क्रॉडल का सुपरट्रेंड

लेखक:चाओझांग, दिनांकः 2022-05-13 17:38:34टैगःएसएमएईएमएएसएमएमएडब्ल्यूएमएवीडब्ल्यूएमए

यह सूचक पुष्टि के रूप में 3 विभिन्न इनपुट के साथ सुपरट्रेंड का उपयोग कर रहा है और साथ ही 200 ईएमए जो हमें ऊपर या नीचे की प्रवृत्ति के लिए डेटा देगा। तो यह स्टॉक संकेतक की तलाश कर रहा है कि यह पुष्टि करने के लिए कि क्या लंबी के लिए 30 से नीचे और छोटी के लिए 70 से ऊपर का क्रॉस है।

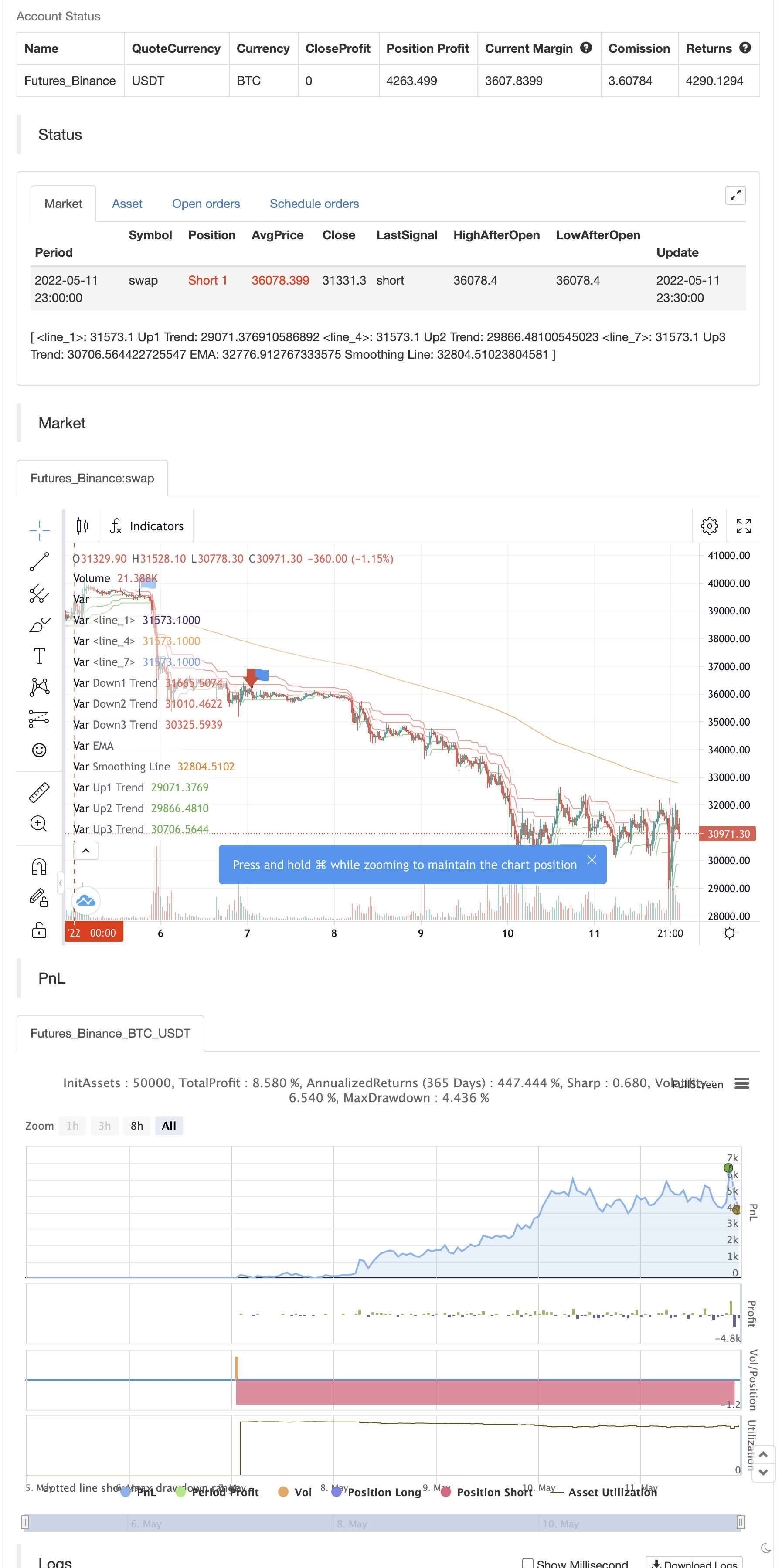

बैकटेस्ट

/*backtest

start: 2022-05-05 00:00:00

end: 2022-05-11 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Visit Crodl.com for our Premium Indicators

// https://tradingbot.crodl.com to use our free tradingview bot to automate any indicator.

//@version=5

indicator("Crodl's Supertrend", overlay=true, timeframe="", timeframe_gaps=true)

atrPeriod1 = input(12, "ATR1 Length")

factor1 = input.float(3.0, "Factor1", step = 0.01)

[supertrend1, direction1] = ta.supertrend(factor1, atrPeriod1)

bodyMiddle1 = plot((open + close) / 2, display=display.none)

upTrend1 = plot(direction1 < 0 ? supertrend1 : na, "Up1 Trend", color = color.green, style=plot.style_linebr)

downTrend1 = plot(direction1 < 0? na : supertrend1, "Down1 Trend", color = color.red, style=plot.style_linebr)

atrPeriod2 = input(11, "ATR2 Length")

factor2 = input.float(2.0, "Factor2", step = 0.01)

[supertrend2, direction2] = ta.supertrend(factor2, atrPeriod2)

bodyMiddle2 = plot((open + close) / 2, display=display.none)

upTrend2 = plot(direction2 < 0 ? supertrend2 : na, "Up2 Trend", color = color.green, style=plot.style_linebr)

downTrend2 = plot(direction2 < 0? na : supertrend2, "Down2 Trend", color = color.red, style=plot.style_linebr)

atrPeriod3 = input(10, "ATR3 Length")

factor3 = input.float(1.0, "Factor3", step = 0.01)

[supertrend3, direction3] = ta.supertrend(factor3, atrPeriod3)

bodyMiddle3 = plot((open + close) / 2, display=display.none)

upTrend3 = plot(direction3 < 0 ? supertrend3 : na, "Up3 Trend", color = color.green, style=plot.style_linebr)

downTrend3 = plot(direction3 < 0? na : supertrend3, "Down3 Trend", color = color.red, style=plot.style_linebr)

len = input.int(200, minval=1, title="Length")

src = input(close, title="Source")

offset = input.int(title="Offset", defval=0, minval=-500, maxval=500)

out = ta.ema(src, len)

plot(out, title="EMA", color=color.white,linewidth=2, offset=offset)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

typeMA = input.string(title = "Method", defval = "SMA", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="Smoothing")

smoothingLength = input.int(title = "Length", defval = 5, minval = 1, maxval = 100, group="Smoothing")

smoothingLine = ma(out, smoothingLength, typeMA)

plot(smoothingLine, title="Smoothing Line", color=#f37f20, offset=offset, display=display.none)

//////

l = input(13, title='Length')

l_ma = input(7, title='MA Length')

t = math.sum(close > close[1] ? volume * (close - close[1]) : close < close[1] ? volume * (close - close[1]) : 0, l)

m = ta.sma(t, l_ma)

//////

periodK = input.int(14, title="%K Length", minval=1)

smoothK = input.int(1, title="%K Smoothing", minval=1)

periodD = input.int(3, title="%D Smoothing", minval=1)

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

stochbuy= float(k) < 30 and ta.crossover(k,d)

stochsell=float(k) > 70 and ta.crossover(d,k)

long =(( ((direction1 < 0 and direction2 < 0 ) or (direction2 < 0 and direction3 < 0 ) and (direction1 < 0 or direction3 < 0 ) )and open > out) and t > 0) and stochbuy

short=(( ((direction1 > 0 and direction2 > 0 ) or (direction2 > 0 and direction3 > 0 ) and (direction1 > 0 or direction3 > 0 ) )and open < out) and t < 0) and stochsell

plotshape(long, title = "Long Signal", location=location.belowbar, style=shape.labelup, color=color.green, textcolor=color.white, size=size.small, text="Long")

plotshape(short, title = "Short Signal", location=location.abovebar, style=shape.labeldown, color=color.red, textcolor=color.white, size=size.small, text="Short")

alertcondition(long, title='Long Signal', message=' Buy')

alertcondition(short, title='Short Signal', message=' Sell')

if long

strategy.entry("Enter Long", strategy.long)

else if short

strategy.entry("Enter Short", strategy.short)

संबंधित सामग्री

- एसएसएस

- ब्रींग बैंड ने मोशन ट्रैकिंग ट्रेडिंग रणनीति को आगे बढ़ाया

- बहुस्तरीय अस्थिर बैंड ट्रेडिंग रणनीति

- आरएसआई पिवोट, बीबी, एसएमए, ईएमए, एसएमएमए, डब्ल्यूएमए, वीडब्ल्यूएमए के साथ विचलन

- द्वि-समान रेखा पार गति ट्रैकिंग परिमाण रणनीति

- बहु-समान रेखा क्रॉस ट्रेंड ट्रैकिंग और उतार-चढ़ाव फ़िल्टरिंग रणनीतियाँ

- बहुचक्रीय समवर्ती क्रॉस ट्रेंड ट्रैकिंग रणनीति

- अनुकूलन की गतिशील औसत रेखा क्रॉसिंग रणनीति

- ओसीसी रणनीति आर5.1

- 2 चलती औसत रंग दिशा का पता लगाना

अधिक जानकारी

- BEARMARKET में आपका स्वागत है [30 मिनट]

- साइड बॉस

- पिवोट पॉइंट्स हाई लो मल्टी टाइम फ्रेम

- भूत प्रवृत्ति ट्रैक रणनीति डेटाबेस

- भूत प्रवृत्ति ट्रैक रणनीति व्यापार सूची

- भूत प्रवृत्ति ट्रैकिंग रणनीति

- इंद्रधनुष दोलन

- इक्विटी वक्र स्थिति आकार उदाहरण का व्यापार

- KLineChart का प्रदर्शन

- विला डायनामिक पिवोट सुपरट्रेंड रणनीति

- zdmre द्वारा आरएसआई

- FTL - रेंज फिल्टर X2 + EMA + UO

- ब्राह्मस्त्र

- मोबो बैंड

- एसएआर + 3एसएमएमए SL और TP के साथ

- एसएसएस

- चंद्रमा प्रक्षेपण अलर्ट टेम्पलेट [सूचक]

- HALFTREND + HEMA + SMA (गलत संकेत की रणनीति)

- आरएसआई पिवोट, बीबी, एसएमए, ईएमए, एसएमएमए, डब्ल्यूएमए, वीडब्ल्यूएमए के साथ विचलन

- आरएसआई और बीबी और एक साथ ओवरसोल्ड