Cukup pindahkan dua indikator tradingview dan uji kembali (hanya untuk komunikasi dan pembelajaran, konsekuensi sebenarnya menjadi risiko Anda sendiri)

7

7

1440

1440

Indikator yang digunakan oleh strategi

1、SSL Hybrid

2. STOCH RSI

Ini adalah indikator yang ada di Trading View, dan Anda bisa langsung memindahkannya ke Trading View.

Ini adalah indikator yang ada di Trading View, dan Anda bisa langsung memindahkannya ke Trading View.

Kode SSL Hybrid, 275 baris panjang

//@version=4

//By Mihkel00

// This script is designed for the NNFX Method, so it is recommended for Daily charts only.

// Tried to implement a few VP NNFX Rules

// This script has a SSL / Baseline (you can choose between the SSL or MA), a secondary SSL for continiuation trades and a third SSL for exit trades.

// Alerts added for Baseline entries, SSL2 continuations, Exits.

// Baseline has a Keltner Channel setting for "in zone" Gray Candles

// Added "Candle Size > 1 ATR" Diamonds from my old script with the criteria of being within Baseline ATR range.

// Credits

// Strategy causecelebre https://www.tradingview.com/u/causecelebre/

// SSL Channel ErwinBeckers https://www.tradingview.com/u/ErwinBeckers/

// Moving Averages jiehonglim https://www.tradingview.com/u/jiehonglim/

// Moving Averages everget https://www.tradingview.com/u/everget/

// "Many Moving Averages" script Fractured https://www.tradingview.com/u/Fractured/

study("SSL Hybrid", overlay=true)

show_Baseline = input(title="Show Baseline", type=input.bool, defval=true)

show_SSL1 = input(title="Show SSL1", type=input.bool, defval=false)

show_atr = input(title="Show ATR bands", type=input.bool, defval=true)

//ATR

atrlen = input(14, "ATR Period")

mult = input(1, "ATR Multi", step=0.1)

smoothing = input(title="ATR Smoothing", defval="WMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, atrlen) =>

if smoothing == "RMA"

rma(source, atrlen)

else

if smoothing == "SMA"

sma(source, atrlen)

else

if smoothing == "EMA"

ema(source, atrlen)

else

wma(source, atrlen)

atr_slen = ma_function(tr(true), atrlen)

////ATR Up/Low Bands

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

////BASELINE / SSL1 / SSL2 / EXIT MOVING AVERAGE VALUES

maType = input(title="SSL1 / Baseline Type", type=input.string, defval="HMA", options=["SMA","EMA","DEMA","TEMA","LSMA","WMA","MF","VAMA","TMA","HMA", "JMA", "Kijun v2", "EDSMA","McGinley"])

len = input(title="SSL1 / Baseline Length", defval=60)

SSL2Type = input(title="SSL2 / Continuation Type", type=input.string, defval="JMA", options=["SMA","EMA","DEMA","TEMA","WMA","MF","VAMA","TMA","HMA", "JMA","McGinley"])

len2 = input(title="SSL 2 Length", defval=5)

//

SSL3Type = input(title="EXIT Type", type=input.string, defval="HMA", options=["DEMA","TEMA","LSMA","VAMA","TMA","HMA","JMA", "Kijun v2", "McGinley", "MF"])

len3 = input(title="EXIT Length", defval=15)

src = input(title="Source", type=input.source, defval=close)

//

tema(src, len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

(3 * ema1) - (3 * ema2) + ema3

kidiv = input(defval=1,maxval=4, title="Kijun MOD Divider")

jurik_phase = input(title="* Jurik (JMA) Only - Phase", type=input.integer, defval=3)

jurik_power = input(title="* Jurik (JMA) Only - Power", type=input.integer, defval=1)

volatility_lookback = input(10, title="* Volatility Adjusted (VAMA) Only - Volatility lookback length")

//MF

beta = input(0.8,minval=0,maxval=1,step=0.1, title="Modular Filter, General Filter Only - Beta")

feedback = input(false, title="Modular Filter Only - Feedback")

z = input(0.5,title="Modular Filter Only - Feedback Weighting",step=0.1, minval=0, maxval=1)

//EDSMA

ssfLength = input(title="EDSMA - Super Smoother Filter Length", type=input.integer, minval=1, defval=20)

ssfPoles = input(title="EDSMA - Super Smoother Filter Poles", type=input.integer, defval=2, options=[2, 3])

//----

//EDSMA

get2PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = sqrt(2) * PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(arg)

c2 = b1

c3 = -pow(a1, 2)

c1 = 1 - c2 - c3

ssf = 0.0

ssf := c1 * src + c2 * nz(ssf[1]) + c3 * nz(ssf[2])

get3PoleSSF(src, length) =>

PI = 2 * asin(1)

arg = PI / length

a1 = exp(-arg)

b1 = 2 * a1 * cos(1.738 * arg)

c1 = pow(a1, 2)

coef2 = b1 + c1

coef3 = -(c1 + b1 * c1)

coef4 = pow(c1, 2)

coef1 = 1 - coef2 - coef3 - coef4

ssf = 0.0

ssf := coef1 * src + coef2 * nz(ssf[1]) + coef3 * nz(ssf[2]) + coef4 * nz(ssf[3])

ma(type, src, len) =>

float result = 0

if type=="TMA"

result := sma(sma(src, ceil(len / 2)), floor(len / 2) + 1)

if type=="MF"

ts=0.,b=0.,c=0.,os=0.

//----

alpha = 2/(len+1)

a = feedback ? z*src + (1-z)*nz(ts[1],src) : src

//----

b := a > alpha*a+(1-alpha)*nz(b[1],a) ? a : alpha*a+(1-alpha)*nz(b[1],a)

c := a < alpha*a+(1-alpha)*nz(c[1],a) ? a : alpha*a+(1-alpha)*nz(c[1],a)

os := a == b ? 1 : a == c ? 0 : os[1]

//----

upper = beta*b+(1-beta)*c

lower = beta*c+(1-beta)*b

ts := os*upper+(1-os)*lower

result := ts

if type=="LSMA"

result := linreg(src, len, 0)

if type=="SMA" // Simple

result := sma(src, len)

if type=="EMA" // Exponential

result := ema(src, len)

if type=="DEMA" // Double Exponential

e = ema(src, len)

result := 2 * e - ema(e, len)

if type=="TEMA" // Triple Exponential

e = ema(src, len)

result := 3 * (e - ema(e, len)) + ema(ema(e, len), len)

if type=="WMA" // Weighted

result := wma(src, len)

if type=="VAMA" // Volatility Adjusted

/// Copyright © 2019 to present, Joris Duyck (JD)

mid=ema(src,len)

dev=src-mid

vol_up=highest(dev,volatility_lookback)

vol_down=lowest(dev,volatility_lookback)

result := mid+avg(vol_up,vol_down)

if type=="HMA" // Hull

result := wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len)))

if type=="JMA" // Jurik

/// Copyright © 2018 Alex Orekhov (everget)

/// Copyright © 2017 Jurik Research and Consulting.

phaseRatio = jurik_phase < -100 ? 0.5 : jurik_phase > 100 ? 2.5 : jurik_phase / 100 + 1.5

beta = 0.45 * (len - 1) / (0.45 * (len - 1) + 2)

alpha = pow(beta, jurik_power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

result := jma

if type=="Kijun v2"

kijun = avg(lowest(len), highest(len))//, (open + close)/2)

conversionLine = avg(lowest(len/kidiv), highest(len/kidiv))

delta = (kijun + conversionLine)/2

result :=delta

if type=="McGinley"

mg = 0.0

mg := na(mg[1]) ? ema(src, len) : mg[1] + (src - mg[1]) / (len * pow(src/mg[1], 4))

result :=mg

if type=="EDSMA"

zeros = src - nz(src[2])

avgZeros = (zeros + zeros[1]) / 2

// Ehlers Super Smoother Filter

ssf = ssfPoles == 2

? get2PoleSSF(avgZeros, ssfLength)

: get3PoleSSF(avgZeros, ssfLength)

// Rescale filter in terms of Standard Deviations

stdev = stdev(ssf, len)

scaledFilter = stdev != 0

? ssf / stdev

: 0

alpha = 5 * abs(scaledFilter) / len

edsma = 0.0

edsma := alpha * src + (1 - alpha) * nz(edsma[1])

result := edsma

result

///SSL 1 and SSL2

emaHigh = ma(maType, high, len)

emaLow = ma(maType, low, len)

maHigh = ma(SSL2Type, high, len2)

maLow = ma(SSL2Type, low, len2)

///EXIT

ExitHigh = ma(SSL3Type, high, len3)

ExitLow = ma(SSL3Type, low, len3)

///Keltner Baseline Channel

BBMC = ma(maType, close, len)

useTrueRange = input(true)

multy = input(0.2, step=0.05, title="Base Channel Multiplier")

Keltma = ma(maType, src, len)

range = useTrueRange ? tr : high - low

rangema = ema(range, len)

upperk =Keltma + rangema * multy

lowerk = Keltma - rangema * multy

//Baseline Violation Candle

open_pos = open*1

close_pos = close*1

difference = abs(close_pos-open_pos)

atr_violation = difference > atr_slen

InRange = upper_band > BBMC and lower_band < BBMC

candlesize_violation = atr_violation and InRange

plotshape(candlesize_violation, color=color.white, size=size.tiny,style=shape.diamond, location=location.top, transp=0,title="Candle Size > 1xATR")

//SSL1 VALUES

Hlv = int(na)

Hlv := close > emaHigh ? 1 : close < emaLow ? -1 : Hlv[1]

sslDown = Hlv < 0 ? emaHigh : emaLow

//SSL2 VALUES

Hlv2 = int(na)

Hlv2 := close > maHigh ? 1 : close < maLow ? -1 : Hlv2[1]

sslDown2 = Hlv2 < 0 ? maHigh : maLow

//EXIT VALUES

Hlv3 = int(na)

Hlv3 := close > ExitHigh ? 1 : close < ExitLow ? -1 : Hlv3[1]

sslExit = Hlv3 < 0 ? ExitHigh : ExitLow

base_cross_Long = crossover(close, sslExit)

base_cross_Short = crossover(sslExit, close)

codiff = base_cross_Long ? 1 : base_cross_Short ? -1 : na

//COLORS

show_color_bar = input(title="Color Bars", type=input.bool, defval=true)

color_bar = close > upperk ? #00c3ff : close < lowerk ? #ff0062 : color.gray

color_ssl1 = close > sslDown ? #00c3ff : close < sslDown ? #ff0062 : na

//PLOTS

plotarrow(codiff, colorup=#00c3ff, colordown=#ff0062,title="Exit Arrows", transp=20, maxheight=20, offset=0)

p1 = plot(show_Baseline ? BBMC : na, color=color_bar, linewidth=4,transp=0, title='MA Baseline')

DownPlot = plot( show_SSL1 ? sslDown : na, title="SSL1", linewidth=3, color=color_ssl1, transp=10)

barcolor(show_color_bar ? color_bar : na)

up_channel = plot(show_Baseline ? upperk : na, color=color_bar, title="Baseline Upper Channel")

low_channel = plot(show_Baseline ? lowerk : na, color=color_bar, title="Basiline Lower Channel")

fill(up_channel, low_channel, color=color_bar, transp=90)

////SSL2 Continiuation from ATR

atr_crit = input(0.9, step=0.1, title="Continuation ATR Criteria")

upper_half = atr_slen * atr_crit + close

lower_half = close - atr_slen * atr_crit

buy_inatr = lower_half < sslDown2

sell_inatr = upper_half > sslDown2

sell_cont = close < BBMC and close < sslDown2

buy_cont = close > BBMC and close > sslDown2

sell_atr = sell_inatr and sell_cont

buy_atr = buy_inatr and buy_cont

atr_fill = buy_atr ? color.green : sell_atr ? color.purple : color.white

LongPlot = plot(sslDown2, title="SSL2", linewidth=2, color=atr_fill, style=plot.style_circles, transp=0)

u = plot(show_atr ? upper_band : na, "+ATR", color=color.white, transp=80)

l = plot(show_atr ? lower_band : na, "-ATR", color=color.white, transp=80)

//ALERTS

alertcondition(crossover(close, sslDown), title='SSL Cross Alert', message='SSL1 has crossed.')

alertcondition(crossover(close, sslDown2), title='SSL2 Cross Alert', message='SSL2 has crossed.')

alertcondition(sell_atr, title='Sell Continuation', message='Sell Continuation.')

alertcondition(buy_atr, title='Buy Continuation', message='Buy Continuation.')

alertcondition(crossover(close, sslExit), title='Exit Sell', message='Exit Sell Alert.')

alertcondition(crossover(sslExit, close), title='Exit Buy', message='Exit Buy Alert.')

alertcondition(crossover(close, upperk ), title='Baseline Buy Entry', message='Base Buy Alert.')

alertcondition(crossover(lowerk, close ), title='Baseline Sell Entry', message='Base Sell Alert.')

// Ini adalah kode Stoch RSI, dan saya menyalinnya

//@version=5

indicator(title="Stochastic RSI", shorttitle="Stoch RSI", format=format.price, precision=2, timeframe="", timeframe_gaps=true)

smoothK = input.int(3, "K", minval=1)

smoothD = input.int(3, "D", minval=1)

lengthRSI = input.int(14, "RSI Length", minval=1)

lengthStoch = input.int(14, "Stochastic Length", minval=1)

src1 = input(close, title="RSI Source") //src重名了,改为src1

rsi1 = ta.rsi(src1, lengthRSI) //src重名了,改为src1

k = ta.sma(ta.stoch(rsi1, rsi1, rsi1, lengthStoch), smoothK)

d = ta.sma(k, smoothD)

plot(k, "K", color=#2962FF)

plot(d, "D", color=#FF6D00)

h0 = hline(80, "Upper Band", color=#787B86)

hline(50, "Middle Band", color=color.new(#787B86, 50))

h1 = hline(20, "Lower Band", color=#787B86)

fill(h0, h1, color=color.rgb(33, 150, 243, 90), title="Background")

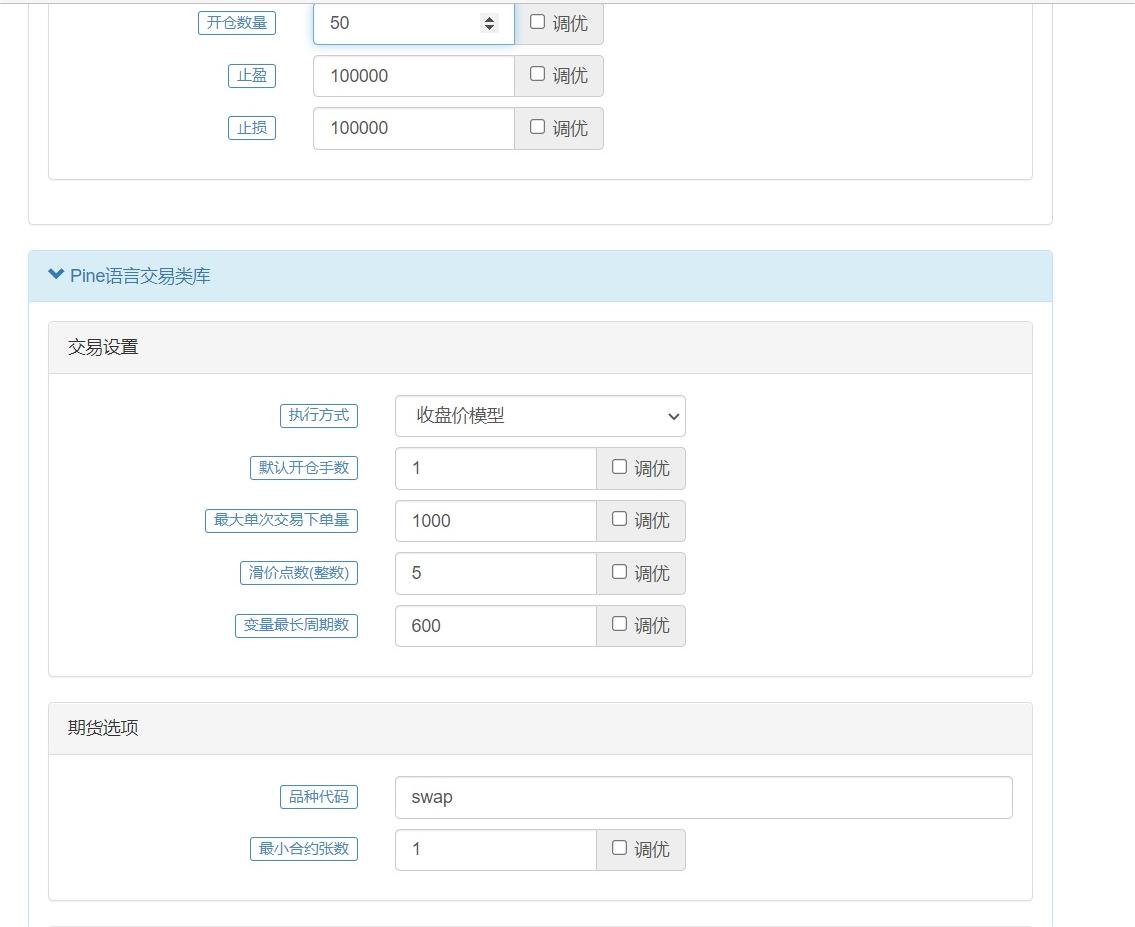

// ada masalah di sini, ada variabel src yang berganti nama di kedua indikator ini, untuk mengubah nama src ke src1 dua kali munculnya stoch rsi /// Di akhir strategi, ditambah fungsi trading

BASEMONEY = input(50, '开仓数量') //开仓数量,回测50000u开50eth还是很靠谱的,如果是btc当然不能这么多

prof = input(10, '止盈') //止盈止损百分比,回测不带止盈止损,直接设置10000

los = input(5,'止损')

if base_cross_Long and k < 20 and d <20 //base_cross_Long ,ssl hybird指标里向上的买入箭头

strategy.entry("Enter Long", strategy.long, BASEMONEY) //k,d <20 ,stoch rsi 超卖信号。同时出现这两个指标,买入

strategy.exit("exit", profit = prof, loss = los )

if base_cross_Short and k > 80 and d > 80 //base_cross_Long ,ssl hybird指标里向下的卖出箭头

strategy.entry("Enter Short", strategy.short, BASEMONEY) //k,d >80 ,stoch rsi 超买信号。同时出现这两个指标,卖出

strategy.exit("exit", profit = prof, loss = los)

// selesai, kode diatas langsung disalin ke dalam bahasa pine strategi baru yang bisa langsung digunakan

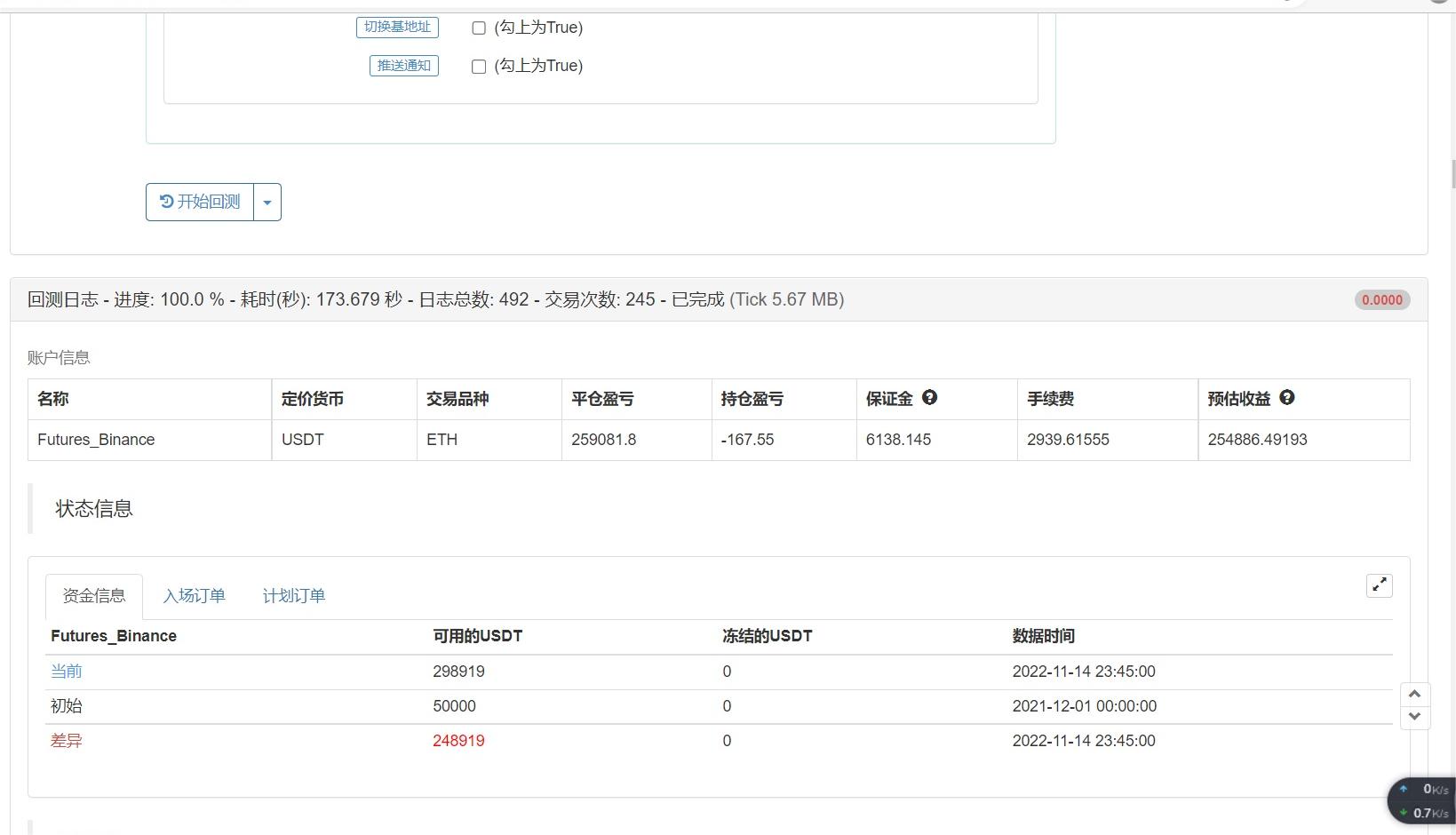

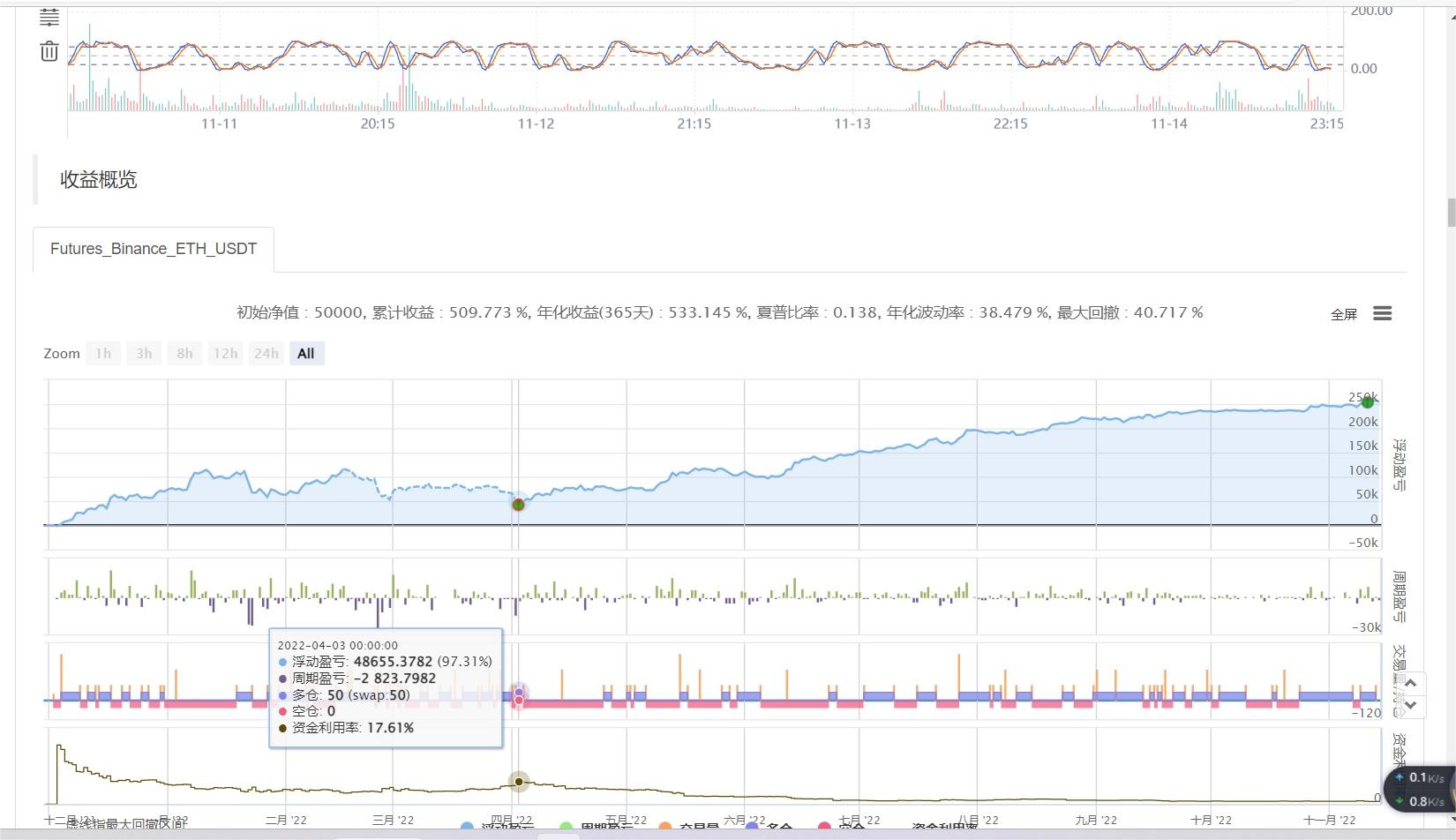

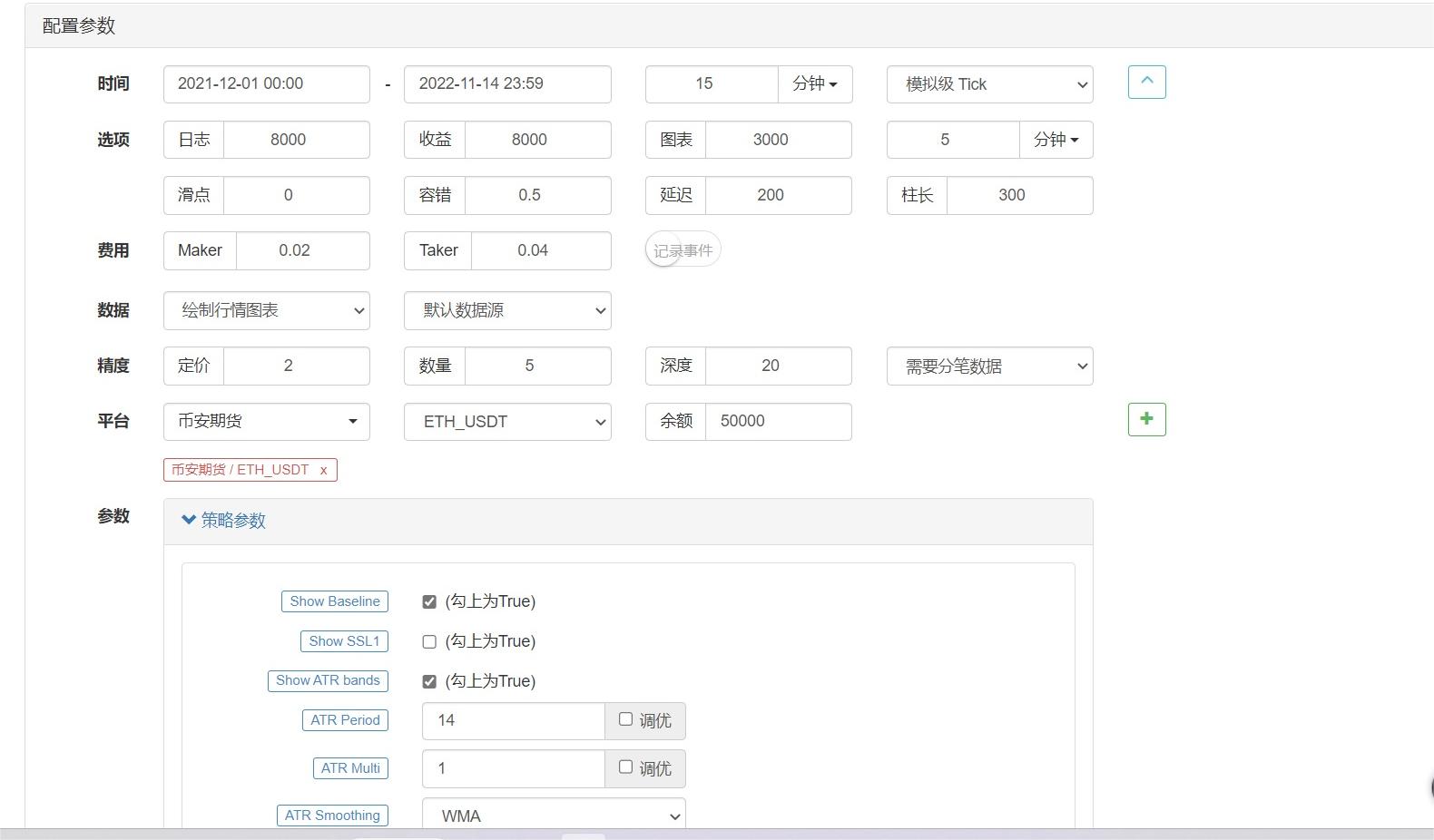

ETH 15 menit retracement, default 10x leverage, stop loss stop loss 10000 dan indikator lainnya default

Waktu pengembalian dari 1 Desember 2021 hingga 14 November 2022, termasuk 124, 512, 618, 119 berbagai peristiwa besar

Hasil pengamatan meledak, hanya untuk pengamatan ulang, kesenangan, dan kesombongan dari hasil tangkapan layar

Hasil pengamatan meledak, hanya untuk pengamatan ulang, kesenangan, dan kesombongan dari hasil tangkapan layar