Crodl's Supertrend

Penulis:ChaoZhang, Tanggal: 2022-05-13 17:38:34Tag:SMAEMASMMAWMAVWMA

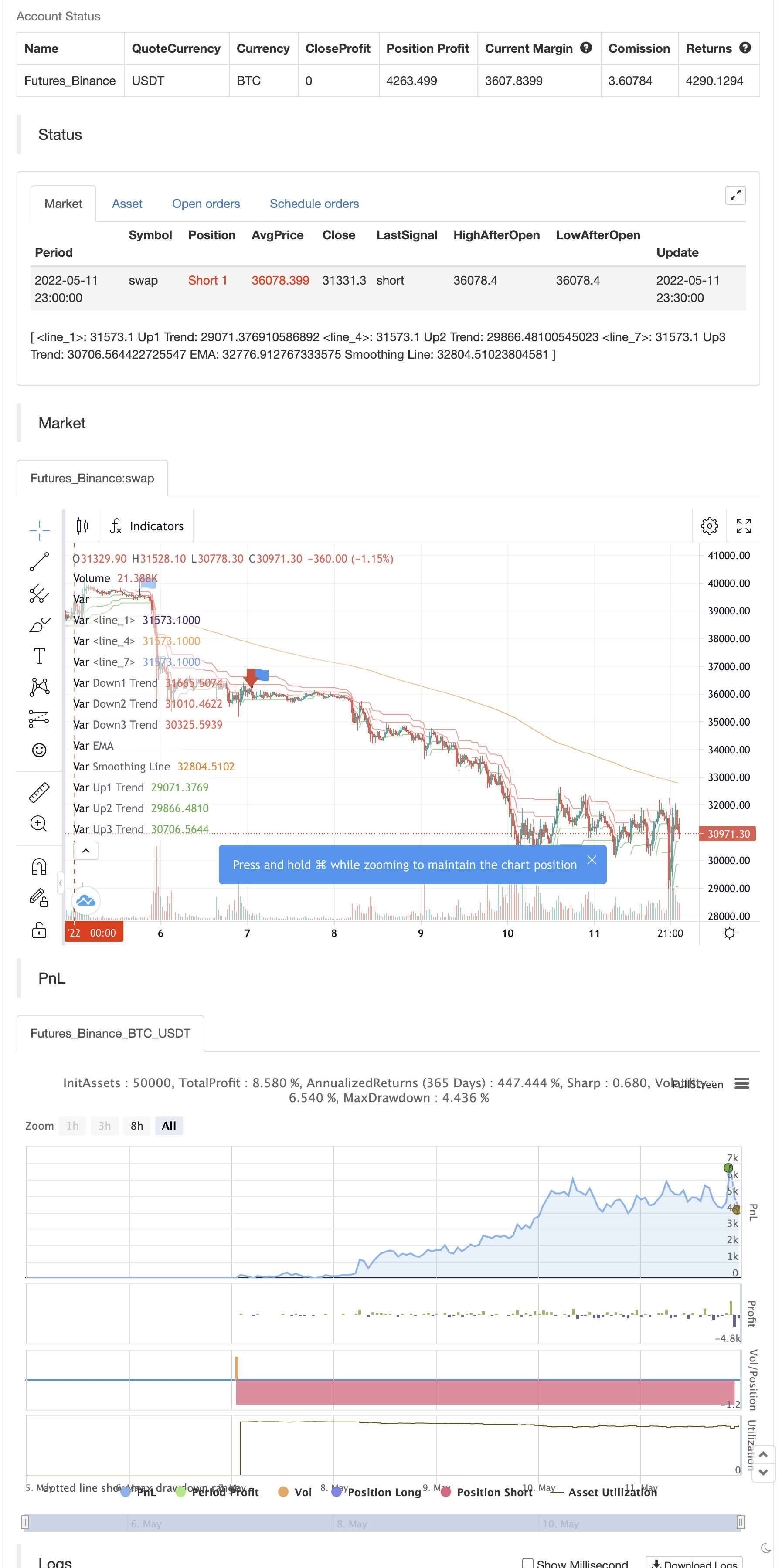

Indikator ini menggunakan supertrend dengan 3 input yang berbeda sebagai konfirmasi serta 200 EMA yang akan memberi kita data untuk tren naik atau turun. maka itu mencari indikator saham untuk mengkonfirmasi apakah ada silang di bawah 30 untuk panjang dan di atas 70 untuk pendek.

backtest

/*backtest

start: 2022-05-05 00:00:00

end: 2022-05-11 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Visit Crodl.com for our Premium Indicators

// https://tradingbot.crodl.com to use our free tradingview bot to automate any indicator.

//@version=5

indicator("Crodl's Supertrend", overlay=true, timeframe="", timeframe_gaps=true)

atrPeriod1 = input(12, "ATR1 Length")

factor1 = input.float(3.0, "Factor1", step = 0.01)

[supertrend1, direction1] = ta.supertrend(factor1, atrPeriod1)

bodyMiddle1 = plot((open + close) / 2, display=display.none)

upTrend1 = plot(direction1 < 0 ? supertrend1 : na, "Up1 Trend", color = color.green, style=plot.style_linebr)

downTrend1 = plot(direction1 < 0? na : supertrend1, "Down1 Trend", color = color.red, style=plot.style_linebr)

atrPeriod2 = input(11, "ATR2 Length")

factor2 = input.float(2.0, "Factor2", step = 0.01)

[supertrend2, direction2] = ta.supertrend(factor2, atrPeriod2)

bodyMiddle2 = plot((open + close) / 2, display=display.none)

upTrend2 = plot(direction2 < 0 ? supertrend2 : na, "Up2 Trend", color = color.green, style=plot.style_linebr)

downTrend2 = plot(direction2 < 0? na : supertrend2, "Down2 Trend", color = color.red, style=plot.style_linebr)

atrPeriod3 = input(10, "ATR3 Length")

factor3 = input.float(1.0, "Factor3", step = 0.01)

[supertrend3, direction3] = ta.supertrend(factor3, atrPeriod3)

bodyMiddle3 = plot((open + close) / 2, display=display.none)

upTrend3 = plot(direction3 < 0 ? supertrend3 : na, "Up3 Trend", color = color.green, style=plot.style_linebr)

downTrend3 = plot(direction3 < 0? na : supertrend3, "Down3 Trend", color = color.red, style=plot.style_linebr)

len = input.int(200, minval=1, title="Length")

src = input(close, title="Source")

offset = input.int(title="Offset", defval=0, minval=-500, maxval=500)

out = ta.ema(src, len)

plot(out, title="EMA", color=color.white,linewidth=2, offset=offset)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

typeMA = input.string(title = "Method", defval = "SMA", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="Smoothing")

smoothingLength = input.int(title = "Length", defval = 5, minval = 1, maxval = 100, group="Smoothing")

smoothingLine = ma(out, smoothingLength, typeMA)

plot(smoothingLine, title="Smoothing Line", color=#f37f20, offset=offset, display=display.none)

//////

l = input(13, title='Length')

l_ma = input(7, title='MA Length')

t = math.sum(close > close[1] ? volume * (close - close[1]) : close < close[1] ? volume * (close - close[1]) : 0, l)

m = ta.sma(t, l_ma)

//////

periodK = input.int(14, title="%K Length", minval=1)

smoothK = input.int(1, title="%K Smoothing", minval=1)

periodD = input.int(3, title="%D Smoothing", minval=1)

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

stochbuy= float(k) < 30 and ta.crossover(k,d)

stochsell=float(k) > 70 and ta.crossover(d,k)

long =(( ((direction1 < 0 and direction2 < 0 ) or (direction2 < 0 and direction3 < 0 ) and (direction1 < 0 or direction3 < 0 ) )and open > out) and t > 0) and stochbuy

short=(( ((direction1 > 0 and direction2 > 0 ) or (direction2 > 0 and direction3 > 0 ) and (direction1 > 0 or direction3 > 0 ) )and open < out) and t < 0) and stochsell

plotshape(long, title = "Long Signal", location=location.belowbar, style=shape.labelup, color=color.green, textcolor=color.white, size=size.small, text="Long")

plotshape(short, title = "Short Signal", location=location.abovebar, style=shape.labeldown, color=color.red, textcolor=color.white, size=size.small, text="Short")

alertcondition(long, title='Long Signal', message=' Buy')

alertcondition(short, title='Short Signal', message=' Sell')

if long

strategy.entry("Enter Long", strategy.long)

else if short

strategy.entry("Enter Short", strategy.short)

Artikel terkait

- SSS

- Blinken Band menerobos strategi pelacakan

- Strategi perdagangan multi-lapisan

- RSI Divergensi dengan Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

- Strategi penelusuran kuantitatif

- Strategi pelacakan tren dan fluktuasi

- Strategi pelacakan tren lintas linier multi-siklus

- Adaptasi dengan strategi penyeberangan rata-rata bergerak

- Strategi OCC R5.1

- 2 Deteksi Arah Rata-rata Bergerak

Informasi lebih lanjut

- Selamat datang di BEARMARKET

- Sidboss

- Titik Pivot Tinggi Rendah Multi Time Frame

- Database Strategi Pelacakan Tren Hantu

- Ghoul Trends Track Strategi Perpustakaan Bisnis

- Strategi Pelacakan Tren Hantu

- Rainbow Oscillator

- Perdagangan kurva ekuitas Contoh Ukuran Posisi

- Demo KLineChart

- Villa Dinamic Pivot Supertrend Strategi

- RSI oleh zdmre

- FTL - Range Filter X2 + EMA + UO

- Brahmastra

- Band Mobo

- SAR + 3SMMA dengan SL & TP

- SSS

- Templat Peringatan Peluncuran Bulan [Indikator]

- HALFTREND + HEMA + SMA (Strategi Sinyal Palsu)

- RSI Divergensi dengan Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

- RSI dan BBand oversold secara bersamaan