RSI Stratégie de moyenne dynamique de position

Auteur:ChaoZhang est là., Date: 2024-02-06 09:44:05 Je vous en prie.Les étiquettes:

Résumé

Cette stratégie combine l'indice de force relative (RSI) et les principes de moyenne de position de martingale. Elle déclenche une position longue lorsque l'indice de force relative descend en dessous de la ligne de survente, et double la position si le prix continue de baisser.

La logique de la stratégie

- Utiliser l'indicateur RSI pour identifier les conditions de survente du marché, la période RSI étant fixée à 14 et le seuil de survente à 30.

- Commencer la première position longue avec 5% du capital du compte lorsque le RSI est inférieur à 30.

- Si le prix baisse de 0,5% par rapport au prix d'entrée initial, doublez la taille de la position pour la faire baisser en moyenne.

- Prenez des profits à 0,5% d'augmentation à chaque fois.

- Répétez le cycle.

Analyse des avantages

- Identifier les conditions de survente du marché avec RSI pour les bons points d'entrée.

- La moyenne des positions de Martingale fait baisser le prix d'entrée moyen.

- Les petits profits permettent des gains constants.

- Convient pour le trading au comptant de pièces à forte capitalisation boursière pour des risques contrôlés.

Analyse des risques

- Un ralentissement prolongé du marché peut entraîner des pertes importantes.

- Aucun stop loss signifie une baisse illimitée.

- Trop de moyennes en bas augmente les pertes.

- Il y a toujours des risques inhérents à la direction longue.

Directions d'optimisation

- Incorporer le stop loss pour limiter la perte maximale.

- Optimiser les paramètres du RSI pour trouver les meilleurs signaux de surachat/survente.

- Définir une fourchette de bénéfices raisonnable en fonction de la volatilité spécifique des pièces.

- Déterminer le rythme de la moyenne sur la base des actifs totaux ou des règles de dimensionnement des positions.

Résumé

Cette stratégie combine l'indicateur RSI et la moyenne de position martingale pour tirer parti des situations de survente avec une moyenne appropriée à la baisse et un petit profit pour des gains réguliers.

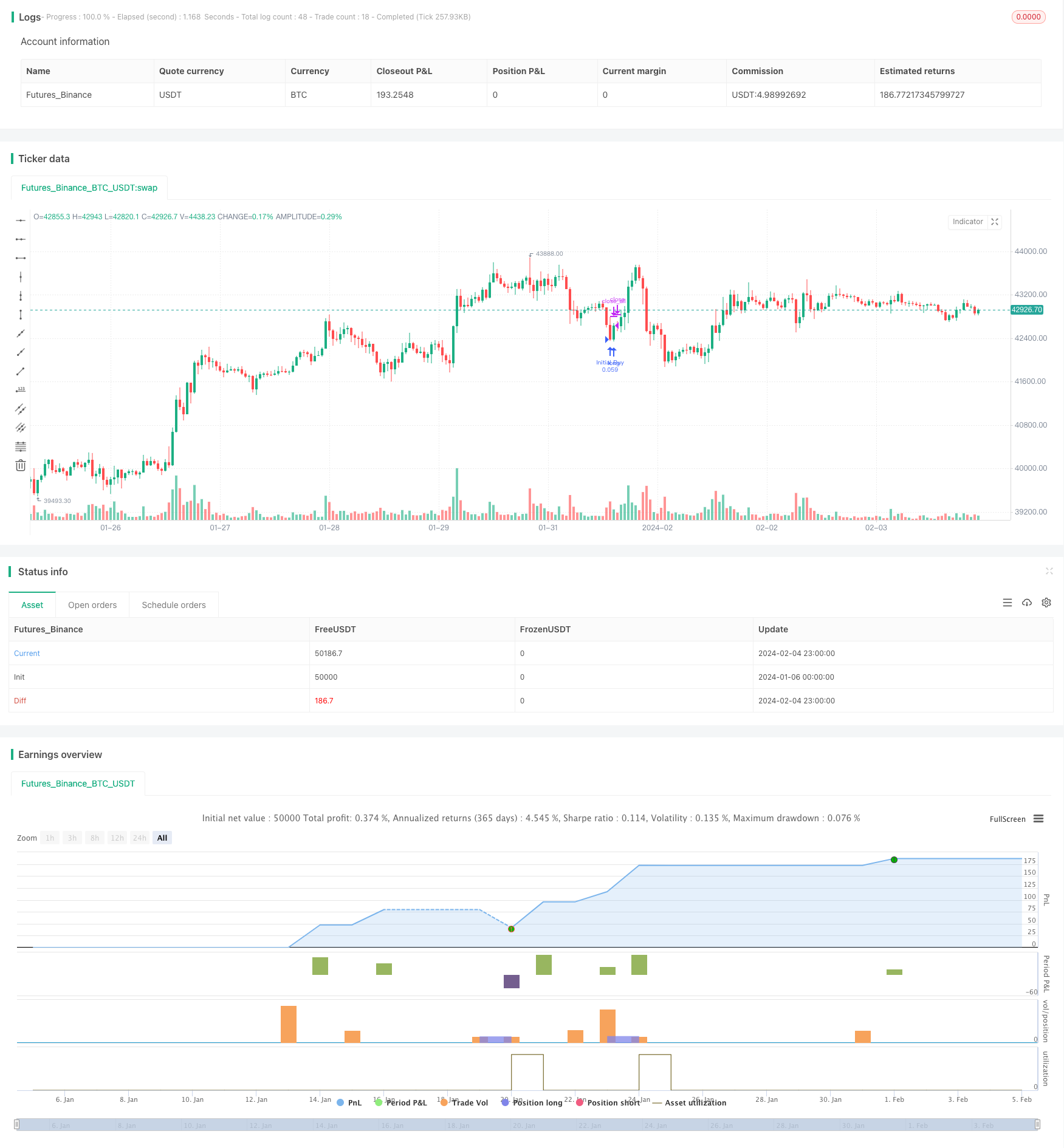

/*backtest

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Stavolt

//@version=5

strategy("RSI Martingale Strategy", overlay=true, default_qty_type=strategy.cash, currency=currency.USD)

// Inputs

rsiLength = input(14, title="RSI Length")

oversoldThreshold = input(30, title="Oversold Threshold") // Keeping RSI threshold

profitTargetPercent = input(0.5, title="Profit Target (%)") / 100

initialInvestmentPercent = input(5, title="Initial Investment % of Equity")

// Calculating RSI

rsiValue = ta.rsi(close, rsiLength)

// State variables for tracking the initial entry

var float initialEntryPrice = na

var int multiplier = 1

// Entry condition based on RSI

if (rsiValue < oversoldThreshold and na(initialEntryPrice))

initialEntryPrice := close

strategy.entry("Initial Buy", strategy.long, qty=(strategy.equity * initialInvestmentPercent / 100) / close)

multiplier := 1

// Adjusting for errors and simplifying the Martingale logic

// Note: This section simplifies the aggressive position size adjustments without loops

if (not na(initialEntryPrice))

if (close < initialEntryPrice * 0.995) // 0.5% drop from initial entry

strategy.entry("Martingale Buy 1", strategy.long, qty=((strategy.equity * initialInvestmentPercent / 100) / close) * 2)

multiplier := 2 // Adjusting multiplier for the next potential entry

if (close < initialEntryPrice * 0.990) // Further drop

strategy.entry("Martingale Buy 2", strategy.long, qty=((strategy.equity * initialInvestmentPercent / 100) / close) * 4)

multiplier := 4

// Additional conditional entries could follow the same pattern

// Checking for profit target to close positions

if (strategy.position_size > 0 and (close - strategy.position_avg_price) / strategy.position_avg_price >= profitTargetPercent)

strategy.close_all(comment="Take Profit")

initialEntryPrice := na // Reset for next cycle

Plus de

- Stratégie de négociation avancée de l'indicateur RSI

- Indicateur RSI Stratégie de profit et de stop-loss croisés sur le cycle

- Stratégie de suivi des tendances basée sur le croisement des moyennes mobiles

- Stratégie de négociation de fusion RSI et bandes de Bollinger pour le LTC

- Stratégie de croisement des moyennes mobiles à dynamique optimisée

- Stratégie d'arrêt dynamique du trail SMA-ATR

- Stratégie de suivi de l'inversion

- Stratégie d'arbitrage à double inversion

- Kama et tendance basée sur la moyenne mobile suivant la stratégie

- Chaîne de prix et tendance basée sur la moyenne mobile

- Les bandes de Bollinger et la stratégie de combinaison RSI

- Stratégie de négociation dynamique de moyenne mobile à double exponentiel

- Une stratégie de négociation de l'indice de dynamique à double renversement

- Stratégie du chasseur de fond

- Stratégie de bande de Bollinger avec sélection de fourchette de dates

- La valeur de l'échange de titres est calculée en fonction de la valeur de l'échange de titres.

- Stratégie de Bressert stochastique doublement lissée

- Tendance croisée des moyennes stochastiques et mobiles suivant une stratégie quantitative

- Stratégie de rupture du canal de moyenne mobile de 5 jours combinée au concept de kilométrage

- Stratégie d'inversion de rupture avec stop loss