Strategi perdagangan dua arah berbasis RSI dan SuperTrend

Penulis:ChaoZhang, Tanggal: 2023-11-03 14:22:50Tag:

Gambaran umum

Ini adalah strategi perdagangan dua arah yang secara komprehensif memanfaatkan indikator RSI dan indikator SuperTrend. Strategi ini bertujuan untuk mengidentifikasi kekuatan dan kelemahan di pasar dan melakukan pergantian posisi tepat waktu ketika arah tren berubah, untuk mendapatkan pengembalian yang lebih tinggi.

Prinsip Strategi

Strategi ini didasarkan pada prinsip-prinsip berikut:

-

Gunakan indikator RSI untuk menentukan kekuatan dan kelemahan pasar saat ini.

-

Gunakan indikator SuperTrend sebagai filter tren. Sinyal perdagangan hanya dipicu ketika harga melewati garis SuperTrend.

-

Ketika RSI memberikan sinyal yang kuat, pergi panjang jika harga pecah di atas band atas, dan tutup posisi jika pecah di bawah band bawah.

-

Ketika RSI memberikan sinyal yang lemah, pergi short jika harga melanggar band bawah, dan tutup posisi jika melanggar band atas.

-

Menangkap titik balik dengan memantau transisi RSI antara panjang dan pendek, dan membuat perubahan posisi tepat waktu.

Pelaksanaan

-

Menghitung nilai RSI dengan panjang 14, menggunakan 50 sebagai ambang untuk kekuatan / kelemahan.

-

Hitung SuperTrend dengan panjang 10 dan pengganda 2.

-

Pergi panjang ketika RSI naik di atas 50 dan harga pecah di atas band atas SuperTrend. Pergi pendek ketika RSI turun di bawah 50 dan harga pecah di bawah band bawah.

-

Ketika sudah long, jika RSI menjadi lemah dan harga pecah di bawah band atas, tutup posisi long.

-

Dapat dikonfigurasi untuk mode panjang atau pendek saja.

Keuntungan

Strategi ini menggabungkan trend berikut dan analisis overbought/oversold dan memiliki keuntungan berikut:

-

Dapat menangkap perubahan tren secara tepat waktu dan menghindari entri yang tidak perlu.

-

RSI secara efektif mengidentifikasi zona overbought / oversold untuk menghindari mengejar puncak dan dasar.

-

SuperTrend menyaring kebisingan pasar dengan baik dan melacak tren jangka menengah dan panjang.

-

Menggabungkan RSI dan SuperTrend meningkatkan stabilitas.

-

Strategi ini memiliki ruang penyesuaian parameter yang besar untuk produk dan kerangka waktu yang berbeda.

-

Mendukung mode hanya panjang/pendek untuk menangani kondisi pasar yang berbeda secara fleksibel.

Risiko

Ada juga beberapa risiko dengan strategi ini:

-

RSI dapat menghasilkan sinyal palsu dengan mudah, yang membutuhkan konfirmasi harga.

-

Parameter SuperTrend yang buruk dapat menyebabkan perdagangan yang terlewatkan atau mengejar.

-

Ada risiko divergensi ketika menggabungkan dua indikator. Parameter perlu disesuaikan untuk pencocokan terbaik.

-

Stop loss dapat diambil secara instan dalam volatilitas yang ekstrem. Penempatan stop loss yang wajar diperlukan.

-

Hindari mengambil posisi pembalikan di dekat level support/resistance utama.

Peningkatan

Strategi ini dapat dioptimalkan lebih lanjut dalam aspek berikut:

-

Sesuaikan parameter RSI untuk menemukan panjang optimal untuk menyaring sinyal palsu.

-

Mengoptimalkan parameter SuperTrend untuk kemampuan pelacakan tren yang lebih baik.

-

Uji kombinasi parameter yang berbeda pada produk dan kerangka waktu yang berbeda untuk menemukan yang optimal.

-

Tambahkan indikator lain seperti MACD, KDJ untuk meningkatkan akurasi sinyal.

-

Tambahkan analisis dukungan / resistensi utama, Bollinger Bands, moving average dll untuk memenuhi syarat sinyal strategi.

-

Mengoptimalkan strategi stop loss untuk mengurangi berhenti keluar sambil mempertahankan efektivitas.

Kesimpulan

Strategi ini mengintegrasikan kekuatan RSI dan SuperTrend untuk secara efektif mengidentifikasi perubahan tren jangka menengah antara pasar bull dan bear. Strategi ini mudah diterapkan dengan logika yang jelas dan memiliki nilai praktis yang kuat. Dengan penyesuaian parameter, strategi ini dapat beradaptasi dengan lebih banyak kondisi pasar. Masalah umum seperti sinyal palsu dan parameter buruk perlu diperhatikan. Secara keseluruhan ini adalah strategi tren yang solid.

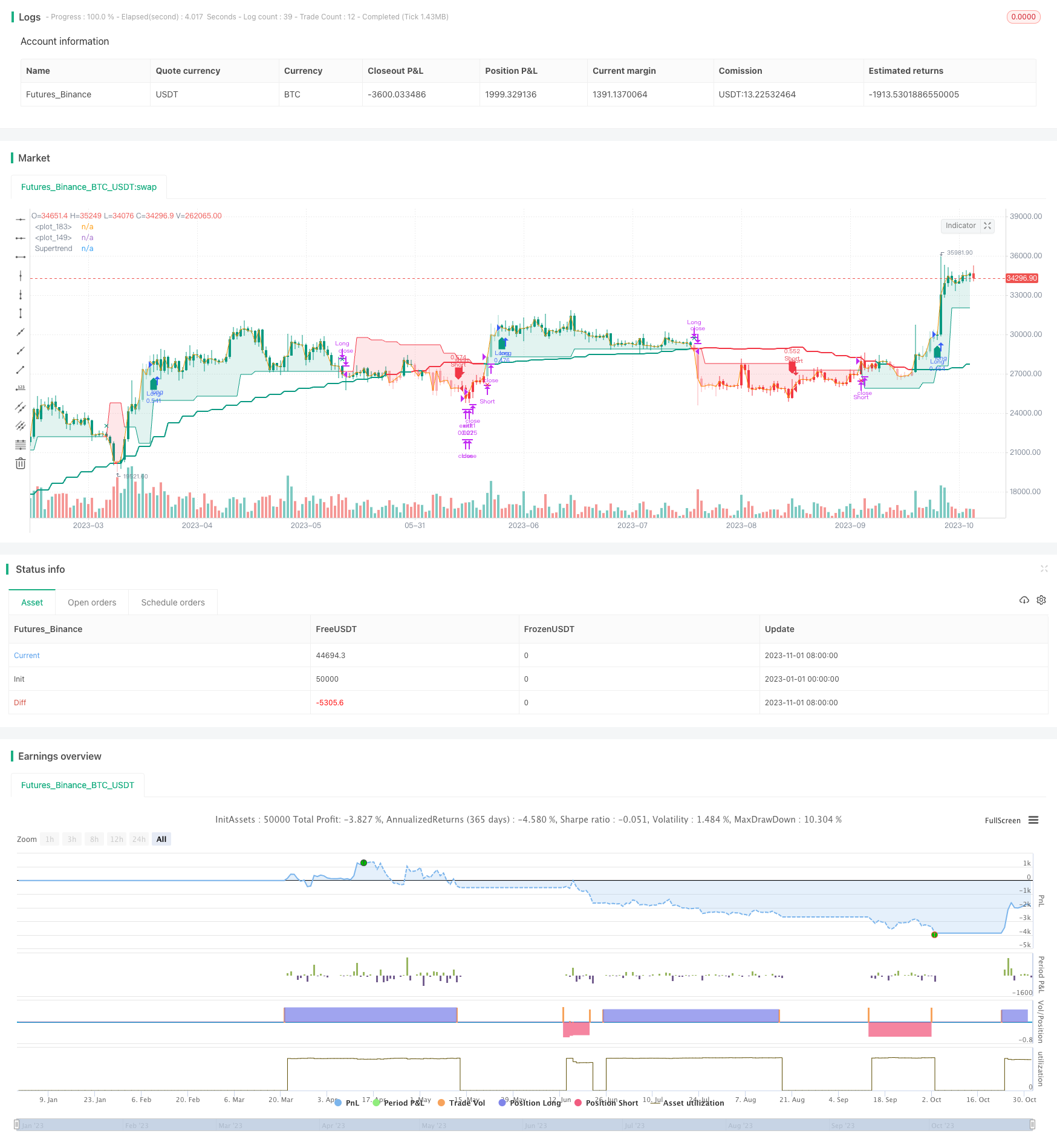

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//Created by @CITIAlgo

// —————————————————————————————————————————————————————————————————————————————————————————————————————————

strategy('CITI Trends A with RSI Candles', shorttitle = "CITI Trends A" , overlay = true ,

initial_capital = 10000,

commission_value = 0.025,

default_qty_value = 25,

slippage = 1,

pyramiding = 0,

max_lines_count = 500,

max_labels_count = 500,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity)

bullColor1 = #089981

bearColor1 = #f23645

bullColor2 = #3873e3

bearColor2 = #630ef5

neutralColor1 = #d5d5d5

//Base Settings

groupBase = "Base Settings ---------------------------------------"

Repaint_type = input.string('Non-Repainting', "Allow Repainting ?", options = ['Non-Repainting', 'Repainting'], inline ='repaint' , group = groupBase , tooltip = 'The default value is Non-Repainting. To learn more visit https://www.tradingview.com/pine-script-docs/en/v5/concepts/Repainting.html')

//Configure trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"] , group=groupBase , inline = 'Type' )

longOK = tradeDirection == "Long" or tradeDirection == "Both"

shortOK = tradeDirection == "Short" or tradeDirection == "Both"

var bool PlotEntries = input.bool (true, "Show Entries" ,group=groupBase , inline = 'Signals' )

var bool PlotExits = input.bool (true, "Show Exits" , group=groupBase, inline = 'Signals' )

//Display Settings

groupDisplay = "Display Settings ------------------------------------"

MomBars = input.bool( true , title="Apply Bar Colors", inline = 'candles' , group=groupDisplay)

cbullColor = input.color( bullColor1 , 'Candle Colors' , inline = 'candles1a',group=groupDisplay)

cbearColor = input.color( bearColor1 , '' , inline = 'candles1a',group=groupDisplay)

//Candle & label Colors

Bullish_Bars = color.new( cbullColor , 0)

WBullish_Bars = color.new( cbullColor , 60)

Bearish_Bars = color.new( cbearColor , 0)

WBearish_Bars = color.new( cbearColor , 60)

lbullColor = input.color( bullColor1 , 'Long/Short Labels' , group=groupDisplay, inline = 'Signals1' )

lbearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'Signals1' )

st_status = input.bool( true , title="Show Supertrend", inline = 'st' , group=groupDisplay)

st_bullColor = input.color( bullColor1 , '' , group=groupDisplay, inline = 'st' )

st_bearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'st' )

//Build Your Signals Settings

groupEntry = " Trend & Signal Settings---------------------"

Entry1a = input.bool(true, title= "Entry", inline='entry1a', group=groupEntry)

Exit1a = input.bool(false, title= "Exit | Strong/Weak Momentum", inline='entry1a', group=groupEntry)

Entry1b = input.bool(false, title= 'Entry' , inline='entry1b', group=groupEntry)

Exit1b = input.bool(false, title= 'Exit | Bull/Bear Momentum' , inline='entry1b', group=groupEntry)

Entry3a = input.bool(false, title= "Filter", inline='entry3a', group=groupEntry)

Exit3a = input.bool(false, title= "Exit | MA ", inline='entry3a', group=groupEntry)

Entry4a = input.bool(false, title= "Filter | Disable RSI Ranges ", inline='entry4a', group=groupEntry)

Entry4b = input.bool(true, title= "Filter", inline='entry4b', group=groupEntry)

Exit4b = input.bool(true, title= "Exit | Supertrend ", inline='entry4b', group=groupEntry)

Entry4c = input.bool(true, title= "Filter | Disable Supertrend Ranges ", inline='entry4c', group=groupEntry)

// —————————————————————————————————————MTF FUNCTIONS

// —————————— PineCoders MTF Selection Framework functions

// ————— Converts current "timeframe.multiplier" plus the TF into minutes of type float.

f_resInMinutes() =>

_resInMinutes = timeframe.multiplier * (timeframe.isseconds ? 1. / 60. : timeframe.isminutes ? 1. : timeframe.isdaily ? 1440. : timeframe.isweekly ? 10080. : timeframe.ismonthly ? 43800. : na)

_resInMinutes

// Get current resolution in float minutes.

var ResInMinutes = f_resInMinutes()

// ————— Returns resolution of _resolution period in minutes.

f_tfResInMinutes(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

request.security(syminfo.tickerid, _res, f_resInMinutes())

// ————— Returns a multiple of current resolution as a string in "timeframe.period" format usable with "security()".

f_multipleOfRes(_res, _mult) =>

// _res: current resolution in minutes, in the fractional format supplied by f_resInMinutes() companion function.

// _mult: Multiple of current TF to be calculated.

// Convert current float TF in minutes to target string TF in "timeframe.period" format.

_targetResInMin = _res * math.max(_mult, 1)

// Find best string to express the resolution.

_targetResInMin <= 0.083 ? '5S' : _targetResInMin <= 0.251 ? '15S' : _targetResInMin <= 0.501 ? '30S' : _targetResInMin <= 1440 ? str.tostring(math.round(_targetResInMin)) : _targetResInMin <= 43800 ? str.tostring(math.round(math.min(_targetResInMin / 1440, 365))) + 'D' : str.tostring(math.round(math.min(_targetResInMin / 43800, 12))) + 'M'

// ————— Converts current resolution

f_resInString(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

_res == "1" ? "1m" :

_res == "3" ? "3m" :

_res == "5" ? "5m" :

_res == "15" ? "15m" :

_res == "30" ? "30m" :

_res == "45" ? "45m" :

_res == "60" ? "1h" :

_res == "120" ? "2h" :

_res == "180" ? "3h" :

_res == "240" ? "4h" :

_res == "1D" ? "D" :

_res == "1W" ? "W" :

_res == "1M" ? "M" : _res

//Set repaint security function

repaint_sw = Repaint_type == 'Non-Repainting' ? false : true

f_security(_symbol, _res, _src, _repaint) => request.security(_symbol, _res, _src[_repaint ? 0 : barstate.isrealtime ? 1 : 0] , barmerge.gaps_off, barmerge.lookahead_on)[_repaint ? 0 : barstate.isrealtime ? 0 : 1]

f_source(_res , source) => f_security(syminfo.tickerid , _res , source , repaint_sw )

Type1 = 'Auto Multiplied TF'

Type2 = 'Fixed TF'

//---------------------------------------------------------------------------

//RSI Settings // INPUTS

groupRange = "RSI Settings ----------------------------------"

TF1type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf1' , group=groupRange)

setHTF1a = input.int( 4 , '' , inline ='tf1', group=groupRange)

setHTF1b = input.timeframe( 'D' , '' , inline ='tf1', group=groupRange)

// Get HTF from user-defined mode.

var TF1 = TF1type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF1a) : setHTF1b

mLength = input.int( 14 , "RSI Length" ,inline='lines', group=groupRange)

BullLevel = input.int( 50 , "Bullish Level | Above 50 ",inline='lines1a', group=groupRange)

BearLevel = input.int( 50 , "Bearish Level | Below 50 ",inline='lines1b', group=groupRange)

ma_length = input.int( 21 , "MA Length" ,inline='ma', group=groupRange)

ma_status = input.bool( true , "Show MA" ,inline='ma1', group=groupRange)

ma_bullColor = input.color( bullColor1 , '' , inline='ma1', group=groupRange)

ma_bearColor = input.color( bearColor1 , '' , inline='ma1', group=groupRange)

//--------------------------------------------------------------------------

//Momentum Calculations

f_momTF( _tf ) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

rsi_ = _isShow ? f_security(syminfo.tickerid , _tf, ta.rsi( close_, mLength) , repaint_sw) : na

ma = _isShow ? f_security(syminfo.tickerid , _tf, ta.vwma( hlc3 , ma_length ) , repaint_sw) : na

[rsi_ , ma]

[ rsi , ma ] = f_momTF(TF1)

ma_color = close > ma ? ma_bullColor : ma_bearColor

plot( ma_status ? ma : na , color = ma_color , linewidth = 2 , style = plot.style_line)

//---------------------------------------------------------------------------

//Supertrend Settings // INPUTS

groupST = "Supertrend Settings ----------------------------------"

TF2type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf2' , group=groupST)

setHTF2a = input.int( 4 , '' , inline ='tf2', group=groupST)

setHTF2b = input.timeframe( 'D' , '' , inline ='tf2', group=groupST)

// Get HTF from user-defined mode.

var TF2 = TF2type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF2a) : setHTF2b

stLength = input.int( 10 , "Supertrend Length" ,inline='lines', group=groupST)

stmult = input.int( 2 , "Mult" ,inline='lines', group=groupST)

stHighlights = input.bool( true , "Highlights",inline='lines1a', group=groupST)

f_st( _tf) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

atr= f_security(syminfo.tickerid , _tf, ta.atr(stLength) , repaint_sw)

Up=close_ -(stmult*atr)

Dn=close_ +(stmult*atr)

TrendUp = 0.0

TrendUp := close_[1]>TrendUp[1] ? math.max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := close_[1]<TrendDown[1]? math.min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := close_ > TrendDown[1] ? 1: close_< TrendUp[1]? -1: nz(Trend[1],1)

stLine = Trend==1? TrendUp: TrendDown

[Trend, stLine]

[Trend, stLine] = f_st( TF2 )

stTrend = close > stLine ? 1:-1

stplot = plot( st_status? stLine : na , color= stTrend ==1 ? st_bullColor : st_bearColor , linewidth=1 ,title ="Supertrend")

priceLineP = plot( close , color= na , linewidth=1 , display = display.none)

fill(priceLineP , stplot , color = stHighlights ? stTrend ==1 ? color.new(st_bullColor , 85) : color.new( st_bearColor , 85 ) : na )

//---------------------------------------------------------------------------

//Momentum BarColors

mom2a = rsi > BullLevel ? Bullish_Bars : WBullish_Bars

mom2b = rsi < BearLevel ? Bearish_Bars : WBearish_Bars

mom2_color = close > ma ? mom2a : mom2b

mom_color = MomBars ? mom2_color : na

barcolor(mom_color)

//-------------------------------------------------

//Momentum Strength & Values

momVal2a = rsi > BullLevel ? 2 : 1

momVal2b = rsi < BearLevel ? -2 : -1

momVal2 = close > ma ? momVal2a : momVal2b

momVal = momVal2

///==============================================================================================================

//Long Trend Conditions

Entry1aL = Entry1a ? momVal == 2 : true

Entry1bL = Entry1b ? momVal == 1 or momVal == 2 : true

Entry3aL = Entry3a ? close > ma : true

Entry4aL = Entry4a ? rsi > BullLevel : true

Entry4bL = Entry4b ? close > stLine : true

Entry4cL = Entry4c ? stLine > stLine[1] : true

//------

noEntry = Entry1a == false and Entry1b == false and Entry3a == false and Entry4a == false and Entry4b == false and Entry4c == false ? false : true

noExit = Exit1a == false and Exit1b == false and Exit3a == false and Exit4b == false ? false : true

//------

EntryL = noEntry and Entry1aL and Entry1bL and Entry3aL and Entry4aL and Entry4bL and Entry4cL

Exit1aL = Exit1a ? momVal == 1 and momVal[1] == 2 : true

Exit1bL = Exit1b ? momVal == -1 or momVal == -2 : true

Exit3aL = Exit3a ? close < ma : true

Exit4bL = Exit4b ? close < stLine : true

ExitL = noExit and Exit1aL and Exit3aL and Exit1bL and Exit4bL

//Short Trend Conditions

Entry1aS = Entry1a ? momVal == -2 : true

Entry1bS = Entry1b ? momVal == -1 or momVal == -2 : true

Entry3aS = Entry3a ? close < ma : true

Entry4aS = Entry4a ? rsi < BearLevel : true

Entry4bS = Entry4b ? close < stLine : true

Entry4cS = Entry4c ? stLine < stLine[1] : true

EntryS = noEntry and Entry1aS and Entry1bS and Entry3aS and Entry4aS and Entry4bS and Entry4cS

Exit1aS = Exit1a ? momVal == -1 and momVal[1] == -2 : true

Exit1bS = Exit1b ? momVal == 1 or momVal == 2 : true

Exit3aS = Exit3a ? close > ma : true

Exit4bS = Exit4b ? close > stLine : true

ExitS = noExit and Exit1aS and Exit3aS and Exit1bS and Exit4bS

///==============================================================================================================

//Entry & exit conditions

isLong = false

isLong := nz(isLong[1], false)

isShort = false

isShort := nz(isShort[1], false)

goLong = not isLong and EntryL and not ExitL and longOK and barstate.isconfirmed

goShort = not isShort and EntryS and not ExitS and shortOK and barstate.isconfirmed

longExit = isLong and ExitL and barstate.isconfirmed

shortExit = isShort and ExitS and barstate.isconfirmed

if (goLong)

isLong := true

isShort := false

if (goShort)

isLong := false

isShort := true

if (longExit)

isLong := false

if (shortExit)

isShort := false

//------------------------------------------------------------------------------

// ——Backtester

grouptime = 'Step 5 - 📆 Time Filter 📆-------------'

startTime = input (group=grouptime, title="Start Timeㅤㅤ", defval=timestamp('UTC 01 Jan 2020 00:00'), inline="Start")

endTime = input (group=grouptime, title="End Time ㅤ ㅤ", defval=timestamp('UTC 31 Dec 2025 23:45'), inline="End")

dateRange = true

//------------------------------------------------------------------------------

// Risk Managment

grouprisk = 'Step 6 - Risk Management-------------'

takeprofit = input.bool(true,title = "TP Price %",group=grouprisk, inline="profit")

tppercent = input.float(1, '', group=grouprisk, inline="profit") / 100

q1 = input.int (5 , "Quantity %",group=grouprisk , inline="profit")

stoploss = input.bool(false,title = "SL Price %",group=grouprisk, inline="loss")

stoppercent = input.float(5, '', group=grouprisk, inline="loss") / 100

// Determine where you've entered and in what direction

longtp = strategy.position_avg_price * (1 + tppercent)

longStop = strategy.position_avg_price * (1 - stoppercent)

shorttp = strategy.position_avg_price * (1 - tppercent)

shortStop = strategy.position_avg_price * (1 + stoppercent)

QTYMethod = input.string ('EQUITY', 'Order Size', group=grouprisk, inline=' ', options=['NONE', 'EQUITY', 'SIZE', 'CONTRACTS'])

useNetProfit = input.bool (true, 'Use Net Profit', group=grouprisk, inline=' ', tooltip='Use Net Profit- On/Off the use of profit in the following trades. *Only works if the type is EQUITY')

riskPerc = input.int (30, '🇪🇶🇺🇮🇹🇾 %', group=grouprisk, inline='.', minval=1, maxval=100)

riskSize = input.int (10000, '🇸🇮🇿🇪', group=grouprisk, inline='.', minval=1)

riskCntr = input.int (1, '🇨🇴🇳🇹🇷🇦🇨🇹🇸', group=grouprisk, inline='.', minval=1, tooltip='Order Size: \nNone- Use the default position size settings in Tab "Properties". \nEquity% - per trade from the initial capital. \nSize- Fixed size amount of trade. \nContracts- The fixed amount of the deal in contracts. \n')

// —————— Order Size

eqty = switch QTYMethod

'NONE' => na

'EQUITY' => riskPerc / close

'SIZE' => riskSize / close

'CONTRACTS' => riskCntr

//-----------------------------------------------------------------------------

// —————— Trade variables

entry = strategy.position_avg_price

sizePos = strategy.position_size

inLong = sizePos > 0

inShort = sizePos < 0

inTrade = inLong or inShort

inPos = (inLong and not inShort[1]) or (inShort and not inLong[1])

var ID = 'TradeID'

var tpPrice = float(na)

var slPrice = float(na)

///==============================================================================================================

// ALERTS

groupalerts = 'Step 7 - Alerts & Bot Trading Settings-------------'

broker = input.string('Binance', "Broker", options=['Binance', 'Alpaca', 'Kucoin', '3Commas'], group=groupalerts, tooltip = 'Choose which type you are using to send the correct Json Alert message for entry and exit alerts.')

my_sym = input("FTMM/USDT", "Ticker", group = 'Cloud Function Server', tooltip = 'Only used with Alerts to fix ticker ID in json message. Some exchanges use the forward slash and some do not.')

my_pass = input('Passphrase', "Passphrase" , group = 'Cloud Function Server', tooltip = 'Only enter your Passphrase and nothing else goes here. Only needed when using a Cloud Function Server.')

i_alert_3CID_txt = input('Bot ID', "Bot ID", group =groupalerts, tooltip = 'Only enter your 3Commas Bot ID and nothing else goes here.')

i_alert_3CET_txt = input('Bot Email Token', title = 'Bot Email Token', group =groupalerts , tooltip = 'Only enter your 3Commas Bot Email Token and nothing else goes here.')

Alert='{"passphrase": "'+str.tostring(my_pass)+'","symbol": "'+ str.tostring(my_sym) +'","type":"market", "side":"{{strategy.order.action}}","amount":"{{strategy.order.contracts}}","price": "' + str.tostring(close) + '"}'

//---------------------------------------------------------------------------------

// JSON alert message used for 3Commas Bots

C3_EntryAlert ='{"message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0 }'

C3_ExitAlert ='{"action": "close_at_market_price_all", "message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0}'

//---------------------------------------------------------------------------------

// JSON alert message used for setting up a Google Cloud Function Server works when using Alpaca Exchange

Alert_Alpaca = '{"symbol": "{{ticker}}", "quantity": "{{strategy.order.contracts}}", "side": "{{strategy.order.action}}", "order_type": "market", "time_in_force": "gtc", "passphrase": "' + str.tostring(my_pass) + '"}'

entryAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_EntryAlert

exitAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_ExitAlert

strategy.initial_capital = 50000

// —————— Entry's

goLongEntry = goLong and dateRange and barstate.isconfirmed

goShortEntry = goShort and dateRange and barstate.isconfirmed

eqty(qty) => QTYMethod=='EQUITY' ? qty / 100 * (strategy.initial_capital + (useNetProfit ? strategy.netprofit : 0)) : QTYMethod=='SIZE' ? qty / syminfo.pointvalue : qty

if goLongEntry

ID := 'Long'

strategy.entry(ID, strategy.long, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

if goShortEntry

ID := 'Short'

strategy.entry(ID, strategy.short, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

// —————— Exit's

qty(perc) => math.abs(sizePos*perc/100)

if longExit

strategy.close("Long",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Long", limit=takeprofit ? longtp : na, stop=stoploss ? longStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Long", stop=stoploss ? longStop : na, comment_loss='SL')

if shortExit

strategy.close("Short",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Short", limit=takeprofit ? shorttp : na, stop=stoploss ? shortStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Short", stop=stoploss ? shortStop : na, comment_loss='SL')

///==============================================================================================================

//Style- Plots on Chart

posH = high + 2 * stLine

posL = low - 2 * stLine

plotshape( goLong and PlotEntries ? posL : na ,'Long Entry Signals' , text= '' , location=location.belowbar, style=shape.labelup , size=size.small , color=lbullColor , textcolor = color.white )

plotshape( longExit and PlotExits ? posH : na ,'Long Exit' , location=location.abovebar, style= shape.xcross , size=size.small, color=lbullColor )

plotshape( goShort and PlotEntries ? posH : na ,'Short Entry Signals' , text= '' , location=location.abovebar, style=shape.labeldown , size=size.small , color=lbearColor , textcolor = color.white )

plotshape( shortExit and PlotExits ? posL : na ,'Short Exit' , location=location.belowbar, style=shape.xcross , size=size.small , color=lbearColor )

///==============================================================================================================

// Alerts

alertcondition( goLong , 'Long Entry Alerts', 'Long Alerts')

alertcondition( goShort , 'Short Entry Alerts', 'Short Alerts')

- Jupiter dan Saturnus Momentum MA Crossover Filter Strategi

- Strategi Beyond The Clouds

- Strategi Perdagangan Bayangan

- Strategi Pelacakan Trend Breakout Moving Average

- Strategi Pelacakan Tren Berdasarkan Osilator Volume

- Tren Mengikuti Strategi Jangka Panjang Berdasarkan SuperTrend dan Fisher Transform

- Strategi perdagangan reversal Golden Cross ganda

- Fibonacci mundur dari skrip strategi perdagangan

- RSI-BB Momentum Breakout Strategi

- Breakout Band Fixed Stop Loss Strategi

- EMA 13 48 Tren Mengikuti Strategi

- Strategi akumulasi/distribusi Williams (Williams AD)

- Strategi Indeks Momentum Relatif

- Sistem Pengamatan Tren Kotak Ganda

- Strategi Martingale dengan rentang rata-rata bergerak yang diperluas untuk perdagangan saham

- Strategi Keseimbangan Bull dan Bear

- Oma dan Apollo Dual Rail Trading Strategy

- Strategi Crossover Rata-rata Bergerak Ganda

- Strategi Pelacakan Tren Sinyal Ganda

- Tren Mengikuti Strategi SMA