Stratégie d'indicateur d'indice Dynamic Traders

Aperçu

La stratégie est basée sur l’indicateur dynamique des traders (TDI) et l’indicateur du canal d’action des prix (PAC), combiné avec le canal de la ceinture de Brin, l’indicateur relativement fort (RSI) et l’indicateur MACD, pour réaliser un système de suivi des tendances.

Cette stratégie est principalement utilisée pour détecter les tendances et générer des signaux de négociation en cas de changement majeur dans la direction des tendances. Elle intègre plusieurs indicateurs visant à améliorer le taux de répétition des signaux et la qualité des signaux.

Principe de stratégie

Le cœur de la stratégie est l’indicateur TDI. L’indicateur TDI est composé de plusieurs sous-indicateurs superposés, principalement:

- Indice de force relative (RSI): la force ou la faiblesse du prix de réaction

- Le canal de la ceinture de Brin: gamme de fluctuations des prix de réaction

- Ligne de prix RSI: moyenne mobile simple du RSI, qui reflète la tendance du RSI

- Ligne de signaux de trading RSI: autre moyenne mobile simple du RSI utilisée pour générer des signaux de trading

Il y a un signal d’achat lorsque la ligne de prix RSI et la ligne de signal de transaction RSI apparaissent dans le croisement de l’or et du cuivre; il y a un signal de vente lorsque les deux lignes apparaissent dans le croisement de la mort et du cuivre. Un signal de transaction traversant la ligne médiane produit également un signal plus faible.

En outre, la stratégie intègre l’indicateur de la chaîne d’action des prix. L’indicateur calcule la chaîne de prix en fonction des prix les plus élevés et les plus bas de la période.

Pour filtrer les signaux erronés, la stratégie a également introduit l’indicateur MACD. Un signal d’entrée est déclenché uniquement lorsque la couleur de la colonne MACD correspond à la direction du signal de négociation.

Avantages stratégiques

La stratégie a pour avantage de combiner plusieurs indicateurs par rapport à un seul:

- L’indicateur TDI est plus sensible aux changements de tendance

- Les courants d’action des prix reflètent clairement les supports et les tensions

- Le MACD peut filtrer efficacement les fausses informations

De plus, les TDI sont plus sensibles aux retournements de tendance que les indicateurs de suivi de tendance tels que les moyennes mobiles, ce qui réduit les pertes inutiles.

La stratégie peut également être adaptée à différents environnements de marché avec des paramètres.

Risque stratégique

- Plus d’indicateurs superposés et des paramètres complexes à régler

- La fréquence des transactions peut être trop élevée, ce qui augmente les coûts de transaction et le risque de glissement

- La détection inverse n’est pas 100% précise et peut passer à côté d’une tendance à la poursuite d’une même direction

- Les changements de prix dans les transactions physiques sont plus complexes que les retracements, et les effets des signaux sont plus difficiles à reproduire.

Il est possible de réduire les pertes individuelles en élargissant la marge de stop-loss. La combinaison de paramètres d’optimisation améliore la qualité du signal. La libéralisation appropriée des conditions d’entrée réduit la fréquence des transactions.

Direction d’optimisation

- Adapter les paramètres du TDI pour trouver la meilleure combinaison

- Adaptation de la longueur du canal d’action sur les prix et optimisation de la détection des résistances de soutien

- Modifier les paramètres MACD pour optimiser le filtrage des entrées

- Ajout d’une stratégie de gestion de position et de stop-loss mobile

Résumer

Cette stratégie utilise de multiples indicateurs pour évaluer les tendances et les opportunités de revirement. Elle peut être adaptée aux différentes variétés par paramètres. Elle a une certaine valeur de combat, mais l’efficacité du signal est encore un peu difficile.

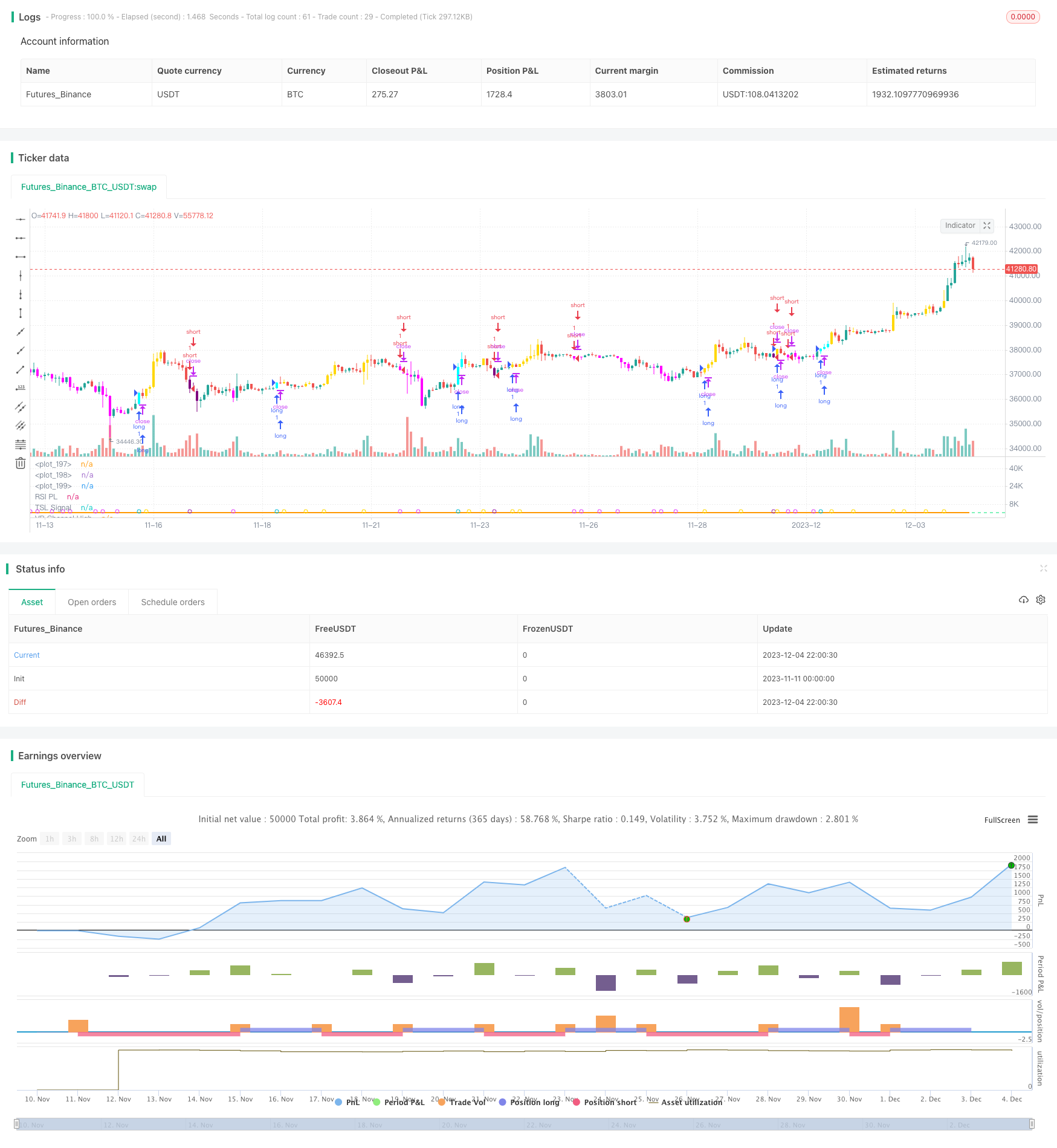

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-05 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

strategy("[BACKTEST]Traders Dynamic Index Indicator Alert by JustUncleL", shorttitle="[BACKTEST]TDIALT")

//

// author: JustUncleL

// date: 10-Oct-2019

//

// Description:

// This script is a "strategy" version of the "Traders Dynamic Index Indicator Alert v0.1 by JustUncleL"

// made available for backtesting to help optimize settings.

//

// This is a Trend following system utilising the Traders Dynamic Index (TDI),

// Price Action Channel (PAC) and Heikin Ashi candles.

// About while ago I came across the use of TDI in "E.A.S.Y. Method" that I found in

// forexfactory forums: http://www.forexfactory.com/attachment.php?attachmentid=686629&d=1303831008

// and I was able to set up a chart based on the specifications by using Kurbelklaus scripts.

// However, I found that the alerts were being generated one or two bars too late,

// so I was not successful using it with Binary Options. Later I found a variation of the

// method in the forums which generates alerts a bit earlier, so this indicator is a

// variation of that early detection version.

// The indicator can optionally use Heikin Ashi candles only for all it's calculations,

// I would recommend viewing the chart with normal Heikin Ashi candles, these

// smooth out the trends and makes them more visible.

//

// I found that this metod it works OK with currency pairs or commodities.

// It also seems to work well with 5min+ timeframe charts,

// and for Binary Options I would suggest expiry of 2 to 6 candles.

//

// ALERT GENERATION:

// =================

//

// The TDI (Traders Dynamic Index)

// -------------------------------

// Volatility Band VB(34), color: Blue, buffer: UpZone, DnZone

// Relative Strength Index RSI(13)

// RSI PRICE LINE (2), color: Green, buffer: mab

// RSI TRADE SIGNAL LINE (7), color: Red, buffer: mbb

// MARKET BASE LINE MID VB(34), color: Orange, buffer: mid

//

// Indicator SignalLevels:

// -----------------------

// RSI_OversoldLevel : 22 (normally: 32)

// RSI_OverboughtLevel : 78 (normally: 68)

//

// Alert Conditions:

// -----------------

// Strong Buy (yellow): HIGH>PAC upper && BULL Candle && Candle High>PAC High && RSI>TRADE SIGNAL LINE && RSI>RSI_OversoldLevel &&

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE> MARKET BASE LINE

// Medium Buy (aqua): HIGH>PAC upper && BULL Candle && Candle High>PAC High && RSI>TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && RSI> MARKET BASE LINE && TRADE SIGNAL LINE< MARKET BASE LINE

// Weak Buy (blue): HIGH>PAC upper && BULL Candle && Candle High>PAC High && RSI>TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE<MARKET BASE LINE && RSI< MARKET BASE LINE

//

// Strong Sell (fuchsia): LOW<PAC lower && BEAR Candle && Candle Low>PAC Low && RSI<TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE< MARKET BASE LINE

// Medium Sell (purple): LOW<PAC lower && BEAR Candle && Candle Low>PAC Low && RSI<TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && RSI< MARKET BASE LINE && TRADE SIGNAL LINE> MARKET BASE LINE

// Weak Sell (black): LOW<PAC lower && BEAR Candle && Candle Low>PAC Low && RSI<TRADE SIGNAL LINE && RSI>RSI_OversoldLevel

// && RSI<RSI_OverboughtLevel && TRADE SIGNAL LINE> MARKET BASE LINE && RSI> MARKET BASE LINE

//

// HIGH LEVEL FILTER (Overbought): RSI>=RSI_OverboughtLevel or MACD Histogram not green

// LOW LEVEL FILTER (Oversold): RSI<=RSI_OversoldLevel or MACD Histogram not red

//

// Hints on How to use:

// --------------------

// - When a Medium or Strong alert is generated and MACD histogram colour matches the direction

// of the alert, then place trade in direction of alert candle and MACD.

// - Use the multi-Hull MA's for trend direction confirmation.

// - Best positions occur near the MACD(8,16,1) Histogram crossing the zero line.

// - The optional coloured Dots along the bottom of the indicator represent the first alert

// of this type that was generated in this sequence.

// - It is advisable to trade in the direction of the main trend as indicated the HULL MA red cloud:

// if red cloud underneath PAC then BULLISH trend, if red cloud above PAC then BEARISH trend.

// - Selecting the HeiKin Ashi candles does affect the MACD and MA caculations, so if you select

// normal candles the result chart will change. Although the TDI calculations and alerts will stay the

// same.

// - When using the Heikin Ashi candles, a good buy entry is indicated by long top wick and no bottom wick

// for bull (green) candles and good sell entry is indicated by long bottom wick and no top wick for

// bear (red) candles.

// - When the MACD histogram is flat and close to zero line,

// this indicates a ranging market, do NOT trade when this occurs.

// - When the PAC channel on the main chart is spread apart widely, this is an indication

// of extreme volitity and choppy chart, do NOT try to trade during these periods.

// A choppy chart is also indicated by Heikin Ashi candles with long wicks on both sides

// of the candles.

// - You can specify what strength level Alerts are generated (default 2):

// Level (1) means only generate Strong Alerts only.

// Level (2) means generate Strong and Medium Alerts.

// Level (3) means generate Strong, Medium and Weak Alerts.

//

// Modifications:

// --------------

// 11-Oct-2019

// - Strategy Version for backtesting created.

// - Converted to Pinescript V4

//

// 1.3 7-Aug-2017

// - Modified Alertcondition code so that it only signals on the last completed alerted

// candle. This should prevent some false alerts and multiple alerts being generated.

// When setting alarms I suggest using Frequency "Once per bar (on condition)" to get

// the earliest signal possible.

// - Added optional alert long/short spikes that only occur on the first Long or Short// Original code @author LazyBear for basic TDI indicator.

// signals.

// 1.2 5-Aug-2017:

// - Added new alerts for Buy and Sell (Long and Short) signals seperately.

// - Upgraded to version 3 Pinescript.

// - Added work around patch for opaque bar colouring issue.

//

// 1.1 - Modified code so when viewing Top chart with Heikin Ashi candles, calculations

// are still based on standard candles, unless Heikin Ashi calculation option selected.

//

// 0.2 - Simplified MACD direction calculation to use just rising/falling.

// 0.1 - Oroginal Version

// References:

// -----------

// Traders Dynamic Index [LazyBear]

// KK_Traders Dynamic Index_Bar Highlighting by Kurbelklaus

// KK_Price Action Channel (TDI BH) by Kurbelklaus

// http://www.forexfactory.com/attachment.php?attachmentid=686629&d=1303831008

// http://www.forexstrategiesresources.com/trading-system-metatrader-4-iv/504-traders-dynamic-index-how-to-use/

// http://www.forexfactory.com/showthread.php?t=460148

// http://www.forexstrategiesresources.com/scalping-forex-strategies-ii/205-scalping-with-tdi-real-macd-stochrainbow/

//

// -----------------------------------------------------------------------------

// Copyright 2016, 2017, 2019 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

//

lengthrsi = input(13)

lengthband = input(34)

lengthrsipl = input(2)

lengthtradesl = input(7)

lenH = input(5, minval=1, title="Price Action Channel Length")

lenL = lenH

rsiOSL = input(22, minval=0, maxval=49, title="RSI Oversold Level")

rsiOBL = input(78, minval=51, maxval=100, title="RSI Overbought Level")

strength = input(2, minval=1, maxval=3, step=1, title="Strength Level: (1)Strong (2)Medium (3)All")

sgb = input(false, title="Check Box To Turn Bars Gray")

sbr = input(true, title="Highlight TDI Alert Bars")

sal = input(true, title="Show Alert Condition Status")

uha = input(false, title="Use Heikin Ashi Candles for Calculations")

//

// Constants colours that include fully non-transparent option.

blue100 = #0000FFFF

aqua100 = #00FFFFFF

fuchsia100 = #FF00FFFF

purple100 = #800080FF

gray100 = #808080FF

gold100 = #FFD700FF

white100 = #FFFFFFFF

black100 = #000000FF

gold = #FFD700

// Use only Heikinashi Candles for all calculations or use Standard Candles for calculations.

security_1 = security(heikinashi(syminfo.tickerid), timeframe.period, close)

security_2 = security(syminfo.ticker, timeframe.period, close)

srcClose = uha ? security_1 : security_2

security_3 = security(heikinashi(syminfo.tickerid), timeframe.period, open)

security_4 = security(syminfo.ticker, timeframe.period, open)

srcOpen = uha ? security_3 : security_4

security_5 = security(heikinashi(syminfo.tickerid), timeframe.period, high)

security_6 = security(syminfo.ticker, timeframe.period, high)

srcHigh = uha ? security_5 : security_6

security_7 = security(heikinashi(syminfo.tickerid), timeframe.period, low)

security_8 = security(syminfo.ticker, timeframe.period, low)

srcLow = uha ? security_7 : security_8

//

r = rsi(srcClose, lengthrsi)

ma = sma(r, lengthband)

offs = 1.6185 * stdev(r, lengthband)

upZone = ma + offs

dnZone = ma - offs

mid = (upZone + dnZone) / 2

mab = sma(r, lengthrsipl)

mbb = sma(r, lengthtradesl)

//

hline(rsiOSL, color=color.red, linewidth=1)

hline(50, color=color.black, linewidth=1)

hline(rsiOBL, color=color.lime, linewidth=1)

// Plot the TDI

upl = plot(upZone, color=color.blue, title="VB Channel High", linewidth=2)

dnl = plot(dnZone, color=color.blue, title="VB Channel Low", linewidth=2)

midl = plot(mid, color=color.orange, linewidth=2, title="MBL")

mabl = plot(mab, color=color.green, linewidth=2, title="RSI PL")

mbbl = plot(mbb, color=color.red, linewidth=2, title="TSL Signal")

//

//create RSI TSL cloud to indicate trend direction.

fill(mabl, mbbl, color=mab > mbb ? color.green : color.red, transp=90)

// Calculate Price Action Channel (PAC)

smmaH = 0.0

smmaL = 0.0

sma_1 = sma(srcHigh, lenH)

smmaH := na(smmaH[1]) ? sma_1 : (smmaH[1] * (lenH - 1) + srcHigh) / lenH

sma_2 = sma(srcLow, lenL)

smmaL := na(smmaL[1]) ? sma_2 : (smmaL[1] * (lenL - 1) + srcLow) / lenL

//

umacd = input(false, title="Use MACD Filtering")

fastMA = input(title="MACD Fast MA Length", type=input.integer, defval=8, minval=2)

slowMA = input(title="MACD Slow MA Length", type=input.integer, defval=16, minval=7)

signal = input(title="MACD Signal Length", type=input.integer, defval=1, minval=1)

//

//

[currMacd, _, _] = macd(srcClose[0], fastMA, slowMA, signal)

rising_1 = rising(currMacd, 2)

falling_1 = falling(currMacd, 2)

macdH = currMacd > 0 ? rising_1 ? color.green : color.red :

falling_1 ? color.red : color.green

//

// Bar - Highlighting based on indication strength

long = (not umacd or macdH == color.green) and mab > mbb and mab < rsiOBL and

mab > rsiOSL and srcHigh > smmaH and srcClose > srcOpen ?

mbb > mid ? 1 : mab > mid and mbb < mid ? 2 : mab < mid and mbb < mid ? 3 : 0 : 0

short = (not umacd or macdH == color.red) and mab < mbb and mab < rsiOBL and

mab > rsiOSL and srcLow < smmaL and srcClose < srcOpen ?

mbb < mid ? 1 : mab < mid and mbb > mid ? 2 : mab > mid and mbb > mid ? 3 : 0 : 0

//

// Find the right Bar colour if enabled.

bcolor = not sbr ? na : long == 1 ? gold100 :

long == 2 and strength > 1 ? aqua100 : long == 3 and strength > 2 ? blue100 :

short == 1 ? fuchsia100 : short == 2 and strength > 1 ? purple100 :

short == 3 and strength > 2 ? black100 : sgb ? gray100 : na

//

barcolor(color=bcolor, title="Bars Colours")

//

//

// === ALERT conditions

//

// create alerts only once per sequence type.

//

longCond = long > 0 and long != long[1] and long <= strength

shortCond = short > 0 and short != short[1] and short <= strength

// show dot only when alert condition is met and bar closed.

plotshape(sal and (longCond[1] or shortCond[1]), title="Alert Indicator", location=location.bottom,

color=long[1] == 1 ? gold : long[1] == 2 ? color.aqua : long[1] == 3 ? color.blue : short[1] == 1 ? color.fuchsia : short[1] == 2 ? color.purple : short[1] == 3 ? color.black : na,

transp=0, style=shape.circle, offset=-1)

//

// === /ALERT conditions.

// === STRATEGY ===

tradeType = input("BOTH", title="What trades should be taken : ", options=["LONG", "SHORT", "BOTH", "NONE"])

// stop loss

slPoints = input(defval=0, title="Initial Stop Loss Points (zero to disable)", minval=0)

tpPoints = input(defval=0, title="Initial Target Profit Points (zero for disable)", minval=0)

//>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>//

testStartYear = input(2018, "Backtest Start Year", minval=1980)

testStartMonth = input(1, "Backtest Start Month", minval=1, maxval=12)

testStartDay = input(1, "Backtest Start Day", minval=1, maxval=31)

testPeriodStart = timestamp(testStartYear, testStartMonth, testStartDay, 0, 0)

testStopYear = input(9999, "Backtest Stop Year", minval=1980)

testStopMonth = input(12, "Backtest Stop Month", minval=1, maxval=12)

testStopDay = input(31, "Backtest Stop Day", minval=1, maxval=31)

testPeriodStop = timestamp(testStopYear, testStopMonth, testStopDay, 0, 0)

testPeriod() =>

time >= testPeriodStart and time <= testPeriodStop ? true : false

//<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<<//

//

//set up exit parameters

TP = tpPoints > 0 ? tpPoints : na

SL = slPoints > 0 ? slPoints : na

// Make sure we are within the bar range, Set up entries and exit conditions

if testPeriod() and tradeType != "NONE"

strategy.entry("long", strategy.long, when=longCond == true and tradeType != "SHORT")

strategy.entry("short", strategy.short, when=shortCond == true and tradeType != "LONG")

strategy.close("long", when=shortCond == true and tradeType == "LONG")

strategy.close("short", when=longCond == true and tradeType == "SHORT")

strategy.exit("XL", from_entry="long", profit=TP, loss=SL)

strategy.exit("XS", from_entry="short", profit=TP, loss=SL)

// === /STRATEGY ===

//EOF