EMA + AROON + ASH

Penulis:ChaoZhang, Tanggal: 2022-05-10 10:34:06Tag:EMAAROONASH

Jh. " Kredit untuk setiap indikator milik mereka, saya hanya memodifikasi mereka untuk menambahkan beberapa opsi tambahan, pengaturan, dll, juga diperbarui semua kode ke PineScript 5.

=== STRATEGI === Pengaturan default sudah seperti yang dibutuhkan oleh TRADE KING, jadi Anda tidak perlu mengubah apa pun. FOR LONGS (landasan hijau menunjukkan entri LONG).

- Harga harus di atas EMA.

- Bullish Aroon crossover.

- Garis histogram kekuatan absolut bullish harus di atas garis bearish.

FOR SHORTS (dasar merah menunjukkan entri SHORT).

- Harga harus di bawah EMA.

- Beruang Aroon crossover.

- Garis histogram kekuatan absolut bearish harus di atas garis bullish.

Silakan lihat saluran YouTube TRADE KING untuk informasi lebih lanjut.

=== Peningkatan Umum === Upgrade ke PineScript 5. Beberapa peningkatan kinerja.

=== Catatan Pribadi === Penulis strategi ini merekomendasikan grafik 5M, namun, 4H terbukti menjadi yang terbaik.

Sekali lagi terima kasih kepada penulis indikator yang menyusun skrip ini dan kepada TRADE KING untuk menciptakan strategi ini.

backtest

/*backtest

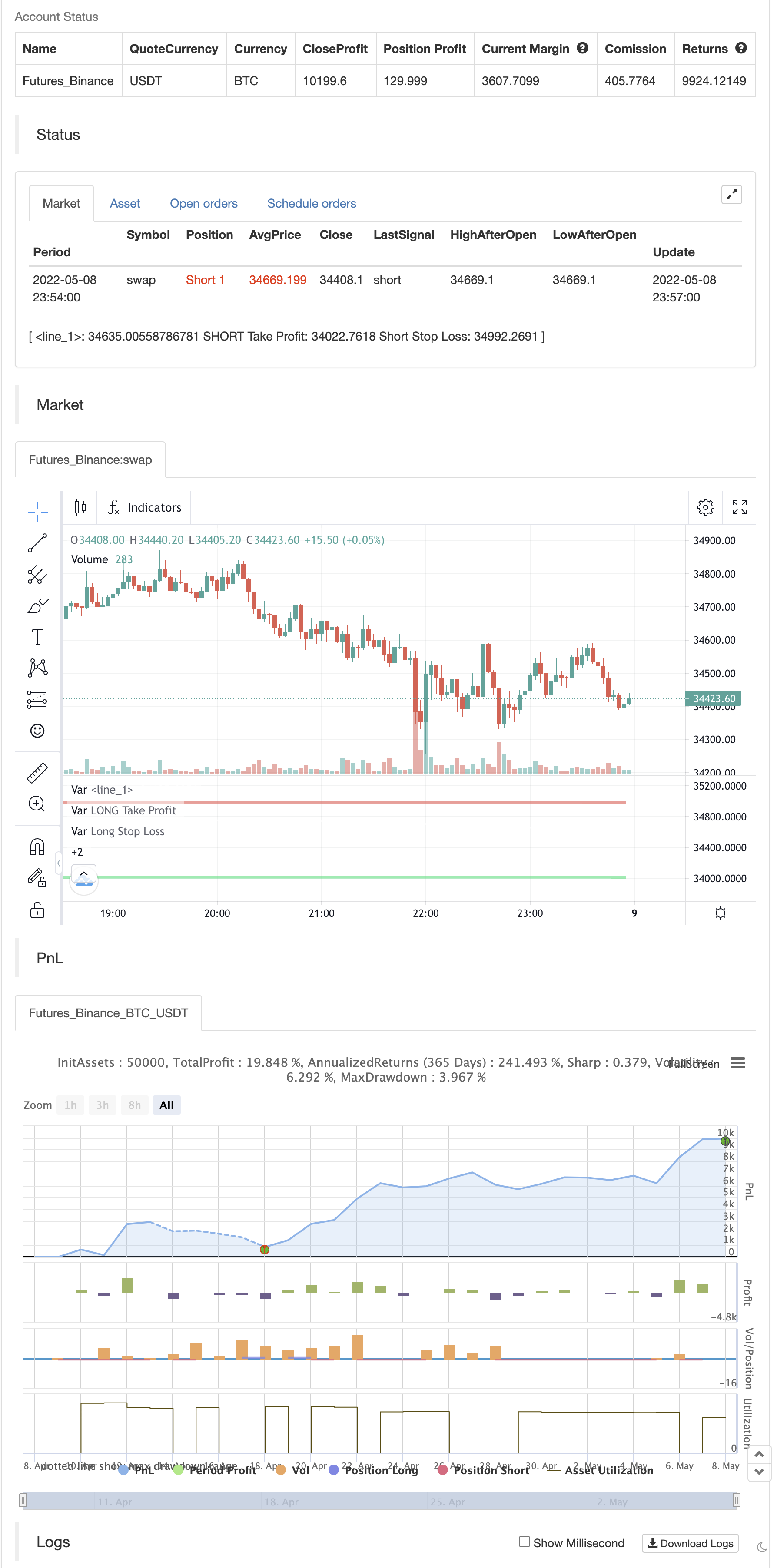

start: 2022-04-09 00:00:00

end: 2022-05-08 23:59:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © JoseMetal

//@version=5

//

//== Constantes

c_verde_radiactivo = color.rgb(0, 255, 0, 0)

c_verde = color.rgb(0, 128, 0, 0)

c_verde_oscuro = color.rgb(0, 80, 0, 0)

c_rojo_radiactivo = color.rgb(255, 0, 0, 0)

c_rojo = color.rgb(128, 0, 0, 0)

c_rojo_oscuro = color.rgb(80, 0, 0, 0)

//== Funciones

//== Declarar estrategia y período de testeo

//strategy("EMA + AROON + ASH (TRADE KING's STRATEGY)", shorttitle="EMA + AROON + ASH (TRADE KING's STRATEGY)", overlay=true, initial_capital=10000, pyramiding=0, default_qty_value=10, default_qty_type=strategy.percent_of_equity, commission_type=strategy.commission.percent, commission_value=0.00075, max_labels_count=500, max_bars_back=1000)

//fecha_inicio = input.time(timestamp("1 Jan 2000"), title="• Start date", group="Test period", inline="periodo_de_pruebas")

vela_en_fecha = true

posicion_abierta = strategy.position_size != 0

LONG_abierto = strategy.position_size > 0

SHORT_abierto = strategy.position_size < 0

//== Condiciones de entrada y salida de estrategia

GRUPO_P = "Positions"

P_permitir_LONGS = input.bool(title="¿LONGS?", group=GRUPO_P, defval=true)

P_permitir_SHORTS = input.bool(title="¿SHORTS?", group=GRUPO_P, defval=true)

GRUPO_TPSL = "TP y SL"

TPSL_TP_pivot_lookback = input.int(title="• SL lookback for pivot / Mult. TP", group=GRUPO_TPSL, defval=20, minval=1, step=1, inline="tp_sl")

TPSL_SL_mult = input.float(title="", group=GRUPO_TPSL, defval=2.0, minval=0.1, step=0.2, inline="tp_sl")

//== Inputs de indicadores

// EMA

GRUPO_EMA = "Exponential Moving Average (EMA)"

EMA_length = input.int(200, minval=1, title="Length", group=GRUPO_EMA)

EMA_src = input(close, title="Source", group=GRUPO_EMA)

EMA = ta.ema(EMA_src, EMA_length)

// Aroon

GRUPO_Aroon = "Aroon"

Aroon_length = input.int(title="• Length", group=GRUPO_Aroon, defval=20, minval=1)

Aroon_upper = 100 * (ta.highestbars(high, Aroon_length+1) + Aroon_length) / Aroon_length

Aroon_lower = 100 * (ta.lowestbars(low, Aroon_length+1) + Aroon_length) / Aroon_length

// ASH

GRUPO_ASH = "Absolute Strength Histogram v2 | jh"

ASH_Length = input(9, title='Period of Evaluation', group=GRUPO_ASH)

ASH_Smooth = input(3, title='Period of Smoothing', group=GRUPO_ASH)

ASH_src = input(close, title='Source')

ASH_Mode = input.string(title='Indicator Method', defval='RSI', options=['RSI', 'STOCHASTIC', 'ADX'])

ASH_ma_type = input.string(title='MA', defval='WMA', options=['ALMA', 'EMA', 'WMA', 'SMA', 'SMMA', 'HMA'])

ASH_alma_offset = input.float(defval=0.85, title='* Arnaud Legoux (ALMA) Only - Offset Value', minval=0, step=0.01)

ASH_alma_sigma = input.int(defval=6, title='* Arnaud Legoux (ALMA) Only - Sigma Value', minval=0)

_MA(type, src, len) =>

float result = 0

if type == 'SMA' // Simple

result := ta.sma(src, len)

result

if type == 'EMA' // Exponential

result := ta.ema(src, len)

result

if type == 'WMA' // Weighted

result := ta.wma(src, len)

result

if type == 'SMMA' // Smoothed

w = ta.wma(src, len)

result := na(w[1]) ? ta.sma(src, len) : (w[1] * (len - 1) + src) / len

result

if type == 'HMA' // Hull

result := ta.wma(2 * ta.wma(src, len / 2) - ta.wma(src, len), math.round(math.sqrt(len)))

result

if type == 'ALMA' // Arnaud Legoux

result := ta.alma(src, len, ASH_alma_offset, ASH_alma_sigma)

result

result

Price1 = _MA('SMA', ASH_src, 1)

Price2 = _MA('SMA', ASH_src[1], 1)

// RSI

Bulls0 = 0.5 * (math.abs(Price1 - Price2) + Price1 - Price2)

Bears0 = 0.5 * (math.abs(Price1 - Price2) - (Price1 - Price2))

// STOCHASTIC

Bulls1 = Price1 - ta.lowest(Price1, ASH_Length)

Bears1 = ta.highest(Price1, ASH_Length) - Price1

// ADX

Bulls2 = 0.5 * (math.abs(high - high[1]) + high - high[1])

Bears2 = 0.5 * (math.abs(low[1] - low) + low[1] - low)

Bulls = ASH_Mode == 'RSI' ? Bulls0 : ASH_Mode == 'STOCHASTIC' ? Bulls1 : Bulls2

Bears = ASH_Mode == 'RSI' ? Bears0 : ASH_Mode == 'STOCHASTIC' ? Bears1 : Bears2

AvgBulls = _MA(ASH_ma_type, Bulls, ASH_Length)

AvgBears = _MA(ASH_ma_type, Bears, ASH_Length)

SmthBulls = _MA(ASH_ma_type, AvgBulls, ASH_Smooth)

SmthBears = _MA(ASH_ma_type, AvgBears, ASH_Smooth)

difference = math.abs(SmthBulls - SmthBears)

//== Cálculo de condiciones

EMA_alcista = close > EMA

EMA_bajista = close < EMA

Aroon_cruce_alcista = ta.crossover(Aroon_upper, Aroon_lower)

Aroon_cruce_bajista = ta.crossunder(Aroon_upper, Aroon_lower)

ASH_alcista = SmthBulls > SmthBears

ASH_bajista = SmthBulls < SmthBears

//== Entrada (deben cumplirse todas para entrar)

longCondition1 = EMA_alcista

longCondition2 = Aroon_cruce_alcista

longCondition3 = ASH_alcista

long_conditions = longCondition1 and longCondition2 and longCondition3

entrar_en_LONG = P_permitir_LONGS and long_conditions and vela_en_fecha and not posicion_abierta

shortCondition1 = EMA_bajista

shortCondition2 = Aroon_cruce_bajista

shortCondition3 = ASH_bajista

short_conditions = shortCondition1 and shortCondition2 and shortCondition3

entrar_en_SHORT = P_permitir_SHORTS and short_conditions and vela_en_fecha and not posicion_abierta

var LONG_stop_loss = 0.0

var LONG_take_profit = 0.0

var SHORT_stop_loss = 0.0

var SHORT_take_profit = 0.0

//psl = ta.pivotlow(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

//psh = ta.pivothigh(TPSL_TP_pivot_lookback, TPSL_TP_pivot_lookback)

psl = ta.lowest(TPSL_TP_pivot_lookback)

psh = ta.highest(TPSL_TP_pivot_lookback)

if (entrar_en_LONG)

LONG_stop_loss := psl - close*0.001

LONG_take_profit := close + ((close - LONG_stop_loss) * TPSL_SL_mult)

strategy.entry("+ Long", strategy.long)

strategy.exit("- Long", "+ Long", limit=LONG_take_profit, stop=LONG_stop_loss)

if (entrar_en_SHORT)

SHORT_stop_loss := psh + close*0.001

SHORT_take_profit := close - ((SHORT_stop_loss - close) * TPSL_SL_mult)

strategy.entry("+ Short", strategy.short)

strategy.exit("- Short", "+ Short", limit=SHORT_take_profit, stop=SHORT_stop_loss)

//== Ploteo en pantalla

// EMA

plot(EMA, color=color.white, linewidth=2)

// Símbolo de entrada (entre o no en compra)

bgcolor = color.new(color.black, 100)

if (entrar_en_LONG or entrar_en_SHORT)

bgcolor := color.new(color.green, 90)

bgcolor(bgcolor)

// Precio de compra, Take Profit, Stop Loss y relleno

avg_position_price_plot = plot(series=posicion_abierta ? strategy.position_avg_price : na, color=color.new(color.white, 25), style=plot.style_linebr, linewidth=2, title="Precio Entrada")

LONG_tp_plot = plot(LONG_abierto and LONG_take_profit > 0.0 ? LONG_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="LONG Take Profit")

LONG_sl_plot = plot(LONG_abierto and LONG_stop_loss > 0.0 ? LONG_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Long Stop Loss")

fill(avg_position_price_plot, LONG_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, LONG_sl_plot, color=color.new(color.maroon, 85))

SHORT_tp_plot = plot(SHORT_abierto and SHORT_take_profit > 0.0 ? SHORT_take_profit : na, color=color.new(color.lime, 25), style=plot.style_linebr, linewidth=3, title="SHORT Take Profit")

SHORT_sl_plot = plot(SHORT_abierto and SHORT_stop_loss > 0.0 ? SHORT_stop_loss : na, color=color.new(color.red, 25), style=plot.style_linebr, linewidth=3, title="Short Stop Loss")

fill(avg_position_price_plot, SHORT_tp_plot, color=color.new(color.olive, 85))

fill(avg_position_price_plot, SHORT_sl_plot, color=color.new(color.maroon, 85))

- Tren Z-Score Mengikuti Strategi

- Sistem CM Sling Shot

- Strategi Dynamic Buy Entry Menggabungkan EMA Crossing dan Penetrasi Tubuh Lilin

- Triple EMA dengan Strategi Perdagangan Dukungan/Resistansi Dinamis

- 3EMA

- Sidboss

- Bermain salib

- Range Filter Beli dan Jual 5 menit [Strategi]

- Membeli/Menjual Strat

- Strategi perdagangan otomatis EMA yang mengikuti tren

- Titik Masuk BB-RSI-ADX

- Hull-4ema

- Angka Serangan Ikuti Indikator Garis

- KijunSen Line dengan Cross

- AMACD - Divergensi semua rata-rata konvergensi bergerak

- MA HYBRID BY RAJ

- Tren Berlian

- Nik Stoch

- Stoch supertrd ATR 200ma

- MTF RSI & Strategi STOCH

- Momentum 2.0

- Strategi Jangkauan EHMA

- Moving Average Beli-Jual

- Midas Mk. II - Ultimate Crypto Swing

- TMA-Legacy

- Strategi TV Tinggi dan Rendah

- Strategi TradingView Terbaik

- Large Snapper Alerts R3.0 + Kondisi Volatilitas Chaiking + TP RSI

- Chande Kroll Berhenti

- CCI + EMA dengan RSI Cross Strategy