Cepat menerapkan alat perdagangan kuantitatif semi otomatis

Penulis:Kebaikan, Dibuat: 2020-08-30 10:11:02, Diperbarui: 2023-10-08 19:54:06

Cepat menerapkan alat perdagangan kuantitatif semi otomatis

Dalam perdagangan berjangka komoditas, arbitrage intertemporary adalah metode perdagangan yang umum. Jenis arbitrage ini tidak bebas risiko. Ketika arah satu sisi spread terus berkembang, posisi arbitrage akan berada dalam keadaan kehilangan terapung. Namun, selama posisi arbitrage dikendalikan dengan benar, itu masih sangat operasional dan layak.

Dalam artikel ini, kami mencoba beralih ke strategi perdagangan lain, alih-alih membangun strategi perdagangan otomatis sepenuhnya, kami menyadari alat perdagangan kuantitatif semi-otomatis interaktif untuk memudahkan arbitrase intertemporary dalam perdagangan berjangka komoditas.

Platform pengembangan kami akan menggunakan platform FMZ Quant. Fokus artikel ini adalah bagaimana membangun strategi semi otomatis dengan fungsi interaktif.

Arbitrage intertemporal adalah konsep yang sangat sederhana.

Konsep arbitrase intertemporal

- Kutipan dari Wikipedia

# Strategy Design

The strategy framework is as follows:

Fungsi utama

Sementara (benar) {

If(exchange.IO(

If the CTP protocol is connected properly, then we need to set up the trading contract and then get the market quote. After obtaining the quotes, we can use the FMZ Quant platform build-in "line drawing" library to draw the difference.

Fungsi utama

Sementara (benar) {

If(exchange.IO(

LogStatus ((_D(),

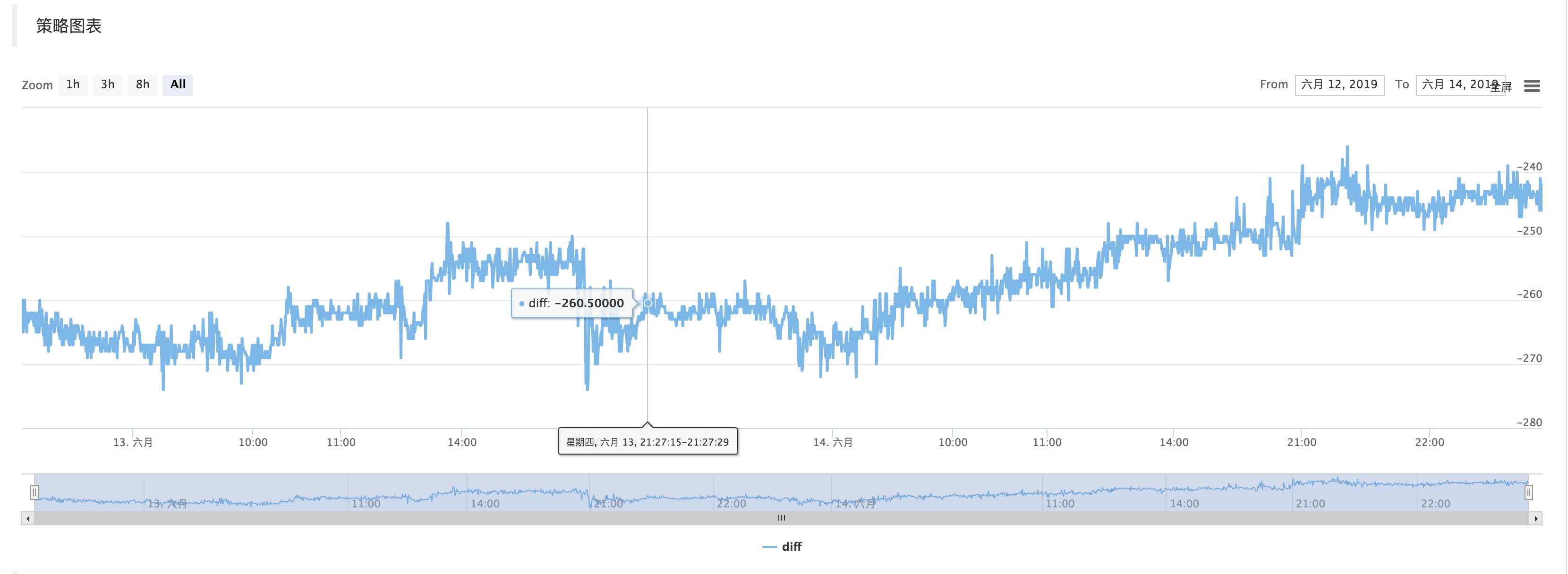

Get the market data, calculate the difference, and draw the graph to record. let it simply reflects the recent fluctuations in the price difference.

Use the function of "line drawing" library ```$.PlotLine```

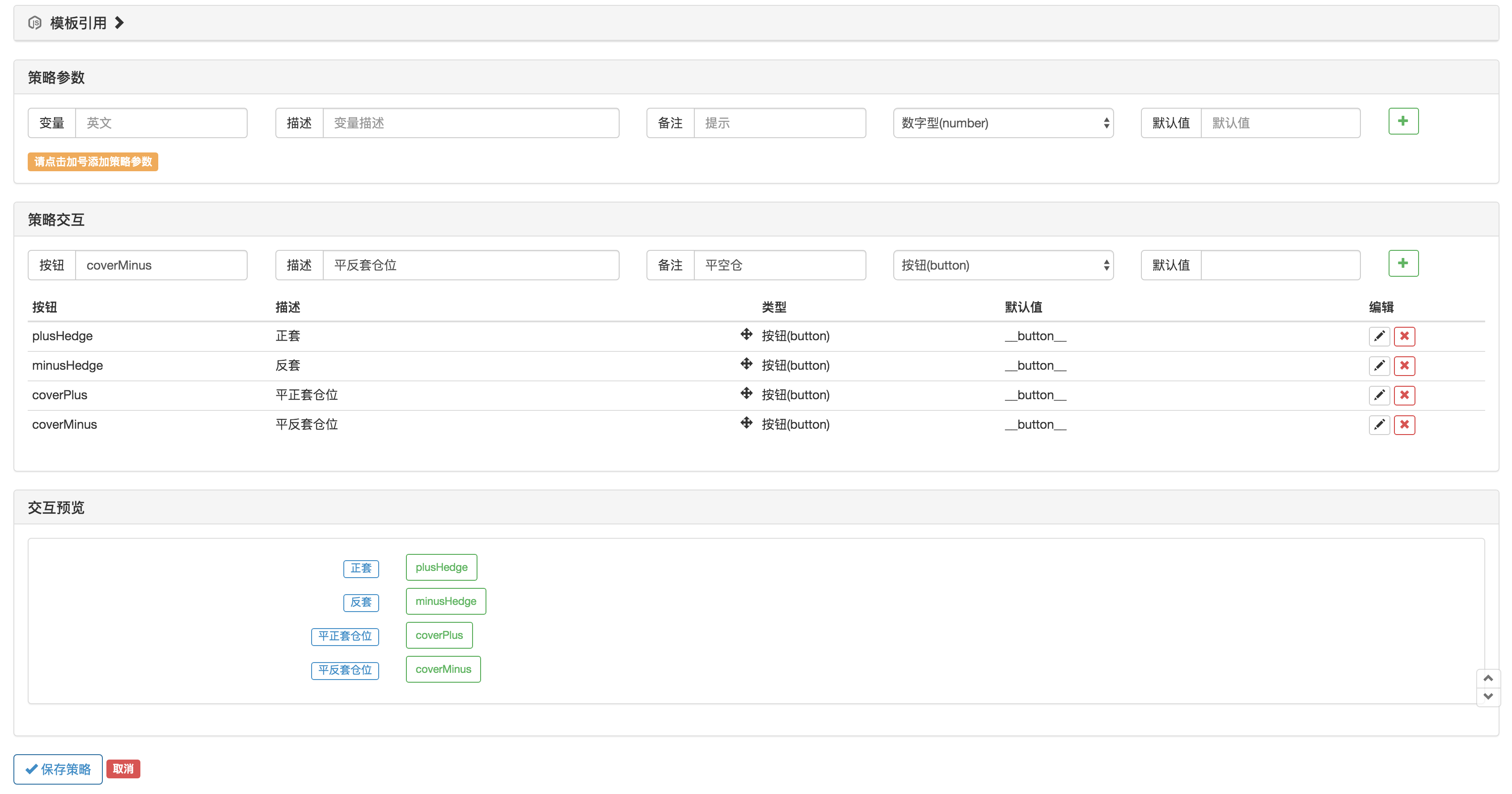

# Interactive part

On the strategy editing page, you can add interactive controls directly to the strategy:

Use the function ```GetCommand``` in the strategy code to capture the command that was sent to the robot after the above strategy control was triggered.

After the command is captured, different commands can be processed differently.

The trading part of the code can be packaged using the "Commodity Futures Trading Class Library" function. First, use ```var q = $.NewTaskQueue()``` to generate the transaction control object ```q``` (declared as a global variable).

var cmd = GetCommand()

jika (cmd) {

jika (cmd ==

- Praktik Kuantitatif Bursa DEX (2) -- Panduan Pengguna Hyperliquid

- DEX Exchange Quantitative Practice ((2) -- Hyperliquid Panduan Penggunaan

- Praktik Kuantitatif Bursa DEX (1) -- DYdX v4 Panduan Pengguna

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (3)

- Praktik Kuantitatif DEX Exchange ((1)-- dYdX v4 Panduan Penggunaan

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (3)

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (2)

- Penjelasan tentang suite Lead-Lag dalam mata uang digital (2)

- Pembahasan Penerimaan Sinyal Eksternal Platform FMZ: Solusi Lengkap untuk Penerimaan Sinyal dengan Layanan Http Terbina dalam Strategi

- FMZ platform eksplorasi penerimaan sinyal eksternal: strategi built-in https layanan solusi lengkap untuk penerimaan sinyal

- Pengantar ke Lead-Lag Arbitrage dalam Cryptocurrency (1)

- Komentar tentang strategi algoritma perkalian mata uang depan

- Dengan kata lain, mengapa tidak mungkin untuk memindahkan aset OKEX melalui strategi hedging kontrak?

- Pikiran untuk melakukan pergerakan aset dengan strategi hedging kontrak

- Strategi pengeditan visualisasi untuk memperluas perpustakaan kustom

- Solusi untuk mengirim pesan permintaan HTTP dari administrator

- Penggunaan server dalam transaksi kuantitatif

- [Perang Milenium] Rasio Pertukaran Bitcoin Strategi 3 Hedging Kupu-kupu

- Strategi pendirian yang seimbang

- RSI2 Strategi Reversi Rata-rata yang digunakan dalam futures

- Penjelasan API berjangka dan cryptocurrency

- Memperkenalkan indikator Aroon

- Studi awal tentang Backtesting Strategi Opsi Mata Uang Digital

- Perbedaan Antara Perdagangan Kuantitatif dan Perdagangan Subyektif

- Strategi Saluran ATR Diimplementasikan di pasar kripto

- Thermostat Strategi menggunakan di pasar crypto oleh MyLanguage

- hans123 strategi terobosan intraday

- Strategi Opsi Mata Uang Digitalisasi

- TradingViewWebHook alarm terhubung langsung ke robot FMZ

- Tambahkan jam alarm ke strategi perdagangan

- Strategi lindung nilai kontrak berjangka OKEX dengan menggunakan C++