Stratégie de trading bidirectionnelle avec croisement de moyennes mobiles

Aperçu

Cette stratégie est une stratégie typique de croisement de moyennes mobiles en calculant des moyennes mobiles de différentes périodes et en émettant des signaux de négociation lorsque les moyennes mobiles de périodes plus longues traversent les moyennes mobiles de périodes plus courtes. La stratégie prend en charge à la fois les hausses et les baisses, permettant des transactions bidirectionnelles.

Principe de stratégie

La stratégie utilise trois moyennes mobiles de 8 cycles, 13 cycles et 21 cycles, dont 8 cycles sont des cycles plus courts et 21 cycles sont des cycles plus longs. Un signal de plus est généré lorsque la ligne de 8 cycles traverse la ligne de 21 cycles. Un signal de vide est généré lorsque la ligne de 8 cycles traverse la ligne de 21 cycles.

Lors de l’exécution de transactions spécifiques, la stratégie ajoute également une condition de jugement pour éviter que les transactions ne soient couvertes en cas de courbe. Par exemple, les ordres ne sont passés que lorsque le prix de clôture de la ligne K est supérieur au point de jonction de la ligne de commande ou inférieur à celui de la ligne de commande. Cela peut filtrer efficacement certains faux signaux.

Avantages stratégiques

- L’application du principe de croisement des moyennes mobiles permet de suivre efficacement les tendances du marché

- Les conditions de filtrage des transactions ont été mises en place pour filtrer certains faux signaux et éviter les pièges.

- Le soutien aux échanges bilatéraux permet de tirer profit de la baisse du marché

- Le croisement des moyennes mobiles interpériodiques permet de capturer le décalage entre les plus grands niveaux

- La logique de la stratégie est simple et claire, facile à comprendre et à modifier et à optimiser

Risque stratégique

- Des défaillances et de nombreux faux signaux peuvent survenir en cas de tremblement de terre important.

- Si vous ne pouvez pas juger les choses en temps normal, vous risquez de rater des opportunités.

- Le retard de la jugemnt intercyclique peut ne pas permettre de saisir en temps opportun les retournements de tendance à court terme.

- Les paramètres doivent être ajustés en fonction des fluctuations des prix sans tenir compte de l’influence de la volatilité des actions

- Il n’y a pas de stop loss, il y a un risque de perte illimitée.

Les solutions au risque

- Éviter l’impact du choc en combinant avec d’autres indicateurs

- Réduire les cycles de moyenne mobile et améliorer la sensibilité au jugement

- Adhésion à un mécanisme d’arrêt des pertes, contrôle strict des risques de transaction et retrait des bénéfices

Direction d’optimisation

- L’efficacité est améliorée par la combinaison d’autres indicateurs techniques tels que MACD, KDJ et autres.

- Tester l’impact des différents paramètres sur l’efficacité globale de la stratégie

- Paramètres d’adaptation définis en fonction du type de marché et de la volatilité

- Optimisation du calcul des moyennes mobiles avec des indicateurs tels que DEMA, ZLEMA

- Ajout d’une logique d’arrêt de perte

- Optimisation des indicateurs de retour de mesure quantitative et détermination des paramètres optimaux

Résumer

La stratégie a une conception globale claire, qui permet de déterminer les relations de tendance à long terme et à court terme par une simple et efficace croisement des moyennes mobiles, de saisir les opportunités de rotation. La stratégie peut être négociée dans les deux sens, tout en étant facile à comprendre et à optimiser. Mais il existe également des risques qui nécessitent une amélioration supplémentaire, tels que l’incapacité de traiter efficacement des situations spécifiques et le manque de contrôle des risques de transaction.

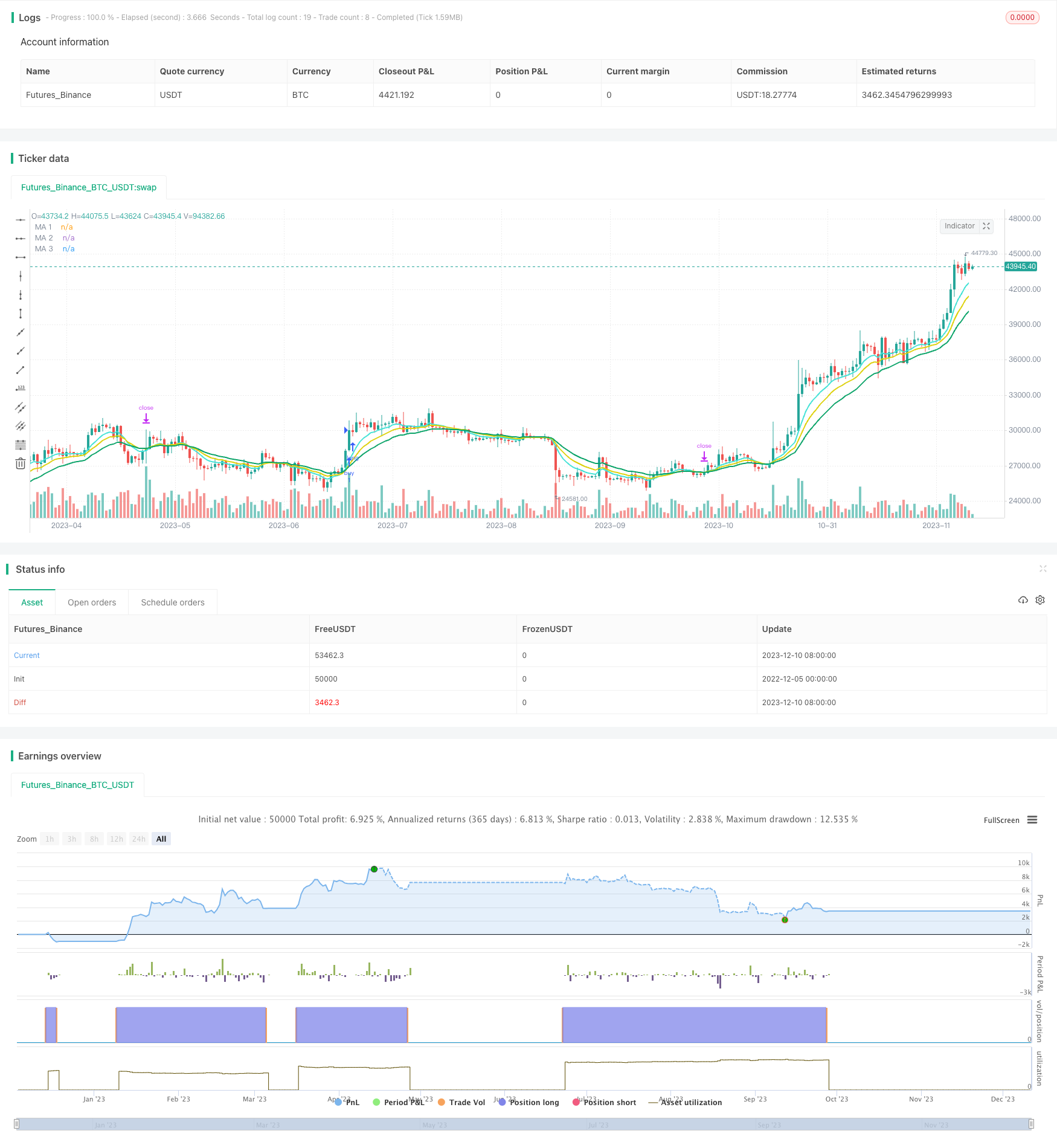

/*backtest

start: 2022-12-05 00:00:00

end: 2023-12-11 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//Converted to strategy by shawnteoh

strategy(title = "MA Emperor insiliconot Strategy" , overlay=true, pyramiding=1, precision=8)

strat_dir_input = input(title="Strategy Direction", defval="long", options=["long", "short", "all"])

strat_dir_value = strat_dir_input == "long" ? strategy.direction.long : strat_dir_input == "short" ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(strat_dir_value)

// Testing start dates

testStartYear = input(2020, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

//Stop date if you want to use a specific range of dates

testStopYear = input(2030, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(30, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

// Order size

orderQty = input(1, "Order quantity", type = float)

// Plot indicator

plotInd = input(false, "Plot indicators?", type = bool)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

haClose = close

haOpen = open

haHigh = high

haLow = low

haClose := (open + high + low + close) / 4

haOpen := (nz(haOpen[1]) + nz(haClose[1])) / 2

haHigh := max(high, max(haOpen, haClose))

haLow := min(low , min(haOpen, haClose))

ssrc = close

ha = false

o = ha ? haOpen : open

c = ha ? haClose : close

h = ha ? haHigh : high

l = ha ? haLow : low

ssrc := ssrc == close ? ha ? haClose : c : ssrc

ssrc := ssrc == open ? ha ? haOpen : o : ssrc

ssrc := ssrc == high ? ha ? haHigh : h : ssrc

ssrc := ssrc == low ? ha ? haLow : l : ssrc

ssrc := ssrc == hl2 ? ha ? (haHigh + haLow) / 2 : hl2 : ssrc

ssrc := ssrc == hlc3 ? ha ? (haHigh + haLow + haClose) / 3 : hlc3 : ssrc

ssrc := ssrc == ohlc4 ? ha ? (haHigh + haLow + haClose+ haOpen) / 4 : ohlc4 : ssrc

type = input(defval = "EMA", title = "Type", options = ["Butterworth_2Pole", "DEMA", "EMA", "Gaussian", "Geometric_Mean", "LowPass", "McGuinley", "SMA", "Sine_WMA", "Smoothed_MA", "Super_Smoother", "Triangular_MA", "Wilders", "Zero_Lag"])

len1=input(8, title ="MA 1")

len2=input(13, title = "MA 2")

len3=input(21, title = "MA 3")

len4=input(55, title = "MA 4")

len5=input(89, title = "MA 5")

lenrib=input(120, title = "IB")

lenrib2=input(121, title = "2B")

lenrib3=input(200, title = "21b")

lenrib4=input(221, title = "22b")

onOff1 = input(defval=true, title="Enable 1")

onOff2 = input(defval=true, title="Enable 2")

onOff3 = input(defval=true, title="Enable 3")

onOff4 = input(defval=false, title="Enable 4")

onOff5 = input(defval=false, title="Enable 5")

onOff6 = input(defval=false, title="Enable 6")

onOff7 = input(defval=false, title="Enable 7")

onOff8 = input(defval=false, title="Enable x")

onOff9 = input(defval=false, title="Enable x")

gauss_poles = input(3, "*** Gaussian poles ***", minval = 1, maxval = 14)

linew = 2

shapes = false

variant_supersmoother(src,len) =>

Pi = 2 * asin(1)

a1 = exp(-1.414* Pi / len)

b1 = 2*a1*cos(1.414* Pi / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src, len) =>

price = src

l = (len - 1) / 2

d = (price + (price - price[l]))

z = ema(d, len)

z

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_WiMA(src, length) =>

MA_s= nz(src)

MA_s:=(src + nz(MA_s[1] * (length-1)))/length

MA_s

fact(num)=>

a = 1

nn = num <= 1 ? 1 : num

for i = 1 to nn

a := a * i

a

getPoles(f, Poles, alfa)=>

filt = f

sign = 1

results = 0 + n//tv series spoofing

for r = 1 to max(min(Poles, n),1)

mult = fact(Poles) / (fact(Poles - r) * fact(r))

matPo = pow(1 - alfa, r)

prev = nz(filt[r-1],0)

sum = sign * mult * matPo * prev

results := results + sum

sign := sign * -1

results := results - n

results

variant_gauss(Price, Lag, Poles)=>

Pi = 2 * asin(1)

beta = (1 - cos(2 * Pi / Lag)) / ( pow (sqrt(2), 2.0 / Poles) - 1)

alfa = -beta + sqrt(beta * beta + 2 * beta)

pre = nz(Price, 0) * pow(alfa, Poles)

filter = pre

result = n > 0 ? getPoles(nz(filter[1]), Poles, alfa) : 0

filter := pre + result

variant_mg(src, len)=>

mg = 0.0

mg := na(mg[1]) ? ema(src, len) : mg[1] + (src - mg[1]) / (len * pow(src/mg[1], 4))

mg

variant_sinewma(src, length) =>

PI = 2 * asin(1)

sum = 0.0

weightSum = 0.0

for i = 0 to length - 1

weight = sin(i * PI / (length + 1))

sum := sum + nz(src[i]) * weight

weightSum := weightSum + weight

sinewma = sum / weightSum

sinewma

variant_geoMean(price, per)=>

gmean = pow(price, 1.0/per)

gx = for i = 1 to per-1

gmean := gmean * pow(price[i], 1.0/per)

gmean

ggx = n > per? gx : price

ggx

variant_butt2pole(pr, p1)=>

Pi = 2 * asin(1)

DTR = Pi / 180

a1 = exp(-sqrt(2) * Pi / p1)

b1 = 2 * a1 * cos(DTR * (sqrt(2) * 180 / p1))

cf1 = (1 - b1 + a1 * a1) / 4

cf2 = b1

cf3 = -a1 * a1

butt_filt = pr

butt_filt := cf1 * (pr + 2 * nz(pr[1]) + nz(pr[2])) + cf2 * nz(butt_filt[1]) + cf3 * nz(butt_filt[2])

variant_lowPass(src, len)=>

LP = src

sr = src

a = 2.0 / (1.0 + len)

LP := (a - 0.25 * a * a) * sr + 0.5 * a * a * nz(sr[1]) - (a - 0.75 * a * a) * nz(sr[2]) + 2.0 * (1.0 - a) * nz(LP[1]) - (1.0 - a) * (1.0 - a) * nz(LP[2])

LP

variant_sma(src, len) =>

sum = 0.0

for i = 0 to len - 1

sum := sum + src[i] / len

sum

variant_trima(src, length) =>

len = ceil((length + 1) * 0.5)

trima = sum(sma(src, len), len)/len

trima

variant(type, src, len) =>

type=="EMA" ? ema(src, len) :

type=="LowPass" ? variant_lowPass(src, len) :

type=="Linreg" ? linreg(src, len, 0) :

type=="Gaussian" ? variant_gauss(src, len, gauss_poles) :

type=="Sine_WMA" ? variant_sinewma(src, len) :

type=="Geometric_Mean" ? variant_geoMean(src, len) :

type=="Butterworth_2Pole" ? variant_butt2pole(src, len) :

type=="Smoothed_MA" ? variant_smoothed(src, len) :

type=="Triangular_MA" ? variant_trima(src, len) :

type=="McGuinley" ? variant_mg(src, len) :

type=="DEMA" ? variant_doubleema(src, len):

type=="Super_Smoother" ? variant_supersmoother(src, len) :

type=="Zero_Lag" ? variant_zerolagema(src, len) :

type=="Wilders"? variant_WiMA(src, len) : variant_sma(src, len)

c1=#44E2D6

c2=#DDD10D

c3=#0AA368

c4=#E0670E

c5=#AB40B2

cRed = #F93A00

ma1 = variant(type, ssrc, len1)

ma2 = variant(type, ssrc, len2)

ma3 = variant(type, ssrc, len3)

ma4 = variant(type, ssrc, len4)

ma5 = variant(type, ssrc, len5)

ma6 = variant(type, ssrc, lenrib)

ma7 = variant(type, ssrc, lenrib2)

ma8 = variant(type, ssrc, lenrib3)

ma9 = variant(type, ssrc, lenrib4)

col1 = c1

col2 = c2

col3 = c3

col4 = c4

col5 = c5

p1 = plot(onOff1 ? ma1 : na, title = "MA 1", color = col1, linewidth = linew, style = linebr)

p2 = plot(onOff2 ? ma2 : na, title = "MA 2", color = col2, linewidth = linew, style = linebr)

p3 = plot(onOff3 ? ma3 : na, title = "MA 3", color = col3, linewidth = linew, style = linebr)

p4 = plot(onOff4 ? ma4 : na, title = "MA 4", color = col4, linewidth = linew, style = linebr)

p5 = plot(onOff5 ? ma5 : na, title = "MA 5", color = col5, linewidth = linew, style = linebr)

p6 = plot(onOff6 ? ma6 : na, title = "MA 6", color = col5, linewidth = linew, style = linebr)

p7 = plot(onOff7 ? ma7 : na, title = "MA 7", color = col5, linewidth = linew, style = linebr)

p8 = plot(onOff8 ? ma8 : na, title = "MA 8", color = col5, linewidth = linew, style = linebr)

p9 = plot(onOff9 ? ma9 : na, title = "MA 9", color = col5, linewidth = linew, style = linebr)

longCond = crossover(ma2, ma3)

if longCond and testPeriod()

strategy.entry("buy", strategy.long, qty = orderQty, when = open > ma2[1])

shortCond = crossunder(ma2, ma3)

if shortCond and testPeriod()

strategy.entry("sell", strategy.short, qty = orderQty, when = open < ma2[1])

plotshape(series=plotInd? longCond : na, title="P", style=shape.triangleup, location=location.belowbar, color=green, text="P", size=size.small)

plotshape(series=plotInd? shortCond : na, title="N", style=shape.triangledown, location=location.abovebar, color=red, text="N", size=size.small)