? sl_ticks : na)

- Stratégie de rupture des bandes de Bollinger

- Stratégie de négociation des moyennes mobiles

- La stratégie du crocodile de Williams

- Stratégie de croisement à double moyenne mobile

- Stratégie d'inversion de tendance à long terme

- Stratégie de tendance haussière persistante à double moyenne mobile croisée

- Stratégie complète de négociation automatisée de moyenne mobile arc-en-ciel

- Stratégie de négociation de filtres à double portée

- Stratégie de rupture dynamique des canaux

- Stratégie de négociation croisée de moyenne mobile dynamique

- Stratégie de rupture de Bollinger

- La stratégie de rupture du RSI de rebond

- Stratégie de l'indice dynamique des traders

- Stratégie d'inversion de l'élan

- Stratégie d'inversion combinée de l'indicateur RSI à moyenne mobile double

- Stratégie transversale de l'EMA

- Stratégie de clôture de position

- Stratégie de suivi du moment

- Stratégie ZVWAP basée sur la distance Z de VWAP

- Tests de retour et optimisation de la stratégie RSI