Stratégie intraday de suivi de tendance avec plusieurs stops

Aperçu

La stratégie intègre plusieurs blocs ATR dynamiques de stop loss et Renko améliorés, conçus pour capturer les tendances intradays. Il combine l’indicateur de tendance et l’indicateur de bloc, permettant une analyse multi-temporelle permettant d’identifier efficacement la direction de la tendance et d’arrêter les pertes en temps opportun.

Principe de stratégie

Le cœur de cette stratégie est le mécanisme de stop multiple ATR. Il est composé de 3 groupes de stop dynamiques ATR, avec des paramètres de 5x ATR, 10x ATR et 15x ATR. Lorsque le prix tombe au-dessus de ces 3 groupes de stop, cela indique une reprise de la tendance, à laquelle il est placé. Ce stop multiple est configuré pour filtrer efficacement les faux signaux générés par les fluctuations à court terme.

L’autre partie centrale est la brique Renko améliorée. Cette brique divise l’augmentation en fonction de la valeur ATR et juge la direction de la tendance en combinaison avec l’indicateur SMA.

La condition d’entrée est de faire plus lorsque le prix franchit le 3e bloc d’arrêt ATR vers le haut, et de faire vide lorsque le prix franchit le 3e bloc d’arrêt ATR vers le bas. La condition d’exit est de faire un plateau lorsque le prix déclenche un bloc d’arrêt ATR ou une variation de la couleur des blocs de Renko.

Avantages stratégiques

- La gestion des risques liés à l’arrêt des ATR multiples

- Renko amélioré, plus sensible et plus rapide à l’arrêt

- Combinaison d’un indicateur de tendance et d’un indicateur de bloc pour assurer la capture de tendances

- Une analyse de plusieurs périodes permet d’évaluer les tendances de manière plus fiable

- Paramètres modifiables pour s’adapter à différents environnements de marché

Risques stratégiques et optimisation

Le risque principal de cette stratégie est que le stop-loss soit amplifié par la rupture. Il peut être optimisé par les moyens suivants:

- Ajuster le multiplicateur des arrêts ATR afin d’assouplir le marché lorsque la tendance est forte; resserrer le marché lorsque la tendance est faible

- Ajuster les paramètres ATR du bloc Renko pour équilibrer la sensibilité et la stabilité

- Ajout d’autres indicateurs de stop loss, tels que le canal Donchian, pour assurer une plus grande fiabilité du stop loss

- Ajout de filtres pour éviter des transactions fréquentes dans le recouvrement

Résumer

La stratégie est globalement adaptée aux tendances intraday fortes. Elle est caractérisée par la science de l’arrêt des pertes, l’indicateur de bloc permet d’identifier à l’avance le changement de tendance.

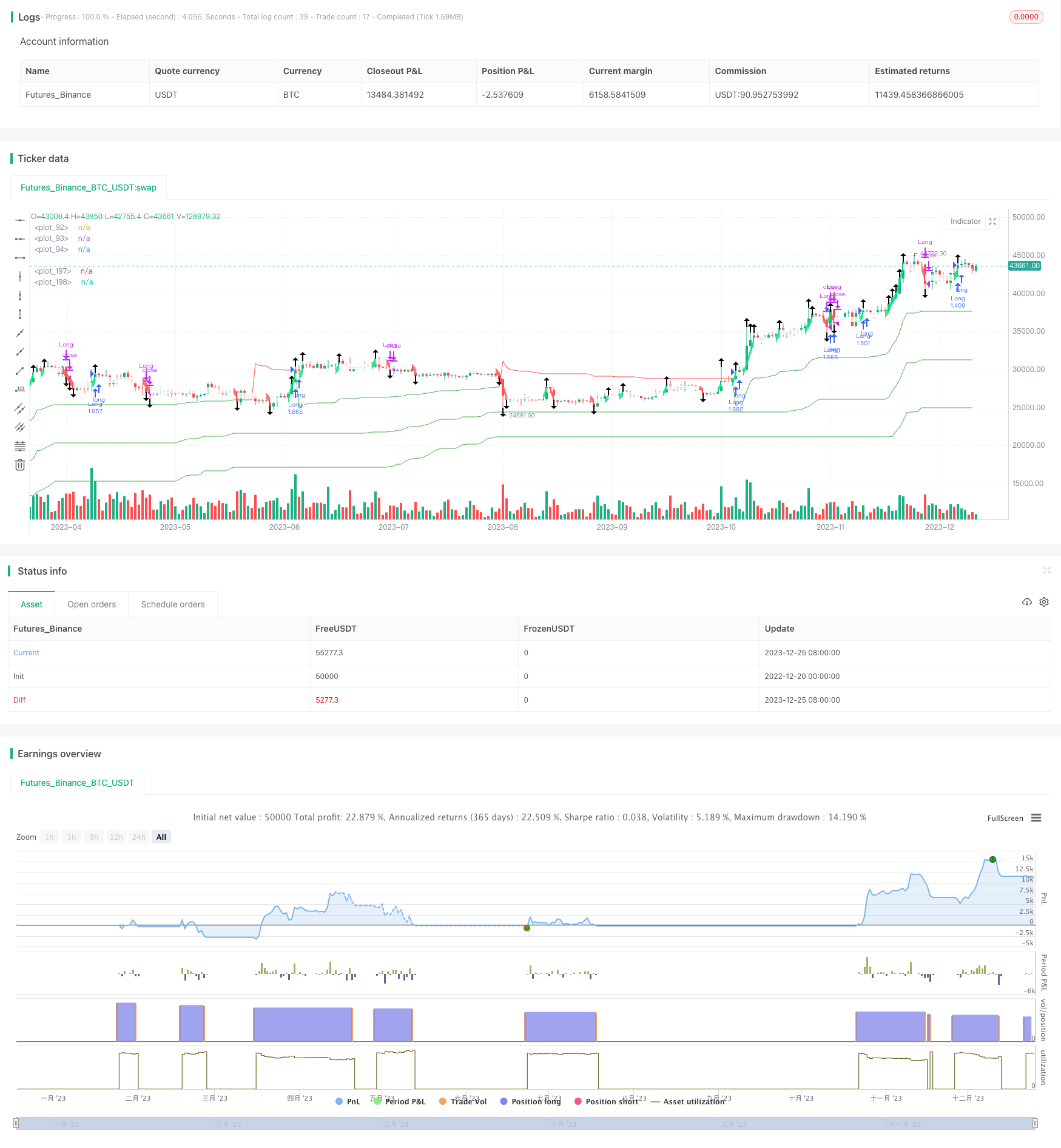

/*backtest

start: 2022-12-20 00:00:00

end: 2023-12-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Lancelot vstop intraday strategy", overlay=true, currency=currency.NONE, initial_capital = 100, commission_type=strategy.commission.percent,

commission_value=0.075, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

///Volatility Stop///

lengtha = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1a = 5

atr_a = atr(lengtha)

max1a = 0.0

min1a = 0.0

is_uptrend_preva = false

stopa = 0.0

vstop_preva = 0.0

vstop1a = 0.0

is_uptrenda = false

is_trend_changeda = false

max_a = 0.0

min_a = 0.0

vstopa = 0.0

max1a := max(nz(max_a[1]), ohlc4)

min1a := min(nz(min_a[1]), ohlc4)

is_uptrend_preva := nz(is_uptrenda[1], true)

stopa := is_uptrend_preva ? max1a - mult1a * atr_a : min1a + mult1a * atr_a

vstop_preva := nz(vstopa[1])

vstop1a := is_uptrend_preva ? max(vstop_preva, stopa) : min(vstop_preva, stopa)

is_uptrenda := ohlc4 - vstop1a >= 0

is_trend_changeda := is_uptrenda != is_uptrend_preva

max_a := is_trend_changeda ? ohlc4 : max1a

min_a := is_trend_changeda ? ohlc4 : min1a

vstopa := is_trend_changeda ? is_uptrenda ? max_a - mult1a * atr_a : min_a + mult1a * atr_a :

vstop1a

///Volatility Stop///

lengthb = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1b = 10

atr_b = atr(lengthb)

max1b = 0.0

min1b = 0.0

is_uptrend_prevb = false

stopb = 0.0

vstop_prevb = 0.0

vstop1b = 0.0

is_uptrendb = false

is_trend_changedb = false

max_b = 0.0

min_b = 0.0

vstopb = 0.0

max1b := max(nz(max_b[1]), ohlc4)

min1b := min(nz(min_b[1]), ohlc4)

is_uptrend_prevb := nz(is_uptrendb[1], true)

stopb := is_uptrend_prevb ? max1b - mult1b * atr_b : min1b + mult1b * atr_b

vstop_prevb := nz(vstopb[1])

vstop1b := is_uptrend_prevb ? max(vstop_prevb, stopb) : min(vstop_prevb, stopb)

is_uptrendb := ohlc4 - vstop1b >= 0

is_trend_changedb := is_uptrendb != is_uptrend_prevb

max_b := is_trend_changedb ? ohlc4 : max1b

min_b := is_trend_changedb ? ohlc4 : min1b

vstopb := is_trend_changedb ? is_uptrendb ? max_b - mult1b * atr_b : min_b + mult1b * atr_b :

vstop1b

///Volatility Stop///

lengthc = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1c = 15

atr_c = atr(lengthc)

max1c = 0.0

min1c = 0.0

is_uptrend_prevc = false

stopc = 0.0

vstop_prevc = 0.0

vstop1c = 0.0

is_uptrendc = false

is_trend_changedc = false

max_c = 0.0

min_c = 0.0

vstopc = 0.0

max1c := max(nz(max_c[1]), ohlc4)

min1c := min(nz(min_c[1]), ohlc4)

is_uptrend_prevc := nz(is_uptrendc[1], true)

stopc := is_uptrend_prevc ? max1c - mult1c * atr_c : min1c + mult1c * atr_c

vstop_prevc := nz(vstopc[1])

vstop1c := is_uptrend_prevc ? max(vstop_prevc, stopc) : min(vstop_prevc, stopc)

is_uptrendc := ohlc4 - vstop1c >= 0

is_trend_changedc := is_uptrendc != is_uptrend_prevc

max_c := is_trend_changedc ? ohlc4 : max1c

min_c := is_trend_changedc ? ohlc4 : min1c

vstopc := is_trend_changedc ? is_uptrendc ? max_c - mult1c * atr_c : min_c + mult1c * atr_c :

vstop1c

plot(vstopa, color=is_uptrenda ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopb, color=is_uptrendb ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopc, color=is_uptrendc ? color.green : color.red, style=plot.style_line, linewidth=1)

vstoplongcondition = close > vstopa and close > vstopb and close > vstopc and vstopa > vstopb and vstopa > vstopc and vstopb > vstopc

vstoplongclosecondition = crossunder(close, vstopa)

vstopshortcondition = close < vstopa and close < vstopb and close < vstopc and vstopa < vstopb and vstopa < vstopc and vstopb < vstopc

vstopshortclosecondition = crossover(close, vstopa)

///Renko///

TF = input(title='TimeFrame', type=input.resolution, defval="240")

ATRlength = input(title="ATR length", type=input.integer, defval=60, minval=2, maxval=100)

SMAlength = input(title="SMA length", type=input.integer, defval=5, minval=2, maxval=100)

SMACurTFlength = input(title="SMA CurTF length", type=input.integer, defval=20, minval=2, maxval=100)

HIGH = security(syminfo.tickerid, TF, high)

LOW = security(syminfo.tickerid, TF, low)

CLOSE = security(syminfo.tickerid, TF, close)

ATR = security(syminfo.tickerid, TF, atr(ATRlength))

SMA = security(syminfo.tickerid, TF, sma(close, SMAlength))

SMACurTF = sma(close, SMACurTFlength)

RENKOUP = float(na)

RENKODN = float(na)

H = float(na)

COLOR = color(na)

BUY = int(na)

SELL = int(na)

UP = bool(na)

DN = bool(na)

CHANGE = bool(na)

RENKOUP := na(RENKOUP[1]) ? (HIGH + LOW) / 2 + ATR / 2 : RENKOUP[1]

RENKODN := na(RENKOUP[1]) ? (HIGH + LOW) / 2 - ATR / 2 : RENKODN[1]

H := na(RENKOUP[1]) or na(RENKODN[1]) ? RENKOUP - RENKODN : RENKOUP[1] - RENKODN[1]

COLOR := na(COLOR[1]) ? color.white : COLOR[1]

BUY := na(BUY[1]) ? 0 : BUY[1]

SELL := na(SELL[1]) ? 0 : SELL[1]

UP := false

DN := false

CHANGE := false

if not CHANGE and close >= RENKOUP[1] + H * 3

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 3

RENKODN := RENKOUP[1] + ATR * 2

COLOR := color.lime

SELL := 0

BUY := BUY + 3

BUY

if not CHANGE and close >= RENKOUP[1] + H * 2

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 2

RENKODN := RENKOUP[1] + ATR

COLOR := color.lime

SELL := 0

BUY := BUY + 2

BUY

if not CHANGE and close >= RENKOUP[1] + H

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR

RENKODN := RENKOUP[1]

COLOR := color.lime

SELL := 0

BUY := BUY + 1

BUY

if not CHANGE and close <= RENKODN[1] - H * 3

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 3

RENKOUP := RENKODN[1] - ATR * 2

COLOR := color.red

BUY := 0

SELL := SELL + 3

SELL

if not CHANGE and close <= RENKODN[1] - H * 2

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 2

RENKOUP := RENKODN[1] - ATR

COLOR := color.red

BUY := 0

SELL := SELL + 2

SELL

if not CHANGE and close <= RENKODN[1] - H

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR

RENKOUP := RENKODN[1]

COLOR := color.red

BUY := 0

SELL := SELL + 1

SELL

plotshape(UP, style=shape.arrowup, location=location.abovebar, size=size.normal)

plotshape(DN, style=shape.arrowdown, location=location.belowbar, size=size.normal)

p1 = plot(RENKOUP, style=plot.style_line, linewidth=1, color=COLOR)

p2 = plot(RENKODN, style=plot.style_line, linewidth=1, color=COLOR)

fill(p1, p2, color=COLOR, transp=80)

///Long Entry///

longcondition = vstoplongcondition and UP

if (longcondition)

strategy.entry("Long", strategy.long)

///Long exit///

closeconditionlong = vstoplongclosecondition or DN

if (closeconditionlong)

strategy.close("Long")

// ///Short Entry///

// shortcondition = vstopshortcondition and DN

// if (shortcondition)

// strategy.entry("Short", strategy.short)

// ///Short exit///

// closeconditionshort = vstopshortclosecondition or UP

// if (closeconditionshort)

// strategy.close("Short")