Strategi Mengikuti Tren Penembusan Momentum

Ringkasan

Strategi ini menggabungkan beberapa indikator teknis untuk mengidentifikasi arah tren, untuk melacak ketika tren terjadi, dan untuk mengejar keuntungan tambahan.

Prinsip Strategi

Menggunakan saluran Donchian untuk menilai arah tren secara keseluruhan. Ketika harga menembus saluran ini, konfirmasi adanya pergeseran tren.

Hull Moving Average membantu menentukan arah tren. Indikator ini sensitif terhadap perubahan harga dan dapat mendeteksi perubahan tren lebih awal.

Sistem semi-orbit mengirimkan sinyal beli dan jual. Sistem ini didasarkan pada saluran harga dan rentang rata-rata fluktuasi yang sebenarnya, untuk menghindari false breakout.

Ketika saluran Donchian, indikator Hull, dan sistem semi-orbit mengirimkan sinyal secara bersamaan, maka terjadi tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren tren

Kondisi Posisi Padat: Ketika indikator di atas mengirimkan sinyal kebalikan, tentukan bahwa tren telah berbalik, dan segera menghentikan kerugian.

Analisis Keunggulan

Kombinasi multi-indikator, penilaian yang lebih baik. Saluran Donchian menilai dasar-dasar, indikator Hull dan semi-orbit menentukan detail, menangkap tren tepat di titik balik.

Bergerak untuk melakukan breakout, mencari keuntungan tambahan. Bermain hanya ketika tren terjadi breakout kuat, menghindari terjebak dalam getaran.

Stop loss yang ketat, menjamin keamanan dana. Setelah indikator mengirimkan sinyal kebalikan, stop loss segera, untuk menghindari kerugian berkembang.

Parameter yang disesuaikan dengan berbagai jenis pasar. Parameter seperti panjang saluran, interval fluktuasi dapat disesuaikan, dan dioptimalkan untuk siklus yang berbeda.

Mudah dimengerti dan diimplementasikan, bahkan bagi pemula. Kombinasi indikator dan kondisi sederhana dan mudah diprogram untuk diimplementasikan.

Analisis risiko

Kehilangan peluang di awal tren. Terlambat masuk, kenaikan awal tidak dapat ditangkap.

Penembusan yang gagal mengembalikan kerugian. Setelah masuk, mungkin terjadi penembusan yang gagal dan berbalik, menyebabkan kerugian.

Indikator mengirimkan sinyal yang salah. Karena parameter yang tidak tepat, penilaian indikator dapat terjadi kesalahan.

Terbatas jumlah transaksi. Hanya masuk saat ada terobosan tren yang jelas, dan terbatas jumlah transaksi tahunan.

Arah optimasi

Mengoptimalkan kombinasi parameter. Mengetes berbagai parameter untuk menemukan kombinasi terbaik.

Menambahkan kondisi mundur linear stop loss. Menghindari stop loss terlalu dini dan kehilangan peluang tren.

Menambahkan filter indikator lain. Seperti MACD, KDJ dan penilaian tambahan, mengurangi sinyal yang salah.

Optimalkan jangka waktu transaksi. Parameter untuk jangka waktu yang berbeda dapat dioptimalkan.

Meningkatkan efisiensi penggunaan dana. Meningkatkan efisiensi penggunaan dana melalui leverage, investasi tetap, dll.

Meringkaskan

Strategi ini mengintegrasikan berbagai indikator untuk menilai kapan tren terjadi momentum terobosan, dengan melacak tren yang telah terbentuk untuk mencapai keuntungan tambahan. Sistem pengendalian risiko yang ketat, pengaturan parameter yang fleksibel untuk menyesuaikan dengan lingkungan pasar yang berbeda. Meskipun frekuensi perdagangan rendah, tetapi setiap perdagangan berusaha untuk mendapatkan keuntungan yang tinggi.

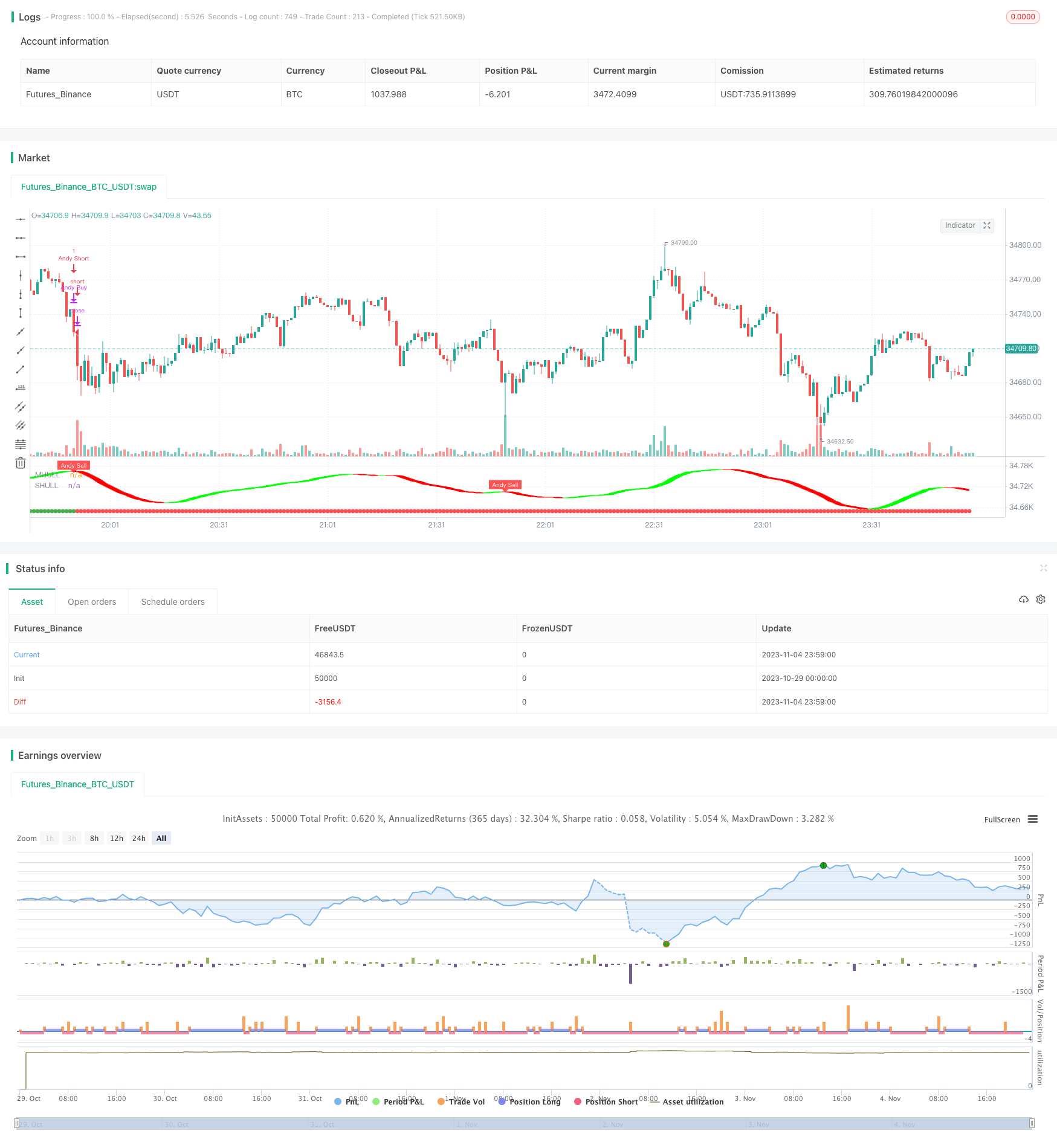

/*backtest

start: 2023-10-29 00:00:00

end: 2023-11-05 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kgynofomo

// @version=5

strategy(title="[Salavi] | Andy Super Pro Strategy",overlay = true)

//Doinchian Trend Ribbon

dlen = input.int(defval=30, minval=10)

dchannel(len) =>

float hh = ta.highest(len)

float ll = ta.lowest(len)

int trend = 0

trend := close > hh[1] ? 1 : close < ll[1] ? -1 : nz(trend[1])

trend

dchannelalt(len, maintrend) =>

float hh = ta.highest(len)

float ll = ta.lowest(len)

int trend = 0

trend := close > hh[1] ? 1 : close < ll[1] ? -1 : nz(trend[1])

maintrend == 1 ? trend == 1 ? #00FF00ff : #00FF009f : maintrend == -1 ? trend == -1 ? #FF0000ff : #FF00009f : na

maintrend = dchannel(dlen)

donchian_bull = maintrend==1

donchian_bear = maintrend==-1

//Hulls

src = input(hlc3, title='Source')

modeSwitch = input.string('Hma', title='Hull Variation', options=['Hma', 'Thma', 'Ehma'])

length = input(55, title='Length')

lengthMult = input(1.0, title='Length multiplier ')

useHtf = false

htf = '240'

switchColor = true

candleCol = false

visualSwitch = true

thicknesSwitch = 1

transpSwitch = 40

//FUNCTIONS

//HMA

HMA(_src, _length) =>

ta.wma(2 * ta.wma(_src, _length / 2) - ta.wma(_src, _length), math.round(math.sqrt(_length)))

//EHMA

EHMA(_src, _length) =>

ta.ema(2 * ta.ema(_src, _length / 2) - ta.ema(_src, _length), math.round(math.sqrt(_length)))

//THMA

THMA(_src, _length) =>

ta.wma(ta.wma(_src, _length / 3) * 3 - ta.wma(_src, _length / 2) - ta.wma(_src, _length), _length)

//SWITCH

Mode(modeSwitch, src, len) =>

modeSwitch == 'Hma' ? HMA(src, len) : modeSwitch == 'Ehma' ? EHMA(src, len) : modeSwitch == 'Thma' ? THMA(src, len / 2) : na

//OUT

_hull = Mode(modeSwitch, src, int(length * lengthMult))

HULL = useHtf ? request.security(syminfo.ticker, htf, _hull) : _hull

MHULL = HULL[0]

SHULL = HULL[2]

//COLOR

hullColor = switchColor ? HULL > HULL[2] ? #00ff00 : #ff0000 : #ff9800

hull_bull = HULL > HULL[2]

bull_start = hull_bull and hull_bull[1]==false

hull_bear = HULL < HULL[2]

bear_start = hull_bear and hull_bear[1]==false

barcolor(color=candleCol ? switchColor ? hullColor : na : na)

//halftrend

amplitude = input(title='Amplitude', defval=2)

channelDeviation = input(title='Channel Deviation', defval=2)

// showArrows = input(title='Show Arrows', defval=true)

// showChannels = input(title='Show Channels', defval=true)

var int trend = 0

var int nextTrend = 0

var float maxLowPrice = nz(low[1], low)

var float minHighPrice = nz(high[1], high)

var float up = 0.0

var float down = 0.0

float atrHigh = 0.0

float atrLow = 0.0

float arrowUp = na

float arrowDown = na

atr2 = ta.atr(100) / 2

dev = channelDeviation * atr2

highPrice = high[math.abs(ta.highestbars(amplitude))]

lowPrice = low[math.abs(ta.lowestbars(amplitude))]

highma = ta.sma(high, amplitude)

lowma = ta.sma(low, amplitude)

if nextTrend == 1

maxLowPrice := math.max(lowPrice, maxLowPrice)

if highma < maxLowPrice and close < nz(low[1], low)

trend := 1

nextTrend := 0

minHighPrice := highPrice

minHighPrice

else

minHighPrice := math.min(highPrice, minHighPrice)

if lowma > minHighPrice and close > nz(high[1], high)

trend := 0

nextTrend := 1

maxLowPrice := lowPrice

maxLowPrice

if trend == 0

if not na(trend[1]) and trend[1] != 0

up := na(down[1]) ? down : down[1]

arrowUp := up - atr2

arrowUp

else

up := na(up[1]) ? maxLowPrice : math.max(maxLowPrice, up[1])

up

atrHigh := up + dev

atrLow := up - dev

atrLow

else

if not na(trend[1]) and trend[1] != 1

down := na(up[1]) ? up : up[1]

arrowDown := down + atr2

arrowDown

else

down := na(down[1]) ? minHighPrice : math.min(minHighPrice, down[1])

down

atrHigh := down + dev

atrLow := down - dev

atrLow

ht = trend == 0 ? up : down

var color buyColor = color.blue

var color sellColor = color.red

htColor = trend == 0 ? buyColor : sellColor

// htPlot = plot(ht, title='HalfTrend', linewidth=2, color=htColor)

// atrHighPlot = plot(showChannels ? atrHigh : na, title='ATR High', style=plot.style_circles, color=color.new(sellColor, 0))

// atrLowPlot = plot(showChannels ? atrLow : na, title='ATR Low', style=plot.style_circles, color=color.new(buyColor, 0))

// fill(htPlot, atrHighPlot, title='ATR High Ribbon', color=color.new(sellColor, 90))

// fill(htPlot, atrLowPlot, title='ATR Low Ribbon', color=color.new(buyColor, 90))

HalfTrend_buySignal = not na(arrowUp) and trend == 0 and trend[1] == 1

HalfTrend_sellSignal = not na(arrowDown) and trend == 1 and trend[1] == 0

// plotshape(showArrows and buySignal ? atrLow : na, title='Arrow Up', style=shape.triangleup, location=location.absolute, size=size.tiny, color=color.new(buyColor, 0))

// plotshape(showArrows and sellSignal ? atrHigh : na, title='Arrow Down', style=shape.triangledown, location=location.absolute, size=size.tiny, color=color.new(sellColor, 0))

//ema

filter_ema = ta.ema(close,200)

ema_bull = close>filter_ema

ema_bear = close<filter_ema

atr_length = input.int(7)

atr = ta.atr(atr_length)

atr_rsi_length = input.int(50)

atr_rsi = ta.rsi(atr,atr_rsi_length)

atr_valid = atr_rsi>50

longCondition = bull_start and atr_valid

shortCondition = bear_start and atr_valid

Exit_long_condition = shortCondition

Exit_short_condition = longCondition

if longCondition

strategy.entry("Andy Buy",strategy.long, limit=close,comment="Andy Buy Here")

if Exit_long_condition

strategy.close("Andy Buy",comment="Andy Buy Out")

// strategy.entry("Andy fandan Short",strategy.short, limit=close,comment="Andy 翻單 short Here")

// strategy.close("Andy fandan Buy",comment="Andy short Out")

if shortCondition

strategy.entry("Andy Short",strategy.short, limit=close,comment="Andy short Here")

// strategy.exit("STR","Long",stop=longstoploss)

if Exit_short_condition

strategy.close("Andy Short",comment="Andy short Out")

// strategy.entry("Andy fandan Buy",strategy.long, limit=close,comment="Andy 翻單 Buy Here")

// strategy.close("Andy fandan Short",comment="Andy Buy Out")

inLongTrade = strategy.position_size > 0

inLongTradecolor = #58D68D

notInTrade = strategy.position_size == 0

inShortTrade = strategy.position_size < 0

// bgcolor(color = inLongTrade?color.rgb(76, 175, 79, 70):inShortTrade?color.rgb(255, 82, 82, 70):na)

plotshape(close!=0,location = location.bottom,color = inLongTrade?color.green:inShortTrade?color.red:na)

plotshape(longCondition, title='Buy', text='Andy Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(shortCondition, title='Sell', text='Andy Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

Fi1 = plot(MHULL, title='MHULL', color=hullColor, linewidth=thicknesSwitch, transp=50)

Fi2 = plot(SHULL, title='SHULL', color=hullColor, linewidth=thicknesSwitch, transp=50)

fill(Fi1, Fi2, title='Band Filler', color=hullColor, transp=transpSwitch)