Thermostat Strategi menggunakan di pasar crypto oleh MyLanguage

Penulis:Kebaikan, Dibuat: 2020-08-21 19:19:20, Diperbarui: 2023-10-10 21:15:32

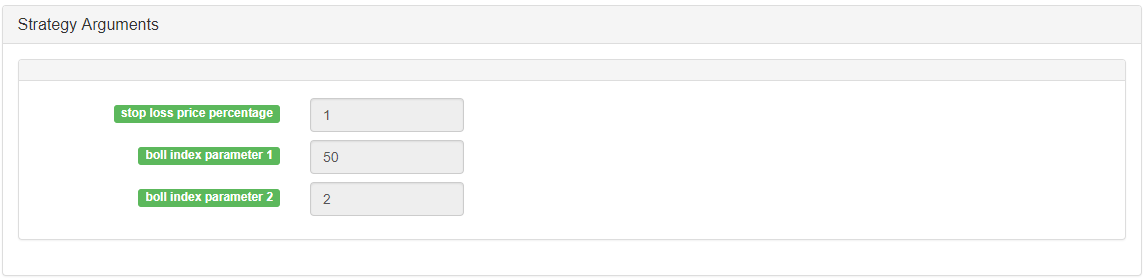

Nama strategi: Strategi termostat yang ditingkatkan

Siklus data: 1 jam

Dukungan: Komoditas Berjangka, Mata Uang Digital Berjangka, Mata Uang Digital Spot

Bagan utama: jalur atas, rumus: TOP^^MAC+N_TMPTMP; / / jalur atas dari bol Jalur bawah, rumus: BOTTOM^^MAC-N_TMPTMP;//jalur bawah bol

Grafik sekunder: CMI, rumus: CMI: ABS ((C-REF ((C,N_CMI-1))/(HHV ((H,N_CMI) -LLV ((L,N_CMI)) * 100; //0-100 semakin besar nilainya, semakin kuat tren, CMI <20 adalah osilasi, CMI>20 adalah tren

Kode sumber:

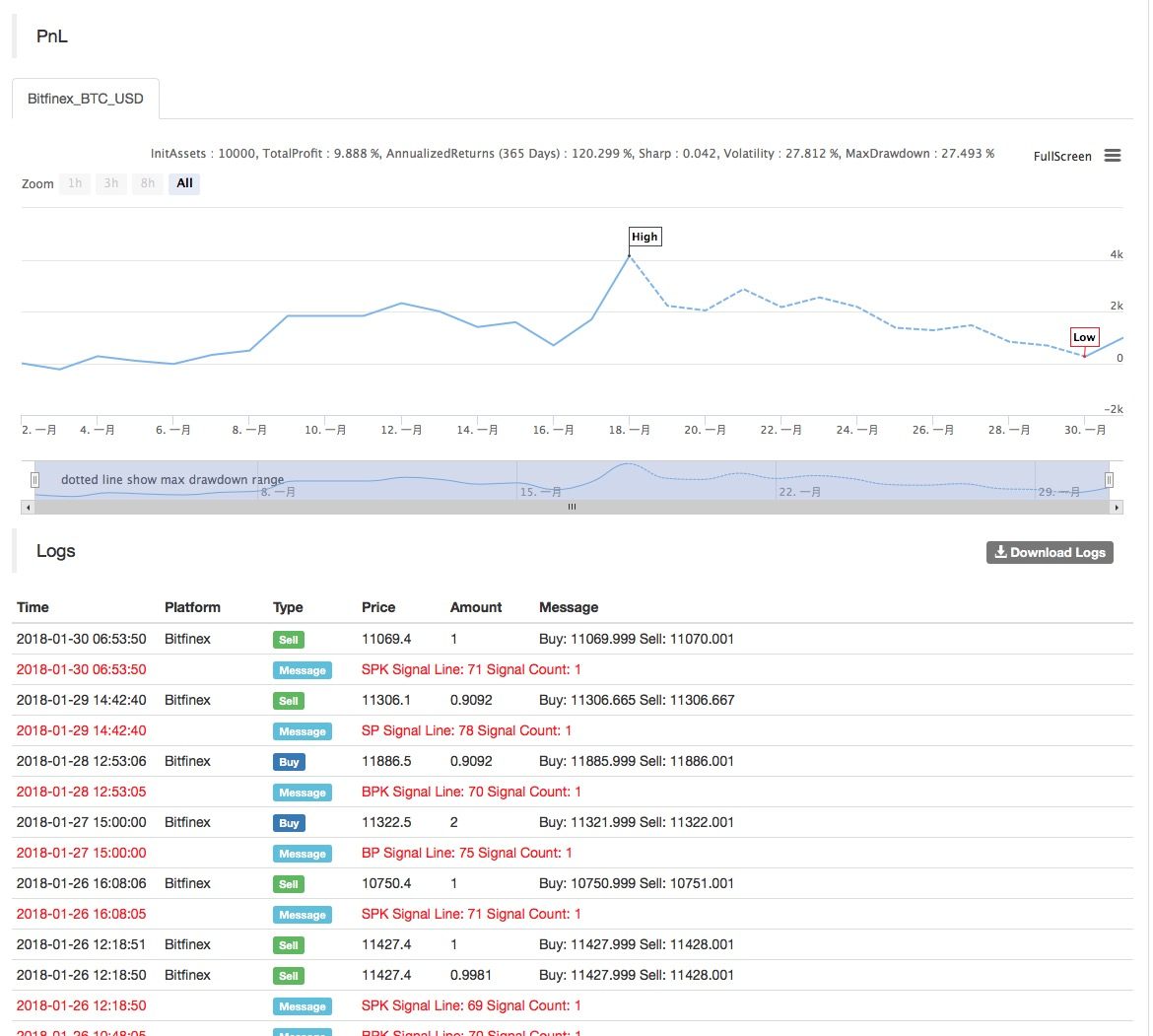

(*backtest

start: 2018-11-06 00:00:00

end: 2018-12-04 00:00:00

period: 1h

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

*)

MAC:=MA(CLOSE,N);

TMP:=STD(CLOSE,N);

TOP^^MAC+N_TMP*TMP;// upper track of boll

BOTTOM^^MAC-N_TMP*TMP;// lower track of boll

BBOLL:=C>MAC;

SBOLL:=C<MAC;

N_CMI:=30;

CMI:ABS(C-REF(C,N_CMI-1))/(HHV(H,N_CMI)-LLV(L,N_CMI))*100;

//0-100 the larger the value, the stronger the trend, CMI <20 is oscillation mode, CMI>20 is the trend

N_KD:=9;

M1:=3;

M2:=3;

RSV:=(CLOSE-LLV(LOW,N_KD))/(HHV(HIGH,N_KD)-LLV(LOW,N_KD))*100;

//(1)closing price - the lowest of cycle N, (2)the highest of cycle N - the lowest of cycle N, (1)/(2)

K:=SMA(RSV,M1,1);//MA of RSV

D:=SMA(K,M2,1);//MA of K

MIND:=30;

BKD:=K>D AND D<MIND;

SKD:=K<D AND D>100-MIND;

//oscillation mode

BUYPK1:=CMI < 20 AND BKD;//if it's oscillation, buy to cover and buy long immediately

SELLPK1:=CMI < 20 AND SKD;//if it's oscillation, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY1:=REF(CMI,BARSBK) < 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND K<D;//if it's oscillation, long position take profit

BUYY1:=REF(CMI,BARSSK) < 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND K>D;//if it's oscillation, short position take profit

//trend mode

BUYPK2:=CMI >= 20 AND C > TOP;//if it's trend, buy to cover and buy long immediately

SELLPK2:=CMI >= 20 AND C < BOTTOM;//if it's trend, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY2:=REF(CMI,BARSBK) >= 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND SBOLL;//if it's trend, long position take profit

BUYY2:=REF(CMI,BARSSK) >= 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND BBOLL;//if it's trend, short position take profit

SELLS2:=REF(CMI,BARSBK) >= 20 AND C<BKPRICE*(1-0.01*STOPLOSS) AND SBOLL;//if it's trend, long position stop loss

BUYS2:=REF(CMI,BARSSK) >= 20 AND C>SKPRICE*(1+0.01*STOPLOSS) AND BBOLL;//if it's trend, short position stop loss

IF BARPOS>N THEN BEGIN

BUYPK1,BPK;

SELLPK1,SPK;

BUYPK2,BPK;

SELLPK2,SPK;

END

BUYY1,BP(SKVOL);

BUYY2,BP(SKVOL);

BUYS2,BP(SKVOL);

SELLY1,SP(BKVOL);

SELLY2,SP(BKVOL);

SELLS2,SP(BKVOL);

Kode sumber:https://www.fmz.com/strategy/129086

Artikel terkait

- Praktik Kuantitatif Bursa DEX (2) -- Panduan Pengguna Hyperliquid

- DEX Exchange Quantitative Practice ((2) -- Hyperliquid Panduan Penggunaan

- Praktik Kuantitatif Bursa DEX (1) -- DYdX v4 Panduan Pengguna

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (3)

- Praktik Kuantitatif DEX Exchange ((1)-- dYdX v4 Panduan Penggunaan

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (3)

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (2)

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (2)

- Pembahasan Penerimaan Sinyal Eksternal Platform FMZ: Solusi Lengkap untuk Penerimaan Sinyal dengan Layanan Http Terbina dalam Strategi

- FMZ platform eksplorasi penerimaan sinyal eksternal: strategi built-in https layanan solusi lengkap untuk penerimaan sinyal

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (1)

Informasi lebih lanjut

- Penggunaan server dalam transaksi kuantitatif

- [Perang Milenium] Rasio Pertukaran Bitcoin Strategi 3 Hedging Kupu-kupu

- Strategi pendirian yang seimbang

- RSI2 Strategi Reversi Rata-rata yang digunakan dalam futures

- Penjelasan API berjangka dan cryptocurrency

- Cepat menerapkan alat perdagangan kuantitatif semi otomatis

- Memperkenalkan indikator Aroon

- Studi awal tentang Backtesting Strategi Opsi Mata Uang Digital

- Perbedaan Antara Perdagangan Kuantitatif dan Perdagangan Subyektif

- Strategi Saluran ATR Diimplementasikan di pasar kripto

- hans123 strategi terobosan intraday

- Strategi Opsi Mata Uang Digitalisasi

- TradingViewWebHook alarm terhubung langsung ke robot FMZ

- Tambahkan jam alarm ke strategi perdagangan

- Strategi lindung nilai kontrak berjangka OKEX dengan menggunakan C++

- Strategi perdagangan berdasarkan arus aktif dana

- Gunakan plug-in terminal perdagangan untuk memfasilitasi perdagangan manual

- Strategi perdagangan tarif penulisan kuantitatif

- Strategi keseimbangan dan strategi jaringan

- Solusi berbagi penawaran pasar multi-robot