Strategi Mengambil Keuntungan Progresiv

Penulis:ChaoZhang, Tanggal: 2023-10-24 14:14:00Tag:

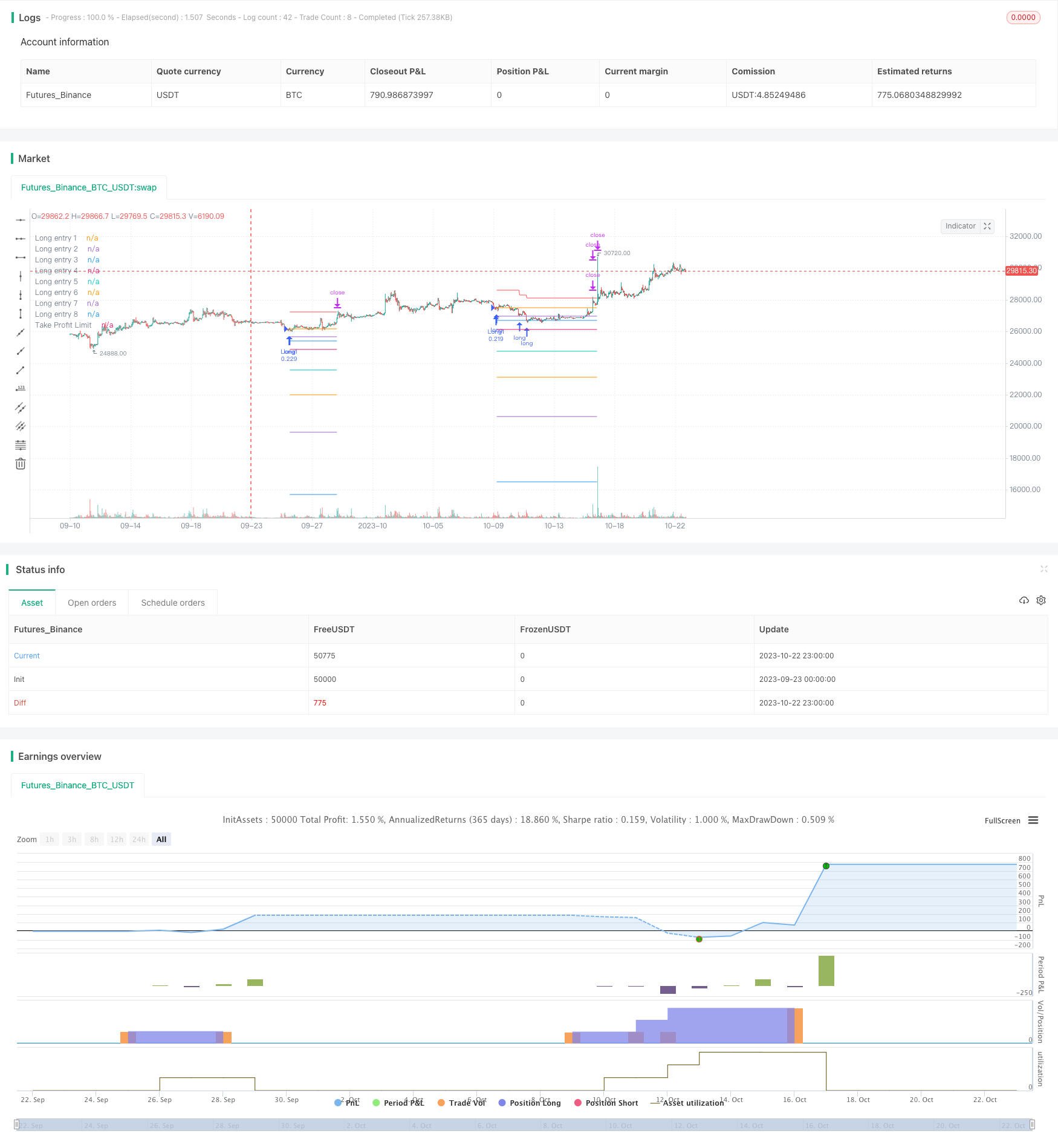

Strategi Mengambil Keuntungan Progresiv

Gambaran umum

Strategi ini menggabungkan indikator RSI dan rata-rata pergerakan harga untuk mengidentifikasi peluang oversold ketika harga pecah di bawah garis rata-rata bergerak. Ketika harga semakin menurun, strategi akan secara progresif piramida posisi yang lebih panjang berdasarkan persentase yang telah ditetapkan untuk mencapai rata-rata biaya. Ketika keuntungan posisi mencapai persentase keuntungan yang dikonfigurasi, strategi akan menutup posisi. Ini juga memperkenalkan mekanisme mengambil keuntungan progresif yang secara dinamis menyesuaikan harga stop profit keseluruhan berdasarkan keuntungan per posisi yang direalisasikan. Ini dapat secara efektif mengurangi risiko kerugian dan mencapai keluar secara bertahap.

Logika Strategi

-

Ketika RSI turun di bawah garis oversold 29 dan harga penutupan di bawah rata-rata bergerak, buka posisi panjang pertama.

-

Ketika harga turun 2% di bawah harga masuk pertama, tambahkan posisi panjang kedua, dan seterusnya sampai maksimum 8 entri.

-

Setelah setiap entri, catat harga masuk. harga ini berfungsi sebagai harga referensi untuk entri. plot mereka sebagai garis pada grafik.

-

Setelah entri, hitung harga pegangan rata-rata. gunakan 3% dari harga rata-rata sebagai mengambil keuntungan untuk setiap posisi, dan 4% untuk posisi keseluruhan.

-

Ketika harga naik di atas mengambil harga keuntungan dari posisi, menutup posisi itu.

-

Perhitungan keuntungan yang progresif: setelah menutup setiap posisi, kurangi keuntungan yang direalisasikan dari harga keuntungan keseluruhan. Ini perlahan-lahan menyeret garis keuntungan. Hanya ketika total keuntungan mencakup kerugian maksimum strategi akan mengambil keuntungan sepenuhnya.

-

Ketika harga mencapai garis keuntungan progresif, tutup semua posisi.

Keuntungan

-

RSI baik dalam mengidentifikasi zona oversold/oversold, memungkinkan entri yang baik untuk pembalikan.

-

Beberapa entri memungkinkan biaya rata-rata dengan harga rendah.

-

Progressive take profit mengurangi risiko dan mencapai keluar secara bertahap.

-

Rasio keuntungan yang dapat disesuaikan dan langkah masuk memungkinkan penyesuaian risiko.

-

Jalur masuk dan mengambil keuntungan yang dicatatkan memberikan panduan visual pada posisi.

Risiko

-

Pasar Whipsaw dapat memicu masuk dan keluar yang berlebihan, menyebabkan slippage.

-

Konfigurasi langkah masuk dan rasio yang buruk dapat menyebabkan over-trading.

-

Terus piramida selama penurunan membawa risiko kerugian tak terbatas. tetapkan batas maksimum entri.

-

Mengambil keuntungan diatur terlalu ketat dapat keluar dini.

Peningkatan

-

Tambahkan filter seperti MACD untuk menghindari sinyal RSI yang buruk.

-

Menggabungkan stop loss berdasarkan ATR untuk membatasi kejadian kerugian ekstrim.

-

Mengoptimalkan masuk, mengambil keuntungan dan parameter lainnya untuk aset yang berbeda.

-

Dinamis menyesuaikan mengambil keuntungan berdasarkan volatilitas.

Kesimpulan

Strategi ini sepenuhnya memanfaatkan RSI untuk mengidentifikasi oversold, dikombinasikan dengan MA untuk perdagangan pembalikan. mekanisme piramida dan progresif mengambil keuntungan mengendalikan risiko sambil memungkinkan entri panjang yang efektif. Optimasi lebih lanjut pada indikator, mengambil keuntungan dll dapat membuat strategi lebih kuat.

/*backtest

start: 2023-09-23 00:00:00

end: 2023-10-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

// © A3Sh

// RSI Strategy that buys the dips, uses Price Averaging and Pyramiding.

// When the price drops below specified percentages of the price (8 PA layers), new entries are openend to average the price of the assets.

// Open entries are closed by a specified take profit.

// Entries can be reopened, after closing and consequently crossing a PA layer again.

// This strategy is based on the RSI+PA+DCA strategy I created earlier. The difference is the way the Take Profit is calculated.

// Instead of directly connecting the take profit limit to the decreasing average price level with an X percent above the average price,

// the take profit is calculated for a part on the decreasing average price and for another part on the deduction

// of the profits of the individual closed positions.

// The Take Profit Limit drop less significant then the average price level and the full position only completely exits

// when enough individual closed positions made up for the losses.

// This makes it less risky and more conservative and great for a long term trading strategy

// RSI code is adapted from the build in Relative Strength Index indicator

// MA Filter and RSI concept adapted from the Optimized RSI Buy the Dips strategy, by Coinrule

// https://www.tradingview.com/script/Pm1WAtyI-Optimized-RSI-Strategy-Buy-The-Dips-by-Coinrule/

// Pyramiding entries code adapted from Pyramiding Entries on Early Trends startegy, by Coinrule

// Pyramiding entries code adapted from Pyramiding Entries on Early Trends startegy, by Coinrule

// https://www.tradingview.com/script/7NNJ0sXB-Pyramiding-Entries-On-Early-Trends-by-Coinrule/

// Plot entry layers code adapted from HOWTO Plot Entry Price by vitvlkv

// https://www.tradingview.com/script/bHTnipgY-HOWTO-Plot-Entry-Price/

strategy(title='RSI+PA+PTP', pyramiding=16, overlay=true, initial_capital=400, default_qty_type=strategy.percent_of_equity, default_qty_value=15, commission_type=strategy.commission.percent, commission_value=0.075, close_entries_rule='FIFO')

port = input.float(12, group = "Risk", title='Portfolio % Used To Open The 8 Positions', step=0.1, minval=0.1, maxval=100)

q = strategy.equity / 100 * port / open

// Long position PA entry layers. Percentage from the entry price of the the first long

ps2 = input.float(2, group = "Long Position Entry Layers", title='2nd Long Entry %', step=0.1)

ps3 = input.float(3, group = "Long Position Entry Layers", title='3rd Long Entry %', step=0.1)

ps4 = input.float(5, group = "Long Position Entry Layers", title='4th Long Entry %', step=0.1)

ps5 = input.float(10, group = "Long Position Entry Layers", title='5th Long Entry %', step=0.1)

ps6 = input.float(16, group = "Long Position Entry Layers", title='6th Long Entry %', step=0.1)

ps7 = input.float(25, group = "Long Position Entry Layers" ,title='7th Long Entry %', step=0.1)

ps8 = input.float(40, group = "Long Position Entry Layers", title='8th Long Entry %', step=0.1)

// Calculate Moving Averages

plotMA = input.bool(group = "Moving Average Filter", title='Plot Moving Average', defval=false)

movingaverage_signal = ta.sma(close, input(100, group = "Moving Average Filter", title='MA Length'))

plot (plotMA ? movingaverage_signal : na, color = color.new (color.green, 0))

// RSI inputs and calculations

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

overSold = input.int(29, title="Oversold, Trigger to Enter First Position", group = "RSI Settings")

// Long trigger (co)

co = ta.crossover(rsi, overSold) and close < movingaverage_signal

// Store values to create and plot the different PA layers

long1 = ta.valuewhen(co, close, 0)

long2 = ta.valuewhen(co, close - close / 100 * ps2, 0)

long3 = ta.valuewhen(co, close - close / 100 * ps3, 0)

long4 = ta.valuewhen(co, close - close / 100 * ps4, 0)

long5 = ta.valuewhen(co, close - close / 100 * ps5, 0)

long6 = ta.valuewhen(co, close - close / 100 * ps6, 0)

long7 = ta.valuewhen(co, close - close / 100 * ps7, 0)

long8 = ta.valuewhen(co, close - close / 100 * ps8, 0)

eps1 = 0.00

eps1 := na(eps1[1]) ? na : eps1[1]

eps2 = 0.00

eps2 := na(eps2[1]) ? na : eps2[1]

eps3 = 0.00

eps3 := na(eps3[1]) ? na : eps3[1]

eps4 = 0.00

eps4 := na(eps4[1]) ? na : eps4[1]

eps5 = 0.00

eps5 := na(eps5[1]) ? na : eps5[1]

eps6 = 0.00

eps6 := na(eps6[1]) ? na : eps6[1]

eps7 = 0.00

eps7 := na(eps7[1]) ? na : eps7[1]

eps8 = 0.00

eps8 := na(eps8[1]) ? na : eps8[1]

plot(strategy.position_size > 0 ? eps1 : na, title='Long entry 1', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps2 : na, title='Long entry 2', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps3 : na, title='Long entry 3', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps4 : na, title='Long entry 4', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps5 : na, title='Long entry 5', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps6 : na, title='Long entry 6', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps7 : na, title='Long entry 7', style=plot.style_linebr)

plot(strategy.position_size > 0 ? eps8 : na, title='Long entry 8', style=plot.style_linebr)

// Take Profit Settings

ProfitTarget_Percent = input.float(3.0, group = "Take Profit Settings", title='Take Profit % (Per Position)')

ProfitTarget_Percent_All = input.float(4.0, group = "Take Profit Settings", title='Take Profit % (Exit All, Progressive Take Profit Limit')

TakeProfitProgression = input.float(12, group = "Take Profit Settings", title='Take Profit Progression', tooltip = 'Progression is defined by the position size. By default 12% of the start equity (portfolio) is used to open a position, see Risk. This same % percentage is used to calculate the profit amount that will be deducted from the Take Profit Limit.')

entryOn = input.bool (true, group = "Take Profit Settings", title='New entries affect Take Profit limit', tooltip = 'This option changes the behaviour of the Progressive Take Profit. When switchted on, the difference between the former and current original Take Profit is deducted from the Progressive Take Profit. When switchted off, the Progressive Take Profit is only affected by the profit deduction or each closed position.')

avPricePlot = input.bool (false, group = "Take Profit Settings", title='Plot Average Price (FIFO)')

// Original Take Profit Limit

tpLimit = strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All)

// Create variables to calculate the Take Profit Limit Progresssion

var endVal = 0.0

var startVal = 0.0

// The value at the the start of the loop is the value of the end of the previous loop

startVal := endVal

// Set variable to the original Take Profit Limit when the first position opens.

if strategy.position_size > 0 and strategy.position_size[1] ==0

endVal := tpLimit

// Everytime a specific position opens, the difference of the previous (original) Take Profit price and the current (original) Take Profit price will be deducted from the Progressive Take Profit Limit

// This feature can be toggled on and off in the settings panel. By default it is toggled on.

entryAmount = 0.0

for i = 1 to strategy.opentrades

entryAmount := i

if entryOn and strategy.position_size > 0 and strategy.opentrades[1] == (entryAmount) and strategy.opentrades == (entryAmount + 1)

endVal := startVal - (tpLimit[1] - tpLimit)

// Everytime a specific position closes, the amount of profit from that specific position will be deducted from the Progressive Take Profit Limit.

exitAmount = 0.0

for id = 1 to strategy.opentrades

exitAmount := id

if strategy.opentrades[1] ==(exitAmount + 1) and strategy.opentrades == (exitAmount)

endVal := startVal - (TakeProfitProgression / 100 * strategy.opentrades.entry_price (id - 1) / 100 * ProfitTarget_Percent )

// The Final Take Profit Price

tpn = (strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All)) - (strategy.position_avg_price + (strategy.position_avg_price / 100 * ProfitTarget_Percent_All) - endVal)

plot (strategy.position_size > 0 ? tpn : na, title = "Take Profit Limit", color=color.new(color.red, 0), style = plot.style_linebr, linewidth = 1)

// Plot position average price as reference

plot (avPricePlot ? strategy.position_avg_price : na, title= "Average price", color = color.new(color.white, 0), style = plot.style_linebr, linewidth = 1)

// When to trigger the Take Profit per position or the Progressive Take Profit

tpl1 = close < tpn ? eps1 + close * (ProfitTarget_Percent / 100) : tpn

tpl2 = close < tpn ? eps2 + close * (ProfitTarget_Percent / 100) : tpn

tpl3 = close < tpn ? eps3 + close * (ProfitTarget_Percent / 100) : tpn

tpl4 = close < tpn ? eps4 + close * (ProfitTarget_Percent / 100) : tpn

tpl5 = close < tpn ? eps5 + close * (ProfitTarget_Percent / 100) : tpn

tpl6 = close < tpn ? eps6 + close * (ProfitTarget_Percent / 100) : tpn

tpl7 = close < tpn ? eps7 + close * (ProfitTarget_Percent / 100) : tpn

tpl8 = close < tpn ? eps8 + close * (ProfitTarget_Percent / 100) : tpn

// Submit Entry Orders

if co and strategy.opentrades == 0

eps1 := long1

eps2 := long2

eps3 := long3

eps4 := long4

eps5 := long5

eps6 := long6

eps7 := long7

eps8 := long8

strategy.entry('Long1', strategy.long, q)

if strategy.opentrades == 1

strategy.entry('Long2', strategy.long, q, limit=eps2)

if strategy.opentrades == 2

strategy.entry('Long3', strategy.long, q, limit=eps3)

if strategy.opentrades == 3

strategy.entry('Long4', strategy.long, q, limit=eps4)

if strategy.opentrades == 4

strategy.entry('Long5', strategy.long, q, limit=eps5)

if strategy.opentrades == 5

strategy.entry('Long6', strategy.long, q, limit=eps6)

if strategy.opentrades == 6

strategy.entry('Long7', strategy.long, q, limit=eps7)

if strategy.opentrades == 7

strategy.entry('Long8', strategy.long, q, limit=eps8)

// Submit Exit orders

if strategy.position_size > 0

strategy.exit(id='Exit 1', from_entry='Long1', limit=tpl1)

strategy.exit(id='Exit 2', from_entry='Long2', limit=tpl2)

strategy.exit(id='Exit 3', from_entry='Long3', limit=tpl3)

strategy.exit(id='Exit 4', from_entry='Long4', limit=tpl4)

strategy.exit(id='Exit 5', from_entry='Long5', limit=tpl5)

strategy.exit(id='Exit 6', from_entry='Long6', limit=tpl6)

strategy.exit(id='Exit 7', from_entry='Long7', limit=tpl7)

strategy.exit(id='Exit 8', from_entry='Long8', limit=tpl8)

// Make sure that all open limit orders are canceled after exiting all the positions

longClose = strategy.position_size[1] > 0 and strategy.position_size == 0 ? 1 : 0

if longClose

strategy.cancel_all()

- Strategi Breakout Berdasarkan Saluran Camarilla

- Berjalan dengan Tren Moving Average Crossover Strategy

- Strategi Penembusan Tren Bulanan

- Strategi Indeks Volatilitas DEMA

- Tren Mengikuti Strategi

- Strategi Crossover Stochastic Multi Timeframe

- Strategi perdagangan rata-rata bergerak

- SMA Melalui RSI Golden Cross Death Cross Strategi Perdagangan

- Mengikuti Strategi Supertrend

- Strategi Kombinasi Volatilitas Pembalikan Tren

- Strategi Terobosan Dua Posisi

- Tren Mengikuti Strategi Beli Drop Jual Puncak

- Strategi Kombinasi Moving Average Crossover dan MACD

- Momentum Moving Average Crossover Trend Mengikuti Strategi

- Tren Mengikuti Strategi Berdasarkan Rata-rata Bergerak Crossover

- Strategi titik balik rata-rata bergerak ganda

- Strategi Terobosan RSI Cepat

- Strategi Stop Loss Tracking Moving Average

- Strategi Perdagangan Kuantitatif Berbagai Faktor

- Tren Mengikuti Strategi Berdasarkan Rata-rata Bergerak Crossover