बहु-समय अवधि MACD मूविंग औसत ट्रेडिंग रणनीति

निर्माण तिथि:

2024-01-16 14:06:10

अंत में संशोधित करें:

2024-01-16 14:06:10

कॉपी:

1

क्लिक्स:

750

1

ध्यान केंद्रित करना

1628

समर्थक

अवलोकन

यह रणनीति MACD सूचक और कई समय अवधि के लिए औसत रेखा पर आधारित है। यह MACD सूचक के विभिन्न समय अवधि के प्रदर्शन और विभिन्न औसत रेखाओं के संबंध में कीमतों की स्थिति के संबंध में व्यापक रूप से उपयोग करता है। यह लंबी और छोटी स्थिति के लिए प्रवेश और बाहर निकलने के नियमों को डिजाइन करता है।

रणनीति सिद्धांत

1. एमएसीडी सूचक

- 5 मिनट, 15 मिनट, 1 घंटे और 4 घंटे की औसत गणना

- विभिन्न आवधिक औसत रेखाओं के साथ कीमतों के संबंधों के आधार पर प्रवृत्ति का न्याय करना

2. आरएसआई

- वर्तमान चक्र और उच्चतर चक्र के लिए RSI मानों की गणना करें

- आरएसआई का उपयोग करके उच्च और निम्न संकेतक का पता लगाने के लिए उलटा संकेत

3. K-रेखा

- विभिन्न प्रकार के सूर्य-नक्षत्र संयोजनों की गणना करें और उलटा संकेतों का आकलन करें

- महत्वपूर्ण समर्थन और दबाव बिंदुओं के साथ कीमतों पर ध्यान केंद्रित करना

4. प्रवेश नियम

कई शर्तें:

- आरएसआई सूचकांक पर वर्तमान आवधिक कमियां

- उच्च-चक्र आरएसआई सूचक के नीचे से विचलन का संकेत देता है कि एक पलटाव आ रहा है

रिक्तियों के लिए शर्तें:

- आरएसआई सूचकांक के तहत उच्च स्तर पर वर्तमान चक्र

- उच्च-चक्र आरएसआई सूचक शीर्ष से विचलित हो रहा है, यह संकेत देता है कि एक पलटाव आ रहा है

5. बाहर निकलने के नियम

सामान्य बहुवचन:

- K-लाइन में उलटा सिग्नलः प्रवृत्ति उलटी हो जाती है, जैसे कि चमकते सितारे और अंधेरे के आवरण

समतल हवा की स्थिति:

- K लाइन में उलटा सिग्नलः प्रवृत्ति सूर्य की ओर उलटी हुई, जैसे कि गोला-बारूद और भारी मात्रा में चूसना

6. हवा नियंत्रण नियम

स्टॉप लॉस और स्टॉप स्टॉप मानदंड सेट करें ताकि घाटे में वृद्धि और मुनाफे में कमी न हो।

श्रेष्ठता विश्लेषण

- बहु-सूचक संयोजन, समग्र निर्णय, उच्च सिग्नल सटीकता

- विभिन्न चक्रों की जानकारी का लाभ उठाना और लाभ की संभावनाओं को बढ़ाना

- सख्त प्रवेश और निकास नियम, नियंत्रित जोखिम

जोखिम और अनुकूलन

- अनुचित पैरामीटर अनुकूलन के कारण अधिक बार लेनदेन हो सकता है

- विभिन्न किस्मों के लिए सूचक मापदंडों को अनुकूलित करने की आवश्यकता

- गतिशील स्टॉपलॉस सेट करें लाभ को लॉक करने के लिए

संक्षेप

इस रणनीति को समग्र रूप से काफी मजबूत माना जाता है, जो बाजार के रुझानों को प्रभावी ढंग से पकड़ने और व्यापारिक जोखिम से बचने के लिए बहु-सूचक निर्णय और सख्त प्रवेश और निकास नियमों के माध्यम से है। हालांकि, आय की स्थिरता को बढ़ाने के लिए और अधिक अनुकूलन की आवश्यकता है।

रणनीति स्रोत कोड

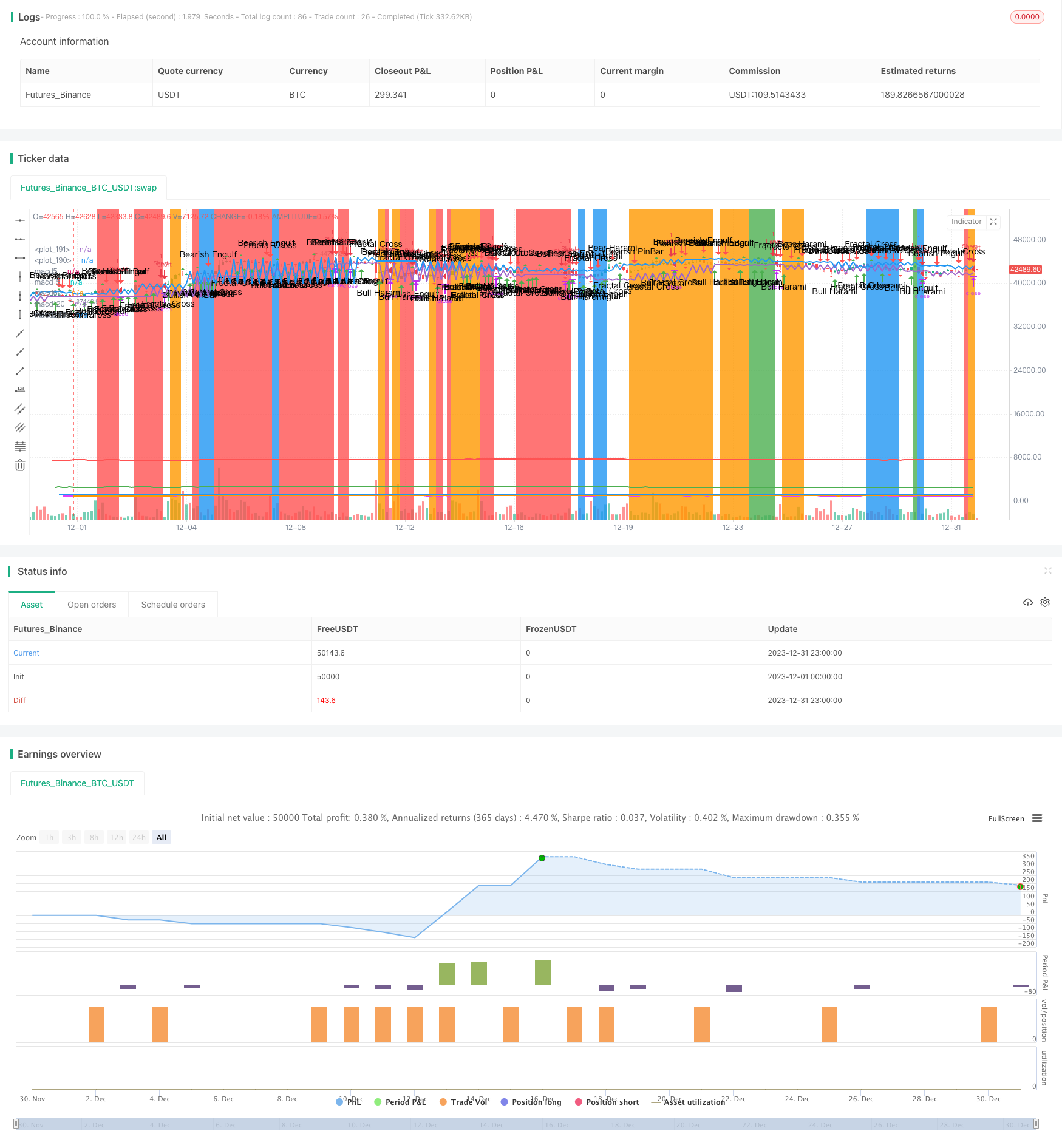

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//

// Author : Jacques CRETINON

// Last Version : V1.0 11-22-2016

//

// Risk disclaimer : Do not use this script in production environment. We assume no liability or responsibility for any damage to you, your computer, or your other property, due to the use of this script.

//

// Purpose of this script :

// 1- use same pine code for strategy or study script (with simple modifications)

// 2- be able to send alerts : enterlong, entershort, exitlong, exitshort, stoplosslong, stoplossshort, takeprofitlong, takeprofitshort in a study script like a strategy script should do

// 3- do not repaint (I HOPE)

//

// RoadMap :

// 1- manage : Trailing Stop Loss and Trailing Stop Loss offset

//

// I use this script :

// 1- with default value for XAUUSD, current chart resolution : 1mn, large timeframe : 15mn.

// 2- That's why I hard code MACD5 (5mn average), MACD15 (15mn average), MACD60 (1h average) ...

// 3- MACD, RSI (1mn and 15mn) and Candles info are my inputs to take any decisions

//

// I do not publish my enterLong, enterShort, exitLong and exitShort conditions (lines 204 to 207 are sample !) as they are not as perfect as I'd like. Fell free to use your own conditions :)

//

// Please, report me any bug, fell free to discuss and share. English is not my natural language, so be clement ;) Happy safe trading :)

// If you use this pine script as a

// * STRATEGY script => uncomment line 31 and lines 210 to 215 ; comment line 34 ; change value of study_script line 37 to false

// * STUDY script => uncomment line 34 ; comment line 31 and lines 210 to 215 ; change value of study_script line 37 to true

// STRATEGY script => uncomment ; STUDY script => comment

strategy(title = "JC_MacD_RSI_Candle_Strat", shorttitle = "JMRCS", overlay = true)

// STUDY script => uncomment ; STRATEGY script => comment

//study(title="JC_MacD_RSI_Candle_Alert", shorttitle="JMRCA", precision=0, overlay = false )

// STUDY script => study_script = true ; STRATEGY script => study_script = false

study_script = false

useCurrentRes = input(false, title="Use Current Chart Resolution")

resCustom = input(title="Use Different Timeframe ? Uncheck Box Above", defval='1')

res = useCurrentRes ? period : resCustom

largeTimeframe = input(title="Large timeframe ? ", defval='15')

// Strategy Time limiting

useTimeLimit = input(defval = true, title = "Use Start Time Limiter?")

startYear = input(defval = 2016, title = "Start From Year", minval = 0, step = 1)

startMonth = input(defval = 11, title = "Start From Month", minval = 0,step = 1)

startDay = input(defval = 22, title = "Start From Day", minval = 0,step = 1)

startHour = input(defval = 00, title = "Start From Hour", minval = 0,step = 1)

startMinute = input(defval = 00, title = "Start From Minute", minval = 0,step = 1)

inputTime = timestamp(syminfo.timezone, startYear, startMonth, startDay, startHour, startMinute)

timeOk = true

// when do we apply this script

run_script = (useTimeLimit and timeOk) or not useTimeLimit

// MACD strat

res_macd5_cur_close = request.security(syminfo.tickerid, res, sma(close ,5 ))

res_macd15_cur_close = request.security(syminfo.tickerid, res, sma(close ,15 ))

res_macd60_cur_close = request.security(syminfo.tickerid, res, sma(close ,60 ))

res_macd120_cur_close = request.security(syminfo.tickerid, res, sma(close ,120))

res_macd240_cur_close = request.security(syminfo.tickerid, res, sma(close ,240))

// Plot MACD info

plot_macd = input(true, title="plot macd (only strategy script) ?")

plot(not study_script and run_script and plot_macd ? res_macd5_cur_close : na, title = "macd5", color = red, linewidth = 2, style = line, transp = 50)

plot(not study_script and run_script and plot_macd ? res_macd15_cur_close : na, title = "macd15", color = green, linewidth = 2, style = line, transp = 50)

plot(not study_script and run_script and plot_macd ? res_macd60_cur_close : na, title = "macd60", color = blue, linewidth = 2, style = line, transp = 50)

plot(not study_script and run_script and plot_macd ? res_macd120_cur_close : na, title = "macd120", color = fuchsia, linewidth = 2, style = line, transp = 50)

plot(not study_script and run_script and plot_macd ? res_macd240_cur_close : na, title = "macd240", color = orange, linewidth = 2, style = line, transp = 50)

// This section based on RSI strat from ChrisMoody 8/15/2014

plot_rsi = input(true, title="plot rsi info ? ")

len = input(14, minval=1, title="Length")

upLine = input(65, minval=50, maxval=90, title="Upper Line Value?")

lowLine = input(35, minval=10, maxval=50, title="Lower Line Value?")

// current Time Frame RSI

res_up_cur_close = rma(max(change(close), 0), len)

res_down_cur_close = rma(-min(change(close), 0), len)

res_rsi_cur_close = res_down_cur_close == 0 ? 100 : res_up_cur_close == 0 ? 0 : 100 - (100 / (1 + res_up_cur_close / res_down_cur_close))

res_outRSI_cur_close = request.security(syminfo.tickerid, res, res_rsi_cur_close)

res_aboveLine = res_outRSI_cur_close > upLine ? 1 : 0

res_belowLine = res_outRSI_cur_close < lowLine ? 1 : 0

res_crossUp = res_outRSI_cur_close[1] < lowLine and res_outRSI_cur_close > lowLine ? 1 : 0

res_crossDn = res_outRSI_cur_close[1] > upLine and res_outRSI_cur_close < upLine ? 1 : 0

// Large Time Frame RSI

ltf_up_cur_close = rma(max(change(close), 0), len)

ltf_down_cur_close = rma(-min(change(close), 0), len)

ltf_rsi_cur_close = ltf_down_cur_close == 0 ? 100 : ltf_up_cur_close == 0 ? 0 : 100 - (100 / (1 + ltf_up_cur_close / ltf_down_cur_close))

ltf_outRSI_cur_close = request.security(syminfo.tickerid, largeTimeframe, ltf_rsi_cur_close)

ltf_aboveLine = ltf_outRSI_cur_close > upLine ? 1 : 0

ltf_belowLine = ltf_outRSI_cur_close < lowLine ? 1 : 0

ltf_crossUp = ltf_outRSI_cur_close[1] < lowLine and ltf_outRSI_cur_close > lowLine ? 1 : 0

ltf_crossDn = ltf_outRSI_cur_close[1] > upLine and ltf_outRSI_cur_close < upLine ? 1 : 0

// Plot RSI info

bgcolor(run_script and plot_rsi and res_aboveLine ? red : na, transp=70)

bgcolor(run_script and plot_rsi and res_crossDn ? red : na, transp=40)

bgcolor(run_script and plot_rsi and res_belowLine ? green : na, transp=70)

bgcolor(run_script and plot_rsi and res_crossUp ? green : na, transp=40)

bgcolor(run_script and plot_rsi and ltf_aboveLine ? orange : na, transp=70)

bgcolor(run_script and plot_rsi and ltf_crossDn ? orange : na, transp=40)

bgcolor(run_script and plot_rsi and ltf_belowLine ? blue : na, transp=70)

bgcolor(run_script and plot_rsi and ltf_crossUp ? blue : na, transp=40)

// This section based on [RS]Fractal Levels by RicardoSantos

plot_candle = input(true, title="plot all candle info (only strategy script) ?")

showfractals = input(true, title="plot fractals info (only strategy script) ?")

showlevels = input(true, title="plot level info (only strategy script) ?")

topfractal = high[2] > high[1] and high[2] > high and high[2] > high[3] and high[2] > high[4]

botfractal = low[2] < low[1] and low[2] < low and low[2] < low[3] and low[2] < low[4]

topfractals = topfractal ? high[2] : topfractals[1]

botfractals = botfractal ? low[2] : botfractals[1]

topfcolor = topfractals != topfractals[1] ? na : green

botfcolor = botfractals != botfractals[1] ? na : red

// This section based on "Candlestick Trend Indicator v0.5" by JustUncleL Date: 12-Aug-2016 Version: v0.5on Almost Zero Lag EMA [LazyBear]

// PBar Percentages

pctP = input(66, minval=1, maxval=99, title="Directional PBars, % of Range of Candle the Long Wick Has To Be")

pctCp = pctP * .01

// Shaved Bars Percentages

pctS = input(5, minval=1, maxval=99, title="Shaved Bars, % of Range it Has To Close On The Lows or Highs")

pctCs = pctS * .01

pctSPO = pctCs

// range

range = high - low

// discard candle with a little body (addon by cretinon)

tradable_val = input(3, minval=-1, title="min body size factor ? WARNING see pine code to understand")

body = abs(open - close)

pbody = ((body / max(high, low)) * 10000 ) > tradable_val ? true : false

// Reversal PinBars %

pctRP = input(72, minval=1, maxval=99, title="Reversal PBars, % of Range of Candle the Long Wick Has To Be")

pctCRp = pctRP * .01

pctCRPO = 1 - pctCRp

// Reversal Pin Bar Lookback Length

pblb =input(6,minval=1,title="Reversal Pin Bar Lookback Length")

pBarRUp = open > high - (range * pctCRPO) and close > high - (range * pctCRPO) and low <= lowest(pblb) ? 1 : 0

pBarRDn = open < high - (range * pctCRp) and close < high-(range * pctCRp) and high >= highest(pblb) ? 1 : 0

// Shaved Bars filter to the MA50 line

sBarUp = (close >= (high - (range * pctCs)))

sBarDown = (close <= (low + (range * pctCs)))

// Inside Bars

insideBarUp = (high < high[1] and low > low[1])

insideBarDn = (high < high[1] and low > low[1])

outsideBarUp= (high > high[1] and low < low[1])

outsideBarDn= (high > high[1] and low < low[1])

// Calculing candles info (only if body is not too small - by cretinon)

pBarDn = open < high - (range * pctCp) and close < high - (range * pctCp)

pBarUp = open > low + (range * pctCp) and close > low + (range * pctCp)

dcc = pbody and ((close[1]>open[1] and abs(close[1]-open[1])/range[1]>=0.7 and close<open and abs(close-open)/range>=0.7 and open>=close[1] and close>open[1] and close<((open[1]+close[1])/2)))

pln= pbody and ((close[1]<open[1] and abs(open[1]-close[1])/range[1]>=0.7 and close>open and abs(close-open)/range>=0.7 and open<=close[1] and close<open[1] and close>((open[1]+close[1])/2)))

beh = pbody and ((close[1] > open[1] and open > close and open <= close[1] and low >= open[1] and open - close < close[1] - open[1] and (high < high[1] and low > low[1])))

blh = pbody and ((open[1] > close[1] and close > open and close <= open[1] and high <= open[1] and close - open < open[1] - close[1] and (high < high[1] and low > low[1])))

bee = pbody and ((close[1] > open[1] and close < open and close<=low[1] and open>= close[1]))

ble = pbody and ((close[1] < open[1] and close > open and close >= high[1] and open<=close[1]))

blfr = pbody and (crossover(close,topfractals))

befr = pbody and (crossunder(close,botfractals))

// Hammer and Inverted Hammer rewrite by cretinon

pHammer = pbody and (pBarUp and (not pBarRUp and not pBarRDn)) ? true :false

pIHammer = pbody and (pBarDn and (not pBarRUp and not pBarRDn)) ? true : false

// Plot candle info

location_Bearish = not study_script ? location.abovebar : location.bottom

location_Bullish = not study_script ? location.belowbar : location.bottom

plotshape(run_script and plot_candle ? pIHammer : na, title= "Bearish Pin Bar", color=red, style=shape.arrowdown, location=location_Bearish , text="Bearish\nPinBar")

plotshape(run_script and plot_candle and pHammer, title= "Bullish Pin Bar", location=location_Bullish, color=green, style=shape.arrowup, text="Bullish\nPinBar")

plotshape(run_script and plot_candle and dcc, title="Dark Cloud Cover",text='DarkCloud\nCover',color=red, style=shape.arrowdown,location=location_Bearish)

plotshape(run_script and plot_candle and pln, title="Piercieng Line",text="Piercing\nLine",color=green, style=shape.arrowup,location=location_Bullish)

plotshape(run_script and plot_candle and beh and not dcc, title= "Bearish Harami", color=red, style=shape.arrowdown,location=location_Bearish, text="Bear\nHarami")

plotshape(run_script and plot_candle and blh and not pln, title= "Bullish Harami", location=location_Bullish, color=green, style=shape.arrowup, text="Bull\nHarami")

plotshape(run_script and plot_candle and bee, title= "Bearish Engulfing", color=red, style=shape.arrowdown, location=location_Bearish, text="Bearish\nEngulf")

plotshape(run_script and plot_candle and ble, title= "Bullish Engulfing", location=location_Bullish, color=green, style=shape.arrowup, text="Bullish\nEngulf")

plotshape(run_script and plot_candle and blfr and not ble and not blh and not sBarUp, title= "Bullish Fractal Cross", location=location_Bullish, color=green, style=shape.arrowup, text="Fractal\nCross")

plotshape(run_script and plot_candle and befr and not bee and not beh and not sBarDown, title= "Bearish Fractal Cross", location=location_Bearish, color=red, style=shape.arrowdown, text="Fractal\nCross")

plotshape(run_script and showlevels ? topfractal : na, color=green, transp=0, style=shape.triangleup, location=location_Bearish, offset=-2, size=size.tiny)

plotshape(run_script and showfractals ? botfractal : na, color=red, transp=0, style=shape.triangledown, location=location_Bullish, offset=-2, size=size.tiny)

plot(study_script ? na : run_script and showlevels ? topfractals : na, color=topfcolor, transp=0, linewidth=2)

plot(study_script ? na : run_script and showfractals ? botfractals : na, color=botfcolor, transp=0, linewidth=2)

// Risk management

inpTakeProfit = input(defval = 1500, title = "Take Profit", minval = 0)

inpStopLoss = input(defval = 100, title = "Stop Loss", minval = 0)

inpTrailStop = input(defval = 0, title = "Trailing Stop Loss", minval = 0)

inpTrailOffset = input(defval = 0, title = "Trailing Stop Loss Offset", minval = 0)

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

useTrailStop = inpTrailStop >= 1 ? inpTrailStop : na

useTrailOffset = inpTrailOffset >= 1 ? inpTrailOffset : na

// Condition to enter/exit short/long

enterLong = (run_script) and res_crossUp

enterShort = (run_script) and res_crossDn

exitLong = (run_script) and pIHammer

exitShort = (run_script) and pHammer

// STRATEGY script => uncomment ; STUDY script => comment

strategy.entry( id = "Long", long = true, when = enterLong )

strategy.close( id = "Long", when = exitLong )

strategy.entry( id = "Short", long = false, when = enterShort )

strategy.close( id = "Short", when = exitShort )

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss, trail_points = useTrailStop, trail_offset = useTrailOffset)

// Transform strtegy to alert by cretinon

last_long_trade_value = enterLong[1] ? close[1] : last_long_trade_value[1]

last_short_trade_value = enterShort[1] ? close[1] : last_short_trade_value[1]

are_we_long = exitLong[1] ? false : enterLong[1] ? true : enterShort[1] ? false : are_we_long[1] and last_long_trade_value + useTakeProfit/100 <= high[1] ? false : are_we_long[1] and last_long_trade_value - useStopLoss/100 >= low[1] ? false : are_we_long[1]

are_we_short = exitShort[1] ? false : enterShort[1] ? true : enterLong[1] ? false : are_we_short[1] and last_short_trade_value - useTakeProfit/100 >= low[1] ? false : are_we_short[1] and last_short_trade_value + useStopLoss/100 <= high[1] ? false : are_we_short[1]

plot_info = (not are_we_long[2] and not are_we_short[2] and enterLong[1]) ? 1 : (not are_we_long[2] and not are_we_short[2] and enterShort[1]) ? 2 : (not are_we_long[2] and not are_we_short[2] and exitLong[1]) ? -1 : (not are_we_long[2] and not are_we_short[2] and exitShort[1]) ? -2 : (are_we_long[2] and enterLong[1]) ? -3 : (are_we_long[2] and enterShort[1]) ? 3 : (are_we_long[2] and exitLong[1]) ? 4 : (are_we_long[2] and exitShort[1]) ? -4 : (are_we_long[2] and last_long_trade_value + useTakeProfit/100 <= high[1]) ? 5 : (are_we_long[2] and last_long_trade_value - useStopLoss/100 >= low[1]) ? 6 :(are_we_short[2] and enterLong[1]) ? 7 : (are_we_short[2] and enterShort[1]) ? -5 : (are_we_short[2] and exitLong[1]) ? -6 : (are_we_short[2] and exitShort[1]) ? 8 : (are_we_short[2] and last_short_trade_value - useTakeProfit/100 >= low[1]) ? 9 : (are_we_short[2] and last_short_trade_value + useStopLoss/100 <= high[1]) ? 10 : -7

// plot : debbuging purpose

plot(study_script ? plot_info : na, title="plot_info", color=yellow, style=line, linewidth=4)

// alertcondition

// STRATEGY script => comment ; STUDY script => uncomment

alertcondition(plot_info == 1,title="enterLong", message="enterLong")

alertcondition(plot_info == 2,title="enterShort", message="enterShort")

alertcondition(plot_info == 3,title="enterShort", message="enterShort after Long")

alertcondition(plot_info == 4,title="exitLong", message="exitLong")

alertcondition(plot_info == 5,title="exitLong", message="TakeProfitLong")

alertcondition(plot_info == 6,title="exitLong", message="StopLossLong")

alertcondition(plot_info == 7,title="enterLong", message="enterLong after Short")

alertcondition(plot_info == 8,title="exitShort", message="exitShort")

alertcondition(plot_info == 9,title="exitShort", message="TakeProfitShort")

alertcondition(plot_info == 10,title="exitShort", message="StopLossShort")