Stratégie de quantité de flèche de sortie hybride SSL

Auteur:ChaoZhang est là., Date: 2023-12-06 15:54:12 Je vous en prie.Les étiquettes:

Résumé

La stratégie quantitative de flèche de sortie hybride SSL est une stratégie quantitative à court terme basée sur des moyennes mobiles et des indicateurs de prix maximum / minimum. Elle utilise les flèches EXIT de l'indicateur hybride SSL pour déterminer les points d'entrée et de sortie, avec l'indicateur QQE comme filtre, et calcule les positions stop loss et add-on avec l'indicateur ATR. Cette stratégie convient aux investisseurs sensibles à la volatilité du marché et ayant un contrôle strict des risques.

La logique de la stratégie

Cette stratégie utilise les flèches EXIT de l'indicateur hybride SSL pour déterminer les points d'entrée. Au-dessus des flèches EXIT se trouvent les points hauts de l'EXIT, et en dessous se trouvent les points bas de l'EXIT. Un signal de vente est généré lorsque le prix de clôture dépasse le point haut de l'EXIT, et un signal d'achat est généré lorsque le prix de clôture dépasse le point bas de l'EXIT.

Pour améliorer la fiabilité du signal, l'indicateur QQE est introduit comme condition de filtre auxiliaire.

Pour contrôler les risques, cette stratégie utilise des multiples ATR pour calculer les positions stop loss et add-on. Le stop loss pour les positions courtes est le prix de clôture + ATR × 1.8. Le stop loss pour les positions longues est le prix de clôture

Chaque lot de positions additionnelles a son propre stop loss. Le premier lot de 20% de la taille de la position arrête la perte lorsqu'il atteint le niveau de stop loss, tandis que les positions restantes continuent de tenir.

Les avantages

- Profitez des flèches EXIT et maîtrisez efficacement les risques avec un stop loss rapide

- Le filtre QQE améliore la précision du signal

- Utiliser l'indicateur ATR pour calculer les positions de stop loss dynamiques et les positions additionnelles basées sur la volatilité du marché afin d'assurer un contrôle plus précis des risques

- Profitez pleinement des tendances grâce à des positions additionnelles groupées

Les risques

- L'arrêt partiel des pertes de positions rentables peut exposer les positions restantes à un arrêt de perte supplémentaire.

- Les différences de sensibilité à la volatilité du marché entre les flèches EXIT et QQE peuvent provoquer des signaux contradictoires.

- Les positions additionnelles trop agressives sont sujettes à la poursuite des sommets et des bas de dumping.

Directions d'optimisation

- Incorporer des indicateurs fondamentaux tels que le ratio P/B, le ratio P/E et le rendement des dividendes pour les niveaux de prise de profit fondés sur les fondamentaux.

- Ajustez les paramètres QQE pour aligner les signaux avec les flèches EXIT.

- Réduire les ratios additionnels basés sur le sentiment du marché sur différents marchés.

- Tester des ensembles de paramètres optimaux basés sur le recours maximal, les ratios risque-rendement, etc.

Résumé

Cette stratégie utilise les flèches EXIT de l'indicateur hybride SSL comme noyau du signal, avec les indicateurs QQE et ATR comme filtres et pour le stop loss. Le comptage des bénéfices est réalisé par le biais de positions additionnelles groupées. Il s'agit d'une stratégie quantitative à court terme adaptée au suivi des tendances du marché à court terme. La stratégie a des capacités de contrôle de la baisse et d'atténuation des risques, mais des risques tels que les conflits de signaux et la poursuite de sommets / creux doivent être notés.

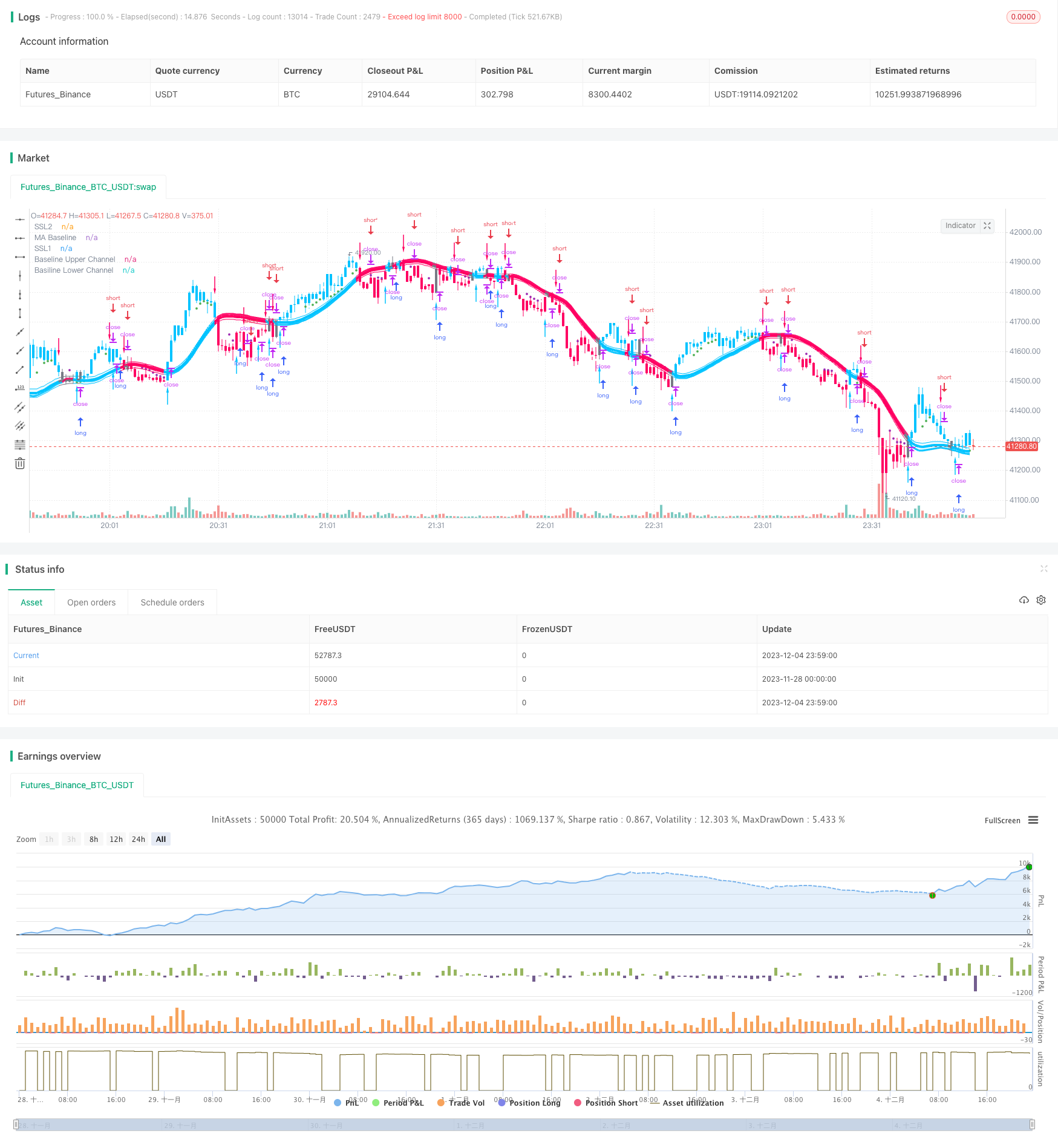

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-05 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

args: [["TradeAmount",2,358374]]

*/

//@version=4

// Strategy based on the SSL Hybrid indicator by Mihkel00

// Designed for the purpose of back testing

// Strategy:

// - Enters both long and short trades based on SSL1 crossing the baseline

// - Stop Loss calculated based on ATR multiplier

// - Take Profit calculated based on 2 ATR multipliers and exits percentage of position on TP1 and TP2

//

// Credits:

// SSL Hybrid Mihkel00 https://www.tradingview.com/u/Mihkel00/

// -------------------------------- SSL HYBRID ---------------------------------

strategy("SSL Exit Arrow Strategy", overlay=true)

show_Baseline = input(title="Show Baseline", type=input.bool, defval=true, group="SSL Hybrid Indicator Settings")

show_SSL1 = input(title="Show SSL1", type=input.bool, defval=true, group="SSL Hybrid Indicator Settings")

show_atr = input(title="Show ATR bands", type=input.bool, defval=false, group="SSL Hybrid Indicator Settings")

//ATR

atrlen = input(14, "ATR Period", group="SSL Hybrid Indicator Settings")

mult = input(1, "ATR Multi", step=0.1, group="SSL Hybrid Indicator Settings")

smoothing = input(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"], group="SSL Hybrid Indicator Settings")

ma_function(source, atrlen) =>

if smoothing == "RMA"

rma(source, atrlen)

else

if smoothing == "SMA"

sma(source, atrlen)

else

if smoothing == "EMA"

ema(source, atrlen)

else

wma(source, atrlen)

atr_slen = ma_function(tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input(title="SSL1 / Baseline Type", type=input.string, defval="HMA", options=["SMA","EMA","DEMA","TEMA","LSMA","WMA","MF","VAMA","TMA","HMA", "JMA", "Kijun v2", "EDSMA","McGinley"], group="SSL Hybrid Indicator Settings")

len = input(title="SSL1 / Baseline Length", defval=60, group="SSL Hybrid Indicator Settings")

SSL2Type = input(title="SSL2 / Continuation Type", type=input.string, defval="JMA", options=["SMA","EMA","DEMA","TEMA","WMA","MF","VAMA","TMA","HMA", "JMA","McGinley"], group="SSL Hybrid Indicator Settings")

len2 = input(title="SSL 2 Length", defval=5, group="SSL Hybrid Indicator Settings")

//

SSL3Type = input(title="EXIT Type", type=input.string, defval="HMA", options=["DEMA","TEMA","LSMA","VAMA","TMA","HMA","JMA", "Kijun v2", "McGinley", "MF"], group="SSL Hybrid Indicator Settings")

len3 = input(title="EXIT Length", defval=15, group="SSL Hybrid Indicator Settings")

src = input(title="Source", type=input.source, defval=close, group="SSL Hybrid Indicator Settings")

//

tema(src, len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

(3 * ema1) - (3 * ema2) + ema3

kidiv = input(defval=1,maxval=4, title="Kijun MOD Divider", group="SSL Hybrid Indicator Settings")

jurik_phase = input(title="* Jurik (JMA) Only - Phase", type=input.integer, defval=3, group="SSL Hybrid Indicator Settings")

jurik_power = input(title="* Jurik (JMA) Only - Power", type=input.integer, defval=1, group="SSL Hybrid Indicator Settings")

volatility_lookback = input(10, title="* Volatility Adjusted (VAMA) Only - Volatility lookback length", group="SSL Hybrid Indicator Settings")

//MF

beta = input(0.8,minval=0,maxval=1,step=0.1, title="Modular Filter, General Filter Only - Beta", group="SSL Hybrid Indicator Settings")

feedback = input(false, title="Modular Filter Only - Feedback", group="SSL Hybrid Indicator Settings")

z = input(0.5,title="Modular Filter Only - Feedback Weighting",step=0.1, minval=0, maxval=1, group="SSL Hybrid Indicator Settings")

//EDSMA

ssfLength = input(title="EDSMA - Super Smoother Filter Length", type=input.integer, minval=1, defval=20, group="SSL Hybrid Indicator Settings")

ssfPoles = input(title="EDSMA - Super Smoother Filter Poles", type=input.integer, defval=2, options=[2, 3], group="SSL Hybrid Indicator Settings")

//----

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = sqrt(2) * PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(arg)

c2 = b1

c3 = -pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

get3PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(1.738 * arg)

c1 = pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ma(type, src, len) =>

float result = 0

if type=="TMA"

result := sma(sma(src, ceil(len / 2)), floor(len / 2) + 1)

if type=="MF"

ts=0.,b=0.,c=0.,os=0.

//----

alpha = 2/(len+1)

a = feedback ? z*src + (1-z)*nz(ts[1],src) : src

//----

b := a > alpha*a+(1-alpha)*nz(b[1],a) ? a : alpha*a+(1-alpha)*nz(b[1],a)

c := a < alpha*a+(1-alpha)*nz(c[1],a) ? a : alpha*a+(1-alpha)*nz(c[1],a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta*b+(1-beta)*c

lower = beta*c+(1-beta)*b

ts := os*upper+(1-os)*lower

result := ts

if type=="LSMA"

result := linreg(src, len, 0)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VAMA" // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid=ema(src,len)

dev=src-mid

vol_up=highest(dev,volatility_lookback)

vol_down=lowest(dev,volatility_lookback)

result := mid+avg(vol_up,vol_down)

if type=="HMA" // Hull

result := wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

if type=="JMA" // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

if type=="Kijun v2"

kijun = avg(lowest(len), highest(len))//, (open + close)/2)

conversionLine = avg(lowest(len/kidiv), highest(len/kidiv))

delta = (kijun + conversionLine)/2

result :=delta

if type=="McGinley"

mg = 0.0

ema = ema(src, len)

mg := na(mg[1]) ? ema : mg[1] + (src - mg[1]) / (len * pow(src/mg[1], 4))

result :=mg

if type=="EDSMA"

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2

? get2PoleSSF(avgZeros, ssfLength)

: get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = stdev(ssf, len)

scaledFilter = stdev != 0

? ssf / stdev

: 0

alpha = 5 * abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true, group="SSL Hybrid Indicator Settings")

multy = input(0.2, step=0.05, title="Base Channel Multiplier", group="SSL Hybrid Indicator Settings")

Keltma = ma(maType, src, len)

range = useTrueRange ? tr : high - low

rangema = ema(range, len)

upperk =Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open*1

close_pos = close*1

difference = abs(close_pos-open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

candlesize_violation = atr_violation and InRange

plotshape(candlesize_violation, color=color.new(color.white, transp=0), size=size.tiny,style=shape.diamond, location=location.top, title="Candle Size > 1xATR")

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//SSL2 VALUES

Hlv2 = int(na)

Hlv2 := close > maHigh ? 1 : close < maLow ? -1 : Hlv2[1]

sslDown2 = Hlv2 < 0 ? maHigh : maLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = crossover(close, sslExit)

base_cross_Short = crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title="Color Bars", type=input.bool, defval=true, group="SSL Hybrid Indicator Settings")

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=color.rgb(0, 195, 255, transp=0), colordown=color.rgb(255, 0, 98, transp=0),title="Exit Arrows", maxheight=20, offset=0)

p1 = plot(show_Baseline ? BBMC : na, color=color.new(color_bar, transp=0), linewidth=4, title='MA Baseline')

DownPlot = plot( show_SSL1 ? sslDown : na, title="SSL1", linewidth=3, color=color.new(color_ssl1, transp=10))

barcolor(show_color_bar ? color_bar : na)

up_channel = plot(show_Baseline ? upperk : na, color=color_bar, title="Baseline Upper Channel")

low_channel = plot(show_Baseline ? lowerk : na, color=color_bar, title="Basiline Lower Channel")

fill(up_channel, low_channel, color=color.new(color_bar, transp=90))

////SSL2 Continiuation from ATR

atr_crit = input(0.9, step=0.1, title="Continuation ATR Criteria", group="SSL Hybrid Indicator Settings")

upper_half = atr_slen * atr_crit + close

lower_half = close - atr_slen * atr_crit

buy_inatr = lower_half < sslDown2

sell_inatr = upper_half > sslDown2

sell_cont = close < BBMC and close < sslDown2

buy_cont = close > BBMC and close > sslDown2

sell_atr = sell_inatr and sell_cont

buy_atr = buy_inatr and buy_cont

atr_fill = buy_atr ? color.green : sell_atr ? color.purple : color.white

LongPlot = plot(sslDown2, title="SSL2", linewidth=2, color=color.new(atr_fill, transp=0), style=plot.style_circles, display=display.none)

u = plot(show_atr ? upper_band : na, "+ATR", color=color.new(color.white, transp=80), display=display.none)

l = plot(show_atr ? lower_band : na, "-ATR", color=color.new(color.white, transp=80), display=display.none)

// ---------------------------- QQE MOD INDICATOR ------------------------------

RSI_Period = input(6, title='RSI Length')

SF = input(5, title='RSI Smoothing')

QQE = input(3, title='Fast QQE Factor')

ThreshHold = input(3, title="Thresh-hold")

rsi_src = input(close, title="RSI Source")

Wilders_Period = RSI_Period * 2 - 1

Rsi = rsi(rsi_src, RSI_Period)

RsiMa = ema(Rsi, SF)

AtrRsi = abs(RsiMa[1] - RsiMa)

MaAtrRsi = ema(AtrRsi, Wilders_Period)

dar = ema(MaAtrRsi, Wilders_Period) * QQE

longband = 0.0

shortband = 0.0

trend = 0

DeltaFastAtrRsi = dar

RSIndex = RsiMa

newshortband = RSIndex + DeltaFastAtrRsi

newlongband = RSIndex - DeltaFastAtrRsi

longband := RSIndex[1] > longband[1] and RSIndex > longband[1] ?

max(longband[1], newlongband) : newlongband

shortband := RSIndex[1] < shortband[1] and RSIndex < shortband[1] ?

min(shortband[1], newshortband) : newshortband

cross_1 = cross(longband[1], RSIndex)

trend := cross(RSIndex, shortband[1]) ? 1 : cross_1 ? -1 : nz(trend[1], 1)

FastAtrRsiTL = trend == 1 ? longband : shortband

////////////////////

length = input(50, minval=1, title="Bollinger Length")

bb_mult = input(0.35, minval=0.001, maxval=5, step=0.1, title="BB Multiplier")

basis = sma(FastAtrRsiTL - 50, length)

dev = bb_mult * stdev(FastAtrRsiTL - 50, length)

upper = basis + dev

lower = basis - dev

rsi_ma_color_bar = RsiMa - 50 > upper ? #00c3ff : RsiMa - 50 < lower ? #ff0062 : color.gray

// Zero cross

QQEzlong = 0

QQEzlong := nz(QQEzlong[1])

QQEzshort = 0

QQEzshort := nz(QQEzshort[1])

QQEzlong := RSIndex >= 50 ? QQEzlong + 1 : 0

QQEzshort := RSIndex < 50 ? QQEzshort + 1 : 0

////////////////////////////////////////////////////////////////

RSI_Period2 = input(6, title='RSI Length')

SF2 = input(5, title='RSI Smoothing')

QQE2 = input(1.61, title='Fast QQE2 Factor')

ThreshHold2 = input(3, title="Thresh-hold")

src2 = input(close, title="RSI Source")

Wilders_Period2 = RSI_Period2 * 2 - 1

Rsi2 = rsi(src2, RSI_Period2)

RsiMa2 = ema(Rsi2, SF2)

AtrRsi2 = abs(RsiMa2[1] - RsiMa2)

MaAtrRsi2 = ema(AtrRsi2, Wilders_Period2)

dar2 = ema(MaAtrRsi2, Wilders_Period2) * QQE2

longband2 = 0.0

shortband2 = 0.0

trend2 = 0

DeltaFastAtrRsi2 = dar2

RSIndex2 = RsiMa2

newshortband2 = RSIndex2 + DeltaFastAtrRsi2

newlongband2 = RSIndex2 - DeltaFastAtrRsi2

longband2 := RSIndex2[1] > longband2[1] and RSIndex2 > longband2[1] ?

max(longband2[1], newlongband2) : newlongband2

shortband2 := RSIndex2[1] < shortband2[1] and RSIndex2 < shortband2[1] ?

min(shortband2[1], newshortband2) : newshortband2

cross_2 = cross(longband2[1], RSIndex2)

trend2 := cross(RSIndex2, shortband2[1]) ? 1 : cross_2 ? -1 : nz(trend2[1], 1)

FastAtrRsi2TL = trend2 == 1 ? longband2 : shortband2

// Zero cross

QQE2zlong = 0

QQE2zlong := nz(QQE2zlong[1])

QQE2zshort = 0

QQE2zshort := nz(QQE2zshort[1])

QQE2zlong := RSIndex2 >= 50 ? QQE2zlong + 1 : 0

QQE2zshort := RSIndex2 < 50 ? QQE2zshort + 1 : 0

hcolor2 = RsiMa2 - 50 > ThreshHold2 ? color.silver :

RsiMa2 - 50 < 0 - ThreshHold2 ? color.silver : na

Greenbar1 = RsiMa2 - 50 > ThreshHold2

Greenbar2 = RsiMa - 50 > upper

Redbar1 = RsiMa2 - 50 < 0 - ThreshHold2

Redbar2 = RsiMa - 50 < lower

qqe_line = FastAtrRsi2TL - 50

qqe_blue_bar = Greenbar1 and Greenbar2 == 1

qqe_red_bar = Redbar1 and Redbar2 == 1

// ----------------------------------STRATEGY ----------------------------------

atr_length = input(title="ATR Length", type=input.integer, defval=14, inline="1", group="Strategy Back Test Settings")

atr = atr(atr_length)

// Back test time range

from_date = input(title="From", type=input.time, defval=timestamp("01 Aug 2021 00:00 +0100"), inline="1", group="Date Range")

to_date = input(title="To", type=input.time, defval=timestamp("01 Sep 2021 00:00 +0100"), inline="1", group="Date Range")

in_date = true

// Strategy entry and exit settings

// Should use SSL as a filter for position side

use_ssl_filter = input(title="SSL Flip as Filter", type=input.bool, defval=false, inline="1", group="Entry Settings")

// Should use SSL as a filter for position side

use_qqe_filter = input(title="QQE MOD as Filter (Please add QQE MOD indicator to your chart separately)", type=input.bool, defval=false, inline="2", group="Entry Settings")

// DCA Settings

dca1_atr_multiplier = input(title="DCA1 ATR Multiplier", type=input.float, defval=0.1, step=0.1, inline="3", group="Entry Settings")

dca1_exit_percentage = input(title="DCA1 Exit Percentage", type=input.integer, defval=20, step=1, maxval=100, inline="3", group="Entry Settings")

dca2_atr_multiplier = input(title="DCA2 ATR Multiplier", type=input.float, defval=0.3, step=0.1, inline="4", group="Entry Settings")

dca2_exit_percentage = input(title="DCA2 Exit Percentage", type=input.integer, defval=40, step=1, maxval=100, inline="4", group="Entry Settings")

dca3_atr_multiplier = input(title="DCA3 ATR Multiplier", type=input.float, defval=0.7, step=0.1, inline="5", group="Entry Settings")

dca3_exit_percentage = input(title="DCA3 Exit Percentage", type=input.integer, defval=40, step=1, maxval=100, inline="5", group="Entry Settings")

// Stop-Loss Settings

sl_atr_multiplier = input(title="SL ATR Multiplier", type=input.float, defval=1.8, step=0.1, inline="2", group="Exit Settings")

var long_sl = float(na)

var long_dca1 = float(na)

var long_dca2 = float(na)

var long_dca3 = float(na)

var short_sl = float(na)

var short_dca1 = float(na)

var short_dca2 = float(na)

var short_dca3 = float(na)

is_open_long = strategy.position_size > 0

is_open_short = strategy.position_size < 0

var in_ssl_long = false

var in_ssl_short = false

var ssl_long_entry = false

var ssl_short_entry = false

var ssl_long_exit = false

var ssl_short_exit = false

var did_prev_bar_ssl_flip = false

ssl_long = use_ssl_filter ? close > sslDown : true

ssl_short = use_ssl_filter ? close < sslDown : true

qqe_long = use_qqe_filter ? (qqe_blue_bar and qqe_line > 0) : true

qqe_short = use_qqe_filter ? (qqe_red_bar and qqe_line < 0) : true

ssl_long_entry := ssl_long and qqe_long and codiff == 1

ssl_short_entry := ssl_short and qqe_short and codiff == -1

ssl_long_exit := codiff == -1

ssl_short_exit := codiff == 1

remaining_percent = 100

var total_tokens = strategy.equity * 0.10 / close

dca1_percent = dca1_exit_percentage <= remaining_percent ? dca1_exit_percentage : remaining_percent

remaining_percent -= dca1_percent

entry_1 = total_tokens * (dca1_percent / 100)

dca2_percent = dca2_exit_percentage <= remaining_percent ? dca2_exit_percentage : remaining_percent

remaining_percent -= dca2_percent

entry_2 = total_tokens * (dca2_percent / 100)

dca3_percent = dca3_exit_percentage <= remaining_percent ? dca3_exit_percentage : remaining_percent

remaining_percent -= dca3_percent

entry_3 = total_tokens * (dca3_percent / 100)

if did_prev_bar_ssl_flip

did_prev_bar_ssl_flip := false

position_value = abs(strategy.position_size * close)

if in_ssl_long

label.new(x=bar_index, y=close, xloc=xloc.bar_index, yloc=yloc.abovebar, text=tostring(position_value), style=label.style_label_down, size=size.tiny)

else

label.new(x=bar_index, y=close, xloc=xloc.bar_index, yloc=yloc.belowbar, text=tostring(position_value), style=label.style_label_up, size=size.tiny)

if ssl_long_exit

strategy.cancel("LongEntry1")

strategy.cancel("LongEntry2")

strategy.cancel("LongEntry3")

strategy.close(id="LongEntry1", comment="Close Long1")

strategy.close(id="LongEntry2", comment="Close Long2")

strategy.close(id="LongEntry3", comment="Close Long3")

in_ssl_long := false

in_ssl_short := false

if ssl_short_exit

strategy.cancel("ShortEntry1")

strategy.cancel("ShortEntry2")

strategy.cancel("ShortEntry3")

strategy.close(id="ShortEntry1", comment="Close Short1")

strategy.close(id="ShortEntry2", comment="Close Short2")

strategy.close(id="ShortEntry3", comment="Close Short3")

in_ssl_long := false

in_ssl_short := false

if ssl_long_entry and in_date and not in_ssl_long

strategy.cancel("LongEntry1")

strategy.cancel("LongEntry2")

strategy.cancel("LongEntry3")

strategy.cancel("ShortEntry1")

strategy.cancel("ShortEntry2")

strategy.cancel("ShortEntry3")

if in_ssl_short

strategy.close(id="ShortEntry1", comment="Close Short1")

strategy.close(id="ShortEntry2", comment="Close Short2")

strategy.close(id="ShortEntry3", comment="Close Short3")

in_ssl_long := true

in_ssl_short := false

did_prev_bar_ssl_flip := true

long_sl := close - (atr * sl_atr_multiplier)

long_dca1 := close - (atr * dca1_atr_multiplier)

long_dca2 := close - (atr * dca2_atr_multiplier)

long_dca3 := close - (atr * dca3_atr_multiplier)

strategy.entry("LongEntry1", strategy.long, limit=long_dca1)

strategy.entry("LongEntry2", strategy.long, limit=long_dca2)

strategy.entry("LongEntry3", strategy.long, limit=long_dca3)

strategy.exit("LongExit1", "LongEntry1", stop=long_sl)

strategy.exit("LongExit2", "LongEntry2", stop=long_sl)

strategy.exit("LongExit3", "LongEntry3", stop=long_sl)

if ssl_short_entry and in_date and not in_ssl_short

strategy.cancel("LongEntry1")

strategy.cancel("LongEntry2")

strategy.cancel("LongEntry3")

strategy.cancel("ShortEntry1")

strategy.cancel("ShortEntry2")

strategy.cancel("ShortEntry3")

if in_ssl_long

strategy.close(id="LongEntry1", comment="Close Long1")

strategy.close(id="LongEntry2", comment="Close Long2")

strategy.close(id="LongEntry3", comment="Close Long3")

in_ssl_short := true

in_ssl_long := false

did_prev_bar_ssl_flip := true

short_sl := close + (atr * sl_atr_multiplier)

short_dca1 := close + (atr * dca1_atr_multiplier)

short_dca2 := close + (atr * dca2_atr_multiplier)

short_dca3 := close + (atr * dca3_atr_multiplier)

strategy.entry("ShortEntry1", strategy.short, limit=short_dca1)

strategy.entry("ShortEntry2", strategy.short, limit=short_dca2)

strategy.entry("ShortEntry3", strategy.short, limit=short_dca3)

strategy.exit("ShortExit1", "ShortEntry1", stop=short_sl)

strategy.exit("ShortExit2", "ShortEntry2", stop=short_sl)

strategy.exit("ShortExit3", "ShortEntry3", stop=short_sl)

- Tendance à la suite de la stratégie avec l'EMA

- Stratégie quantitative de la barre de changement en pourcentage de double renversement

- Retour des bandes de Bollinger avec filtre de tendance MA

- Stratégie de négociation quantitative basée sur les indicateurs de risque

- Stratégie de négociation croisée sur plusieurs moyennes mobiles

- Stratégie de croisement des moyennes mobiles

- Stratégie de rupture automatique de la S/R

- Stratégie d'ouverture et de clôture du canal de prix de dynamique

- Amélioration de la stratégie transversale des moyennes mobiles avec orientation des tendances du marché

- Stratégie de négociation dynamique de la grande ligne Yang

- Stratégie de chronométrage de la moyenne mobile ADX double

- Stratégie de déclin de la tendance de l'indice BB en pourcentage

- La stratégie de négociation de la tortue de Bollinger

- Stratégie de l'indicateur de volatilité de la bourse

- Stratégie croisée des moyennes mobiles des bénéfices de 1%

- Stratégie de négociation croisée des moyennes mobiles quantitatives pondérées

- stratégie d'indicateur RSI auxiliaire multiple

- Stratégie de tendance croisée à moyenne mobile double

- Stratégie de renversement des bandes de Bollinger

- Une stratégie de tendance adaptative ATR-ADX V2