Versi Python strategi iceberg komisi

Penulis:Kebaikan, Dibuat: 2020-07-21 10:21:10, Diperbarui: 2023-10-26 20:08:29

Artikel ini membawa dua strategi klasik untuk transplantasi: komisi Iceberg (beli / jual). strategi ini ditransplantasikan dari komisi Iceberg versi JavaScript dari platform FMZ. alamat strategi adalahhttps://www.fmz.com/square/s:Iceberg/1

Mengutip versi JavaScript dari Iceberg komisi strategi perdagangan pengenalan:

Komisi Iceberg mengacu pada fakta bahwa ketika investor melakukan transaksi bernilai besar, untuk menghindari dampak yang berlebihan pada pasar, komisi pesanan besar secara otomatis dibagi menjadi beberapa komisi, berdasarkan harga beli / jual 1 terbaru saat ini dan harga yang ditetapkan oleh pedagang. Strategi ini secara otomatis komisi pesanan kecil. Ketika komisi terakhir sepenuhnya ditransfer atau harga terbaru menyimpang secara signifikan dari harga komisi saat ini, operasi komisi secara otomatis dimulai kembali.

Banyak halaman perdagangan pertukaran dilengkapi dengan alat komisi gunung es, yang memiliki fungsi yang kaya, tetapi jika Anda ingin menyesuaikan beberapa fungsi atau memodifikasi beberapa fungsi sesuai dengan kebutuhan Anda sendiri, Anda memerlukan alat yang lebih fleksibel. Platform FMZ dirancang untuk memecahkan masalah ini dengan benar. Strategy Square kami tidak memiliki terlalu banyak strategi perdagangan Python. Beberapa pedagang yang ingin menggunakan bahasa Python untuk menulis alat dan strategi perdagangan perlu merujuk pada contoh. Oleh karena itu, strategi komisi gunung es klasik dipindahkan ke versi Python.

Komisi Iceberg untuk Python - Pembelian

import random # Import random number library

def CancelPendingOrders(): # The function of CancelPendingOrders is to cancel all pending orders of the current transaction.

while True: # Loop detection, call GetOrders function to detect the current pending order, if orders is an empty array, that is, len(orders) is equal to 0, indicating that all orders have been cancelled, you can exit the function and call return to exit.

orders = _C(exchange.GetOrders)

if len(orders) == 0 :

return

for j in range(len(orders)): # Traverse the current array of pending orders, and call CancelOrder to cancel the orders one by one.

exchange.CancelOrder(orders[j]["Id"])

if j < len(orders) - 1: # Except for the last order, execute Sleep every time and let the program wait for a while to avoid canceling orders too frequently.

Sleep(Interval)

LastBuyPrice = 0 # Set a global variable to record the the latest buying price.

InitAccount = None # Set a global variable to record the initial account asset information.

def dispatch(): # Main functions of iceberg commission logic

global InitAccount, LastBuyPrice # Reference global variables

account = None # Declare a variable to record the account information obtained in real time for comparison calculation.

ticker = _C(exchange.GetTicker) # Declare a variable to record the latest market quotes.

LogStatus(_D(), "ticker:", ticker) # Output time and latest quotation in the status bar

if LastBuyPrice > 0: # When LastBuyPrice is greater than 0, that is, when the commission has started, the code in the if condition is executed.

if len(_C(exchange.GetOrders)) > 0: # Call the exchange.GetOrders function to get all current pending orders, determine that there are pending orders, and execute the code in the if condition.

if ticker["Last"] > LastBuyPrice and ((ticker["Last"] - LastBuyPrice) / LastBuyPrice) > (2 * (EntrustDepth / 100)): # Detect the degree of deviation, if the condition is triggered, execute the code in the if, and cancel the order.

Log("Too much deviation, the latest transaction price:", ticker["Last"], "Commission price", LastBuyPrice)

CancelPendingOrders()

else :

return True

else : # If there is no pending order, it proves that the order is completely filled.

account = _C(exchange.GetAccount) # Get current account asset information.

Log("The buying order is completed, the cumulative cost:", _N(InitAccount["Balance"] - account["Balance"]), "Average buying price:", _N((InitAccount["Balance"] - account["Balance"]) / (account["Stocks"] - InitAccount["Stocks"]))) # Print transaction information.

LastBuyPrice = 0 # Reset LastBuyPrice to 0

BuyPrice = _N(ticker["Buy"] * (1 - EntrustDepth / 100)) # Calculate the price of pending orders based on current market conditions and parameters.

if BuyPrice > MaxBuyPrice: # Determine whether the maximum price set by the parameter is exceeded

return True

if not account: # If account is null, execute the code in the if statement to retrieve the current asset information and copy it to account

account = _C(exchange.GetAccount)

if (InitAccount["Balance"] - account["Balance"]) >= TotalBuyNet: # Determine whether the total amount of money spent on buying exceeds the parameter setting.

return False

RandomAvgBuyOnce = (AvgBuyOnce * ((100.0 - FloatPoint) / 100.0)) + (((FloatPoint * 2) / 100.0) * AvgBuyOnce * random.random()) # random number 0~1

UsedMoney = min(account["Balance"], RandomAvgBuyOnce, TotalBuyNet - (InitAccount["Balance"] - account["Balance"]))

BuyAmount = _N(UsedMoney / BuyPrice) # Calculate the buying quantity

if BuyAmount < MinStock: # Determine whether the buying quantity is less than the minimum buying quantity limit on the parameter.

return False

LastBuyPrice = BuyPrice # Record the price of this order and assign it to LastBuyPrice

exchange.Buy(BuyPrice, BuyAmount, "spend:¥", _N(UsedMoney), "Last transaction price", ticker["Last"]) # Place orders

return True

def main():

global LoopInterval, InitAccount # Refer to LoopInterval, InitAccount global variables

CancelPendingOrders() # Cancel all pending orders when starting to run

InitAccount = _C(exchange.GetAccount) # Account assets at the beginning of the initial record

Log(InitAccount) # Print initial account information

if InitAccount["Balance"] < TotalBuyNet: # If the initial assets are insufficient, an error will be thrown and the program will stop

raise Exception("Insufficient account balance")

LoopInterval = max(LoopInterval, 1) # Set LoopInterval to at least 1

while dispatch(): # The main loop, the iceberg commission logic function dispatch is called continuously, and the loop stops when the dispatch function returns false.

Sleep(LoopInterval * 1000) # Pause each cycle to control the polling frequency.

Log("委托全部完成", _C(exchange.GetAccount)) # When the loop execution jumps out, the current account asset information is printed.

Iceberg Komisi untuk Python - Penjualan

Logika strategi adalah sama dengan pembelian, hanya dengan sedikit perbedaan.

import random

def CancelPendingOrders():

while True:

orders = _C(exchange.GetOrders)

if len(orders) == 0:

return

for j in range(len(orders)):

exchange.CancelOrder(orders[j]["Id"])

if j < len(orders) - 1:

Sleep(Interval)

LastSellPrice = 0

InitAccount = None

def dispatch():

global LastSellPrice, InitAccount

account = None

ticker = _C(exchange.GetTicker)

LogStatus(_D(), "ticker:", ticker)

if LastSellPrice > 0:

if len(_C(exchange.GetOrders)) > 0:

if ticker["Last"] < LastSellPrice and ((LastSellPrice - ticker["Last"]) / ticker["Last"]) > (2 * (EntrustDepth / 100)):

Log("Too much deviation, the latest transaction price:", ticker["Last"], "Commission price", LastSellPrice)

CancelPendingOrders()

else :

return True

else :

account = _C(exchange.GetAccount)

Log("The buy order is completed, and the accumulated selling:", _N(InitAccount["Stocks"] - account["Stocks"]), "Average selling price:", _N((account["Balance"] - InitAccount["Balance"]) / (InitAccount["Stocks"] - account["Stocks"])))

LastSellPrice = 0

SellPrice = _N(ticker["Sell"] * (1 + EntrustDepth / 100))

if SellPrice < MinSellPrice:

return True

if not account:

account = _C(exchange.GetAccount)

if (InitAccount["Stocks"] - account["Stocks"]) >= TotalSellStocks:

return False

RandomAvgSellOnce = (AvgSellOnce * ((100.0 - FloatPoint) / 100.0)) + (((FloatPoint * 2) / 100.0) * AvgSellOnce * random.random())

SellAmount = min(TotalSellStocks - (InitAccount["Stocks"] - account["Stocks"]), RandomAvgSellOnce)

if SellAmount < MinStock:

return False

LastSellPrice = SellPrice

exchange.Sell(SellPrice, SellAmount, "Last transaction price", ticker["Last"])

return True

def main():

global InitAccount, LoopInterval

CancelPendingOrders()

InitAccount = _C(exchange.GetAccount)

Log(InitAccount)

if InitAccount["Stocks"] < TotalSellStocks:

raise Exception("Insufficient account currency")

LoopInterval = max(LoopInterval, 1)

while dispatch():

Sleep(LoopInterval)

Log("All commissioned", _C(exchange.GetAccount))

Operasi Strategi

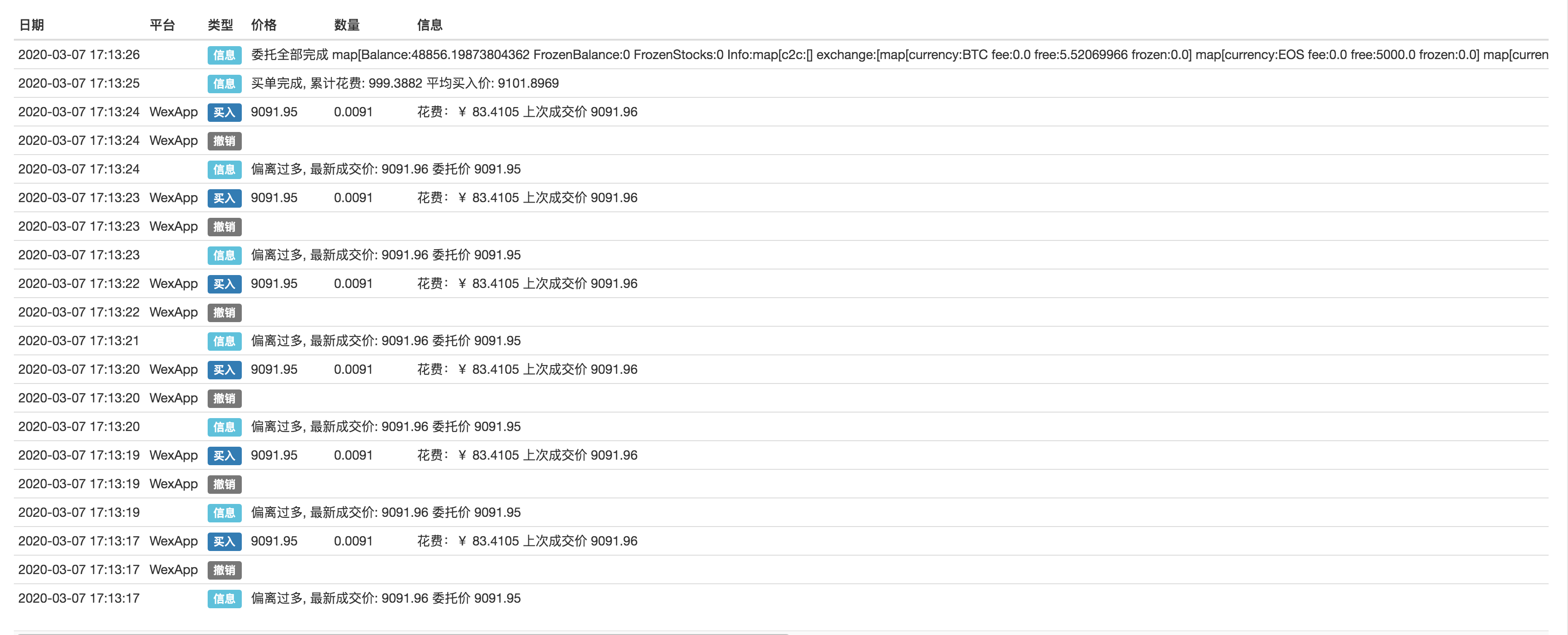

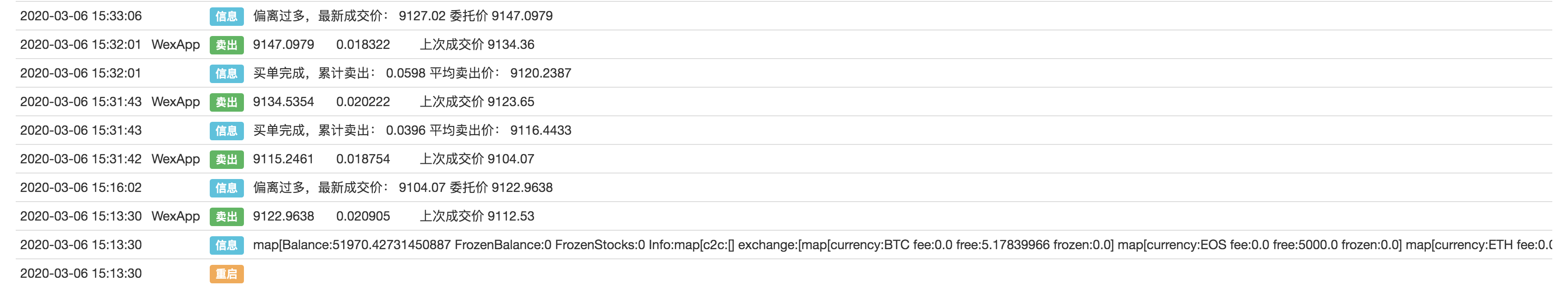

Gunakan WexApp untuk mensimulasikan tes pertukaran:

Membeli:

Menjual:

Logika strategi tidak rumit. Ketika strategi dieksekusi, secara dinamis akan menempatkan dan membatalkan pesanan berdasarkan parameter strategi dan harga pasar saat ini. Ketika jumlah transaksi / nomor koin mencapai atau mendekati nomor pengaturan parameter, strategi berhenti. Kode strategi sangat sederhana dan cocok untuk pemula. Pembaca yang tertarik dapat memodifikasinya dan merancang strategi yang sesuai dengan gaya trading mereka.

- Praktik Kuantitatif Bursa DEX (2) -- Panduan Pengguna Hyperliquid

- DEX Exchange Quantitative Practice ((2) -- Hyperliquid Panduan Penggunaan

- Praktik Kuantitatif Bursa DEX (1) -- DYdX v4 Panduan Pengguna

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (3)

- Praktik Kuantitatif DEX Exchange ((1)-- dYdX v4 Panduan Penggunaan

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (3)

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (2)

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (2)

- Pembahasan Penerimaan Sinyal Eksternal Platform FMZ: Solusi Lengkap untuk Penerimaan Sinyal dengan Layanan Http Terbina dalam Strategi

- FMZ platform eksplorasi penerimaan sinyal eksternal: strategi built-in https layanan solusi lengkap untuk penerimaan sinyal

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (1)

- Tambahkan jam alarm ke strategi perdagangan

- Strategi lindung nilai kontrak berjangka OKEX dengan menggunakan C++

- Strategi perdagangan berdasarkan arus aktif dana

- Gunakan plug-in terminal perdagangan untuk memfasilitasi perdagangan manual

- Strategi perdagangan tarif penulisan kuantitatif

- Strategi keseimbangan dan strategi jaringan

- Solusi berbagi penawaran pasar multi-robot

- Robot WeChat pesan push implementasi skema

- Strategi keseimbangan dan strategi grid

- Strategi perdagangan Martingale grafis

- Logika Perdagangan Berjangka Mata Uang Crypto

- Bentuk dasar strategi ZDZB

- Solusi berbagi pasar multi-robot

- Pemodelan dan analisis volatilitas Bitcoin berdasarkan model ARMA-EGARCH

- Solusi masalah akurasi perhitungan numerik dalam desain strategi JavaScript

- Mengajarkan Anda untuk mengkapsulkan strategi Python ke dalam file lokal

- Perdagangan FMEX membuka optimalisasi volume pesanan optimal Bagian 2

- Perdagangan FMEX membuka optimalisasi volume pesanan yang optimal

- Analisis dan Realisasi Commodity Futures Volume Footprint Chart

- FMEX mengoptimalkan pemesanan