概述

本策略运用双指数平均线指标判断市场趋势方向,结合布林带指标判断超买超卖现象,实现低买高卖,获利退出。

策略原理

本策略使用双指数平均线判断市场总体走势,布林带判断具体入场时机。

双指数平均线的运算法则是,分别计算一短期和一长期的指数平均线,当短期线从下向上突破长期线 becoming为看多信号; 当短期线从上向下跌破长期线时,为看空信号。

布林带指标则判断价格是否处于超买或超卖状态。布林带中轨为n天收盘价的移动平均线,带宽则为移动平均线前n天的标准差幅度。价格接近上轨时为超买,接近下轨时为超卖。

本策略规则为: 当短均线从下向上突破长均线,并且收盘价突破布林带上轨时,做多;当短均线从上向下跌破长均线,并且收盘价跌破布林带下轨时,做空。

做多后的止损点为之前n天内最低价,止盈点则为开仓价格的1.6倍;做空后的止损点为之前n天最高价,止盈点为开仓价格的1.6倍。

此外,本策略还考虑EMA多空指标判断总体走势,避免逆势开仓。

优势分析

- 使用双指数平均线判断总体走势,布林带判断具体买卖点位,指标搭配合理;

- 做多停损点采用之前n天最低价,做空停损采用之前n天最高价,有利于减少止损被追杀的概率;

- 止盈点采用开仓价点的1.6倍,有利于获得足够盈利;

- 考虑EMA总体走势指标,避免逆势开仓,可减少系统性损失。

风险分析

- 布林带参数优化不当可能导致交易频率过高或信号稀少;

- 止损点过于宽松可能带来更大亏损;

- 止盈点过于宽松可能错过更大利润。

针对以上风险,优化布林带参数组合,测试不同止损止盈水平,选择最优参数。

优化方向

- 优化布林带参数,寻找最佳参数组合;

- 测试不同的止损幅度参数,降低止损被追的概率;

- 测试不同的止盈倍数参数,争取获得更大收益。

总结

本策略运用双指数平均线判断市场总体走势,布林带判断具体买卖时机,在回测数据中表现不俗。通过参数优化及规则修改可望获得更佳效果。其止损止盈机制也可移植至其他策略中,具有借鉴价值。

策略源码

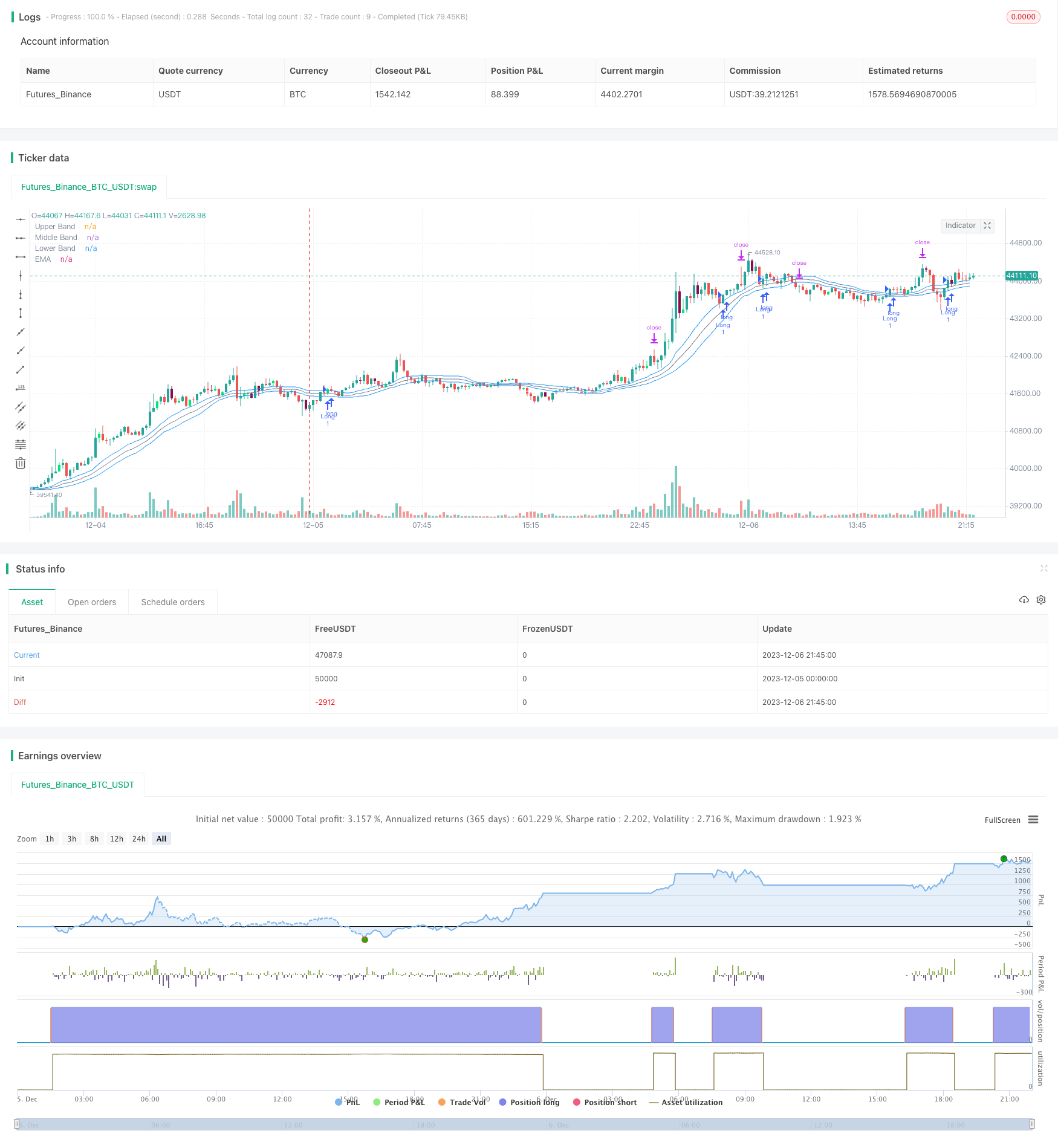

/*backtest

start: 2023-12-05 00:00:00

end: 2023-12-06 22:00:00

period: 15m

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This close code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AugustoErni

//@version=5

strategy('Bollinger Bands Modified (Stormer)', overlay=true)

bbL = input.int(20, title='BB Length/Comprimento da Banda de Bollinger', minval=1, step=1, tooltip='Calculate the length of bollinger bands./Calcula o comprimento das bandas de bollinger.')

mult = input.float(0.38, title='BB Standard Deviation/Desvio Padrão da Banda de Bollinger', minval=0.01, step=0.01, tooltip='Calculate the standard deviation of bollinger bands./Calcula o desvio padrão das bandas de bollinger.')

emaL = input.int(80, title='EMA Length/Comprimento da Média Móvel Exponencial', minval=1, step=1, tooltip='Calculate the length of EMA./Calcula o comprimento da EMA.')

highestHighL = input.int(7, title='Highest High Length/Comprimento da Alta Maior', minval=1, step=1, tooltip='Fetches the highest high candle from length input. Use to set stop loss for short position./Obtém a vela de maior alta com base na medida fornecida. Usa para definir o stop loss para uma posição curta.')

lowestLowL = input.int(7, title='Lowest Low Length/Comprimento da Baixa Menor', minval=1, step=1, tooltip='Fetches the lowest low candle from length input. Use to set stop loss for long position./Obter a vela de menor baixa com base na medida fornecida. Usa para definir o stop loss para uma posição longa.')

targetFactor = input.float(1.6, title='Target Take Profit/Objetivo de Lucro Alvo', minval=0.1, step=0.1, tooltip='Calculate the take profit factor when entry position./Calcula o fator do alvo lucro ao entrar na posição.')

emaTrend = input.bool(true, title='Check Trend EMA/Verificar Tendência da Média Móvel Exponencial', tooltip='Use EMA as trend verify for opening position./Usa a EMA como verificação de tendência para abrir posição.')

crossoverCheck = input.bool(false, title='Add Another Crossover Check/Adicionar Mais uma Verificação de Cruzamento Superior', tooltip='This option is to add one more veryfication attempt to check if price is crossover upper bollinger band./Esta opção é para adicionar uma verificação adicional para avaliar se o preço cruza a banda superior da banda de bollinger.')

crossunderCheck = input.bool(false, title='Add Another Crossunder Check/Adicionar Mais uma Verificação de Cruzamento Inferior', tooltip='This option is to add one more veryfication attempt to check if price is crossunder lower bollinger band./Esta opção é para adicionar uma verificação adicional para avaliar se o preço cruza a banda inferior da banda de bollinger.')

insideBarPatternCheck = input.bool(true, title='Show Inside Bar Pattern/Mostrar Padrão de Inside Bar', tooltip='This option is to show possible inside bar pattern./Esta opção é para mostrar um possível padrão de inside bar.')

[middle, upper, lower] = ta.bb(close, bbL, mult)

ema = ta.ema(close, emaL)

highestHigh = ta.highest(high, highestHighL)

lowestLow = ta.lowest(low, lowestLowL)

isCrossover = ta.crossover(close, upper) ? 1 : 0

isCrossunder = ta.crossunder(close, lower) ? 1 : 0

isPrevBarHighGreaterCurBarHigh = high[1] > high ? 1 : 0

isPrevBarLowLesserCurBarLow = low[1] < low ? 1 : 0

isInsideBar = isPrevBarHighGreaterCurBarHigh and isPrevBarLowLesserCurBarLow ? 1 : 0

isBarLong = ((close - open) > 0) ? 1 : 0

isBarShort = ((close - open) < 0) ? 1 : 0

isLongCross = crossoverCheck ? ((isBarLong and not isBarShort) and (open < upper and close > upper)) ? 1 : 0 : isCrossover ? 1 : 0

isShortCross = crossunderCheck ? ((isBarShort and not isBarLong) and (close < lower and open > lower)) ? 1 : 0 : isCrossunder ? 1 : 0

isCandleAboveEma = close > ema ? 1 : 0

isCandleBelowEma = close < ema ? 1 : 0

isLongCondition = emaTrend ? isLongCross and isCandleAboveEma ? 1 : 0 : isLongCross

isShortCondition = emaTrend ? isShortCross and isCandleBelowEma ? 1 : 0 : isShortCross

isPositionNone = strategy.position_size == 0 ? 1 : 0

isPositionLong = strategy.position_size > 0 ? 1 : 0

isPositionShort = strategy.position_size < 0 ? 1 : 0

var float enterLong = 0.0

var float stopLossLong = 0.0

var float targetLong = 0.0

var float enterShort = 0.0

var float stopLossShort = 0.0

var float targetShort = 0.0

var bool isLongEntry = false

var bool isShortEntry = false

if (isPositionNone)

isLongEntry := false

isShortEntry := false

enterLong := 0.0

stopLossLong := 0.0

targetLong := 0.0

enterShort := 0.0

stopLossShort := 0.0

targetShort := 0.0

if (isPositionShort or isPositionNone)

isLongEntry := false

enterLong := 0.0

stopLossLong := 0.0

targetLong := 0.0

if (isPositionLong or isPositionNone)

isShortEntry := false

enterShort := 0.0

stopLossShort := 0.0

targetShort := 0.0

if (isPositionLong and isLongEntry)

isLongEntry := true

isShortEntry := false

enterShort := 0.0

stopLossShort := 0.0

targetShort := 0.0

if (isPositionShort and isShortEntry)

isShortEntry := true

isLongEntry := false

enterLong := 0.0

stopLossLong := 0.0

targetLong := 0.0

if (isLongCondition and not isLongEntry)

isLongEntry := true

enterLong := close

stopLossLong := lowestLow

targetLong := (enterLong + (math.abs(enterLong - stopLossLong) * targetFactor))

alertMessage = '{ "side/lado": "buy", "entry/entrada": ' + str.tostring(enterLong) + ', "stop": ' + str.tostring(stopLossLong) + ', "target/alvo": ' + str.tostring(targetLong) + ' }'

alert(alertMessage)

strategy.entry('Long', strategy.long)

strategy.exit('Exit Long', 'Long', stop=stopLossLong, limit=targetLong)

if (isShortCondition and not isShortEntry)

isShortEntry := true

enterShort := close

stopLossShort := highestHigh

targetShort := (enterShort - (math.abs(enterShort - stopLossShort) * targetFactor))

alertMessage = '{ "side/lado": "sell", "entry/entrada": ' + str.tostring(enterShort) + ', "stop": ' + str.tostring(stopLossShort) + ', "target/alvo": ' + str.tostring(targetShort) + ' }'

alert(alertMessage)

strategy.entry('Short', strategy.short)

strategy.exit('Exit Short', 'Short', stop=stopLossShort, limit=targetShort)

plot(upper, title='Upper Band', color=color.blue)

plot(middle, title='Middle Band', color=color.gray)

plot(lower, title='Lower Band', color=color.blue)

plot(ema, title='EMA', color=color.white)

barcolor(insideBarPatternCheck and isInsideBar and isBarLong ? color.lime : insideBarPatternCheck and isInsideBar and isBarShort ? color.maroon : na, title='Inside Bar Color in Long Bar Long and in Short Bar Short/Cor do Inside Bar em Barra Longa Longa e em Barra Curta Curta')

tablePosition = position.bottom_right

tableColumns = 2

tableRows = 5

tableFrameWidth = 1

tableBorderColor = color.gray

tableBorderWidth = 1

tableInfoTrade = table.new(position=tablePosition, columns=tableColumns, rows=tableRows, frame_width=tableFrameWidth, border_color=tableBorderColor, border_width=tableBorderWidth)

table.cell(table_id=tableInfoTrade, column=0, row=0)

table.cell(table_id=tableInfoTrade, column=1, row=0)

table.cell(table_id=tableInfoTrade, column=0, row=1, text='Entry Side/Lado da Entrada', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=0, row=2, text=isLongEntry ? 'LONG' : isShortEntry ? 'SHORT' : 'NONE/NENHUM', text_color=color.yellow)

table.cell(table_id=tableInfoTrade, column=1, row=1, text='Entry Price/Preço da Entrada', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=1, row=2, text=isLongEntry ? str.tostring(enterLong) : isShortEntry ? str.tostring(enterShort) : 'NONE/NENHUM', text_color=color.blue)

table.cell(table_id=tableInfoTrade, column=0, row=3, text='Take Profit Price/Preço Alvo Lucro', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=0, row=4, text=isLongEntry ? str.tostring(targetLong) : isShortEntry ? str.tostring(targetShort) : 'NONE/NENHUM', text_color=color.green)

table.cell(table_id=tableInfoTrade, column=1, row=3, text='Stop Loss Price/Preço Stop Loss', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=1, row=4, text=isLongEntry ? str.tostring(stopLossLong) : isShortEntry ? str.tostring(stopLossShort) : 'NONE/NENHUM', text_color=color.red)

更多内容